Institutional Firms Projects Ether As Crypto with The Biggest Growth Outlook: Survey

Publikováno: 1.11.2023

Global wealth fund managers have backed Ethereum (ETH) as the asset with the highest growth projection despite a slow price increase in recent months, a new survey shows. A new CoinShares Digital Asset Quarterly Fund survey shows an analysis of market-related activities, regulation, and institutional investment in the ecosystem amongst others. According to the study, […]

The post Institutional Firms Projects Ether As Crypto with The Biggest Growth Outlook: Survey appeared first on Cryptonews.

Global wealth fund managers have backed Ethereum (ETH) as the asset with the highest growth projection despite a slow price increase in recent months, a new survey shows.

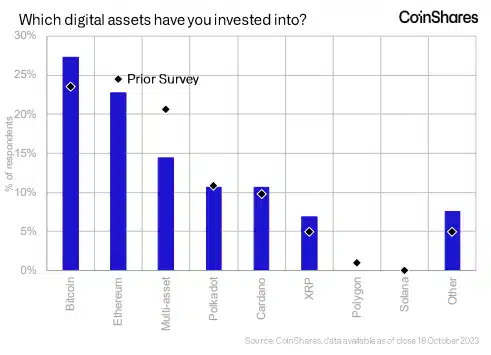

A new CoinShares Digital Asset Quarterly Fund survey shows an analysis of market-related activities, regulation, and institutional investment in the ecosystem amongst others.

According to the study, big investor firms believe that Ether has the best growth prospects amongst other top coins even as its products record a poor run this year.

Of the 55 participants, 45% viewed ether with the most growth while 39% sided with the market leader, Bitcoin. Solana, which has been described as an institutional investor favorite in terms of related products, notched 6% of the votes.

This recent survey shows positive sparks around the biggest altcoin following weekly outflows around its investment products earning the tag “least loved altcoin in 2023.”

”Although this sentiment has not been reflected in our fund flows report, which indicates $127 million of outflows this year, taking the place as the most unloved altcoin.”

Investors eye yield

Most institutional investors base their analysis on the high rate of validator entry queue due to profits from yields. Ethereum remains the largest decentralized blockchain and with many applications, users stand to gain from its ecosystem.

Although this has been popular for years, the ETH Merge one year ago that saw the network transition to a Proof-of-Stake blockchain replacing miners with validators increased talks of wider adoption as investors looked to make more profit.

This was not reflected in the price of the asset as the asset plunged for most of last year due to wider market factors and slow growth.

Bitcoin remained fairly unchanged in terms of outlook despite many analysts describing it as a safe asset in the wake of the recent regulatory onslaught by the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Investments in Ripple (XRP) have seen growth making up about 14% of the participant choices due to its legal victory over the SEC. Multi-asset positions declined by 6% culminating in outflows of $35 million.

Regulation remains a major concern

The recent actions taken by authorities have led to an increase in confidence of some investors although many remain skeptical that overzealous regulators may scare users from the ecosystem.

According to the survey, regulators remain a top risk for most fund managers although this quarter recorded a 7% drop in sentiments of a wider government ban. Other risks include accessibility and the general crypto winter.

The majority of participants delved into the crypto market as a result of the growth of blockchain technology while an increasing number bought assets for speculative reasons and good value.

The survey was conducted from responses by 58 global asset managers with over $500 billion in assets under management.

The post Institutional Firms Projects Ether As Crypto with The Biggest Growth Outlook: Survey appeared first on Cryptonews.