Investment Banks See Uncertain Path Ahead as Middle East Crisis Unfolds

Publikováno: 16.10.2023

Major U.S. investment banks are urging caution and flexibility as the crisis sparked by a surprise Hamas attack on Israel earlier this month continues to evolve. Analyst notes from JPMorgan and Morgan Stanley provide insight into how Wall Street is interpreting events on the ground and potential impacts on global markets. Morgan Stanley Market Analyst […]

Major U.S. investment banks are urging caution and flexibility as the crisis sparked by a surprise Hamas attack on Israel earlier this month continues to evolve. Analyst notes from JPMorgan and Morgan Stanley provide insight into how Wall Street is interpreting events on the ground and potential impacts on global markets. Morgan Stanley Market Analyst […]

Major U.S. investment banks are urging caution and flexibility as the crisis sparked by a surprise Hamas attack on Israel earlier this month continues to evolve. Analyst notes from JPMorgan and Morgan Stanley provide insight into how Wall Street is interpreting events on the ground and potential impacts on global markets.

Morgan Stanley Market Analyst Advises Caution Amid Escalating Geopolitical Risks

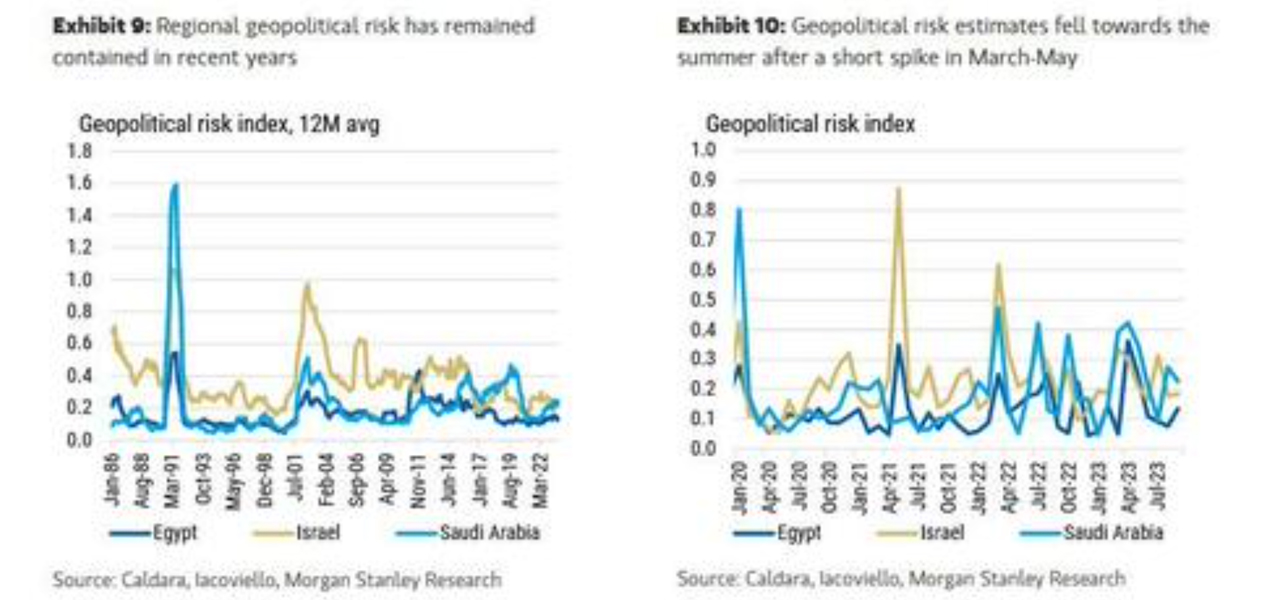

Michael Zezas, Morgan Stanley’s global head of fixed income research, acknowledged in a note to clients that while pundits have speculated extensively about whether the conflict could escalate and involve other nations, “there’s no obvious path from here.” He advised accepting uncertainty itself to gain clarity, stating geopolitical risks have been rising globally as governments enact policies to avoid empowering rivals.

Zezas said the militant strike demonstrates and escalates this uncertainty, raising the possibility that multiple countries with major economic roles could get involved. He stressed containment remains possible through several paths. Zezas outlined three reliable market implications of an environment where uncertainty keeps increasing while governments react to safeguard interests.

This includes national security-driven corporate spending rising as a theme, and an emerging market Middle East sovereign credit may be mis-priced for risks. While oil prices could increase, the strategist said it should not be assumed rates will move higher in reaction. He concluded that a price shock from oil supply disruptions could strain regional finances even without direct actions against production.

JPMorgan Researcher Says Markets Historically Weather Geopolitical Crises With ‘Limited’ Long-Term Impacts

Madison Faller, JPMorgan’s global investment strategist, similarly advised watching for potential escalation and impacts on natural resources as the clearest market linkage. She said neither side has an outsized role in oil output, and so far supply/demand balance has muted price moves. But Faller noted today’s moderate disruption tolerance could shift if major routes like the Strait of Hormuz were affected.

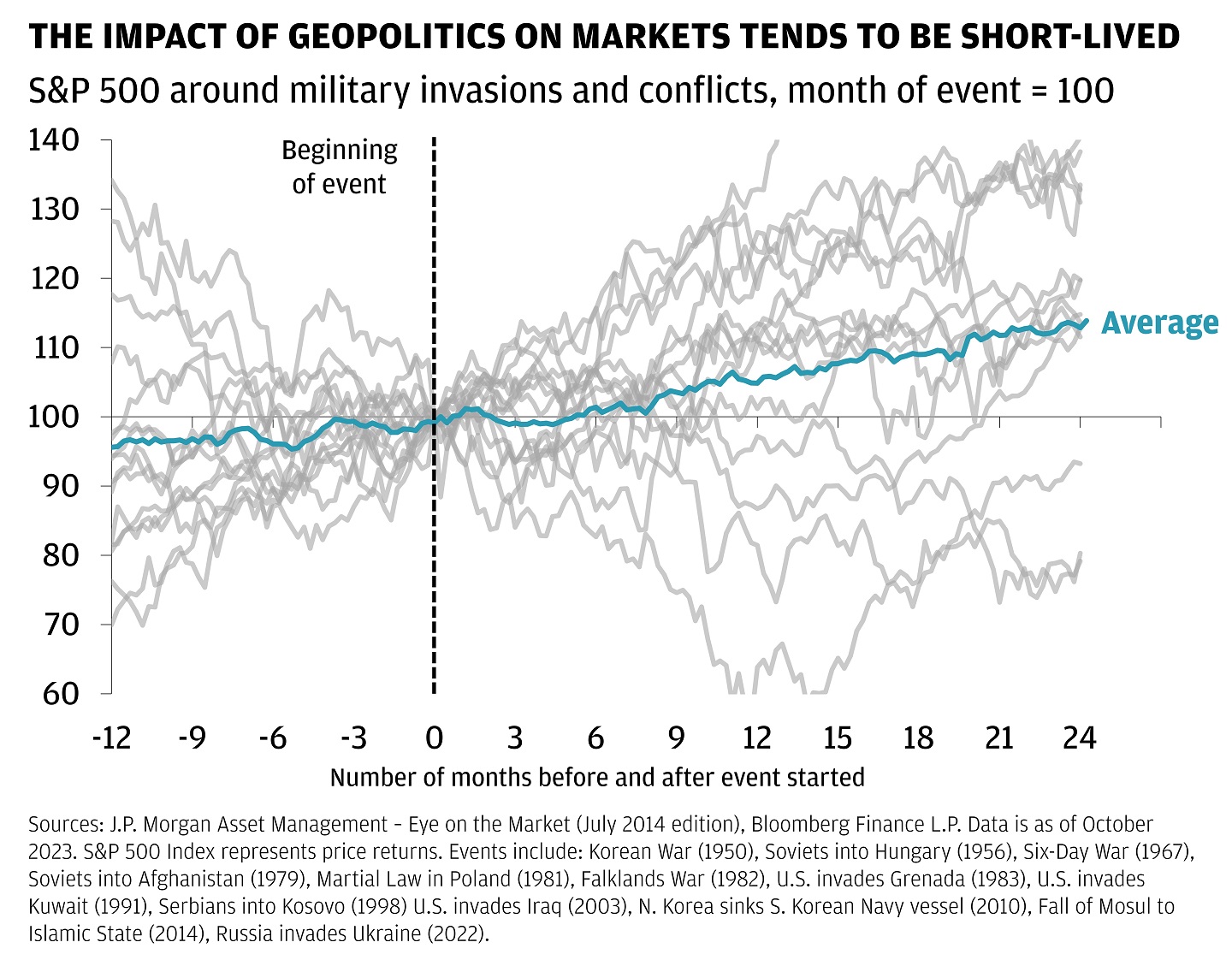

Faller indicated markets have endured geopolitical crises before, and long-run impacts are historically limited. She suggested focusing on fundamentals like inflation, rates, fiscal efforts, and corporate strength. Along with reasonable valuations, Faller sees opportunity in equities and high yields providing compensation for uncertainty. Her overarching advice was staying invested according to goals, as diversified portfolios have paid off through countless challenges.

Amid escalating tensions in the Middle East last week, both stock markets and cryptocurrencies faced a downturn, while precious metals, notably gold and silver, soared. Gold leaped upwards of 3% on Friday, with silver climbing over 4% against the U.S. dollar. As bond prices rose, the U.S. Treasury 10-year yield saw a dip. Additionally, oil recorded its most significant weekly rise since 2023 began. Meanwhile, shares in defense companies, including L3Harris Technologies, Lockheed Martin, and Northrop Grumman, experienced a sharp uptick in value over the week.

What do you think about the market analysts’ opinions about the conflict in the Middle East and its impact on global markets? Share your thoughts and opinions about this subject in the comments section below.