Is NEO Going to Zero? NEO Price Dips 4% as Attention Shifts to Innovative New Bitcoin Platform

Publikováno: 13.11.2023

NEO price has dipped -4% following rejection from a significant resistance level, leaving some panicked NEO bag-holders asking ‘Is NEO Going to Zero’? Over the past few weeks, NEO price had rallied incredibly hard following an announcement that the NEO network will be delivering censorship resistant sidechains. The move was significant in delivering utility for […]

The post Is NEO Going to Zero? NEO Price Dips 4% as Attention Shifts to Innovative New Bitcoin Platform appeared first on Cryptonews.

NEO price has dipped -4% following rejection from a significant resistance level, leaving some panicked NEO bag-holders asking ‘Is NEO Going to Zero’?

Over the past few weeks, NEO price had rallied incredibly hard following an announcement that the NEO network will be delivering censorship resistant sidechains.

The move was significant in delivering utility for NEO’s GAS token – which acts a means of settlement for transaction fees – and will be used to power the new NEO sidechains.

An eruption of GAS price, which has shot-up more than +290% over the past month, has fuelled significant gains for NEO token – which generates GAS when staked.

But now following failed resistance testing, NEO price alongside GAS appears to be undertaking a retracement move, as price action cools down from the explosive upside movement.

Wish you all a MERRY XMAS already.

$NEOpic.twitter.com/ztyNvaPHle

— Crypto Bob

(@RealCryptoBob) November 12, 2023

Although market sentiment remains incredibly bullish for the leading Chinese layer-1 solution, with a healthy shift down likely to poise NEO price for another rally leg.

NEO Price Analysis: As NEO Retraces From Sidechain Pump, is NEO Going to Zero?

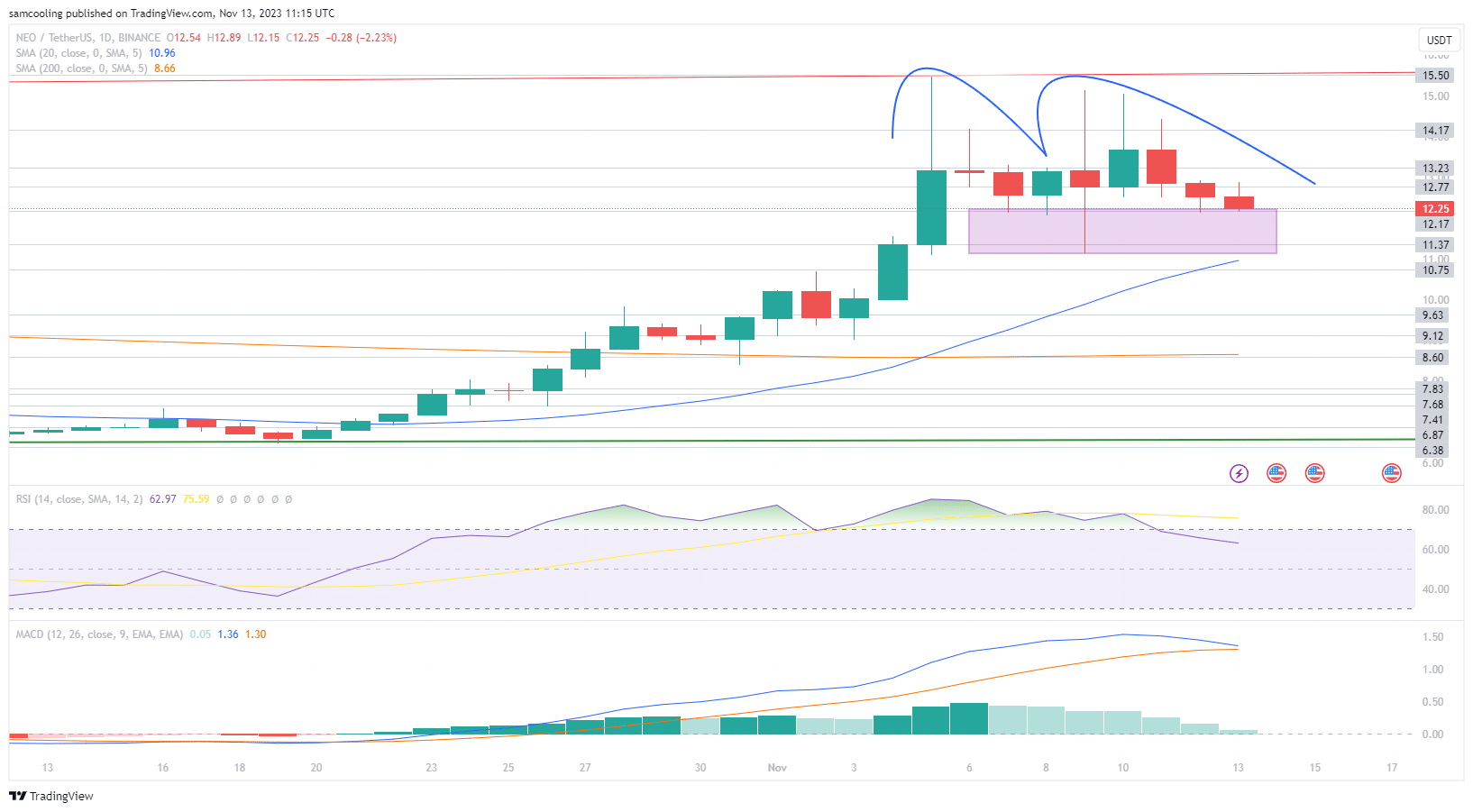

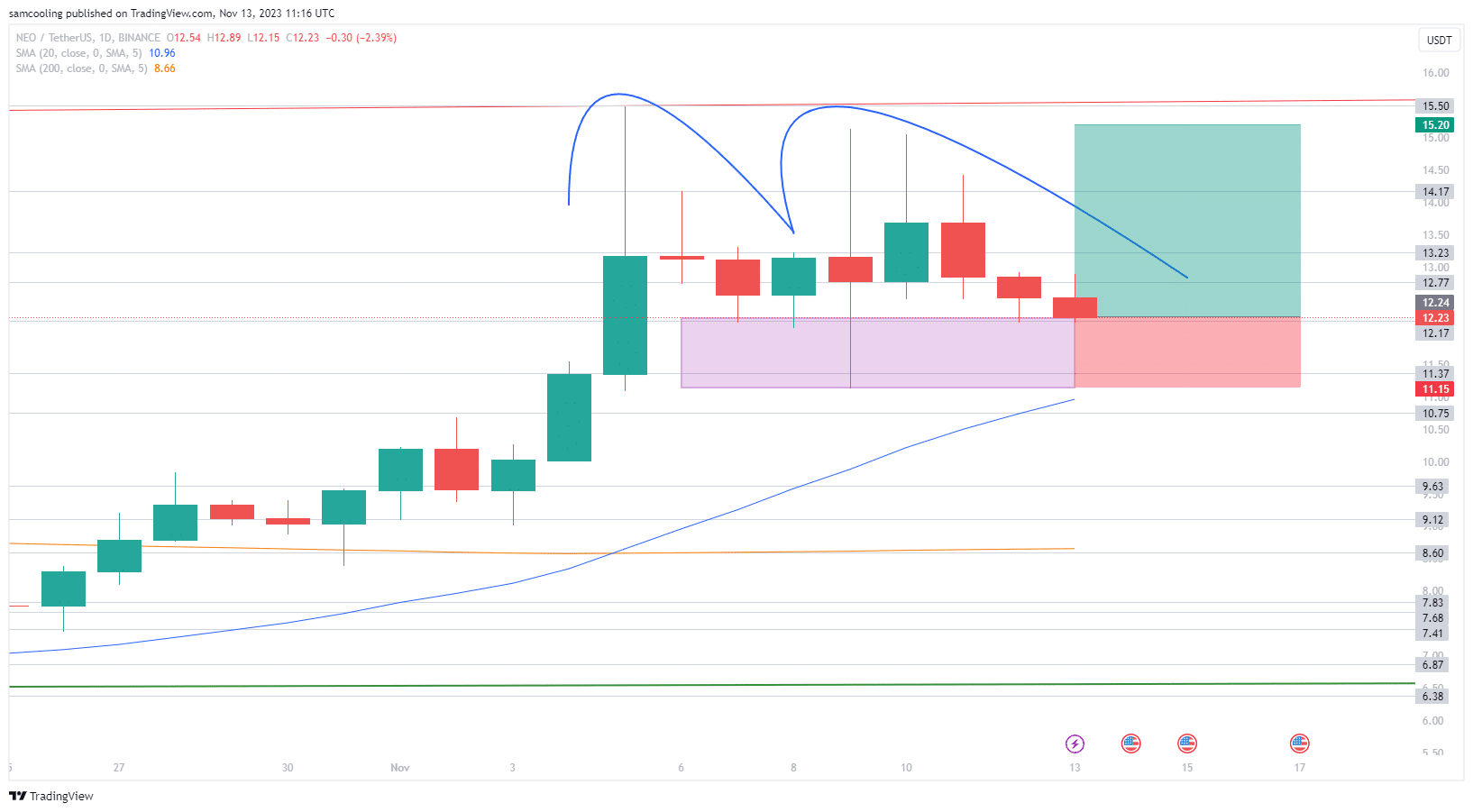

As NEO price undertakes a minor dip, NEO is currently trading at a market price of $12.25 (representing a 24-hour change of -12.39%).

This comes following two pronged rejection from upper trendline resistance at $15.50 on November 5, and later at $15.20 on November 10.

$15 denotes a historic resistance level that will be well-known to NEO bag-holders after it triggered a similar rejection on February 22.

However, it also appears that NEO is establishing a consolidation zone between $11.20 and $12.20, with 5-days of lower support offering a supply zone for further upside moves.

Currently this supply zone appears to be holding, suggesting that NEO price could stabilize at this healthy higher level – cementing recent rally gains.

This view is backed by a decline on the RSI, which is cooling down from a significant overbought period, with the key indicator sat at 62.97.

Consolidation here could be sufficient to cool down the indicator to a more neutral 55, which would prime price action to push up once more.

The MACD supports this view, with a continuous display of bullish divergence at 0.05, highlighting the sustained momentum.

Overall, despite the -4% dip, NEO looks healthy here, with a much needed retracement move finding support at the supply zone, whilst cooling down an overheated RSI.

This could leave NEO poised to push up to an upside target at $15.20 (a potential +24.18%).

While downsize risk here appears limited by the supply zone at $11.15 (a possible -8.91%).

NEO therefore carries a risk: reward ratio of 2.72, a strong entry, characterised by poised upside risk, with NEO certainly not going to zero anytime soon.

But while NEO undertakes a retracement back to the supply zone, other investors are rushing to claim a slice of the latest Bitcoin Cloud Mining presale ahead of the 2024 halving event.

NEO Price Retracement Alternative? Don’t Sleep on Bitcoin Minetrix as Presale Explodes Almost $4M Raised

Dive into the innovative world of Bitcoin Minetrix and its pioneering stake-to-mine system – as the skyrocketing presale smashes +$3,904,377 raised.

Offering an enticing 1224% Staking APY, Bitcoin Minetrix provides a platform where users can buy, stake, and then watch as the rewards start accumulating.

The true essence of passive income in the crypto world has never been this accessible.

With the Bitcoin Minetrix approach, gone are the days of heavy initial capital and navigating complex mining contracts.

Bitcoin Minetrix Smashes $3.9M Raised as Traders Rally Against Bitcoin Mining Centralization

No longer the mainstay of basement ASICs, Bitcoin mining is now a multi-billion dollar industry, but with the success of Bitcoin mining centers comes the challenge of increased centralization.

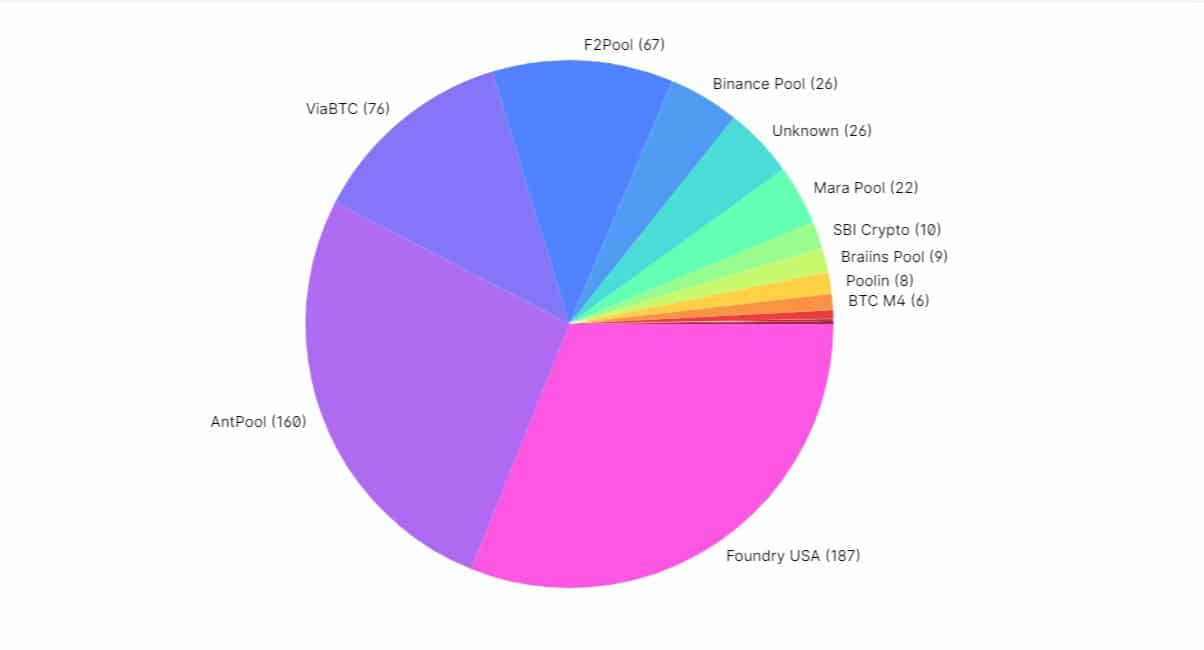

Indeed, with just two mining pools (Foundry USA and Antpool) representing 57.5% of the Bitcoin network hashrate, mining centralization is desperately in need of modern solutions to ensure long-term network security.

This is where the magic of Bitcoin Minetrix comes into play, with Bitcoin cloud mining offering the opportunity for everyday investors to claim their slice of the pie – while bolstering Bitcoin’s network security.

All interested parties have to do is buy $BTCMTX tokens in presale and stake them to earn cloud mining credits, with Bitcoin Minetrix’s automated system handling the heavy work.

In effect, this means no more expensive barriers to entry, such as costly hardware requirements or complicated technical understandings – simply buy, stake, and earn to unlock the benefits of Bitcoin mining rewards.

Key Highlights of the BTCMTX Advantage:

- Distinctive Edge in the Market: In an industry filled with numerous cloud mining platforms, Bitcoin Minetrix carves a niche for itself. As the first-ever tokenized Bitcoin cloud mining initiative, it offers an automated system that’s geared for cloud-based Bitcoin mining, setting a new standard for the industry.

- Safety First with Ethereum Blockchain: Bitcoin Minetrix operates on the tried and trusted Ethereum blockchain. This ensures top-notch security and reliability, allowing users to sidestep the risks associated with external mining pools, and offering a safeguard against potential fraudulent cloud mining services.

- Championing True Decentralization: At its core, Bitcoin Minetrix upholds the ethos of decentralization. In an age where centralization often introduces vulnerabilities, Bitcoin Minetrix breaks the mold, redistributing mining profits from big corporations to individual retail investors through its novel Stake-to-Mine system.

- Tapping into the Bitcoin Halving Opportunity: Perfectly poised to make the most of the upcoming Bitcoin halving, Bitcoin Minetrix provides investors with a golden opportunity. The impending halving might seem daunting for miners due to reduced block rewards, but historically, such events have driven up Bitcoin’s value. Bitcoin Minetrix provides a platform for investors to tap into this potential surge, sans the associated capital risks.

- The BTCMTX Presale Opportunity: The ongoing BTCMTX presale has already garnered significant interest, with over $3.9m raised towards its $4.4M goal. At a competitive price of just $0.0116 per token, early investors have a unique chance to be at the forefront of this stake-to-mine evolution.

In sum, Bitcoin Minetrix is set to redefine the Bitcoin landscape. With its innovative methodologies, stringent security measures, and the vast potential of its stake-to-mine mechanism, it beckons as a lucrative opportunity for early-bird investors.

Secure your position in this transformative journey by joining the BTCMTX presale today.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

The post Is NEO Going to Zero? NEO Price Dips 4% as Attention Shifts to Innovative New Bitcoin Platform appeared first on Cryptonews.