JPMorgan, Goldman Sachs Initiate Coverage of Coinbase Stock — up to 60% Price Upside

Publikováno: 25.5.2021

Investment banks JPMorgan and Goldman Sachs have initiated coverage of the Coinbase Global stock. JPMorgan gives Coinbase an overweight rating with a 60% upside potential while Goldman Sachs begins with a buy rating. JPMorgan, Goldman Sachs Now Covering Coinbase Stock A couple of major investment banks initiated coverage of the Coinbase Global stock (NASDAQ: COIN) […]

Investment banks JPMorgan and Goldman Sachs have initiated coverage of the Coinbase Global stock. JPMorgan gives Coinbase an overweight rating with a 60% upside potential while Goldman Sachs begins with a buy rating. JPMorgan, Goldman Sachs Now Covering Coinbase Stock A couple of major investment banks initiated coverage of the Coinbase Global stock (NASDAQ: COIN) […]

Investment banks JPMorgan and Goldman Sachs have initiated coverage of the Coinbase Global stock. JPMorgan gives Coinbase an overweight rating with a 60% upside potential while Goldman Sachs begins with a buy rating.

JPMorgan, Goldman Sachs Now Covering Coinbase Stock

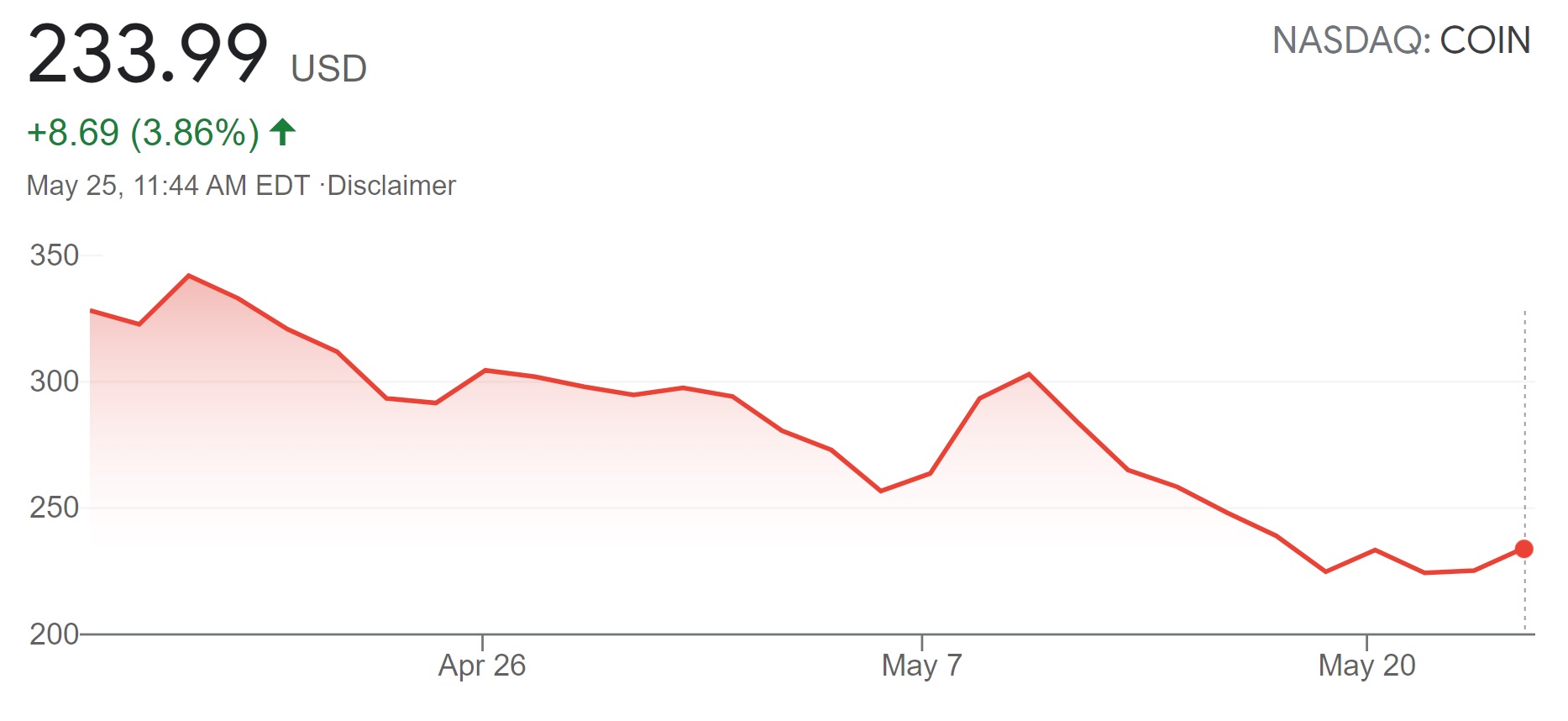

A couple of major investment banks initiated coverage of the Coinbase Global stock (NASDAQ: COIN) this week. At the time of writing the price of COIN Is $233.99.

JPMorgan initiated coverage of Coinbase on Tuesday with an overweight rating largely due to the company’s key position in the growing cryptocurrency space, analyst Kenneth Worthington explained. The firm sets the target price for Coinbase at $371, a 59% increase from the current level. The analyst detailed:

We see the cryptomarkets as durable and growing, and expect Coinbase has the opportunity to influence and benefit from this market growth as it innovates.

Another investment bank, Goldman Sachs, initiated coverage of the Coinbase Global stock on Monday with a buy rating. The firm has set the price target for Coinbase at $306, a 31% increase from the current level.

Goldman Sachs analyst Will Nance explained that Coinbase Global “brings leverage to an ecosystem that has seen strong growth driven by increasing adoption of digital currencies.” In addition, COIN has “an attractive business model that thrives on elevated cryptocurrency volatility,” with “significant opportunities to add additional features and capabilities.” The analyst further said:

We believe COIN represents a blue-chip way through which to invest in the development of the ecosystem.

Bitcoin News reported Monday that Goldman Sachs is now considering bitcoin an investable asset and a new asset class. “Clients and beyond are largely treating it as a new asset class, which is notable — it’s not often that we get to witness the emergence of a new asset class,” Goldman’s analyst wrote.

Would you buy the Coinbase stock? Let us know in the comments section below.