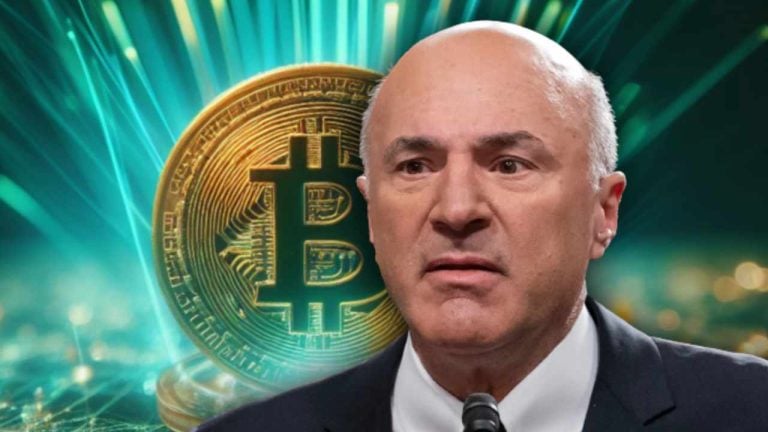

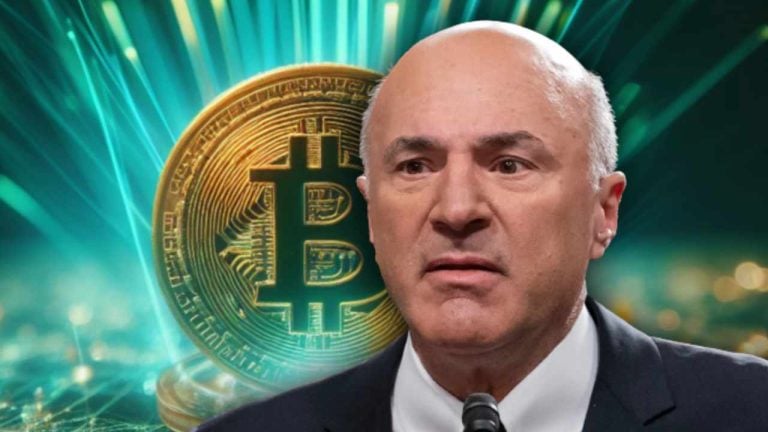

Kevin O’Leary Warns Spot Bitcoin ETF Approval Could Be 18 Months Away

Publikováno: 15.11.2023

Shark Tank investor Kevin O’Leary, aka Mr. Wonderful, has cautioned that it could take another year and a half for the U.S. Securities and Exchange Commission (SEC) to approve a spot bitcoin exchange-traded fund (ETF). He emphasized that we will not see a spot bitcoin ETF in the U.S. until there is a crypto exchange […]

Shark Tank investor Kevin O’Leary, aka Mr. Wonderful, has cautioned that it could take another year and a half for the U.S. Securities and Exchange Commission (SEC) to approve a spot bitcoin exchange-traded fund (ETF). He emphasized that we will not see a spot bitcoin ETF in the U.S. until there is a crypto exchange […]

Shark Tank investor Kevin O’Leary, aka Mr. Wonderful, has cautioned that it could take another year and a half for the U.S. Securities and Exchange Commission (SEC) to approve a spot bitcoin exchange-traded fund (ETF). He emphasized that we will not see a spot bitcoin ETF in the U.S. until there is a crypto exchange that’s compliant with the SEC.

Kevin O’Leary’s Spot Bitcoin ETF Prediction

Shark Tank investor Kevin O’Leary, the chairman of O’Leary Ventures, discussed the potential approval of spot bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) at the Benzinga Fintech Deal Day & Awards on Monday.

O’Leary believes that increased regulatory clarity is necessary for the SEC to approve a spot bitcoin ETF. He explained that a spot bitcoin ETF needs a transparent and compliant crypto exchange to confirm the spot market pricing daily, emphasizing that the SEC will not approve one until there is such an exchange. He predicted:

There’s not going to be any bitcoin ETF until there is an exchange that is compliant with the SEC.

The Shark Tank star noted that the Nasdaq-listed cryptocurrency exchange Coinbase (Nasdaq: COIN) is the leading candidate for compliance. However, the crypto trading platform is currently in litigation with the SEC. The securities regulator charged Coinbase in June for operating as an unregistered securities exchange, broker, and clearing agency. Coinbase has been trying to get the lawsuit dismissed, insisting that it does not list crypto securities. However, the SEC told the exchange that everything other than bitcoin is a security.

Mr. Wonderful highlighted two hurdles to institutions investing in bitcoin: SEC compliance and 24/7 trading. He explained that BTC’s 24/7 trading poses challenges for institutional investors, as they typically limit their exposure to any one asset class to 5%. With stocks, it’s easy to rebalance daily because the markets close at 4 p.m. ET every day, he noted.

In response to a question about private discussions he’s had with institutions and major organizations regarding bitcoin, O’Leary revealed that “all of them” are prepared to invest in BTC. “They aren’t interested in the 10,000 token story,” he shared, elaborating:

Bitcoin is proving itself to be liquid enough, it’s proving itself to be a storage of wealth, most people consider it a commodity.

Citing that SEC Chairman Gary Gensler is set to remain chair of the securities regulator for another 18 months, O’Leary predicted that a spot bitcoin ETF approval could still be more than a year and a half away. Gensler was confirmed by the U.S. Senate on April 14, 2021, to serve a five-year term as SEC Chair. He was sworn into office on April 17, 2021. Nonetheless, Mr. Wonderful stressed that when the SEC finally approves a spot bitcoin ETF, demand for BTC will soar.

Gensler recently said that the securities watchdog is considering between eight to 10 spot bitcoin ETF applications. Some people expect the SEC to approve multiple spot bitcoin ETFs at once early next year, including JPMorgan’s analysts. Microstrategy Chairman Michael Saylor expects the demand for BTC to double after the halving and spot bitcoin ETF approvals.

What do you think about the statements by Shark Tank investor Kevin O’Leary about spot bitcoin ETFs? Let us know in the comments section below.