Market Strategist Draws Parallels Between Bitcoin and 1930 Stock Market Crash

Publikováno: 22.8.2023

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has explained that bitcoin appears similar to the stock market in 1930. At that time, elevated equity prices led to the stock market losing almost 90%. The crash of 1929, also called the Great Crash, contributed to the Great Depression which lasted approximately 10 years. Bitcoin v Stock […]

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has explained that bitcoin appears similar to the stock market in 1930. At that time, elevated equity prices led to the stock market losing almost 90%. The crash of 1929, also called the Great Crash, contributed to the Great Depression which lasted approximately 10 years. Bitcoin v Stock […]

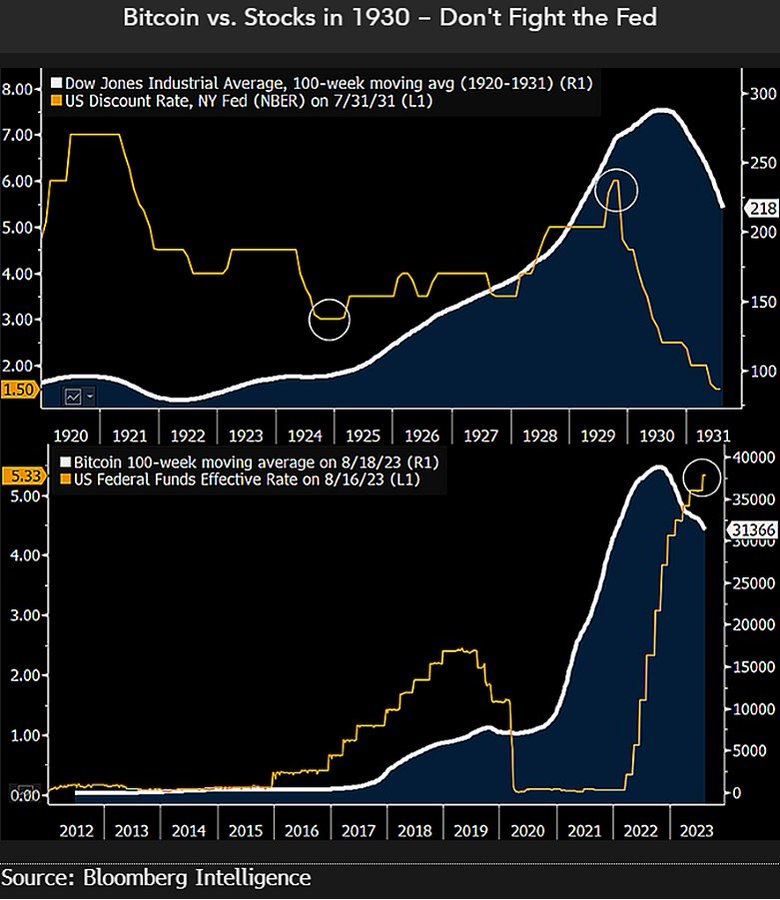

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, has explained that bitcoin appears similar to the stock market in 1930. At that time, elevated equity prices led to the stock market losing almost 90%. The crash of 1929, also called the Great Crash, contributed to the Great Depression which lasted approximately 10 years.

Bitcoin v Stock Market in 1930s

Mike McGlone, a senior commodity strategist for Bloomberg Intelligence (BI), the research arm of Bloomberg, has pointed out the similarity between bitcoin and the stock market in 1930. He tweeted on Monday:

One of the best-performing assets in history and a leading indicator — bitcoin — appears similar to the stock market in 1930.

“Statistician and entrepreneur Roger Babson began warning about elevated equity prices well before economist Irving Fisher proclaimed a ‘permanently high plateau’ in 1929,” the commodity strategist added, emphasizing: “The Fed tilts our bias toward a stance similar to Babson’s.”

Babson told a National Business Conference in Massachusetts in September 1929 that “sooner or later a crash is coming which will take in the leading stocks and cause a decline from 60 to 80 points in the Dow-Jones barometer.”

The Dow Jones Industrial Average increased nearly six-fold from sixty-three in August 1921 to 381 in September 1929. The epic boom culminated in a catastrophic crash. From April 1930 to July 1932, the Dow suffered a loss of 89.2%. The stock market crash of 1929, also called the Great Crash, contributed to the Great Depression of the 1930s which lasted approximately 10 years.

The Federal Reserve has increased interest rates to the highest level in 22 years, as it continues to fight persistent inflation in the U.S. economy. In July, the Fed raised its key interest rate by 25 basis points to a range of 5.25%-5.5%. Fed officials have said that more rate hikes may be needed to bring inflation down toward the central bank’s 2% target.

Do you agree with Bloomberg Intelligence strategist Mike McGlone about bitcoin and the crypto’s similarity to the stock market in 1930? Let us know in the comments section below.