Market Update: Blood in the Crypto Streets, Bitcoin Miner Dumps, CME Gap, Defi Doldrums

Publikováno: 4.9.2020

The cryptocurrency economy slid significantly on Thursday afternoon (ET), as the aggregate market cap of all the crypto coins shaved more than 10% during yesterday’s trading sessions. More than 12 hours later, a number of the top crypto assets are still down in value between 4-12%, and some digital coins saw even bigger losses during […]

The cryptocurrency economy slid significantly on Thursday afternoon (ET), as the aggregate market cap of all the crypto coins shaved more than 10% during yesterday’s trading sessions. More than 12 hours later, a number of the top crypto assets are still down in value between 4-12%, and some digital coins saw even bigger losses during […]

The post Market Update: Blood in the Crypto Streets, Bitcoin Miner Dumps, CME Gap, Defi Doldrums appeared first on Bitcoin News.

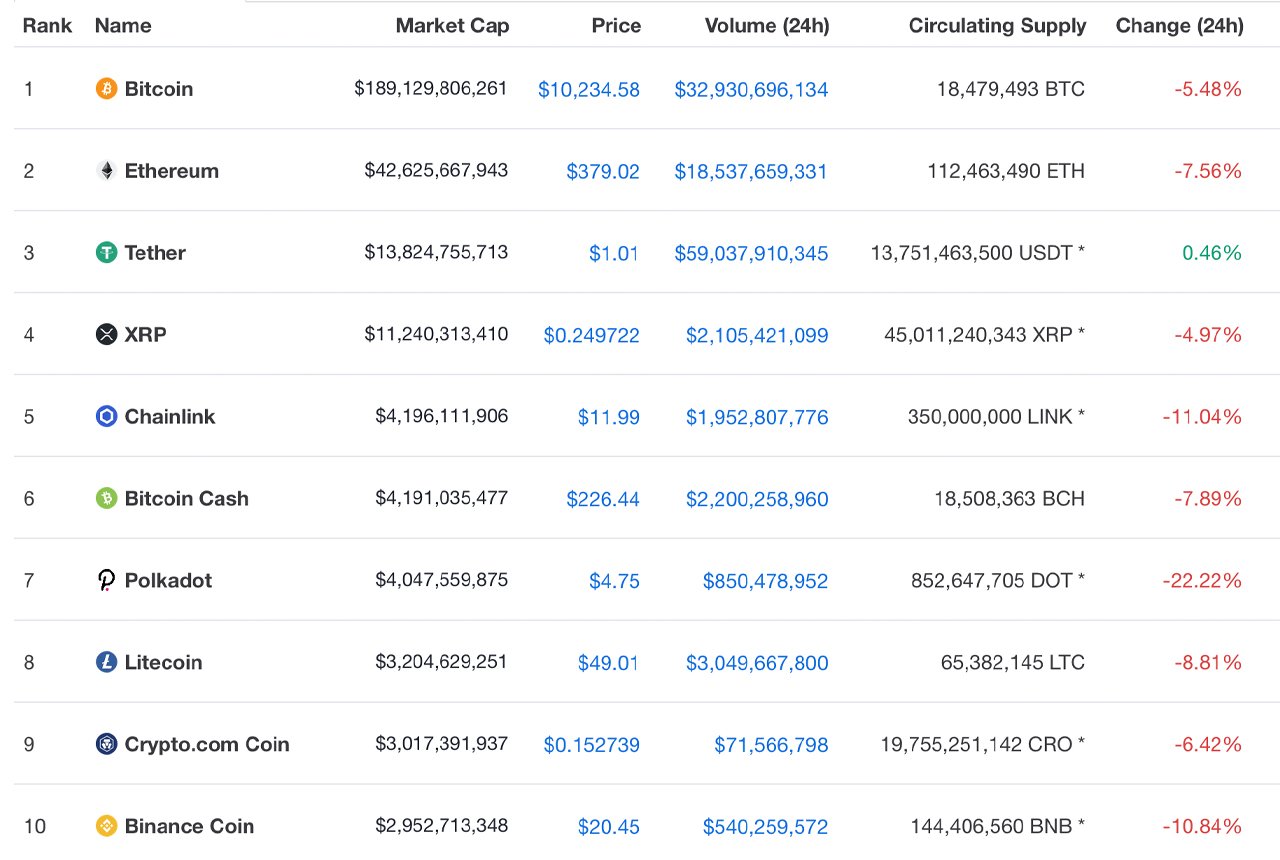

The cryptocurrency economy slid significantly on Thursday afternoon (ET), as the aggregate market cap of all the crypto coins shaved more than 10% during yesterday’s trading sessions. More than 12 hours later, a number of the top crypto assets are still down in value between 4-12%, and some digital coins saw even bigger losses during the last 48 hours.

Things change quickly in the crypto ecosystem, as digital currency proponents have been dealing with extremely volatile prices this week. For instance, bitcoin (BTC) touched a top on September 1, as prices touched $12,044 per coin on Tuesday.

Ever since then the crypto asset has been tumbling downward. BTC hovered around $11,200 on September 3, but shuddered once more to a low of $10,000 the following day. Bitcoin (BTC) is down 5.4% on Friday, over 10% for the last seven days, and down 11% for the last 30 days. At the time of publication, BTC has been coasting along between $10,250 to $10,400.

Following BTC’s drop, ethereum (ETH) also lost a decent chunk of value during the last 48 hours. ETH is down over 5% today as the crypto asset is trading for $395 per coin. Ethereum has lost only a half of a percentage during the week and is still up over 10% for the last 30 days.

Tether has removed XRP from the third-largest market cap position with a valuation of roughly $13.7 billion between all the circulating USDT. XRP has lost 2.5% today and the crypto asset is currently swapping for $0.25 per token.

The number five position now belongs to the Polkadot (DOT) project with it’s $4.5 billion market valuation. Chainlink (LINK) holds the sixth position trading for $12.67 per coin and has a market cap of around $4.4 billion on Friday.

Bitcoin cash (BCH) markets are down over 5% today as each BCH swaps for $235 per coin. BCH is down 7.5% for the last 90 days, over 20% during the last 30 days, and one-week stats show bitcoin cash is down 12.8%.

All over Twitter and forums like Reddit, crypto proponents are trying to figure out why digital currency markets shuddered. Some people think the price could go lower as there’s a $9,700 CME gap in the waiting.

A CME gap happens when the Chicago Mercantile Exchange’s Bitcoin futures markets pause trading during the weekend, but futures prices don’t reflect spot prices that have risen higher until the next week’s open. Not all CME and futures gaps get filled but sometimes they do and some large price dumps in the crypto economy have been attributed to CME price gaps.

Other theories have pointed to miners selling bitcoins as BTC deposits from mining operations into exchange wallets were the highest they had been in weeks. Data stemming from mining pool outflows via large pool operations like Poolin, Slush, and Haobtc show that it’s a possibility bitcoin miners sold off a good number of coins during the last 48 hours.

Analytics from Glassnode and Cryptoquant, indicate that bitcoin miners transferred a great number of BTC on Thursday which corroborates with the miner sell-off theories.

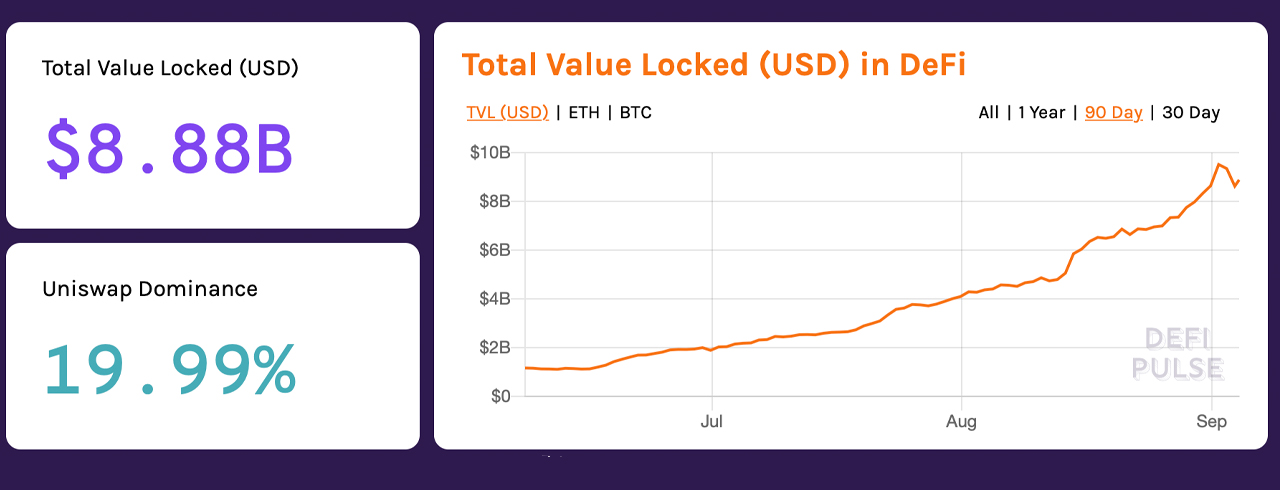

Another cause people are looking at during the dump is the decentralized finance (defi) economy simmering down. A great number of crypto asset holders have been complaining about ETH’s massive transaction fees and a lot of money has left defi since September 1.

On Tuesday, defipulse.com stats show the total value locked (TVL) in defi was $9.5 billion, but that has since shuddered to $8.8 billion on Friday. Many crypto speculators assume that a great number of defi players may have exited their positions in recent days.

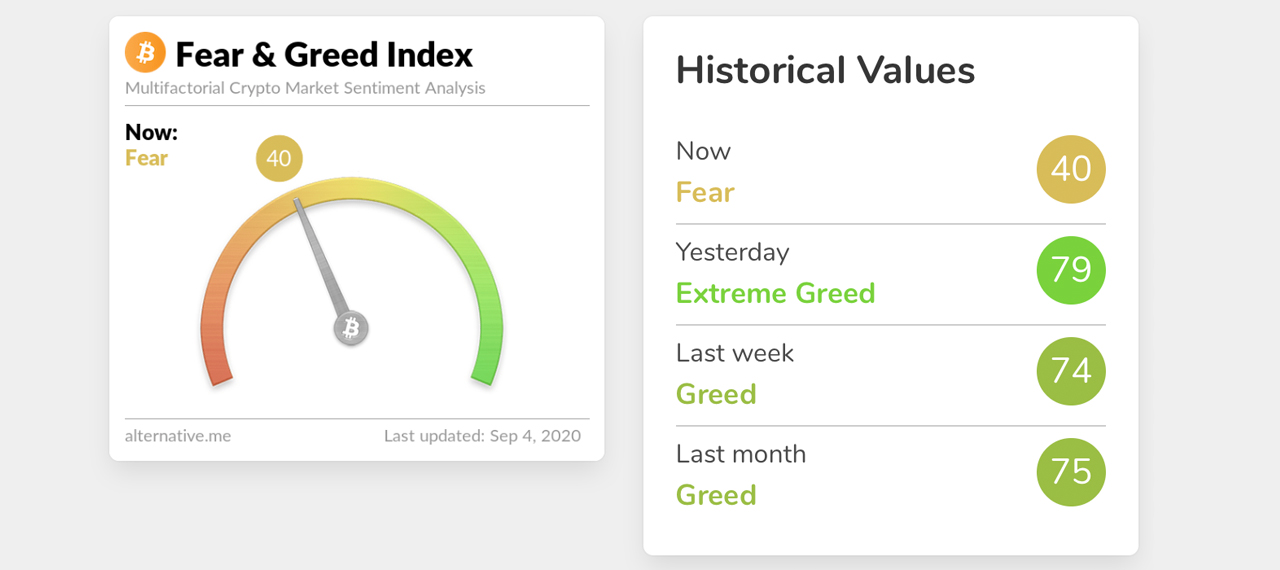

Lastly, the Crypto Fear and Greed Index (CFGI) has changed quite a bit in the last few days as well. Last month the chart read “greed” and similarly the chart was reading “greed” during the last week. However, just before the big price slide, the CFGI slid from “extreme greed” to “fear” during the last 24 hours of trading.

Despite this, the overall market valuation of all 7,000+ crypto assets is still well above a quarter of a trillion dollars at $326 billion. Alongside this metric, is $49 billion worth of global trade volume, but tether (USDT) commands most of the volume today.

However, many traders look at the stablecoin economy’s backdrop of funds a positive outlook as many believe that money will eventually flow right back into more decentralized crypto assets like bitcoin (BTC) and ethereum (ETH).

What do you think about crypto markets taking a huge hit in value during the last 48 hours? Let us know what you think about this subject in the comments below.

The post Market Update: Blood in the Crypto Streets, Bitcoin Miner Dumps, CME Gap, Defi Doldrums appeared first on Bitcoin News.