Network Landmarks, Derivatives Records- 2020 Bitcoin Metrics See a Number of All-Time Highs

Publikováno: 3.12.2020

While the price of bitcoin has spiked to levels not seen in three years a number of other factors show that the current run-up is similar to the 2017 bull run. Active bitcoin addresses have neared all-time record highs, while the network’s hashpower has remained high as well coasting along at 130 exahash. Moreover, bitcoin […]

While the price of bitcoin has spiked to levels not seen in three years a number of other factors show that the current run-up is similar to the 2017 bull run. Active bitcoin addresses have neared all-time record highs, while the network’s hashpower has remained high as well coasting along at 130 exahash. Moreover, bitcoin […]

The post Network Landmarks, Derivatives Records- 2020 Bitcoin Metrics See a Number of All-Time Highs appeared first on Bitcoin News.

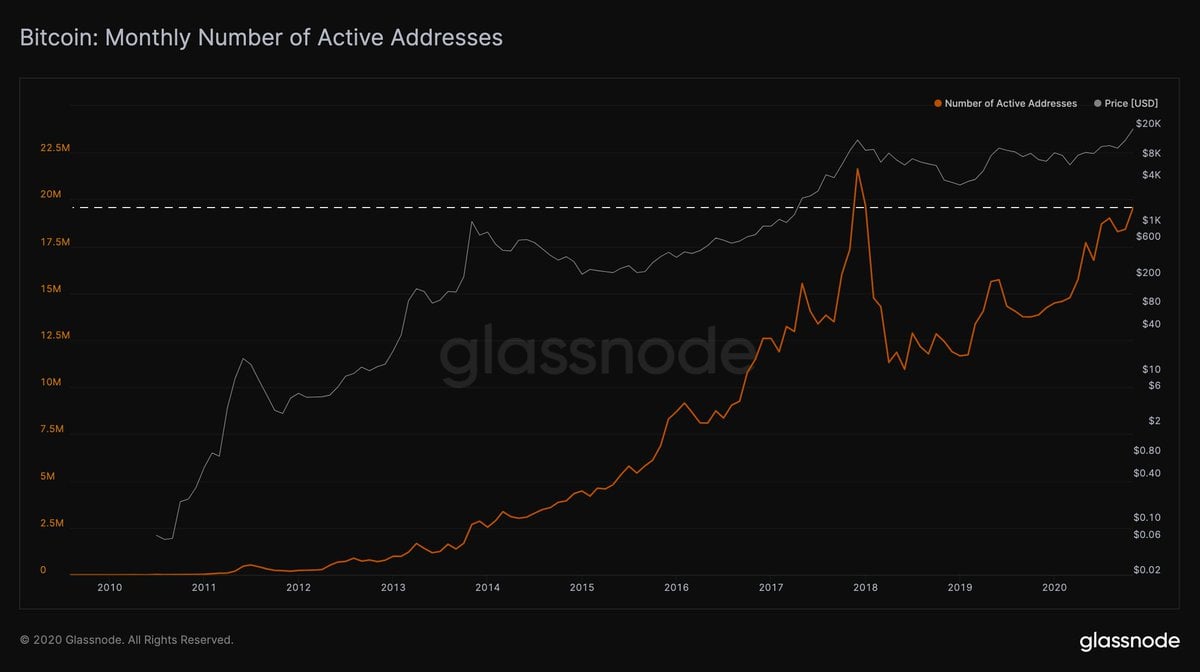

While the price of bitcoin has spiked to levels not seen in three years a number of other factors show that the current run-up is similar to the 2017 bull run. Active bitcoin addresses have neared all-time record highs, while the network’s hashpower has remained high as well coasting along at 130 exahash. Moreover, bitcoin derivatives markets have crossed record levels as well as open interest in options, and futures have never been so high.

Following a 1,079 day wait, on November 30, 2020, BTC broke its record price high that was recorded in mid-December 2017. Since then, BTC has been consolidating about $1k lower than the ATH, as traders and analysts are uncertain what will happen next. Despite the slight downturn, there are a number of metrics showing the current market is very similar to the bull run witnessed three years ago.

For instance, onchain analytics researchers from Glassnode tweeted about how active BTC addresses have touched its third-highest value in November at close to 19.6 million. Back in December 2017, active addresses hit 21.64 million, and in January 2018 19.67 million.

The Block’s director of research, Larry Cermak, told his Twitter followers on December 2 that many metrics have been reaching all-time highs. “Total on-chain volume, a proxy for economic throughput, saw a strong increase of 51.5%, to a new yearly high of $204 billion in November. Bitcoin’s on-chain volume was 2 times higher than Ethereum’s in November,” Cermak said.

The researcher also highlighted that BTC miners generated $520 million in revenue last November. “Representing a significant month-over-month increase of 48%,” Cermak wrote. “This is the highest amount of revenues since February 2020, and higher than prior to the halving.”

Bitcoin’s hashrate has also remained high as many people believe that hashpower follows price. Currently on December 2, the overall BTC hashrate is roughly 129 exahash per second (EH/s). 17 mining operations have SHA256 hash pointed at the BTC chain on Wednesday and the network difficulty is awfully high. Currently, the difficulty is 19.16 trillion and in roughly 11 days it may jump to a touch over 20 trillion at current speeds.

Glassnode stats show the “Number of Active Entities (7d Moving Average)” increased a great deal in 2020 and “is now approaching 400,000 active entities per day.” The researchers note that this is less than 4% of the previous ATH in terms of active entities.

“This heightened onchain activity signifies increased adoption and usage of the network. However, unlike the last bull market, the [Number of New Entities] is still comparatively low,” Glassnode wrote in The Week Onchain report published on November 30.

In addition to the recent BTC spot market milestones and onchain achievements, other investment vehicles that leverage the crypto asset have seen significant demand as well. As far as bitcoin derivatives markets are concerned, both options and futures markets saw all-time highs in terms of open interest. The crypto trading platform Deribit has captured a lion’s share of the bitcoin options and explained in a recent newsletter that “multiple new records were achieved.”

“Increased volatility has also fueled the demand for options,” Deribit noted. “In November, multiple new records were achieved. A new monthly notional turnover record – USD 14.3 billion, a new average daily BTC options turnover record – 25k BTC contracts, and the largest options OI – USD 4.8 billion, a 100% increase versus October.”

The trading platform notes that last month, “volatility nearly doubled, reaching 84% for BTC versus 49%.” In general, however, the bitcoin derivatives markets’ volatility has been changing and Deribit stressed: “volatility term structure inverting from upward to downward sloping in just a few days.”

While there’s been some retracement, once BTC spikes past the $20k price zone analysts have highlighted that there is zero historical resistance above the psychological zone. Paolo Ardoino, CTO at Bitfinex explains that the crypto space has matured a great deal since the previous 2017 bull run.

“Crypto markets are today retracing some of the recent gains,” Ardoino said. “As some of the euphoria in the cryptosphere subsides, participants can reflect on how far the space has evolved since the previous all-time high for bitcoin of $20,000. No amount of cynicism, disbelief, or even fantastical thinking can obscure the compelling case for Bitcoin. Global asset managers will continue to recalibrate their portfolios accordingly.”

What do you think about all the milestones bitcoin has seen in 2020? Let us know what you think about this subject in the comments section below.

The post Network Landmarks, Derivatives Records- 2020 Bitcoin Metrics See a Number of All-Time Highs appeared first on Bitcoin News.