Over 600 Stablecoins ‘Depeg’ in 2023, Moody’s Analytics Launches Monitoring Tool

Publikováno: 7.11.2023

Stablecoins, the crypto assets crafted to mirror the stability of fiat currency, have encountered over 600 significant instances of price instability in 2023, as per Moody’s Analytics. A ‘depeg’ or ‘depegging’ event is characterized by a stablecoin’s value swinging beyond a 3% margin from its standard $1 mark within a day, according to Moody’s Analytics’ […]

Stablecoins, the crypto assets crafted to mirror the stability of fiat currency, have encountered over 600 significant instances of price instability in 2023, as per Moody’s Analytics. A ‘depeg’ or ‘depegging’ event is characterized by a stablecoin’s value swinging beyond a 3% margin from its standard $1 mark within a day, according to Moody’s Analytics’ […]

Stablecoins, the crypto assets crafted to mirror the stability of fiat currency, have encountered over 600 significant instances of price instability in 2023, as per Moody’s Analytics. A ‘depeg’ or ‘depegging’ event is characterized by a stablecoin’s value swinging beyond a 3% margin from its standard $1 mark within a day, according to Moody’s Analytics’ latest report.

Stablecoins Wobble in 2023

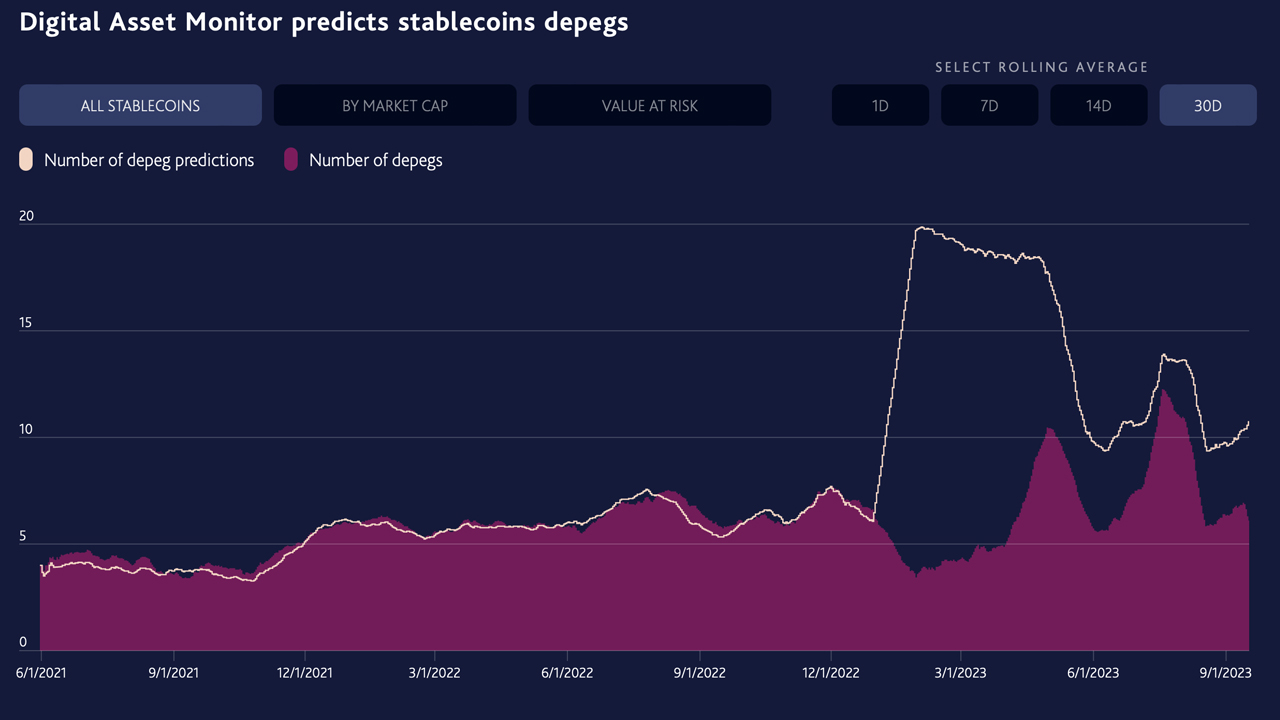

In an effort to keep a close watch on stablecoin fluctuations, Moody’s Analytics has introduced its Digital Asset Monitor (DAM), focusing on key players such as tether, usd coin, and binance usd. This tool has tallied a total of 1,914 depegging events across various stablecoins, with high-value fiat-pegged tokens experiencing 609 such instances alone.

The analysts at Moody’s Analytics revealed a total of 707 depegging events for stablecoins in 2022. Stablecoins are engineered to anchor their value to a fixed rate, commonly $1 per unit, backed by a reserve of fiat currencies or other assets to maintain a uniform value. Despite this, some of the most sizable stablecoins in terms of market value have fallen short of their $1 benchmark, as was the case with USDC during the downfall of Silicon Valley Bank (SVB).

“We have seen the stablecoin market grow into a multibillion-dollar asset class accounting for about 10 percent of the crypto market and most on-chain activity,” Yiannis Giokas, the senior director of Product Innovation at Moody’s Analytics wrote. “However, given ongoing volatility in the asset class, we saw substantial demand from our customers to fill a gap in this space with a comprehensive risk assessment tool for digital assets.”

Moody’s latest analytical tool scrutinizes the movements, reserves, and transparency of 25 leading fiat-anchored stablecoins. Leveraging a mix of exclusive data, advanced machine learning, and blockchain scrutiny, the monitor also evaluates potential future “depegs.” The report emphasizes that the digital asset monitoring solution does not connect to Moody’s credit ratings business.

Fluctuations in the broader economic landscape, such as spikes in interest rates, often precipitate a detachment from the stablecoins’ pegged value. Nonetheless, Moody’s findings indicate that stablecoins regularly experience depegging for various reasons. The monitor’s purpose is to shed light on the inherent perils of stablecoins for entities delving into the decentralized finance (defi) sector.

This initiative by Moody’s to chart stablecoin activity follows significant depegging episodes that rattled the crypto economy in 2022. Notably, the crash of the algorithmic stablecoin terrausd (UST) along with its sister token LUNA in May 2022 wiped out massive market capital. Stablecoins serve as the cornerstone for cryptocurrency lending and borrowing, and the escalated volatility has sent waves through digital asset values throughout 2023.

Moody’s DAM reports that alongside USDC’s depegging incident during the SVB collapse in the week of March 10, 2023, five additional stablecoins also experienced depegging. On May 2, 2023, DAM captured 10 separate depegging events. A considerable number of fiat-linked tokens have utterly failed to maintain their trading value at $1.

The volatility of prominent stablecoins might come as a surprise to many, with tokens such as USDC, TUSD, FRAX, DAI, BUSD, LUSD, USDT, MIM, and USDP undergoing significant value fluctuations over time. In the latter half of October, Tangibledao’s USDR plummeted to around 50 cents and hasn’t recovered since. In another instance, Aave’s GHO stablecoin has never matched the dollar since its inception, currently trading at 96 cents despite the liquidity team’s promises of a resolution.

Paypal’s stablecoin, PYUSD, has dipped to a low of 97.9769 cents, narrowly avoiding a depegging by the threshold of a 3% drop from its peg. On August 17, 2023, the new stablecoin FDUSD hit a record low, trading at 94.2129 cents per unit — its most substantial drop from the 1:1 dollar parity to date.

What do you think about Moody’s Digital Asset Monitor (DAM) and stablecoin report? Share your thoughts and opinions about this subject in the comments section below.