Q2 2022 Cryptocurrency Report Highlights Terra’s Collapse and Capital Exiting the Crypto Ecosystem

Publikováno: 23.7.2022

On July 13, the dedicated crypto price tracking, volume, and market capitalization web portal Coingecko published the company’s “Q2 2022 Cryptocurrency Report” which discusses the last quarter’s crypto market action and insights. The 46-page report explains how the Terra UST and LUNA fallout wreaked havoc on the entire crypto ecosystem and the stablecoin economy. Moreover, […]

On July 13, the dedicated crypto price tracking, volume, and market capitalization web portal Coingecko published the company’s “Q2 2022 Cryptocurrency Report” which discusses the last quarter’s crypto market action and insights. The 46-page report explains how the Terra UST and LUNA fallout wreaked havoc on the entire crypto ecosystem and the stablecoin economy. Moreover, […]

On July 13, the dedicated crypto price tracking, volume, and market capitalization web portal Coingecko published the company’s “Q2 2022 Cryptocurrency Report” which discusses the last quarter’s crypto market action and insights. The 46-page report explains how the Terra UST and LUNA fallout wreaked havoc on the entire crypto ecosystem and the stablecoin economy. Moreover, Coingecko researchers say “a decrease in the stablecoin market share suggests that a certain amount of capital has completely exited the crypto ecosystem.”

Coingecko’s Data Suggests Q2 Investors Exited Stablecoins Rather Than De-Risking Into Them

Coingecko has published the company’s second quarter cryptocurrency report for 2022 as there’s been a number of significant changes during the last three months. The study, published last Wednesday, notes that Q2 2022 was “filled with many unfortunate events in the crypto space.”

The crypto firm’s report explains that while spot market trade volumes have remained steady at $100 billion daily, “the top 30 coins have lost over half their market cap since the previous quarter.” Much of the crypto blunder started from a domino effect caused by the Terra UST and LUNA collapse.

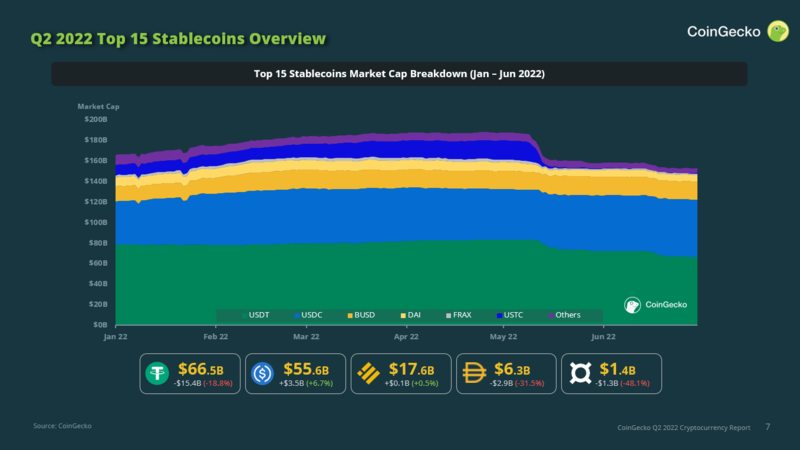

Coingecko details that just before UST’s downfall, the stablecoin was the third-largest fiat-based token in existence, and $18 billion was erased in just a few days. The report notes that BUSD managed to become the third-largest stablecoin. Beside’s Terra’s UST, other stablecoin assets saw their valuations suffer and Coingecko’s analysts suspect a specific amount of funds have left the crypto economy. The researcher’s Q2 2022 study says:

The slight decrease (discounting UST) in stablecoin market share suggests that a certain amount of capital has completely exited the crypto ecosystem, in contrast to last quarter when investors likely de-risked into stables amidst market uncertainty.

The Terra and 3AC Fallouts Spread, Defi Market Cap Tumbles

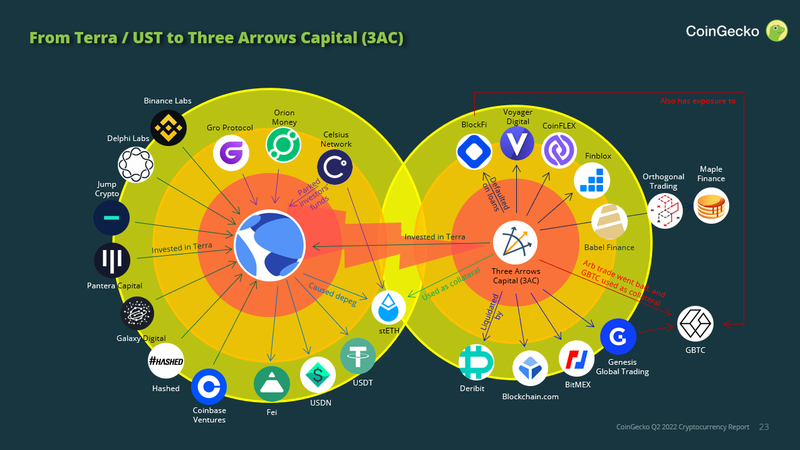

The 46-page report further explains how Lido’s bonded assets were affected by the Terra blowout and the demise of the crypto hedge fund Three Arrows Capital (3AC). One specific chart shared in the study shows how 3AC’s financial issues affected at least 12 different crypto companies directly or indirectly.

Decentralized finance (defi) was also hit, as Coingecko’s authors say “Due to third-order effects, defi protocols such as Maple Finance were not spared as some users’ funds were lent to Orthogonal Trading, which in turn had gone to Babel Finance, one of 3AC’s creditors.”

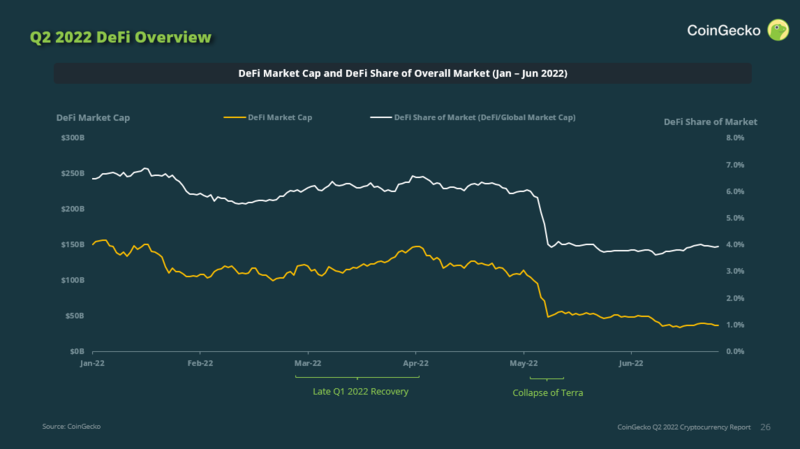

Defi itself suffered a lot and Coingecko’s data shows that the defi market cap slid from “$142 billion to $36 billion in a span of 3 months.” The report again says that much of the value in defi was “wiped out largely due to the collapse of Terra and its stablecoin, UST.”

Coingecko’s study covers a wide variety of subjects that pertain to Q2 2022’s crypto action and touches on topics like other stablecoins losing their peg, decentralized exchange (dex) trade volumes, non-fungible tokens (NFTs), and NFT marketplaces. While the second quarter saw a lot of action, Coingecko’s report highlights how most of it has been bearish and gloomy.

What do you think about Coingecko’s report and the action recorded in the second quarter of 2022? Let us know what you think about this subject in the comments section below.