Robert Kiyosaki’s Advice: Get Into Bitcoin Now ‘Before It’s Too Late’

Publikováno: 27.11.2023

Rich Dad Poor Dad author Robert Kiyosaki has advised investors to get into bitcoin and ditch fiat money now “before it’s too late,” reiterating that workers and savers in U.S. dollars are losers. Kiyosaki has made a number of bullish predictions about the price of bitcoin, ranging from $135,000 in the near term to $1 […]

Rich Dad Poor Dad author Robert Kiyosaki has advised investors to get into bitcoin and ditch fiat money now “before it’s too late,” reiterating that workers and savers in U.S. dollars are losers. Kiyosaki has made a number of bullish predictions about the price of bitcoin, ranging from $135,000 in the near term to $1 […]

Rich Dad Poor Dad author Robert Kiyosaki has advised investors to get into bitcoin and ditch fiat money now “before it’s too late,” reiterating that workers and savers in U.S. dollars are losers. Kiyosaki has made a number of bullish predictions about the price of bitcoin, ranging from $135,000 in the near term to $1 million.

Robert Kiyosaki Recommends Getting Into Bitcoin Now

The author of Rich Dad Poor Dad, Robert Kiyosaki, has reiterated his recommendation of gold, silver, and bitcoin while advising investors to ditch fiat currency. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

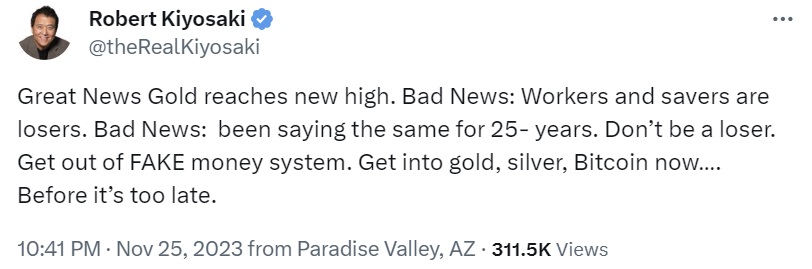

The famous author wrote on social media platform X Saturday that gold has reached a new high. Noting that workers and savers are losers, he urged them to “get out of fake money system” and immediately get into gold, silver, and bitcoin “before it’s too late.”

Kiyosaki often refers to fiat money as “fake money.” He previously explained that “the U.S. dollar became fake money” when President Richard Nixon removed it from the gold standard in 1971. “This is because rather than being tied to real money,” such as gold, “it was tied to the ‘full faith and credit’ of the United States,” the Rich Dad Poor Dad author described. In contrast, he calls gold and silver God’s money while bitcoin is “people’s money.”

Earlier this month, he stressed that fiat money isn’t safe, urging investors to protect themselves from central bankers. The renowned author has said repeatedly that he doesn’t trust the Federal Reserve, the Biden administration, and Wall Street, warning that the Fed and the Treasury are destroying the U.S. dollar.

He previously predicted that people who own gold, silver, and bitcoin will get richer when the Federal Reserve prints trillions of dollars, emphasizing: “Fake money savers will be the biggest losers.” In September last year, he stated: “Today, U.S. debt in 100s of trillions. Real inflation is 16%, not 7%. Fed raising interest rates will destroy U.S. economy. Savers will be biggest losers. Invest in real money. Gold, silver & bitcoin.”

Earlier this month, he reminded investors of Rich Dad’s first lesson that the rich don’t work for dollars. “The rich do not want jobs or fake paper assets. The rich want assets that put real tax-free money in their pockets and they know how to save real assets, gold, silver, bitcoin assets that provide lifelong financial security and freedom,” Kiyosaki explained.

The renowned author has long been recommending gold, silver, and bitcoin. Last week, he said bitcoin is the best protection against hyperinflation. Kiyosaki has made a number of bullish predictions about the price of BTC, ranging from $135,000 in the near term to $1 million in the event of a global economic crisis. He has also predicted that gold could reach $75,000 and silver could reach $60,000 in the same scenario. In February, he projected that the price of bitcoin would reach $500,000 by 2025, while gold could rise to $5,000 and silver could reach $500 within the same timeframe.

What do you think about Rich Dad Poor Dad author Robert Kiyosaki’s advice? Let us know in the comments section below.