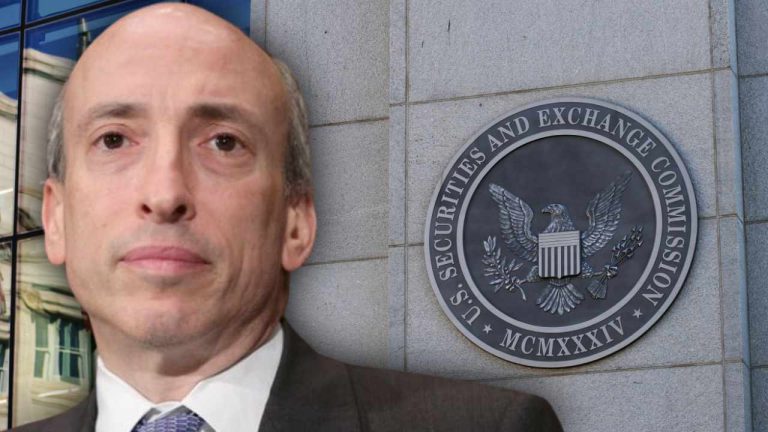

SEC Chair Gary Gensler Issues Crypto Warnings as Anticipation of Spot Bitcoin ETF Approval Soars

Publikováno: 23.12.2023

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has issued warnings regarding cryptocurrency investments. “There is a lot of noncompliance in the crypto space,” he stressed, emphasizing that it “undermines confidence when so many people have been hurt and all they can do is stand in line in the bankruptcy court.” Gensler’s warnings came […]

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has issued warnings regarding cryptocurrency investments. “There is a lot of noncompliance in the crypto space,” he stressed, emphasizing that it “undermines confidence when so many people have been hurt and all they can do is stand in line in the bankruptcy court.” Gensler’s warnings came […]

U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler has issued warnings regarding cryptocurrency investments. “There is a lot of noncompliance in the crypto space,” he stressed, emphasizing that it “undermines confidence when so many people have been hurt and all they can do is stand in line in the bankruptcy court.” Gensler’s warnings came as the market expects imminent approvals of spot bitcoin exchange-traded funds (ETFs).

Gary Gensler’s Crypto Warnings

The chairman of the U.S. Securities and Exchange Commission (SEC), Gary Gensler, issued crypto warnings on social media platform X Thursday. The SEC chief wrote:

There is a lot of noncompliance in the crypto space. It undermines confidence when so many people have been hurt and all they can do is stand in line in the bankruptcy court. Further, this can make it hard for the good faith actors to compete.

His post is accompanied by a video of him on CNBC last week, elaborating on the prevalent noncompliance within the crypto industry concerning securities laws. These laws, he emphasized, are not only “there to help give you the disclosure so you can make the investment decision, but also to protect you against fraud and manipulation.” He then reiterated his previous statement that crypto also violates laws set by other regulatory bodies, such as the Commodity Futures Trading Commission (CFTC) and the Financial Crimes Enforcement Network (FinCEN).

“This is really the Wild West and it’s around the globe,” Gensler exclaimed. Noting that it’s not just one or a few bad actors, he stressed: “This is something that pervades a lot of this field globally, and it’s hard for the good faith actors even to compete because there are so many challenges elsewhere.”

Gensler’s X post was hit with a “Readers added context,” stating: “Crypto companies like Coinbase (a public company that the SEC oversaw the listing of) have been trying to gain clarity on SEC guidance for compliance for the past few years. The SEC hasn’t taken a clear stance and has relied on regulation by enforcement.”

Many people on X mocked the SEC chairman’s statements. One user wrote: “Community notes just wrecked Gensler. Good!” Another described: “Gary Gensler embarrasses himself and earns a readers added context. The only confidence that has been undermined is public confidence of anyone in crypto globally (except Prometheum) in the SEC under his leadership.” A third user pointed out: “Gary met with SBF [former FTX CEO Sam Bankman-Fried] multiple times prior to FTX’s downfall so they could discuss the SEC agreeing to allow FTX to operate w/o SEC interference. The bad actors that Gary is referring to are his friends.” Some questioned the timing of Gensler’s warnings. “Gary dropping this video at a suspicious time. I think he might be hinting at what’s coming next,” an X user opined.

Chair Gensler and the SEC under his leadership have been heavily criticized by many for taking an enforcement-centric approach to regulating the crypto industry. There is even a bill in Congress to remove him as the chairman of the securities regulator. Meanwhile, the SEC is currently evaluating 13 spot bitcoin exchange-traded fund (ETF) applications and is expected to approve multiple of them by Jan. 10.

What do you think about the crypto warnings by SEC Chairman Gary Gensler? Let us know in the comments section below.