SEC Looks to Enhance Control by Trimming Intermediaries in Spot Bitcoin ETFs: Bloomberg Analyst

Publikováno: 29.12.2023

Source: AdobeStock Bloomberg analyst Eric Balchunas has shared insights on the latest requirements imposed by the U.S. Securities and Exchange Commission (SEC) to regulate the involvement of third parties in Spot Bitcoin ETFs through a “cash-create” redemption model. The SEC has set a deadline of December 29, 2023, for spot Bitcoin exchange-traded fund (ETF) applicants […]

The post SEC Looks to Enhance Control by Trimming Intermediaries in Spot Bitcoin ETFs: Bloomberg Analyst appeared first on Cryptonews.

Bloomberg analyst Eric Balchunas has shared insights on the latest requirements imposed by the U.S. Securities and Exchange Commission (SEC) to regulate the involvement of third parties in Spot Bitcoin ETFs through a “cash-create” redemption model.

The SEC has set a deadline of December 29, 2023, for spot Bitcoin exchange-traded fund (ETF) applicants to submit the final S-1 amendment.

Confirming the date for final amendments to all S-1s by Friday the 29th. The @SECGov has told issuers that applications that are fully finished and filed by Friday will be considered in the first wave. Anyone who is not will not be considered. In addition, the filings cannot… https://t.co/syyINu1BEI

— Eleanor Terrett (@EleanorTerrett) December 24, 2023

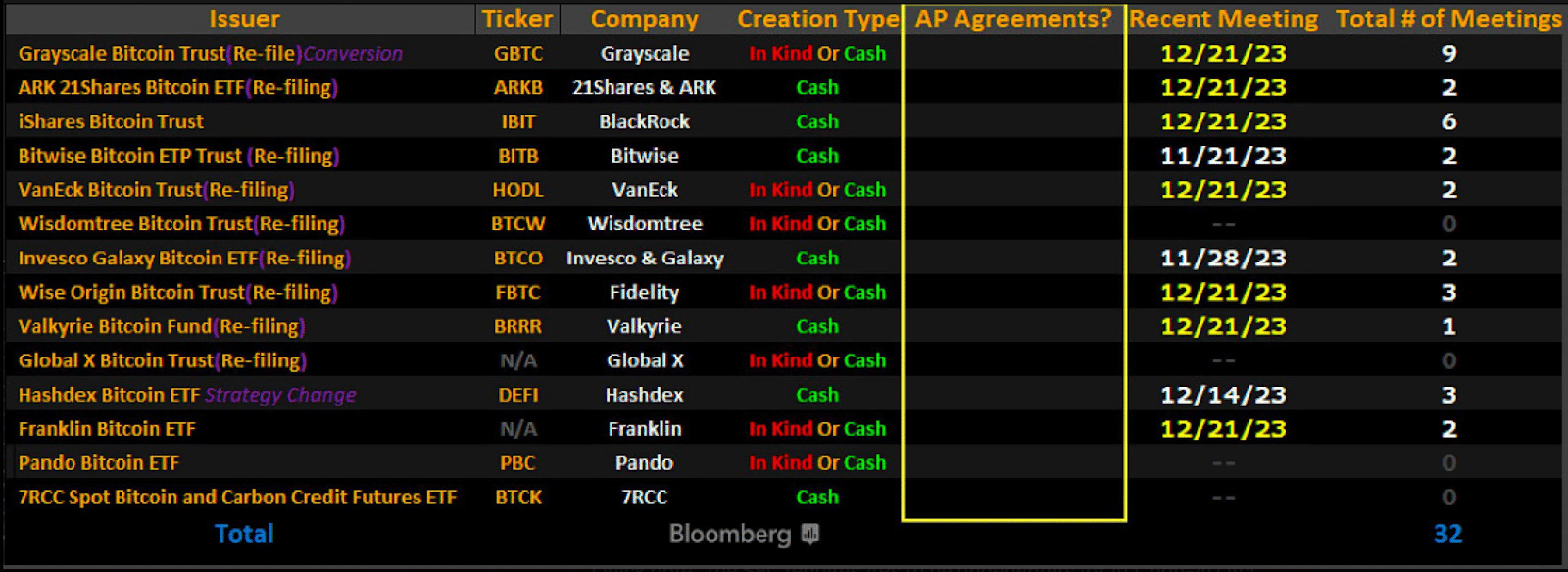

Other deadline requirements include issuers entering into agreements with Authorized Participants (APs) and specifying the cash-create or in-kind redemption models that will be employed.

In a thread post on X, Balchunas highlighted the significance of the S-1 Amendment deadline for ETFs and the challenges tied to identifying APs for approval.

Happy S-1 Amendment Deadline Day to all (the maniacs) who celebrate.. unfort today may not tell us who is officially in the Cointucky Derby yet as most S-1s prob have blank space where AP name should go. Need those to declare horse qualified. Could see some today, but guessing… pic.twitter.com/o830GFqQvP

— Eric Balchunas (@EricBalchunas) December 29, 2023

He pointed out that the SEC not only demands APs to be named in the documents but also to serve as underwriters, guaranteeing the issuance of new ETF shares to the market.

This additional requirement raises concerns among potential APs, given the novelty of the asset class and potential legal risks.

Meanwhile, there has been a noteworthy development related to the amendment of applications in accordance with the deadline.

Seven out of the 14 applicants have adjusted their ETF filings to adopt a cash-create structure, indicating a preference for cash settlements.

The remaining applicants have chosen a combination of cash-create and in-kind models in their registration statements, suggesting a diverse range of approaches among the applicants in structuring their ETFs.

Balchunas previously highlighted that Ark Investment was the first issuer to implement the S-1 amendment.

ARK kicks off the S-1 Amendment-athon. Ahead of the pack as usual. Unclear yet what was changed tho, AP mentioned a ton but not named. Assuming that will prob come in the very final effective update just prior to launch. But we still don't know if they have signed agreement. https://t.co/mcNgpoR451

— Eric Balchunas (@EricBalchunas) December 28, 2023

However, there was no mention of an AP or signed agreement, which is anticipated to occur in the final hours leading up to the December 29 deadline.

Crypto Communities Remain Optimistic

Over the past years, the SEC has consistently postponed or rejected approval for a spot Bitcoin exchange-traded fund (ETF).

Meanwhile, the regulatory body has scheduled January 10, 2024, to announce the verdict on the Ark and 21Shares ETF application.

Despite previous disapprovals, industry insiders, including Eric Balchunas and fellow analyst James Seyffart, express optimism that the SEC may finally greenlight the spot Bitcoin ETF this time.

New Research note from me today. We still believe 90% chance by Jan 10 for spot #Bitcoin ETF approvals. But if it comes earlier we are entering a window where a wave of approval orders for all the current applicants *COULD* occur pic.twitter.com/u6dBva1ytD

— James Seyffart (@JSeyff) November 8, 2023

If approved, the spot Bitcoin ETF would be officially listed on traditional stock exchanges, similar to company stocks.

This would facilitate easy trading for retail investors through standard brokerage accounts, eliminating the necessity for a dedicated cryptocurrency exchange account.

The introduction of such ETFs is expected to streamline retail investment in the crypto market, potentially resulting in increased demand.

While the specific details of the application amendments requested by the SEC are not explicitly confirmed, previous updates suggest a shift from non-monetary payments to cash redemption.

Additionally, the SEC’s insistence on ETF filers naming the APs in their applications underscores the significance of transparency and accountability in the regulatory process.

The post SEC Looks to Enhance Control by Trimming Intermediaries in Spot Bitcoin ETFs: Bloomberg Analyst appeared first on Cryptonews.