Solana Price Prediction as SOL Drops 10% – Time to Buy the Dip?

Publikováno: 27.12.2023

Solana. Source: Adobe The price of SOL, the native cryptocurrency of the smart-contract-enabled layer-1 Solana blockchain protocol, continues to cool following a meteoric rise in the past few weeks. SOL was last changing hands around $112 per token, down roughly 10% from highs printed earlier in the week above $125, though still up over 60% […]

The post Solana Price Prediction as SOL Drops 10% – Time to Buy the Dip? appeared first on Cryptonews.

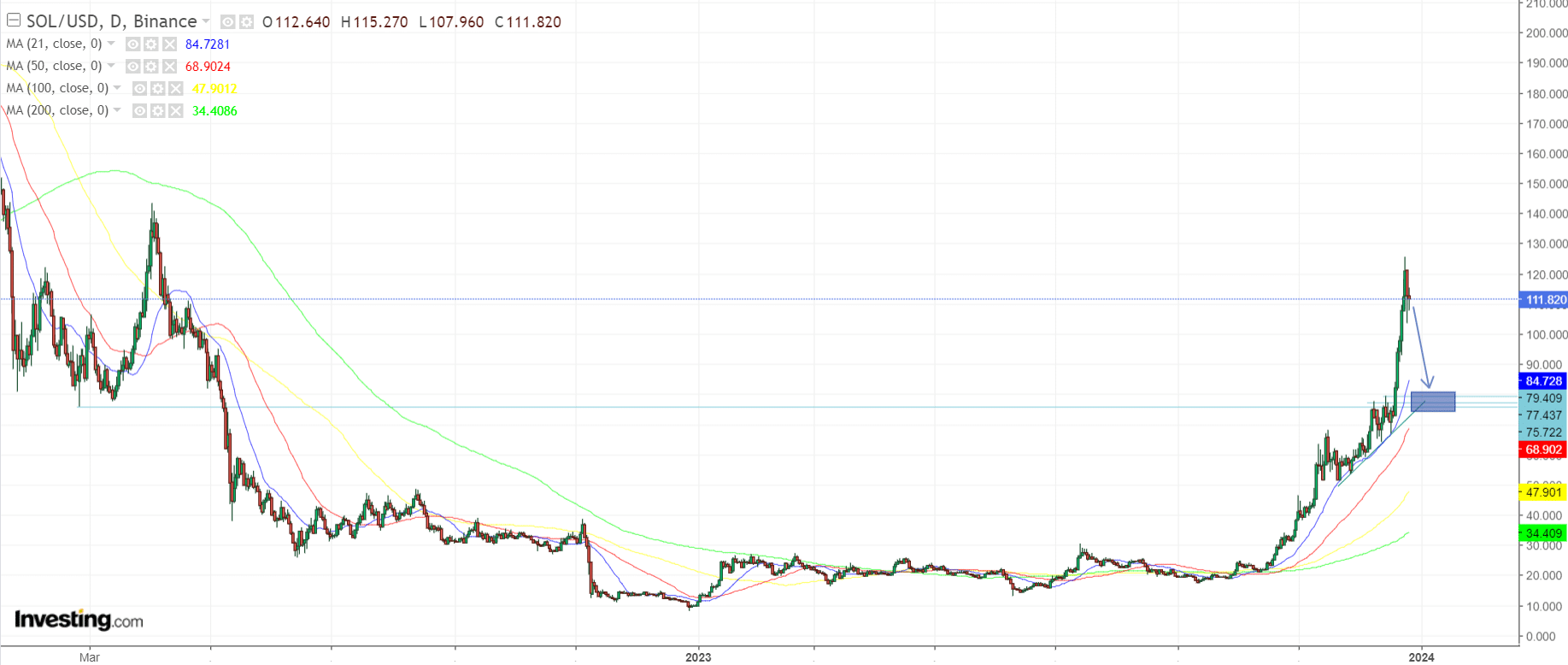

The price of SOL, the native cryptocurrency of the smart-contract-enabled layer-1 Solana blockchain protocol, continues to cool following a meteoric rise in the past few weeks.

SOL was last changing hands around $112 per token, down roughly 10% from highs printed earlier in the week above $125, though still up over 60% since the start of the month, and up more than 430% from October’s lows in the low $20s.

Solana’s impressive price pump comes at a time when the broader cryptocurrency market has been experiencing significant gains as traders bet that 1) the US Federal Reserve will began easing liquidity conditions next year with rate cuts and 2) that the SEC will approve spot Bitcoin ETFs in the next few weeks.

But SOL has also been benefitting from an impressive surge in demand for the token amid a rapid expansion in activity on its network in the past few months.

Solana Enjoying Massive On-Chain Expansion

An explosion in Solana-based meme coin trading (Bonk! is up 8,800% since October and now ranks as the third largest meme coin) coupled with the arrival of a huge influx of new Solana DeFi protocol users (who are hunting for aidrops) has seen network transactions, network fees, daily transactions and daily trading volumes on the network pump.

As per data presented by The Block, the seven-day moving average of new addresses interacting with the Solana network was last close to an all-time high of around 430,000.

Monthly active addresses, meanwhile, was last at its highest since October 2022 at over 18 million, while the seven-day moving average of non-vote transactions was last at its highest since September 2022 at above 33 million.

The surge in activity has seen daily fees collected by the Solana network hit an all-time high on Monday of over $600,000 as per DeFi Llama, while some reports claimed that trading volume on Solana-based decentralized exchanges (DEXs) briefly surpassed that of those based on Ethereum, which remains the dominant blockchain in the DeFi and broader web3 space.

While the initial motives that have brought droves of new users to Solana network (meme coin trading and airdrop hunting) are speculative in nature, the network’s fast transaction throughput and low fees are likely encourage new users to stick around.

Solana adoption appears to be rapidly heading in the right direction once again.

Solana (SOL) Price Prediction – Time to Buy the Dip?

Given the stunning rise witnessed in recent weeks, traders will naturally be asking “is a good time to buy the dip?”.

Some longer-term bulls might prefer to wait for a larger pullback, perhaps to the key long-term support-turned-resistance (and now turned support?) level around $75.

If there is a “sell the fact” reaction to the SEC’s expected approval of spot Bitcoin ETFs in the US, then a broader market dip could easily send SOL back under $100.

But there is no guarantee that SOL will retrace as far as $75, and in the near term the cryptocurrency could easily test its April 2022 highs in the $140s.

With fundamentals on the Solana blockchain looking so strong, the medium-term trajectory remains higher.

Price predictions will remain bullish for 2024, with many likely to predict a retest of all-time highs in the $260 area.

The post Solana Price Prediction as SOL Drops 10% – Time to Buy the Dip? appeared first on Cryptonews.