Solana’s Rally Hits 184% Gain in 30 Days as $19M in SOL Shorts Liquidate in 24 Hours

Publikováno: 11.11.2023

This weekend, the crypto community’s buzz centered on solana (SOL) and its notable surge in value against the U.S. dollar over the previous week. SOL has posted an 11% gain in the last 24 hours, with a striking 45.2% uptick over the week, ascending to the rank of the sixth largest asset by market cap. […]

This weekend, the crypto community’s buzz centered on solana (SOL) and its notable surge in value against the U.S. dollar over the previous week. SOL has posted an 11% gain in the last 24 hours, with a striking 45.2% uptick over the week, ascending to the rank of the sixth largest asset by market cap. […]

This weekend, the crypto community’s buzz centered on solana (SOL) and its notable surge in value against the U.S. dollar over the previous week. SOL has posted an 11% gain in the last 24 hours, with a striking 45.2% uptick over the week, ascending to the rank of the sixth largest asset by market cap.

Solana Leapfrogs in Crypto Race With 45% Weekly Rise

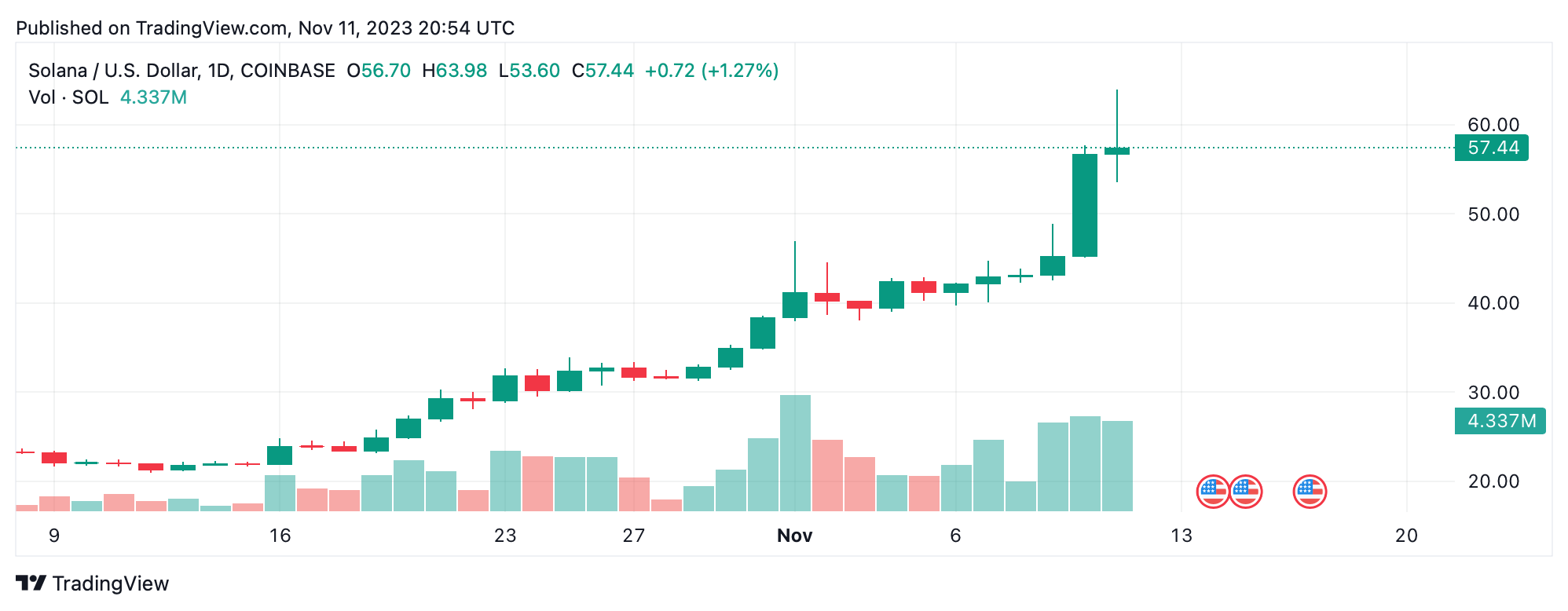

Among the leading ten crypto assets by market value, solana (SOL) has outperformed its peers this week. Currently, SOL boasts a 45.2% increase over the last week and has vaulted by 184% against the U.S. dollar in the last 30 days. On Saturday, November 11, trading prices for SOL ranged from $53.59 to $63.44 per coin. With around $4.41 billion in global trade volume over the past day, SOL ranks as the fifth most traded cryptocurrency in terms of trading activity.

The recent uptick in solana’s value has resulted in a significant number of short positions wagering on the digital currency’s decline being liquidated. Data from Coinglass reveals that solana tops today’s chart with short position liquidations amounting to $19.28 million. Concurrently, conversations about SOL’s rise are peppered across social media networks, including X.

“I missed SOL because less than 30 minutes after my bottom call when I went to buy it had pumped to $12 in one straight candle and now it’s at $62,” wrote Eric Wall. Meanwhile, others gloated over their SOL gains. “Mfers watching me make life changing gains with solana right now,” one individual remarked. Another added:

GM to all the people who understand why SOL is headed [higher] than it’s ever been! Now is the time to CHAD a bit more.

Data from Cryptocompare indicates that on Saturday, SOL’s primary trading pair is tether (USDT), capturing 52% of the activity, with trades against the U.S. dollar ranking second at 17.83%. The Korean won is responsible for a significant 16.27% slice of all SOL trades, while BTC claims 5.83% of the market share.

Following BTC, SOL’s trading volumes are bolstered by pairs with BUSD, EUR, TRY, USDC, and ETH. Despite solana’s impressive performance this past month, with triple-digit increases, SOL’s current value is still over 75% lower than its peak of $259 per unit, reached two years back on November 6, 2021.

What are your views on solana’s recent growth, both in the past day and over the previous month? Share your insights and perspectives on this topic in the comment section below.