Stablecoin Market Faces Fresh Challenges with ‘Fourth-Gen Coins’ – South Korean Report

Publikováno: 21.5.2024

South Korean analysts think new challenges await the “next generation” of stablecoins, as the industry continues to develop.

The post Stablecoin Market Faces Fresh Challenges with ‘Fourth-Gen Coins’ – South Korean Report appeared first on Cryptonews.

analysts think new challenges await the “next generation” of stablecoins, as the industry continues to develop.

The use of algorithms in stablecoin development, they say, will present new “risks” for token holders. And experts are still unconvinced by their algorithmic designs.

The claims came in a report from researchers at the South Korean Bithumb crypto exchange, according to the media outlet Kyunghyang Games.

Stablecoin Market: Four Generations of Coins

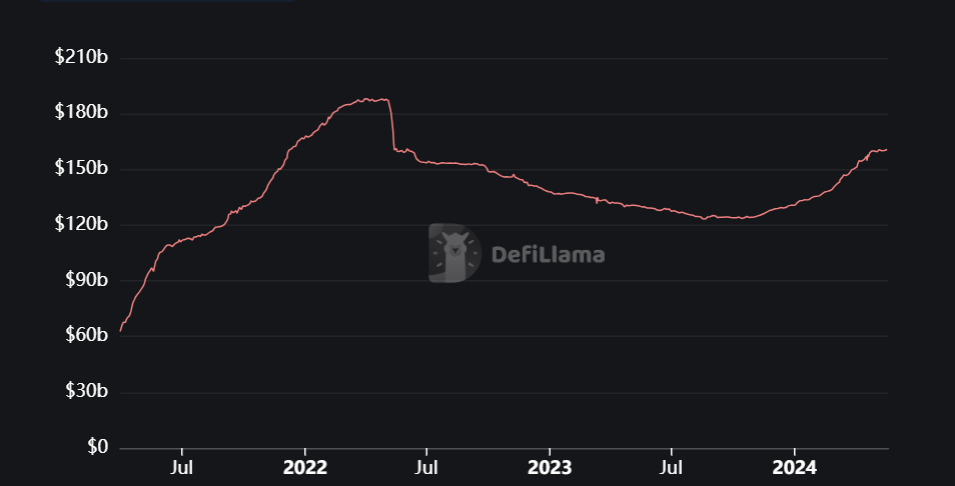

The media outlet noted that stablecoins were currently used mainly to “purchase assets on exchanges.”

The exchange said that some people also used these coins in the “remittance and payments spaces.”

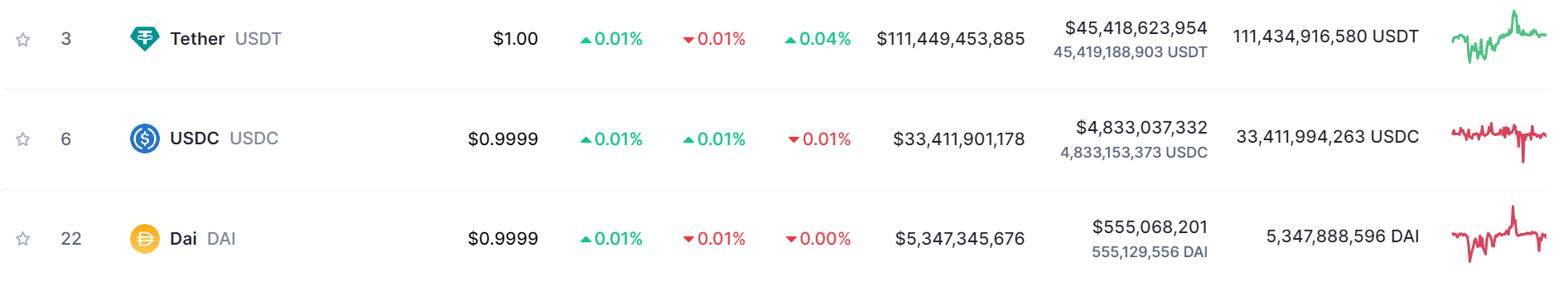

Bithumb identified “four generations” of stablecoins, beginning with “first-generation” coins like USDT.

Such coins use fiat currencies such as the US dollar as reserves. Their issuers claim to hold assets matching the value of the number of coins in circulation.

The exchange noted that USDT’s issuer was “initially criticized” for its “lack of transparency” on the status of its reserve holdings.

Bithumb remarked that these concerns had largely been “resolved” by the fact that the issuer now published quarterly reports detailing asset holdings, including US Treasury bonds and Bitcoin.

Second-generation coins, such as DAI, use crypto as a “source of reserve value,” Bithumb said.

This helps such coins maintain their “decentralized value” and keep in “the basic spirit of the blockchain world.”

However, these tokens also experienced the “disadvantage of greater value volatility,” with cryptoassets often experiencing sudden price fluctuations. Bithumb wrote:

“To address the shortcomings of second-generation stablecoin projects, [communities] have added US Treasury bonds and real-world assets (RWA) to their collateral reserves.”

Limitations – and Opportunities

The report’s authors noted that “in the case of second-generation stablecoins,” project teams have tended to “proceed with care” when issuing coins.

This is “because the proportion of cryptoassets in their reserves” is large, the authors wrote.

However, while this conservative approach has helped many such coins “protect value,” they have experienced “scalability” issues, the authors said.

Third-gen Problems and Advantages

The report then went on to discuss what it called “third-generation” stablecoins, which make use of algorithmic features.

The authors noted that algorithmic stablecoins use neither fiat nor crypto as collateral. Instead, their issuers “control the supply and demand of coins using an algorithm that maintains the asset price stability.”

As such, when market forces push the stablecoin’s value above $1, the algorithm triggers the release of more tokens into the ecosystem.

Conversely, the algorithm can cause the network to burn tokens from designated pools if the value drops.

Here, the authors noted, scalability “was maximized in favorable market conditions.”

But if the inverse were true, “it was found that it could not maintain a fixed value only by controlling the circulation volume and arbitrage algorithm, without the use of collateral.”

Korea's major cryptocurrency exchange Bithumb said Friday that it will cover all the 40 billion won ($30 million) of taxes imposed on the winners of its crypto airdrop events.https://t.co/36G4cGNQRv

— The Korea Herald 코리아헤럴드 (@TheKoreaHerald) May 10, 2024

As such, developers have begun to issue what the exchange called “fourth-generation stablecoins.”

These, the authors said, were created to address the risk of third-generation stablecoins “de-pegging” from their fixed value.

While they also use algorithms to control supply, these algorithmic features are “improved” in 4th-gen coins such as Ethena (USDe).

A South Korean convenience store chain is partnering with Bithumb to launch Bitcoin Meal packs with a chance to win Bitcoin rewards.#SouthKorea#Bitcoin#Bithumbhttps://t.co/wymgTmEj2Y

— Cryptonews.com (@cryptonews) May 9, 2024

Experts Still Not Sure About Gen Four

Bithumb said that while many experts think these 4th-generation coins are still “risky,” they are expanding their market share and “attracting market attention to emerging assets.”

The exchange noted that “since the emergence of 4th-generation stablecoins, USDT’s market share “has decreased from 80% to 70%.” The authors concluded:

“Many experts emphasize the risks of 4th-generation stablecoins, as they use algorithmic systems. Overcoming the perception of these experts will be a challenge for this new class of stablecoins.”

The post Stablecoin Market Faces Fresh Challenges with ‘Fourth-Gen Coins’ – South Korean Report appeared first on Cryptonews.