Stablecoins Hit Record $190B Market Cap, Surpassing Pre-Terra Crash Peak: CCData

Publikováno: 27.11.2024

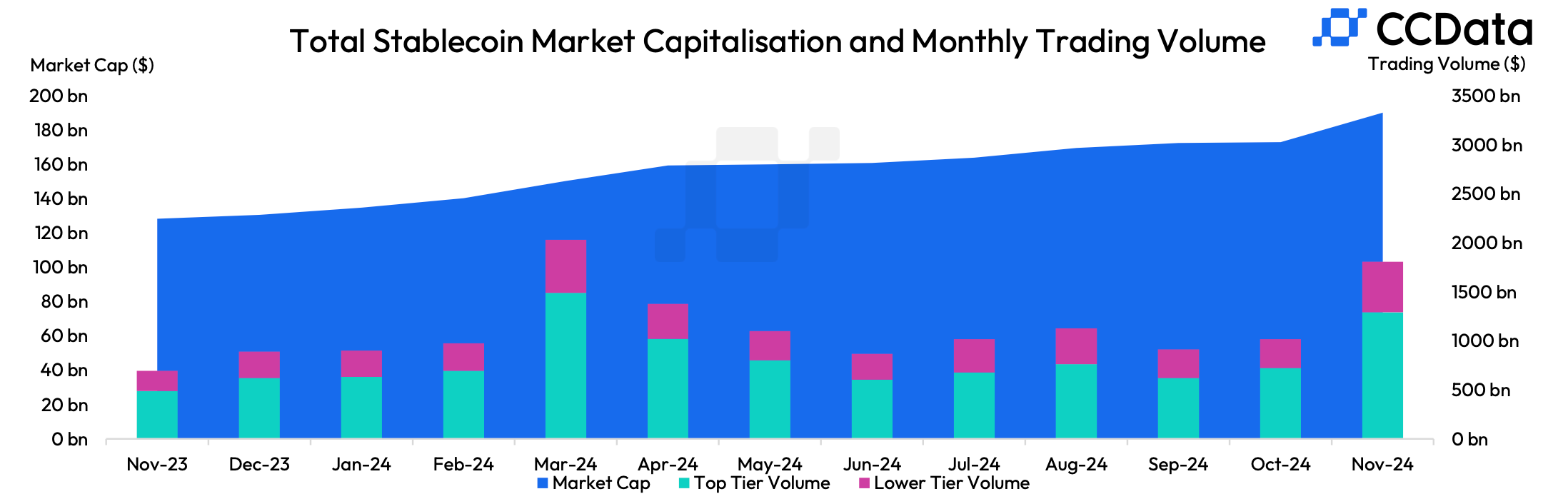

Stablecoin market capitalization rose to $190 billion this month, surpassing the pre-crypto winter peak of April 2022, CCData reported.

The crypto rally this year and particularly since the U.S. presidential election fueled demand for stablecoins, which are widely used for trading.

The emergence of novel tokenized investment products with fixed prices such as BlackRock's BUIDL and Ethena's USDe also helped growth for the sector.

Tether's USDT supply rose 10% over the last month to a new peak of $132 billion, while Circle's USDC grew 12% to almost $39 billion, the report said.

Following bitcoin (BTC) and solana (SOL) reaching all-time high prices earlier this month, the stablecoin sector has now joined crypto's record-breaking streak.

The combined market size of stablecoins hit $190 billion this month for the first time ever, Wednesday's report by digital asset analytics firm CCData noted. CCData is owned by Bullish, CoinDesk's parent company. The previous peak of $188 billion was recorded in April 2022, just before the cataclysmic implosion of the Terra-Luna stablecoin that added fuel to the digital asset bear market now referred to as crypto winter.

Demand for stablecoins soared as cryptocurrency prices exploded in November as investors rushed into crypto, expecting that the U.S. government will be friendlier toward the industry following Donald Trump's election victory. Stablecoins are a key piece of plumbing in the crypto ecosystem. With their prices anchored to an external asset, predominantly the U.S. dollar, they are a popular source of liquidity for crypto trading, serving as dry powder on exchanges.

This year also brought an explosion of novel tokenized products with prices also pegged to $1, including tokenized money market funds like BlackRock's BUIDL and investment strategies wrapped into a token like Ethena's "synthetic dollar" USDe, which is backed by a crypto carry trade. The CCData report included these platforms in the tally.

Tether's USDT continues to dominate the stablecoin sector. The token's market cap rose 10% over the past month to a new peak of $132 billion, CCData noted. Meanwhile, Circle's USDC, grew 12% to a nearly $39 billion market cap, the highest since the March 2023 regional banking crisis that heavily impacted the token. USDT claims a 69.9% market share currently, while USDC is second-largest with a 20.5% share.

It was not just the top two that saw rapid growth: 38 of the nearly 200 tokens tracked made a new all-time high supply over the past month, CCData said.

Ethena's USDe, for example, saw a 42% increase to a new record of $3.8 billion in November. The token generates yield to investors by holding spot BTC and ETH and simultaneously shorting (selling) an equal amount of perpetual futures farming the funding rate. Ethena now offers 25% annualized yield (APY) to token holders, as frothy crypto markets elevated funding rates, benefitting the protocol.

The broad-market crypto rally also boosted trading volumes with stablecoin pairs on centralized exchanges, rising 77% month-over-month to $1.8 trillion, the report said. USDT was responsible for about 83% of the volumes, followed by Hong Kong-based First Digital's FDUSD 9% and USDC's 8% share.