Supply of Stablecoins on Ethereum Protocol 30% Lower Than in 2022 — Study

Publikováno: 21.12.2023

The supply of stablecoins on the Ethereum chain has dropped by more than 30% from the peak of $100 billion to $66 billion since 2022. The study data shows BUSD and USDC as the two stablecoins which caused the overall market value to fall from $139 billion to $129.5 billion. Tron Stablecoin Supply up 57% […]

The supply of stablecoins on the Ethereum chain has dropped by more than 30% from the peak of $100 billion to $66 billion since 2022. The study data shows BUSD and USDC as the two stablecoins which caused the overall market value to fall from $139 billion to $129.5 billion. Tron Stablecoin Supply up 57% […]

The supply of stablecoins on the Ethereum chain has dropped by more than 30% from the peak of $100 billion to $66 billion since 2022. The study data shows BUSD and USDC as the two stablecoins which caused the overall market value to fall from $139 billion to $129.5 billion.

Tron Stablecoin Supply up 57%

According to Six Degree’s stablecoin study, the supply of stablecoins on the Ethereum chain has dropped by more than 30% from the peak of $100 billion to $66 billion since 2022. The stablecoin supply on the Tron network on the other hand went up by over 57% from $31 billion in 2022 to $48.9 billion.

The study data, which covers the period between December 2022 and December 2023, shows the total market value of stablecoins at $129.5 billion by Dec. 16, 2023. This figure is 31% lower than the year’s peak value of $188 billion, the study report noted. In December 2022, the market value of stablecoins was $139 billion.

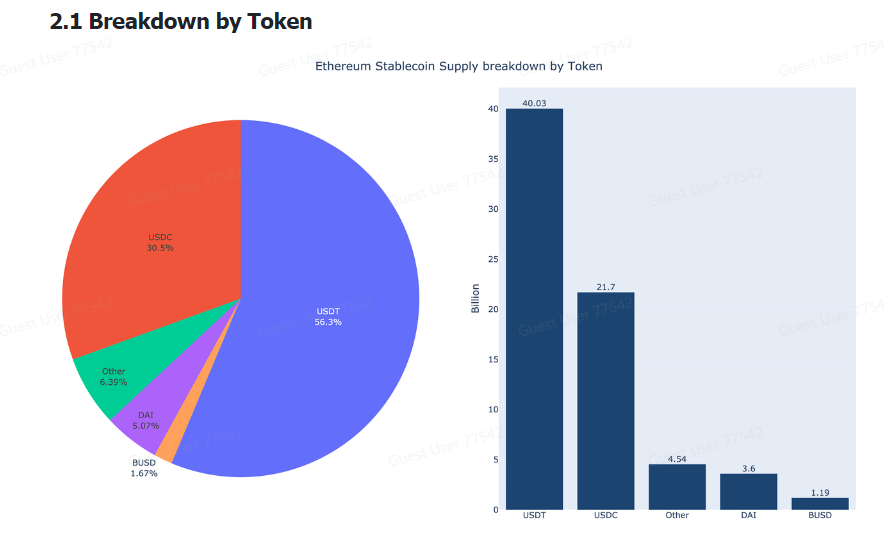

With respect to Ethereum stablecoin supply by token metric, the study data shows BUSD and USDC accounting for most of the decrease with -36% and -48% respectively. However, USDT, which is the number one stablecoin, saw an increase of 23%.

Defi Stablecoin Supply Lower

When breaking down stablecoin ownership by holders, the study data shows that externally owned accounts (EOAs) accounted for approximately 50%. From the remaining 50%, centralized exchanges owned 30% while decentralized finance (defi) platforms accounted for less than 6%.

Commenting on the movement of stablecoins on the Ethereum blockchain during the period under review, the study said:

The strong influx of stablecoins on Ethereum played a crucial role in driving the last bull market, particularly during the defi summer period. However, the amount of stablecoin supply in defi protocols on Ethereum has been moving in the opposite direction compared to the overall market trend since 2023.

According to a report, the growing maturity of Ethereum Layer2 solutions has given “a more fertile ground for the development of defi and innovative protocols.” The report also found that around 60% of the stablecoins held by top addresses “are dormant, either being in reserve or inactive.”The study revealed that new addresses mostly made their first stablecoin transfer in the previous 30 days.

What are your thoughts on this story? Let us know what you think in the comments section below.