Three Predictions For 2025

Publikováno: 18.12.2024

2024 has been a pivotal year for crypto. However, the real turning point is still to come. Here are three predictions for 2025 that could help ignite it, says Marcin Kazmierczak.

No one can argue with 2024 being a breakthrough year for crypto. BTC and ETH ETFs launched, BlackRock spearheaded bitcoin adoption, a pro-crypto president was elected and BTC broke the 15-year all-time-high, to name a few. But the inflection point for crypto still awaits. Here are three predictions for 2025 that can help spark it:

You're reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

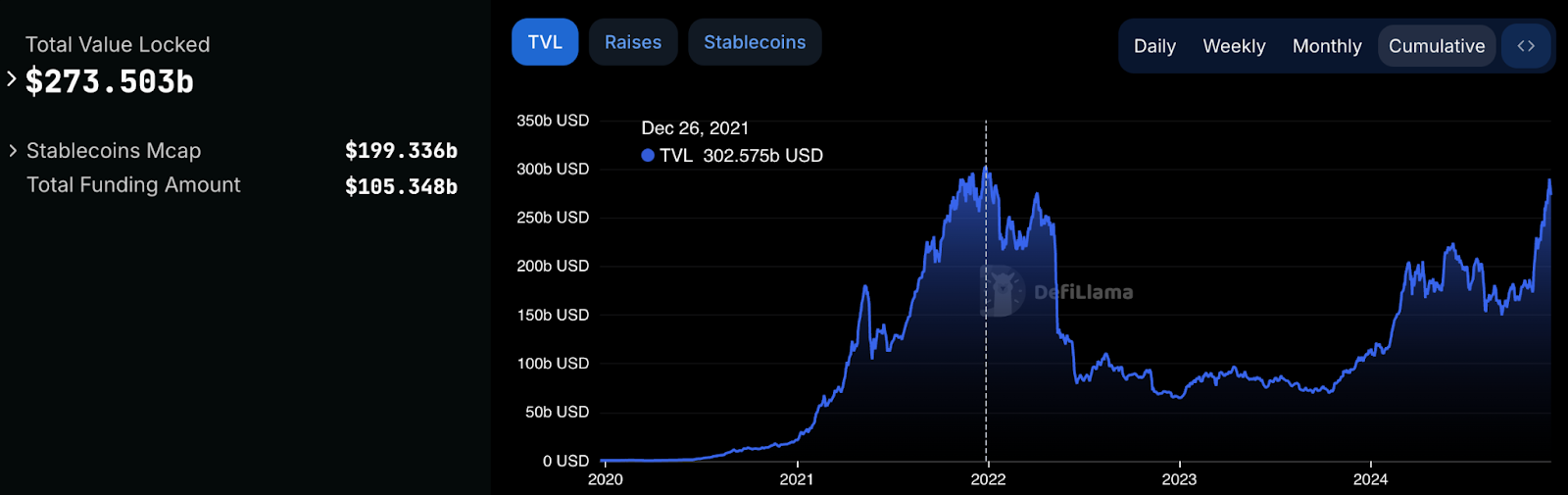

1. DeFi is about to skyrocket

DeFi is becoming more complex, much like traditional finance, in terms of its product suite. We’ve already seen this trend emerging with the adoption of products like Pendle, Ethena, EtherFi and Lombard. In 2025, DeFi usage will explode, with a wave of adoption for products such as options, swaps, and other derivatives like the interest rate swap market — the latter’s market size is at 465.9 trillion USD in TradFi.

Moreover, new institutional players are entering the crypto ecosystem, nurturing a new category: On-chain finance. Participation is no longer limited to buying blue-chip cryptocurrencies like BTC and ETH. These market participants also actively expand on-chain market depth by using tools such as lending markets and liquidity provision with RWA-backed digital assets, i.e. stablecoins. Securitize and BlackRock are great examples of companies pushing the frontier on this front.

DeFi is almost back to its all-time-high, Source: https://defillama.com/

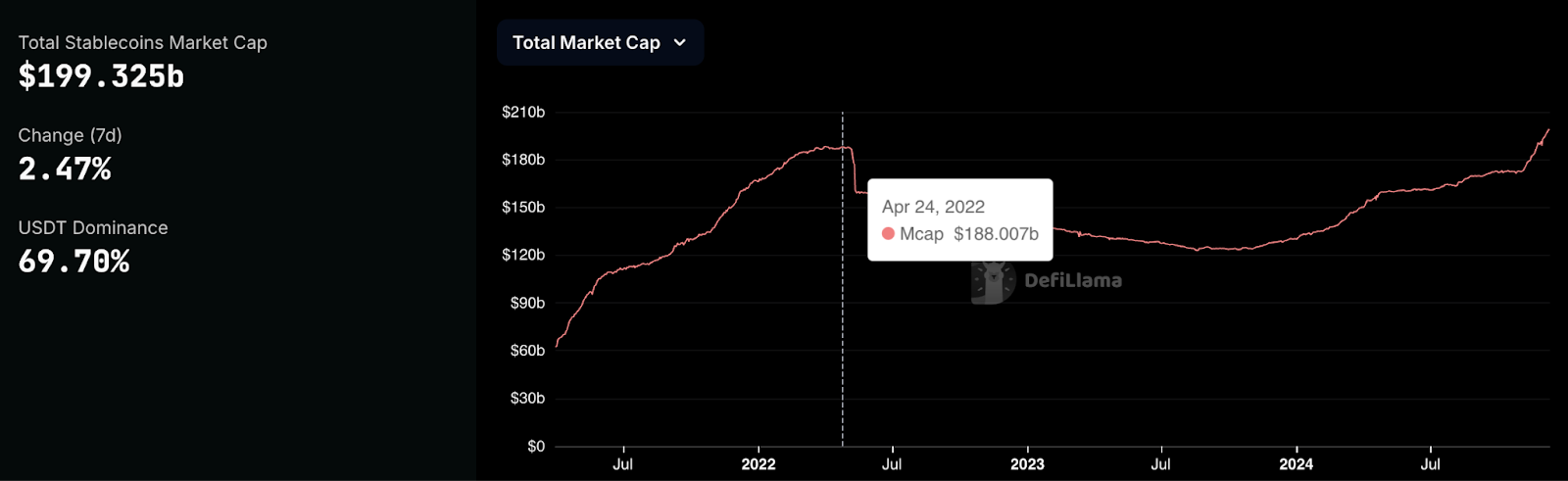

2. Stablecoins will continue to grow as the crypto killer use case

Stablecoins aren’t just another crypto product; they’re poised to become the digital backbone of the global financial system. Tether is the most profitable crypto company with a $5.2 billion profit in H1 2024, surpassing BlackRock.

The political landscape is shifting dramatically in favour of stablecoins, with Operation Choke Point 2.0 coming to an end. They are finally being viewed as a national asset that can strengthen the dominance of the U.S. dollar and address growing public debt. This shift also paves the way for major banks and payment companies like Visa and Mastercard to expand their efforts in the sector, especially when you consider Stripe’s acquisition of stablecoin platform Bridge for $1.1 billion (the biggest acquisition in crypto ever) and rumors of Revolut launching its stablecoin.

Stablecoins market cap is at an All-Time-High already at about $200 billion, Source: https://defillama.com/stablecoins

3. The race for retail adoption

ETFs will be key drivers for new capital to enter crypto. BTC ETFs are here, and soon we’ll see the success of Ethereum ETFs. After SOL’s undeniable growth over the last year, the SOL ETF will either catch the momentum and become a reality in the first half of 2025 or will delay until 2026 or later.

We’ll also see major Web3 social platforms compete with the LensChain mainnet launch and Farcaster’s further expansion. As the pie grows bigger, we can end up with the "Twitter/X and Facebook of crypto" platforms.

Notably, “Super Wallets” took off in Q4 2024. They aim to offer a comprehensive alternative to centralized exchanges for new users. The leading players are Infinex, launched by Kain Warwick, and DeFiApp, launched by seasoned builders in DeFi. Both are working on UX problems, something we have never done very well as an industry.

Bonus prediction: MiCA will power crypto expansion in Europe

Crypto regulations provide the foundations for new projects. They lay the groundwork for clear rules and guidelines of organizational structure. MiCA (Markets in Crypto-Assets Regulation) attempts to bring just that with an aim to increase the importance of EUR-related assets. This could potentially bridge crypto innovation between the U.S. and Europe.