TUSD Supply Skyrockets With 1 Billion Injection Amidst Decline in Stablecoins

Publikováno: 20.6.2023

Despite the decline in stablecoins due to substantial redemptions, particularly from projects like USDC, DAI, and BUSD, the project TUSD has experienced a notable surge in its supply. TUSD has added more than a billion dollars’ worth of tokens to its existing supply. As of the present moment, the market capitalization of TUSD stands at […]

Despite the decline in stablecoins due to substantial redemptions, particularly from projects like USDC, DAI, and BUSD, the project TUSD has experienced a notable surge in its supply. TUSD has added more than a billion dollars’ worth of tokens to its existing supply. As of the present moment, the market capitalization of TUSD stands at […]

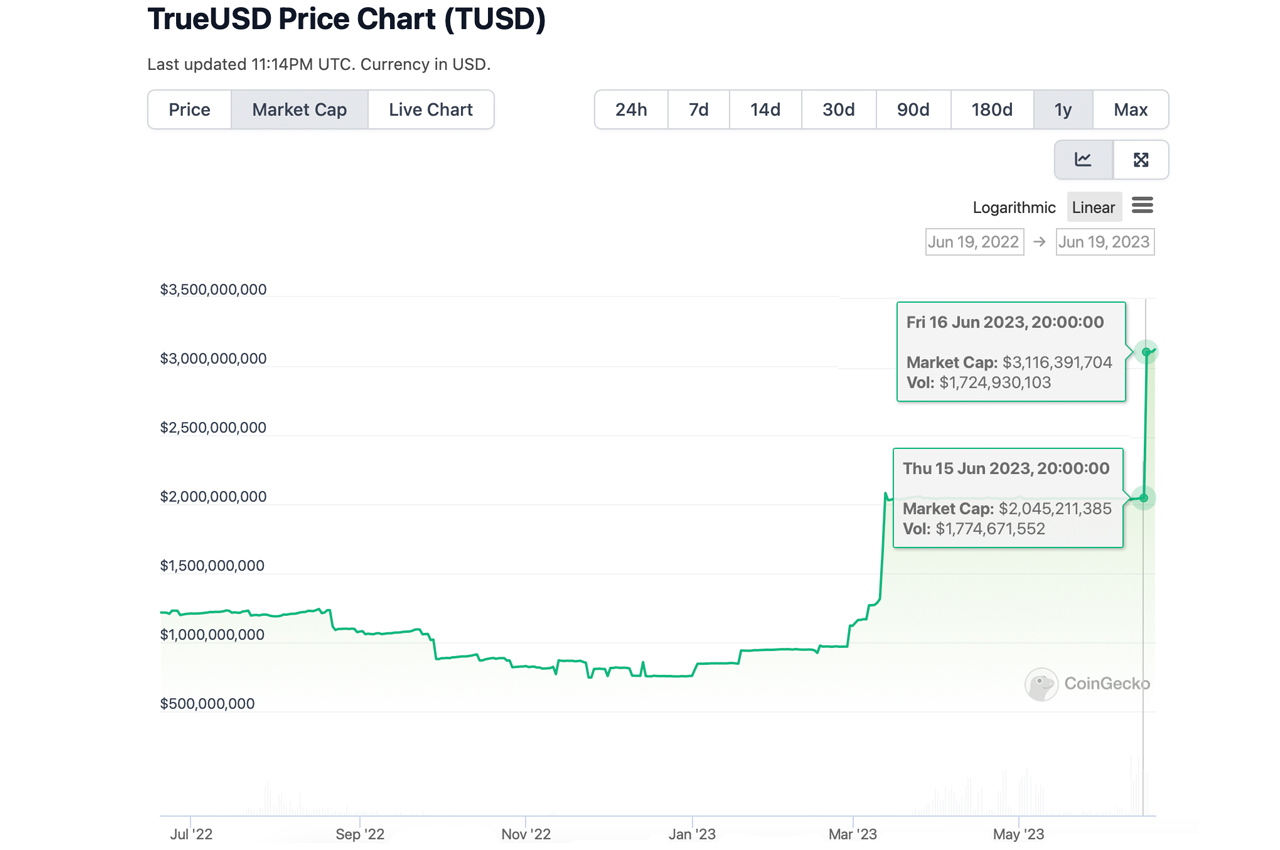

Despite the decline in stablecoins due to substantial redemptions, particularly from projects like USDC, DAI, and BUSD, the project TUSD has experienced a notable surge in its supply. TUSD has added more than a billion dollars’ worth of tokens to its existing supply. As of the present moment, the market capitalization of TUSD stands at approximately $3.13 billion.

TUSD’s Supply Spiked 52% on June 16, Rising by a Billion Tokens

In a recent stablecoin update, Bitcoin.com News shed light on the challenging times faced by the dollar-pegged token economy, with significant redemptions causing its market valuation to plummet to its lowest point in 20 months. As of June 19, 2023, the collective market capitalization of the leading stablecoins amounts to $129.99 billion, while these tokens have witnessed global trade volume of $20.84 billion in the past 24 hours.

Notably, three of the top five stablecoins in terms of market capitalization, namely USDC, DAI, and BUSD, have experienced supply reductions ranging from 3.8% to 22% over the past 30 days. TUSD, on the other hand, has witnessed a supply increase of about 53.5% over the past month.

The stablecoin experienced a surge in market valuation on July 16, 2023, reaching $3.11 billion, a substantial jump from the previous day’s $2.04 billion. This means that while TUSD grew by 53.5% within 30 days, a single day last Friday accounted for 52% of that increase. According to the smart contract data on Etherscan, the circulating supply of TUSD tokens on June 19 is approximately 3,135,633,560.

Interestingly, despite there being 52,079 TUSD holders, the top 10 wallets control 83.31% of the circulating supply. Among the top ten wallets, Binance emerges as the largest holder with its leading address containing 389,561,743 TUSD tokens. Moreover, out of the top ten addresses with the highest TUSD holdings, controls five of them.

The crypto exchange, known for its substantial trade volume, also possesses another wallet with 45,233,811 TUSD, one with precisely 28,000,000, another with 10,601,602, and lastly, one holding 10,270,001 TUSD. Additionally, the decentralized finance (defi) protocol Aave has locked 4,780,182 TUSD for its aTUSD tokens.

According to statistics from Nansen.ai, Binance’s TUSD stash accounts for 5.26% of the exchange’s $52.45 billion portfolio. TUSD was introduced in mid-2018 through the Trust Token platform as an ERC20-based stablecoin. It asserts to be entirely backed by U.S. Dollars and overseen by a regulated operator.

The stablecoin company also collaborated with the custodian Prime Trust, the company that Bitgo expressed intentions of acquiring. However, earlier this month, the team’s Twitter account disclosed that “TUSD mints via Prime Trust are paused” until further notice. On Monday, at 8:58 a.m. Eastern Time, the company reiterated that mints via Prime Trust remain unavailable.

“In view of the uncertainty, minting through Prime Trust is still temporarily paused while minting/redemption through our other banking partners are unaffected,” the company tweeted. “We will resume Prime Trust process when the circumstances improve. Thanks for your patience.”

What are your thoughts on TUSD’s surge in supply amidst the decline of other stablecoins? Share your thoughts and opinions about this subject in the comments section below.