Tuttle Capital Files for Six Leveraged and Inverse Bitcoin ETFs with SEC

Publikováno: 4.1.2024

Source: DALL·E Tuttle Capital Management has filed for six new Bitcoin exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission (SEC). On Jan.3, Tuttle Capital filed three separate N1-A filings with the SEC. The company’s proposed Bitcoin ETFs are structured to offer leveraged and inverse investment options based on the performance of reference spot […]

The post Tuttle Capital Files for Six Leveraged and Inverse Bitcoin ETFs with SEC appeared first on Cryptonews.

Tuttle Capital Management has filed for six new Bitcoin exchange-traded funds (ETFs) with the U.S. Securities and Exchange Commission (SEC).

On Jan.3, Tuttle Capital filed three separate N1-A filings with the SEC. The company’s proposed Bitcoin ETFs are structured to offer leveraged and inverse investment options based on the performance of reference spot Bitcoin ETFs, which is still pending SEC approval.

According to Bloomberg Intelligence ETF Analyst Henry Jim, all Tuttle’s Bitcoin ETFs will “use the yet-to-be launched iShares Spot Bitcoin ETF as initial reference ETF,” but “reserves right to use other spot Bitcoin ETFs.”

The six proposed ETFs by Tuttle Capital include T-REX 1.5X, 1.75X, and 2X Long Spot Bitcoin Daily Target ETFs, as well as T-REX 1.5X, 1.75X, and 2X Inverse Spot Bitcoin Daily Target ETFs. These funds aim to provide daily leveraged or inverse results, magnifying the performance of their reference spot Bitcoin ETF by 150% to 200%.

T-Rex files 6 leveraged and inverse Bitcoin ETFs

T-Rex 1.5X Inverse Spot Bitcoin Daily Target ETF

T-Rex 1.5X Long Spot Bitcoin Daily Target ETF

T-Rex 1.75X Inverse Spot Bitcoin Daily Target ETF

T-Rex 1.75X Long Spot Bitcoin Daily Target ETF

T-Rex 2X Inverse Spot Bitcoin Daily… pic.twitter.com/eLFTiS1Gq9— ETF Hearsay by Henry Jim (@ETFhearsay) January 3, 2024

The effective date for these ETFs is set for March 18. As of now, Tuttle Capital has not disclosed specific ticker symbols or management fees for these ETFs.

“We have filings for 6 leveraged #Bitcoin ETFs already. Don’t even have a spot ETF approved yet,” said Bloomberg analyst James Seyffart. “But @TuttleCapital waits for no one.”

“It was only a matter of time…” added Bloomberg analyst Eric Balchunas.

Goldman Sachs to Become AP in BlackRock and Grayscale ETFs

Goldman Sachs is reported to be on track to become an authorized participant in Bitcoin ETFs offered by BlackRock and Grayscale. This development was revealed in a recent report citing insider sources.

The investment bank’s involvement would mark its entry into a role currently occupied by other major financial players, including Jane Street, JPMorgan, and Cantor Fitzgerald.

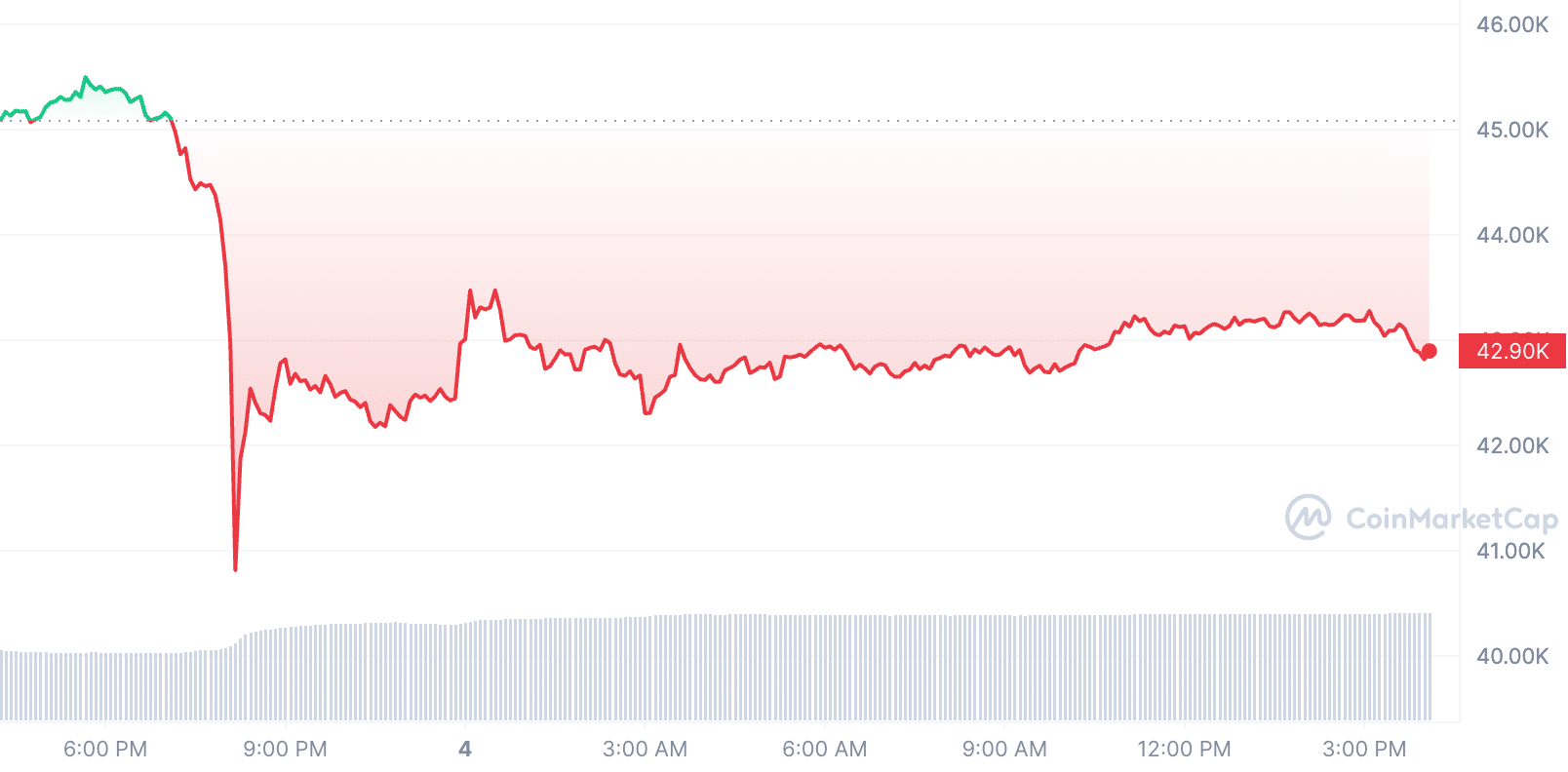

Matrixport Report in Spotlight as Bitcoin Sees Market Dip

Bitcoin is trading at $42,896 at the time of writing, according to CoinMarketCap, down by 4.9% from 24 hours ago.

Some have attributed this anticlimactic dip to a Matrixport report which predicted that the SEC will reject spot Bitcoin ETF applications in January and postpone the eventual approval to the second quarter of 2024.

Meanwhile, Matrixport co-founder Jihan Wu defended the analyst and stated his disagreement with the speculation that the report has directly caused the price drop.

“I found out that Matrixport analyst’s report is actually being held responsible for the market crash,” said Wu in a post. “It’s too much blame to take.”

While on holiday, I have more time than usual for writing.

Matrixport, a small private firm based in Asia, is a considerable distance from New York, requiring a 17-hour and 55-minute flight. We don't receive insider information from U.S. regulators. To the best of my knowledge,…

— Jihan Wu (@JihanWu) January 3, 2024

“Some Matrixport analysts change positions rapidly, reflecting the market’s dynamic nature and inherent uncertainty,” said Wu in another post. “Despite potential controversies, I will always support the independence of our analysts.”

The post Tuttle Capital Files for Six Leveraged and Inverse Bitcoin ETFs with SEC appeared first on Cryptonews.