Uniswap Captures $2 Billion Locked, Dex Volume Outpaces Second-Largest Centralized Exchange

Publikováno: 30.9.2020

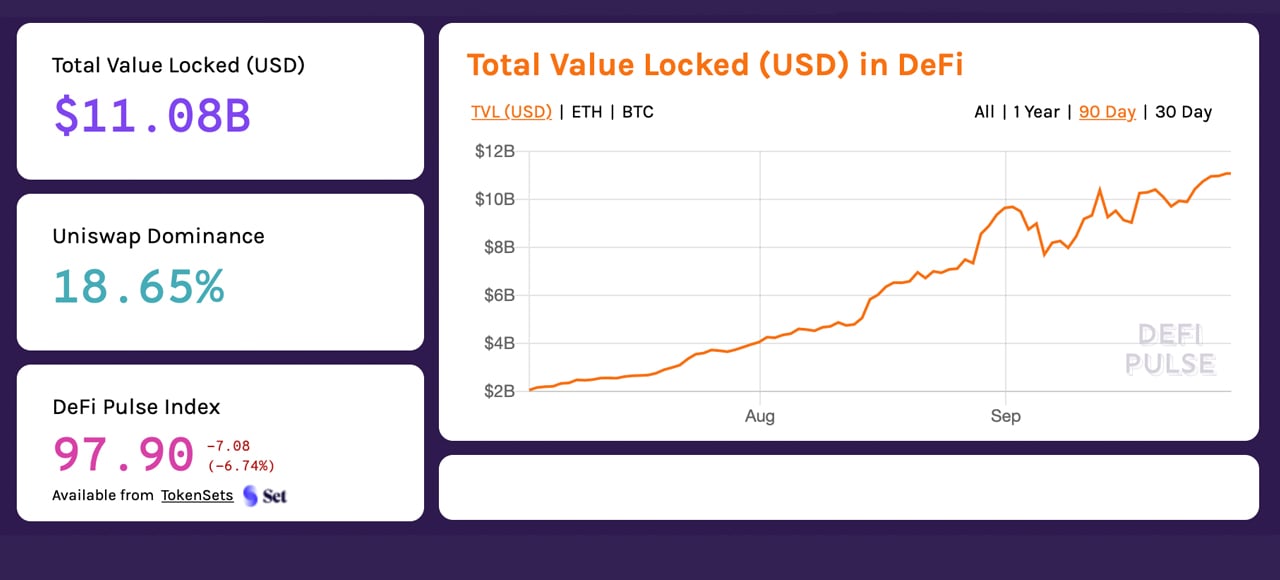

The decentralized exchange (dex) built on Ethereum, Uniswap has accumulated a whopping $2 billion in total value locked (TVL) this week. Tuesday’s data shows out of all the decentralized finance (defi) application’s Uniswap dominates the $11 billion landscape by over 18%. Just recently, the defi space has touched a few new milestones as the ecosystem’s […]

The decentralized exchange (dex) built on Ethereum, Uniswap has accumulated a whopping $2 billion in total value locked (TVL) this week. Tuesday’s data shows out of all the decentralized finance (defi) application’s Uniswap dominates the $11 billion landscape by over 18%. Just recently, the defi space has touched a few new milestones as the ecosystem’s […]

The post Uniswap Captures $2 Billion Locked, Dex Volume Outpaces Second-Largest Centralized Exchange appeared first on Bitcoin News.

The decentralized exchange (dex) built on Ethereum, Uniswap has accumulated a whopping $2 billion in total value locked (TVL) this week. Tuesday’s data shows out of all the decentralized finance (defi) application’s Uniswap dominates the $11 billion landscape by over 18%.

Just recently, the defi space has touched a few new milestones as the ecosystem’s TVL this week has topped $11 billion. The dex Uniswap is dominating the defi landscape by 18.65% with over $2 billion TVL to-date.

Uniswap is followed by Makerdao ($1.9B), Aave ($1.56B), Curve.fi ($1.22B), and the Wrapped Bitcoin (WBTC) project ($990M). The Uniswap trading platform has captured a massive amount of demand this week with 104,324 unique users during the last seven days.

Today according to stats, the Uniswap dex is moving just as much trade volume as some of the top centralized exchanges (cex) globally. On Tuesday, Binance has the top trade volume as far as cex trade volumes are concerned with $2.5 million in 24-hour volume.

Coinbase Pro is the second-largest cex in terms of trade volume on Tuesday with $343 million trades during the last 24 hours. Uniswap is well above Coinbase Pro with $398 million today, making the dex the second-largest crypto exchange worldwide in terms of trade volume on September 29.

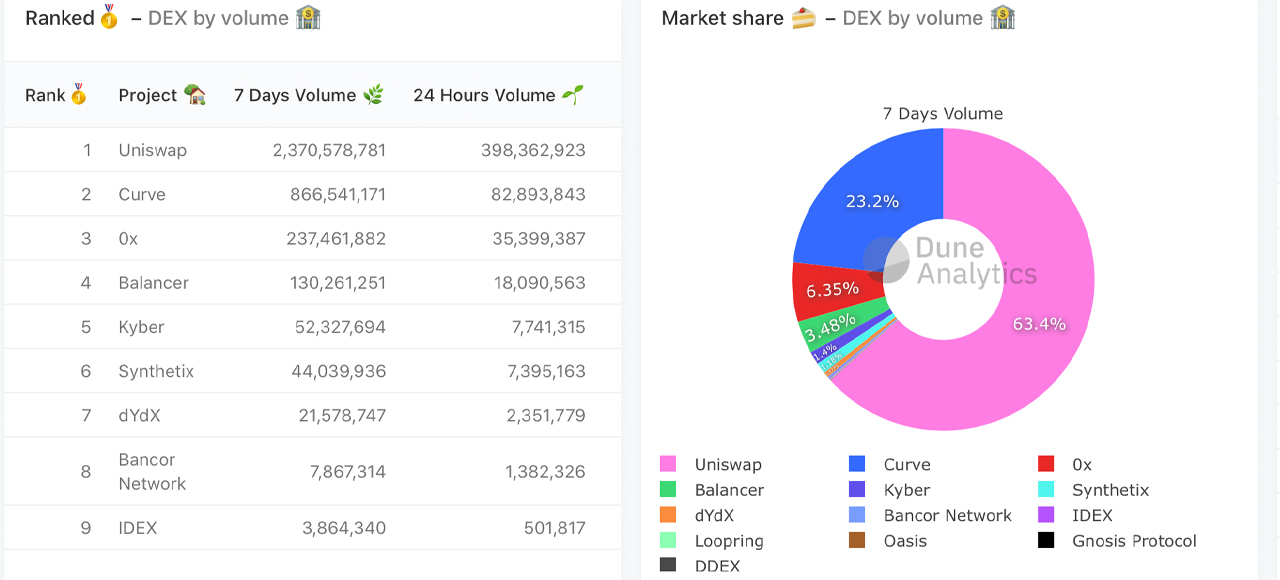

Dex volume in general has been quite large this week and during the last seven days Dune Analytics data shows 13 dex platforms saw $3.7 billion in trades. $2.3 billion of those swaps took place on Uniswap as it currently captures 63.7% of the trailing seven day average.

Cumulatively, all 13 dex platforms saw a whopping $24 billion in swaps during the last 30 days. Dex platforms following Uniswap’s trade volume lead include Curve.fi, 0x, Balancer, Kyber, Synthetix, Dydx, and the Bancor Network respectively.

Uniswap’s weekly and 24-hour trade volume has been a topical conversation on social media and crypto-related forums. A number of crypto enthusiasts wonder if dex volumes will someday supersede cex volumes entirely.

Ethereum proponents believe the rise of stablecoins and dex platforms like Uniswap are starting to prove ETH skeptics wrong.

“In the last bull market, critics said ETH had no use case besides scammy ICO’s,” the CTO and analyst Leon Fu from the web portal cryptocurrency.market recently told his 19,000 Twitter followers. “With the rise of stablecoins, Uniswap, and other protocols [that] enable actual utility [and] have nothing to do with ICO’s. Clearly, ETH skeptics were wrong,” he added.

What do you think about Uniswap’s massive trade volume this week and during the last 24 hours? Let us know what you think about this subject in the comments below.

The post Uniswap Captures $2 Billion Locked, Dex Volume Outpaces Second-Largest Centralized Exchange appeared first on Bitcoin News.