US Spot Bitcoin ETFs Attracting European Bitcoin ETPs – CoinShares Analyst

Publikováno: 19.1.2024

Source: AdobeStock/Luisa Spot Bitcoin ETFs are already grabbing the headlines, according to a recent CoinShares report released on January 15. In the blog post, the digital assets investment firm revealed a $1.18 billion inflow into the crypto space in the past week. Turning its searchlight into the region receiving the bulk of these funds, CoinShares’ […]

The post US Spot Bitcoin ETFs Attracting European Bitcoin ETPs – CoinShares Analyst appeared first on Cryptonews.

Spot Bitcoin ETFs are already grabbing the headlines, according to a recent CoinShares report released on January 15.

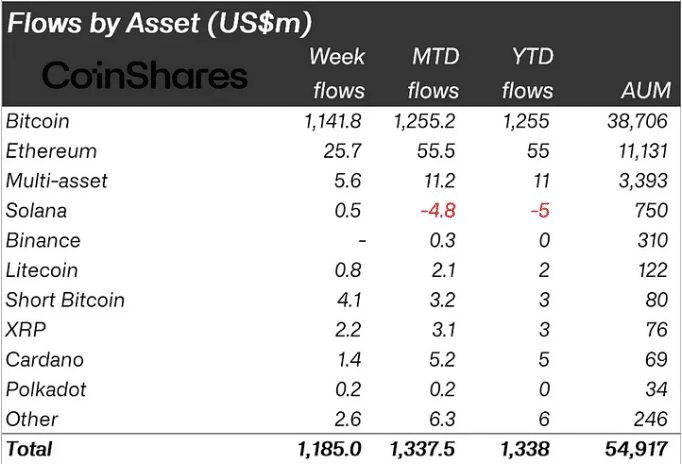

In the blog post, the digital assets investment firm revealed a $1.18 billion inflow into the crypto space in the past week. Turning its searchlight into the region receiving the bulk of these funds, CoinShares’ James Butterfill identified the US market as the principal recipient of the net inflows.

ETF approval week inflows: US$1.18 billion.

The record set at the launch of the futures-based #Bitcoin ETFs is not broken, but inflows are significant.

ETP trading volumes, on the other hand, broke a record, trading US$17.5 billion.

— Main beneficiaries —$BTC: US$1.16… pic.twitter.com/fA0xAwQQer

— CoinShares (@CoinSharesCo) January 15, 2024

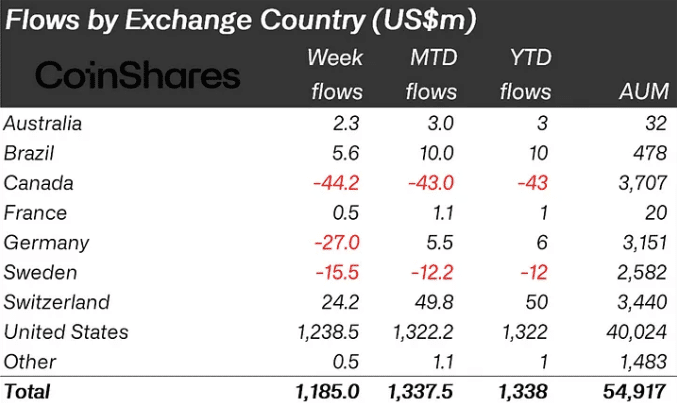

The North American market took in a total of $1.24 billion, with the European market taking in minor inflows within the same period.

While the inflows are commendable, Butterfill notes that they fall short of the record set at the launch of Bitcoin futures exchange-traded funds (ETFs) in October 2021, which received up to $1.5 billion.

Providing reasons for the sudden shift from the European institutional crypto landscape to the US market, CoinShares points to the recent approval of a spot Bitcoin ETF by the US Securities and Exchange Commission (SEC).

Additional data in the report indicates that month-to-date (MTD) inflows to the US institutional crypto market reached a robust $1.322 billion, the same as year-to-date (YTD). The total assets under management (AUM) for the US market stood at $40.024 billion.

Following the same steps, ProShares ETFs in the US attracted $265 million in the past week, while its MTD inflows stood at $337.4 million.

Meanwhile, CoinShares’ report showed that Bitcoin was the chief beneficiary of the inflows, with $1.141.8 billion worth of Bitcoin assets making their way into the US market.

Spot Bitcoin ETFs have been a sensation in the nascent crypto ecosystem in the last two years. The regulatory approval process proved challenging, with the securities agency citing concerns about market manipulation and insufficient mechanisms to track the performance of the leading crypto asset.

Following the official approval of a spot Bitcoin ETF, the price of bitcoin spiked but has since sold off. Why did the cryptocurrency experience a pullback? Insights by @jimiuoriopic.twitter.com/va529P6RCn

— CME Active Trader (@CMEActiveTrader) January 19, 2024

However, after a two-year delay, the US government agency gave the green light to roll out the crypto-backed service on January 10.

In its announcement, the SEC approved 12 spot Bitcoin ETF applications, including ones from BlackRock, Fidelity, WisdomTree, and nine others.

Canadian Bitcoin ETF Also Impacted

The impact of this change in market dynamics has not been limited to the European landscape alone.

The Canadian crypto market witnessed the most significant negative inflows, leading to a weekly outflow totaling -44.2. Germany and Sweden also experienced the repercussions, showing negatives of -27 and -15.5, respectively.

Corroborating this outflow trend, a BitMEX Research posted on X (formerly Twitter) noted that $30 million was moved out of the European markets on January 17 across all the top four largest European crypto products. The total outflow stood at a whopping $106 million for that day.

Cointucky Derby – Day 4 Flow Update

No data from the US as trading is still open. Data is available for Europe, where people are switching away from the high fee Bitcoin ETPs

$30m outflow today accross the 4 largest European products and $106m outflow in total pic.twitter.com/syJ6N4KrrD

— BitMEX Research (@BitMEXResearch) January 17, 2024

Sharing insights into the outflows, BitMEX Research revealed that European investors are rapidly moving their funds out of high-fee Bitcoin exchange-traded products (ETPs) for more cost-effective spot Bitcoin ETFs on offer in the US market.

CoinShares’ Luke Nolan also revealed that using a domestic spot Bitcoin ETF was more convenient for these institutions as they can execute the same basis trades.

The post US Spot Bitcoin ETFs Attracting European Bitcoin ETPs – CoinShares Analyst appeared first on Cryptonews.