5 key platform & discovery takeaways from GDC 2025

Publikováno: 21.3.2025

Also: the week's big Steam releases analyzed for Plus/Pro subscribers.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re rolling straight into the end of the week, and we hope you survived GDC 2025 in one piece, if you’re just leaving. (Thanks to all the GDCo Plus/Pro subscribers who came to our GDC meetup at the Hathora Hub - and Gabi at Hathora for co-hosting us!)

And before we start, the GameDiscoverCo newsletter hit 35,000 subscribers last weekend. As we said on LinkedIn: “Not bad, given we're - relatively speaking - a niche B2B newsletter. Infinite thanks to all our supporters and my colleagues, and roll on 50k.”

Game discovery news: Switch 2 hype bubbling up..

There’s quite a few GDC announcements, of course, but also a fair amount of other platform and discovery goodness. So let’s hit it:

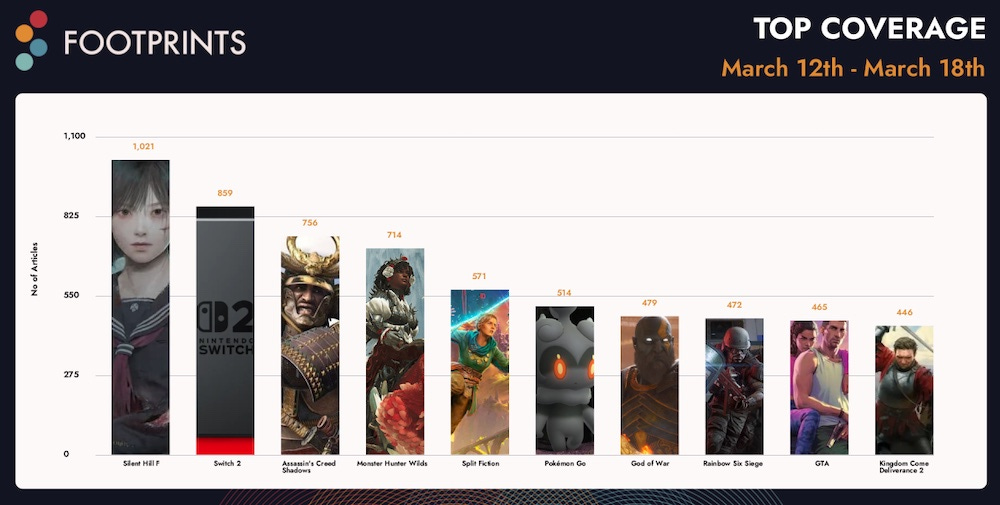

Checking in on ICO & Footprints.gg’s ‘trade media’ mentions chart for March 12th-18th, always helpful, we see Silent Hill F’s full announce topping interest, followed by Switch 2 (no news, just rampant speculation!), Assassin’s Creed Shadows, Monster Hunter Wilds, and Split Fiction.

Xbox has been showing possible future UI across its devices“that looks a lot more console-like… and even appears to list Steam games” as a filter - but they removed the pic. It was def. a mockup, but The Verge believes “the company is currently working on an Xbox app update that will show every game you have installed on your PC.”

Kevin Ng pinged us to say: “I’ve updated Steampoacher - the free tool for gathering Steam image asset reference that you featured previously in the newsletter - to version 2. V2 adds support for Steam’s large graphical assets (2x image assets) and a handy Download All Images button.” Great!

VR/XR people should be very interested by this Meta blog post by Chris Pruett (smart guy!) counterspinning recent Quest paid game woes & F2P shift: “Total [Quest game] payments were up about 12% in 2024. Engagement was up at the end of 2024 - customers spent 30% more monthly time in VR in 2024 than the previous year.”

Pruett’s view? A lot of Quest 3S were gifted to teenagers and young adults, who “don’t have a lot of disposable income on their own”, and so “they skew mid-core rather than core (I Am Cat is doing great).” There’s also a older adult market who use the device “primarily for media consumption”. And he claims an $ impact of <1% to the Quest store redesign and “at most 3%” for extra Horizon Worlds visibility. YMMV.

GDC’s awards shows happened this week, and arthouse slice-of-life title Consume Me won the Independent Games Festival’s Grand Prize and Nuovo Award, while ‘joker poker’ standout Balatro got Best Debut and Game Of The Year at the Game Developers Choice Awards - congrats to all.

Circana’s U.S. game hardware (& select software) charts for February 2025 are showing $ down 11% YTD, at $9b, but game standouts in strong Monster Hunter: Wilds sales (>2x MH: Rise in dollars!) and Kingdom Come: Deliverance II (>5x the original game.) Game console hardware spending’s down 25% to $256m, though.

Netflix Games’ current strategy was shown at GDC by newish boss Alain Tascan, as covered by GameDeveloper.com and by MobileGamer.biz, among others, and he insists: “We are not yet the Netflix of Games, but that's exactly where we're heading… We have to match the overall ambition of Netflix, otherwise, we’re just a distraction.”

If you read GDCo, you may know the top Steam games of Feb. 2025. But Valve’s sales page for the top releases also has a top DLC section. And in February, ARK, Warframe, Company Of Heroes 3, Ranch Simulator & Destiny 2 had top (non-IAP!) downloadable content in there.

The ESA’s big GDC announcement was the launch of the Accessible Games Initiative, with founder members EA, Google, Microsoft, Nintendo and Ubisoft, and “a set of 24 [accessibility] ‘tags’ [for games], all with clear criteria about what each tag means.” Examples: clear text, narrated menus, stick inversion and save anytime.

Unity released its 2025 Gaming Report, and it notes: “27% of surveyed devs say they’re trying to create cooperative, social, or lighthearted experiences in their multiplayer games”, also highlighting the need to “do more with less”, either tech or personnel-wise.

Some useful stats released by Newzoo at GDC: in 2024, “67% of the total hours spent playing PC games was on [titles] that are six years old or more”, headed by CS2, LoL, Roblox, DOTA 2, and Fortnite. And “in 2024, overall [Steam] discount events… are nearly four times less effective than they were in 2019 at generating page impressions.”

Microlinks: notable titles coming to Xbox Game Pass in March include 33 Imortals, Blizzard Arcade Colection, Atomfall & more; the devs of Rail Route discuss how they sold 160k copies on Steam; Epic Games Store is giving away free games weekly on its mobile store, starting with Super Meat Boy Forever.

GDC 2025: key platform & discovery takeaways?

Surveying the wilds of Game Developers Conference 2025 via the prehistoric-looking ferns of Yerba Buena Gardens this week, people seemed to have significantly different perspectives on the event, based on longevity of attendance.

If you hadn’t been to the San Francisco-based event much in the past, you might have the impression it was hopping: 25,000+ attendees (we presume!), a large and busy show floor, and a lots of Moscone-adjacent spaces rented out by game firms big and small.

But the more veteran attendee - and I’d be one, since I helped run GDC from 2005-2020 or so, and first attended in 1999 - might discern some emerging changes. So here’s what we got out of the event this year, platform & discovery-wise:

GDC still has biz attendees that matter, but is in its ‘hangover’ era: the era of big new spending on PC/console games peaked in 2021/2022. And as the industry has diversified and big investment bets haven’t paid out, there’s still a lot of the right people at the show - but less business being done, because there’s less to do.

Platforms aren’t evangelizing on the GDC expo floor like they used to: the pandemic (and inflationary expenses) has cooled large expo budgets. And as the competitive FOMO dissipates, we see lots of smaller exhibitors and country pavilions, yet smaller (or no) presence from many bigger fish.

Services-first dealmaking was to the fore at GDC 2025: Triband CEO Peter Bruun goofed about this, but we checked Meet2Match’s 1,500 opted-in companies at GDC, and co-dev & work for hire firms - perhaps post-pivot from original IP - were the majority. And game tools firms were also high-profile at the show.

VC firms (and angels!) appear to be still searching for direction: there’s some experimentation on the project funding side of things. But there’s also some formerly game-specific initiatives pivoting into wider tech, as, frankly, a lot of funders are shooting blanks on more of their projects than they would like.

AI hype is a little tangential to the games space: there were definitely companies offering AI solutions at GDC. But it was not a big chunk of exhibits or chatter. And emerging AI productivity tools like Cursor span ‘all of programming’, not just games. (BTW, Web3 at GDC 2025 was lower profile or carefully obscured.)

We should also tip a hat to the local (San Francisco) and national (U.S.) sociopolitical issues - which doubtless haven’t helped international GDC attendance, esp. from Europe and Canada. (International ‘welcomeness’ issues will, we reckon, only worsen.)

[On location: if the show’s staying in SF, it’s because GDC’s owners think it will make the most $ there, and because relatively few conference centers have enough simultaneous lecture rooms. I may have been asked about this 425316 times during my GDC tenure, lol. But Informa knows how to run similarly big events elsewhere! So who knows for the future?]

Anyhow, as we see a raft of ‘what we learned at GDC’ posts hit LinkedIn - and entertainment lawyer Simon Pulman’s is particularly on point - we had one overarching thought.

Most years at GDC there’s somebody (often a platform!) who has a money truck. (Not literally, but over time, they give out hundreds of millions of dollars on content.) They back the money truck up to the event, and everybody tries to get a meeting with that particular company. And there’s a whisper network about how to get in the door.

Some of the previous money trucks (or cars, or zambonis, depending on deal size?) over the past decade or so at GDC have included:

Epic Games Store (for PC exclusives).

Apple Arcade v1 & Netflix Games v1.

Xbox (via Game Pass deals)

NetEase and Tencent (via investment),

Embracer (via rollup) & other rollup-centric public or wannabe public companies.

Myriad VCs (via investment.)

These augmented traditional third-party publisher deals, which were pretty vibrant all the way through 2022 or even 2023. Things were slowing down in 2024, and now in 2025, we have not only few third-party publishing deals, but a lack of money trucks.

Notably, a lot of recent bigger game biz deals have been private equity-driven, and those tend to herd towards consolidation and profit optimization. Not all of the above company money trucks have gone away, but most are significantly diminished. Which gets to the key question for the game industry: where’s the next money truck?

And, more importantly, are there going to be ANY money trucks again, besides the money trucks you assemble yourself from launching a successful game in the open market? Because if there aren’t, GDC is going to look different in another 5 years…