A heavily curated store? Meta Quest thinks it's a winner...

Publikováno: 25.4.2022

The ambassador's reception invite, or the golden ticket in a Wonka bar?

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Happy Monday, GameDiscoverCo newsletter crew, and time for our regular check into whether the platform we’re writing on has been bought by Elon Musk….nope, we’re good. (Can’t say the same for Larry the bird & friends, though.)

Plenty to talk about again this week, starting out with a rare thing indeed - a platform holder (in this case Meta) talking explicitly about why they closely curate a store, and the perceived advantages of doing so. So let’s read about that!

[ALERT: 5 days left to grab the new lifetime 20% off both monthly and yearly Plus subs deal. This video shows the data/newsletter/Discord perks, and we’re just about to launch a new ‘top 2,000 Steam games, monthly’ chart - should be a really interesting data slice.]

Quest Q: why Meta’s VR game store has curation?

Originally tipped off by Protocol, we were recently checking out the above GDC 2022 talk from Meta’s director of content ecosystem Chris Pruett. Chris’ history is as both a game dev himself, and a serious veteran at Oculus/Meta - he’s been there since 2014, and is a passionate & smart advocate for devs.

In general, the trend in video game platforms in recent years has been ‘sure, come and release games if you want!’ In other words, relatively open. Which is why Meta Quest’s approach of a carefully curated/limited VR store was a bit surprising.

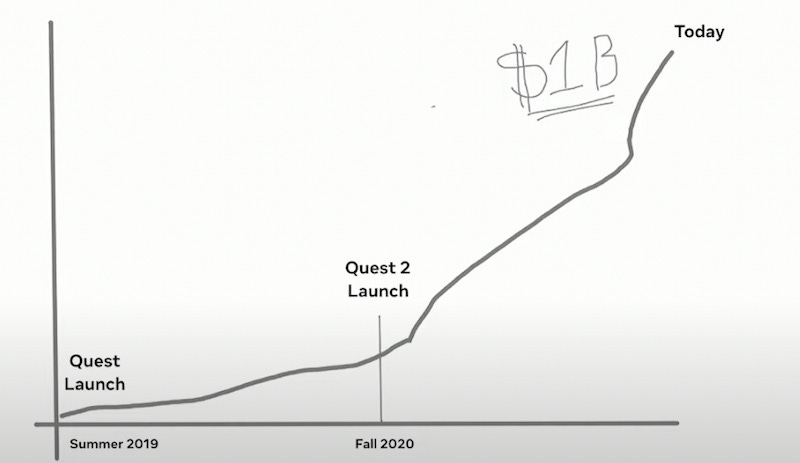

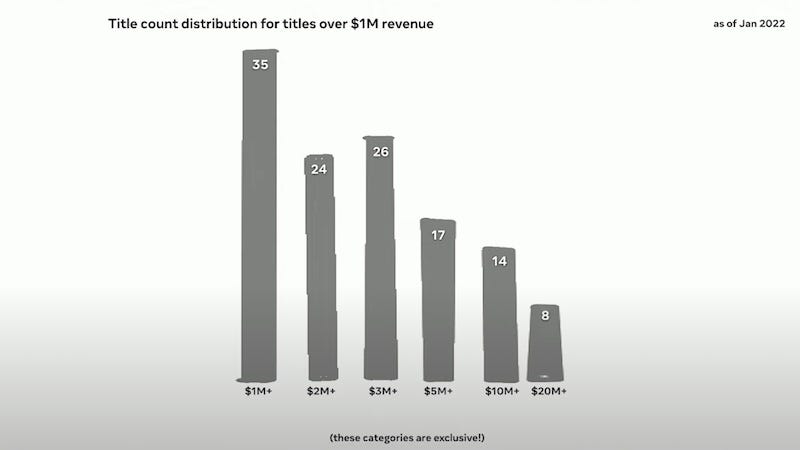

We had more info on the ecosystem in our January 2022 Quest Store survey, and Chris mentions more than 400 games in the Store proper. And the revenue totals from the ‘real’ Quest Store itself (as opposed to App Lab or SideQuest) are impressive:

So - why does Chris Pruett (and the Meta team) believe that this heavily curated approach is the right thing to do? He explains that in the talk, and it’s fascinating:

Chris’ opinion was spawned by Oculus Go’s ecosystem - an intended mass-market device. It had an open app store, and along the way there were a lot of weekend projects, experiments, and “really cool experience[s] that lasted 5 minutes and then were over.” As he explains it, the core VR enthusiasts would enjoy these, but “the shape of the application didn’t make sense” for casual players.

So when Oculus saw audiences trying Go for the first time, they split into two. The folks who “engaged with the highest quality software” would retain. But the folks who got something that was “rough around the edges” or niche would make an assumption that “what they were seeing… was probably representative” of the rest of the catalog, and stop playing.

In part, this is because VR is new. And the problem was: players couldn’t really run a value assessment of what they expected from VR games. So, for Quest, Pruett says: “we had to make a really good first impression… we needed customers to trust us.” They might get something that’s not their taste, “but it won’t be badly made - it’ll be high polish and high quality.”

Chris is honest that there was lots of internal debate too - whether it was “too early in VR’s lifecycle to start closing the doors”. But he noted that much early software in the VR space “doesn’t have IP or brand value” & he wanted customers to feel free to sample many types of game. So for Meta as a platform, he felt the baseline expectation that “whatever they try is going to be pretty good” was vital.

Pruett freely admits that he thinks there’s a problem with a lot of ‘open app store’-like platforms: he feels you “can’t find anything in them”, and there’s little or no value in browsing. This means that things that “already have velocity” are fine, but finding niche titles & new games can be way trickier - and there’s a smaller number of winners.

Boy, I have a million thoughts on this. (One of them is: has Nintendo Switch been harming its user retention by allowing ‘90% off’ shovelware titles so high up its store pages?) And it’s interesting that at one point, Chris says: “I don’t want to be selling lottery tickets” - citing some impressive numbers for those who do publish on the store:

Most of all, I think this move shows the increasing power of massive tech companies to control their own platforms. Meta has opted not to sell lottery tickets at all - by making publishing on the Quest Store a limited affair. It can do so because it’s spending a lot of money & handily outselling competitors on the hardware front.

So in the end, Meta’s giving out a few invites to the ambassador’s cocktail reception, not millions of chocolate bars with a golden ticket in a handful. And the reason they’re doing it is they feel it helps players trust the platform, and improves the quality of the games. (I actually think it does, and it was the correct decision for Meta.)

Under those circumstances, the balance of power shifts. Chris notes on approving games: “Saying no is hard” and admits: “Sometimes we say no and we make a mistake”. But… it’s just not that painful for a gatekeeper. It’s much more difficult for those who are trying to fund a game independently of Meta, and don’t have Quest Store approval.

Nonetheless, there are positive byproducts of this ecosystem. Quality video games that don’t abuse IAP or microtransactions are being part-funded by Meta. And these games are much more likely to get the remaining funding and positive ROI as a result, because supply is lower and demand is stronger. And players trust the platform more.

So the situation isn’t ‘bad’ - in the same way that Xbox’s binary choices to feature a limited amount of good quality games in Game Pass isn’t bad. I just think these yes/no decisions are very difficult to build business plans around, as an individual dev. (Platform power at work! Then again, look at the increasingly flooded open market.)

Onde: a useful Steam game sales case study!

Something we love doing on GameDiscoverCo is highlighting real sales numbers for games that have ‘just done OK’. And challenging readers to think about video games as a medium where you can sell 1 million copies - but can also sell a fraction of that.

Along these lines, Grhyll passed along a Twitter thread they created about “soothing, sound-surfing” abstract platformer Onde. It debuted in March on Steam, and has 49 Positive Steam reviews. (It reminds me visually of early ThatGameCompany title Fl0w.) Here’s the rundown:

Wishlists: “The game launched with 3,500 wishlists (mostly from Steam events and some advertising). 2K were added during the first week, and close to 1K more during the rest of the launch month.”

Sales: “We sold ~130 units the first day, ~260 during the rest of the first week, and we're slowly approaching 500 total units a month later. 39% of our sales are at home in France, 17% in the US, and everything else is at 5% or below, with the game localized in 10 languages.” (So W1 ‘launch wishlists to total sales’ conversion was 0.11.)

Reviews/refunds: “We have 47 reviews, 95% of which are positive. That gives a 1/10 review to sales ratio, which seems pretty low but has been stable for now (that's a very small sample size though). 6.4% of the units have been returned, which I think is a pretty standard number.”

Buzz from press/content creators: good & “quite above what I was expecting” was “great for us to see, [but] it didn't convert to lots to sales”, according to Grhyll. The team is working on iOS and Switch versions, and final comment: “Even though the game sales are low, we're still proud of what we've done, and quite happy with the critical reception!”

We highlight this purely because this game looks pretty good, and is well-reviewed! As for its relatively limited sales - Grhyll says: “The abstract nature of our character and the world around it + the unusual gameplay make it hard to quickly understand what's happening in the game without playing.”

I’d agree with that - the hook is fairly abstract. And it’s in a genre (platformer) that just isn’t selling that well nowadays, unless you’re a particularly standout Soulsvania or Metroidvania. (It doesn’t even visually ‘read’ much like a platformer, actually.)

Separately of that, it’s another reminder that in this world of high game supply & ‘no-reset’ game stores, there’s just a limited amount of attention space for new games, even decent ones. Which is why curated stores (see above!) and game subscription services are on the rise.

[BTW, according to our Plus data, Onde had 35 Steam reviews in Week 1, ranking it #180 out of 960 games releasing in March 2022. Our ‘Hype to Reality’ score for Onde was median-ish. So we expected it to do about this well, given pre-release follower/wishlist rankings.]

The game discovery news round-up..

We race into the final furlong of the newsletter striding hard, calf muscles filling with lactic acid as our jockey (in this tortuous extended metaphor, the reading public) pushes us to the limit. And our 50/1 longshot delivers, as we give you the latest news:

There’s a lotta money at play in the game biz, folks: “Between January and March [2022], the total value for reported deals closed was $98.7 billion spread across 387 transactions, as per new research from Drake Star Partners.” That includes some big ones - MS/ATVI - but also plenty of smaller investments/deals - full data here.

Rumor report: someone told us that Sony is getting (new?) PS4/PS5 games that cost $35 or more to have a 2-hour timed trial for the PlayStation Plus Premium tier launching in June. (Sony will provide the gating tech. But this is a pretty unorthodox intrusion into the biz model for standalone games, right?)

Netflix update: as growth stalls outside of games (read this analysis!), they’re picking up more games - such as 11Bit’s Moonlighter - for ‘mobile with Netflix logon’ access. Full current list available here, btw. Also: an Exploding Kittens ‘board game => animated series’ comes with a bundled mobile game deal.

As Nintendo’s quixotic Switch Online Expansion Pack subscription continues to roll out, the company just added Splatoon 2’s Octo Expansion DLC to it. (There’s already Animal Crossing and Mario Kart DLC included.) Clearly in part this is to promote Splatoon 3’s September arrival.

Apple seems to be removing old iOS games that haven’t been updated recently. It’s not happening to all games - perhaps there’s a ‘low downloads only’ filter? But as Emilia Lazer-Walker says: “Games can exist as completed objects! These free projects aren’t suitable for updates or a live service model, they’re finished artworks from years ago.” So boo, Apple.

Further to the PlayStation Plus revamp global rollout, Sony announced that it’s launching earlier in Asia: “Asia markets (excluding Japan) – targeting May 23, 2022; Japan – targeting June 1, 2022; Americas – targeting June 13, 2022; Europe – targeting June 22, 2022.” And adding cloud game access to more countries like Poland, Greece & the Czech Republic.

A minor detail for ‘reviews to sales’ ratio Steam nerds: we had a couple of public data points - for Aircraft Carrier Survival (20,000 copies sold with 270-ish Steam reviews) & for Lumencraft (above - 20,000 units, 250 Steam reviews) to indicate that the ratio can be as high as 80-100 immediately after launch. (This is important when evaluating early progress against long-term benchmarks.)

Sales milestones: Warner Bros announced that the new Lego Star Wars game has sold over 3.2 million copies across all platforms; Techland said that Dying Light 2 has sold 5 million units; Iron Gate’s Valheim just made it to 10 million copies sold on Steam alone, wowee.

Finally, the video game satire nerds at Mega64 just took on the (not always great!) state of Nintendo’s ‘classic games coming to Switch Online’, and the result was… this:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]