Analyzing the top-grossing Steam games of 2021

Publikováno: 3.1.2022

What made it to the tippermost toppermost heights?

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Greetings, fellow game discovery fans! Looks like we’ve made it to 2022. I hope you had a relaxing and none-too-stressful time off. Beside the Steam in China fire drill - which was actually sorta fun - we had a chill time, too.

So, let’s get back into it. And there’s a lot of things to delve into, starting with Steam’s extremely useful listing of the top games of 2021 from a gross revenue perspective. (Why don’t all game platforms provide this? They totally should…)

Also: New Year, new subscription deal! We’re offering 20% off yearly subscriptions (reduced to just $10 per month) for our GameDiscoverCo Plus tier until January 17th. Plus, we’ll randomly pick one new paid subscriber to get a) their money back and b) a free lifetime Plus subscription. Gotta love gamification at work, eh?

[Reminder: with Plus, you get a Plus-exclusive Discord with much useful peer chat, a daily updated Steam Hype/post-release data site, exclusive newsletters analyzing PC/console game trends, two eBooks, & more. Your support’s appreciated - here’s our video explaining the perks.]

Steam’s top-grossing 2021 titles: a deep dive?

On December 27th, when we were all recovering from Xmas festivities, Valve published a blog post called ‘The Best Of 2021’. It’s full of excellent empirical rankings (VR, new releases, Early Access graduates) from the empire that is Steam.

Of course, you don’t get exact revenue included. But what you do get - and have done every year since 2016, at least - is a grouped set of the top-grossing Steam games for the year. This takes into account all their revenue - base game $ (if it exists), DLC, and IAP via Steam Wallet. (Some games optionally allow you to buy IAP via their website - this won’t be counted.)

Just to get Valve’s official word on how they calculate this: “Since we don't divulge revenue specifics for the games on these lists, we sort them into categories to give an idea of how they stack up. Games are randomly sorted within the following categories: Platinum: 1st - 12th; Gold: 13th - 24th; Silver: 25th - 40th; Bronze: 41st - 100th”

Can we anchor these abstractions against revenue somehow? There’s not much data out there, but here’s one. We know that Valheim (Platinum tier for 2021!) had sold 8 million copies by the end of June 2021. We’d guess another couple of million sold by year end. So perhaps we’re talking $150 million gross on Steam for the year?

Here’s another data point: Rust had grossed $43 million on Steam between the ‘end of 2019’ update and the ‘end of 2020’ update, according to Facepunch, and it was Silver tier in 2020. (No ‘end of 2021’ blog to compare it against, and it moved up to Gold in 2021 on the back of some big streamer coverage.)

So perhaps we’re talking - very, VERY vaguely, and remember, the tiers aren’t tied to round numbers in reality - Platinum being USD $100m+, Gold is $50m-$100m, Silver is $30m-$50m, and Bronze is $20m-$30m.

That’s all before Steam’s 30% cut, refunds and VAT, etc. So the net will be closer to 60% of the gross. But this gives you all a basic idea of how well games are doing on the service, at least?

What do these top Steam games have in common?

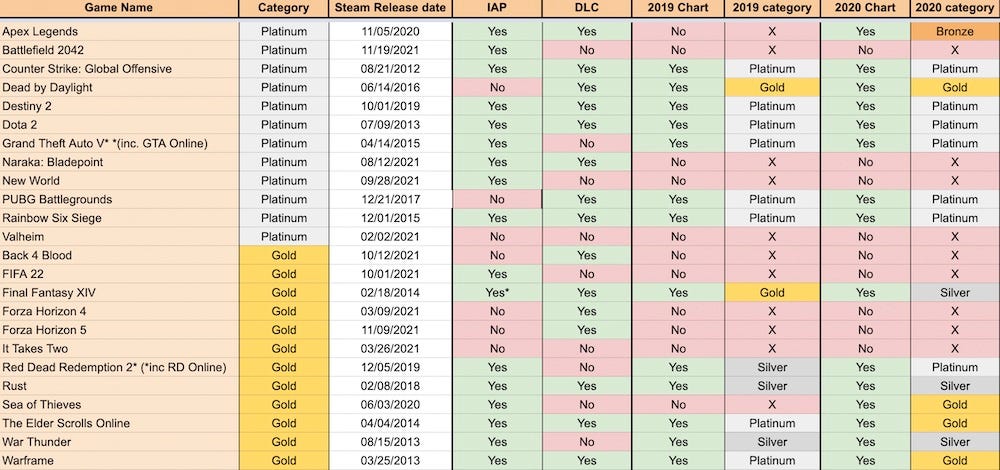

Sure, we can just stare at the list, but GameDiscoverCo data czar Al made a special GameDiscoverCo-exclusive Google spreadsheet for us all (pic, above) with additional information.

This includes whether the game has IAP (via Steam Wallet) or DLC (via an ‘add-on’ Steam item - including Battle Passes, etc), its original release date, and its 2019 and 2020 chart rankings on this same ‘Top 100 grossing’ chart. From it, there’s quite a number of interesting conclusions:

GaaS is where the money is on Steam: of the 24 games ranking Platinum or Gold, 22 of them have either IAP, DLC, or both - a striking result. (The only ones that do not, according to our research, are Valheim and It Takes Two.)

The majority of top titles aren’t new: 13 out of the top 24 Steam games were also in the Top 100 charts in 2019. And 15 out of the top 24 also charted in 2020. So - ignoring Forza Horizon 4, which came to Steam post-release - there were 8 ‘released in 2021’ in that top echelon: Battlefield 2042, Naraka: Bladepoint, New World, Forza Horizon 5, Valheim, Back 4 Blood, FIFA 22, and It Takes Two.

22 out of the top 100 titles were ‘premium & standalone’: these titles with no IAP or DLC were mainly located in the Bronze tier, and include ‘fairly’ indie titles like Dyson Sphere Program, Satisfactory, Hades. These seems reasonably non-scary and expected to me - but be aware they are a significant minority.

A subscription service made the ranking: super-interesting to see EA Play make it to the Bronze tier - especially because it’s $5 per month, but as inexpensive as $30 per year if you pay annually. EA is obviously using it for a) back catalog revenue but also b) to upsell its newer games with bundled bonus DLC and IAP, or even free 10-hour trials to Battlefield 2042.

Finally, just perusing the Top 100 list may provide some surprises, even for those who think they know about top Steam games. ‘Oh, that made the Top 100-grossing?’ semi-surprises for us included theHUNTER: Call Of The Wild, Phantasy Star Online 2, The Forest & Yu-Gi-Oh! Duel Links. Were you paying attention to those titles?

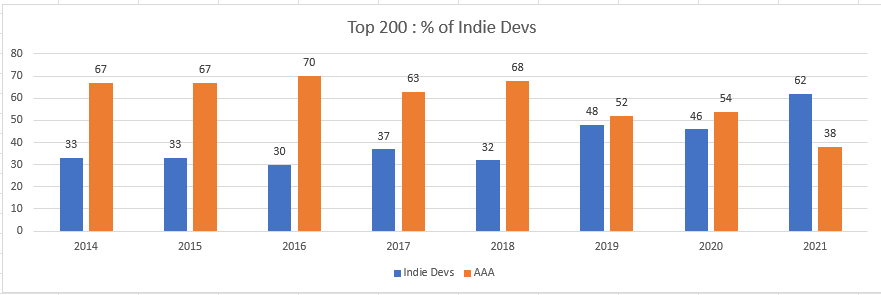

Finally, for a different view on this type of data, Focus Entertainment’s Chief Content Officer Yves Le Yaouanq posted this neat chart on Steam’s top releases per year, ‘indie’ vs. ‘AAA’:

And yes, the attempted definition of ‘indie’ is “new releases from indie studios below 100 [full-time employees]”. Which is still interesting, if naturally debatable. As for the flip to majority ‘indies’ in 2021, he speculates, among other things: “More indie games from China… Wholesome trend = more indies… more players from new territories with new tastes.”

Oculus/Meta’s big holiday win with Quest 2?

Although all major console hardware (that you could source!) had a good Xmas, this year we got multiple data points around a great holiday season for Meta’s Quest 2 VR headset.

Our read is definitely that VR’s form factor, price & games have finally settled down to a product where people are comfortable shelling out $300 for the hardware. This is especially true given the hardware seems freely available, & supply chain issues seem less pronounced for it.

The thing that folks like Benedict Evans noticed was the Oculus app at #1 in the U.S. iOS App Store on Xmas Day. (You need to run the mobile app to set up your Quest 2 device!) Quartz further noticed: “Before this week, Oculus was a top 10 iOS app in only one country—the US—but by Dec. 26 became a top five app in 14 different countries and the number one app in the US.”

According to Sensor Tower’s extrapolated mobile estimates (via Quartz), “Oculus was downloaded 1.3 million times globally between Dec. 21-27 [on iOS/Android].. a 363% increase in new downloads week over week. Sensor Tower counts 13 million lifetime installs of the app, meaning that 10% came this past week.” Not bad.

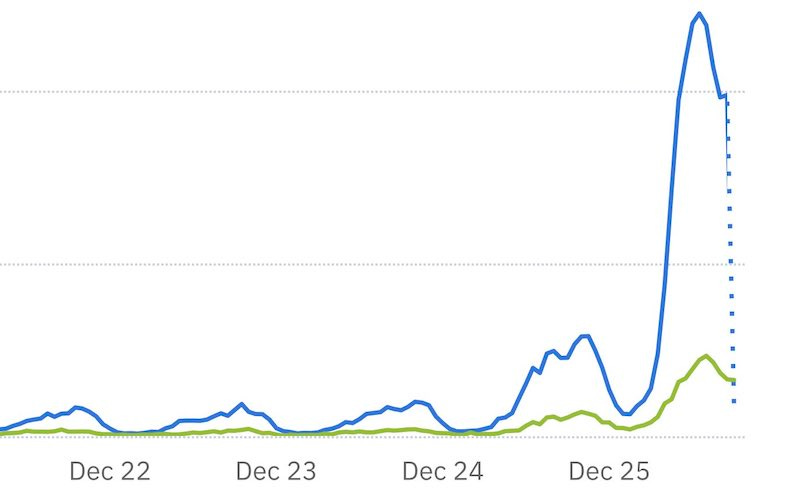

As for further evidence, see the above ‘Xmas sales go brrr’ graph. That’s year on year Quest hourly unit sales of Golf+, with 2020 in green and 2021 in blue, via a series of Ryan Engle Tweets. (A young relative got a Quest 2 for Xmas and ended up getting golf and bowling games. So perhaps Wii-style casual games are a good place to be?)

But the Quest hardware space is in rude health overall. And the ‘standalone, only plays VR games’ angle may be helping with retention - previously a big problem with optional VR accessories. Engle also said, intriguingly: “According to our data, over 80% of our lifetime [Golf+] customers have used their Quest within the last 28 days. Our first set of players joined over 18 months ago.”

Finally, the app is available on other VR platforms too, but VRChat’s Xmas CCU boost is public, trackable and notable. Looks like it added around 20-25k max CCUs starting on Xmas Day? Which is significant, given it ‘only’ had around 50-60k max CCU before then.

So we’re not at console scale. And the Quest library is already large, so there’s no ‘get there early and sell millions’ win. But it’s still the best bet for VR devs by far - if you can get on the Quest storefront.

The game discovery news round-up..

Sure, the above includes a few things that might pique your interest as you return to work. But we racked up a bunch more links over the holiday period, and we really need to tell you about them. So that’s what we’re going to do, dammit:

A new Steam Labs experiment launched on Dec. 17th! It’s Experiment 13, ‘Store hubs’, “where we’ve revamped [Experiment 10 - ‘new ways to browse Steam’] with powerful new tools for browsing, filtering, and exploring deeper into each category.” If you opt in to test, you’ll see a new ‘rich recommendations carousel’, info on ‘events’ for games in that tag/view & more. Mm, the sweet smell of discovery.

Some interesting musings from Finji’s Bekah Saltsman in this IGN piece, discussing the cost ($4 million?) of making a decent quality indie game in the U.S. while paying fair local salaries, and cautioning: “The number of indies that hit 100,000 copies is still a very, very, very small fraction. So, that's what we're bumping up against [on budget vs. return]. Things take forever to make. And it's really, really, really hard to cut graphical corners or polish corners.”

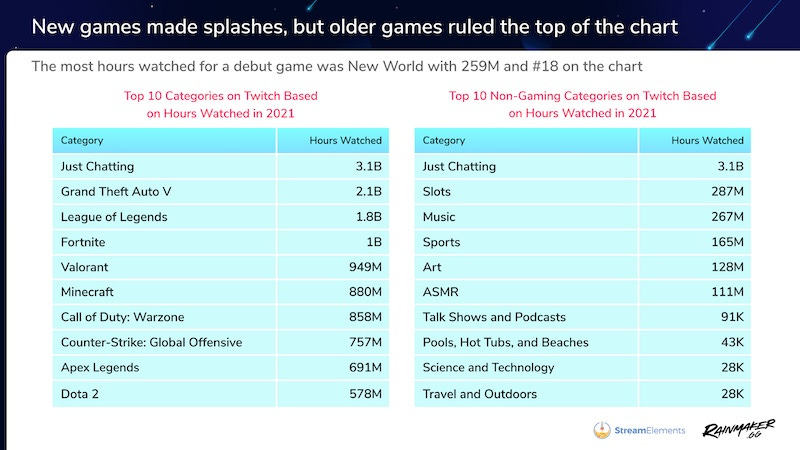

StreamElements & Rainmaker.gg put out its ‘state of streaming in 2021’ report, with some notable facts (also see above pic): “There were no surprises among the top 10 categories on Twitch in 2021, with Just Chatting, Grand Theft Auto V, and League of Legends [charting] every month this year. Coming close to cracking the top of the charts was New World at #18, which had the crowning achievement of being the most viewed new IP of the year with 259M hours watched.”

Another ‘this happened over the holidays’ thing, the Steam Awards for 2021 just got handed out, with the player-voted awards picking Resident Evil Village as the Game Of The Year and Cooking Simulator VR as the VR Game Of The Year. (Also in there: Cyberpunk 2077 raising some eyebrows - for a couple of reasons - as ‘Outstanding Story-Rich Game’.)

A few more ‘that was 2021’ compilations to look at: here’s Ars Technica’s ‘best game’ picks, here’s a GI.biz round-up of ‘the year in numbers’, infographic-stylee, here’s my buddies at GameDeveloper.com’s ‘best game’ picks, here’s the 8 mobile games that grossed >$1 billion in 2021 (!) according to Sensor Tower.

Remember how ARK-like Myth Of Empires got big on Steam (mainly in China) and then got removed due to alleged plagiarism? Well, the company who made it is going after ARK’s developer and Chinese publisher, claiming “the evidence provided to Valve [to remove Myth of Empires] ‘misleadingly presents, out of order, an extremely small set of 'names' that exist in Myth of Empires source code and omits software code that actually drives the operation of Myth of Empires’.” Interesting.

Oh yes, we have 2022 things too! Polygon takes a look at their most anticipated 50 games of 2022, Nintendo Life picks 30 Switch games to keep an eye on in 2022, and Kotaku has 29 games coming out in 2022 that they are excited to play. Oh, and IGN’s 48 games to look forward to in 2022, also.I find these useful - there’s always something or other you missed.

We just ran across the FOSS Patents blog, which has a LOT of good Epic/Apple coverage. Brand new: a think-heavy preview of Epic’s appeal over the case, but also notable and new to us, though it happened in early December: “The largest and most influential U.S. regional appeals court denied a motion by the Coalition for App Fairness and some of its members to submit an amicus brief in support of Epic's opposition to Apple's motion… nothing short of a nightmare for any advocacy group.”

Microlinks: Xbox’s Phil Spencer is playing the ‘business model diversity’ card in this recent metaverse-centric interview; Victoria Tran’s great GDC talk on ‘charming your communities’ is now up on YouTube, if you missed it ; TikTok has been testing a PC streaming app which “lets users broadcast live footage from games and other desktop applications” - though maybe it’s violating OBS’ open-source licenses? Doh.

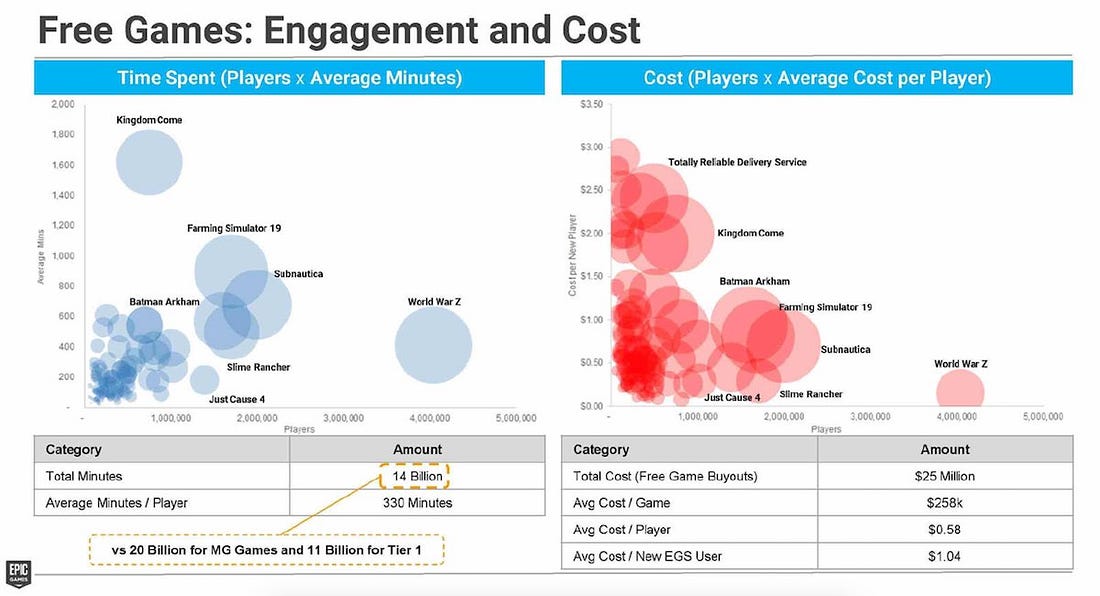

Finally, here’s one final (final!) leftover from the Epic/Apple spat that didn’t fit in our last newsletter on it. Which free games on Epic Games Store got the most players vs. time spent vs. cost to ‘buy out’, as of early 2020? There’s an unredacted graph for that:

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]