Are conversion rates dipping over time on Steam?

Publikováno: 29.5.2024

And which month should you release your game in? Also: a DLC investigation.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back, as if we’d ever gone anywhere. And this version of GameDiscoverCo’s newsletter delves deep into the data to ask a simple question: is it getting more difficult to convert your PC game’s ‘Hype’ on Steam over time?

Before we get started, we’d argue Duncan Fyfe is a premiere long-form essayist in video games, and his latest, ‘Paying Respects To Press F’, a longform history of the Call Of Duty: Advanced Warfare meme (!), is up on Remap’s website now. It good.

[HEADS UP: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data cache for unreleased & released games, weekly PC/console sales research, Discord access, 8 detailed game discovery eBooks - & lots more.]

Are conversion rates dipping over time on Steam?

Back in August 2022, we put out a column asking about the ‘best’ time of year to release a game on Steam, according to our data that looks at how well ‘Hype’ is converted*. Almost two years later, we thought we’d come back and look at it again.

(*The data point we’re using in this piece is ‘# of Week 1 Steam reviews as a % of GameDiscoverCo Hype launch score’. This is a bit abstract, but roughly equivalent - or at least first cousins - with ‘Steam wishlist balance at launch compared to total Week 1 sales’.)

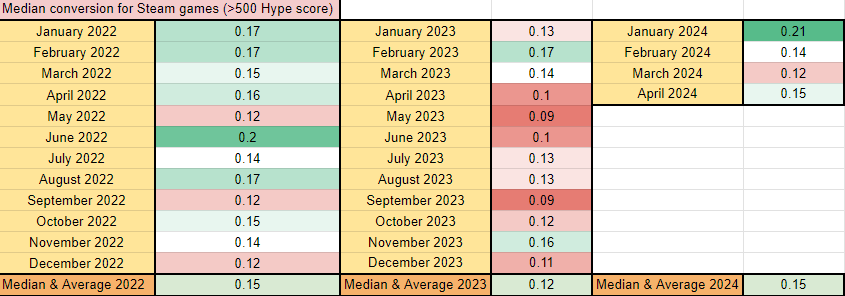

Now that we have over two years of data, we can also look at overall new game Week 1 conversion since the beginning of 2022 on Steam. And here’s the median conversion numbers, only for games with >500 Hype score. (>20,000 Steam wishlists at launch?)

So far, so incomprehensible, right? But to explain more, this is basically ‘how did the top 40-80 games on Steam do in Week 1 compared to LTD interest coming into launch?’ We pick the conversion of the middle (median) game in that list, and hey presto…

Right away, we see one thing that stands out - 2023 has a few more lower-trending (red) months in it, although the start of 2024 hasn’t seen the same yet. (But Q1 is often one of the best-converting periods of the year, so perhaps it’s no surprise.)

Actually, January 2024 was a super-good month for median conversion, and if Plus subscribers look at the line-up, you’ll remember the high-end winners: Palworld, Granblue Fantasy, and Enshrouded all overperformed by a lot.

So: should games release in Q1 because of better conversion? Frankly, it’s unclear because of correlation/causation issues. (Maybe the kind of games that choose to release in January are more unheralded, so will perform a little better vs. expectations.)

The other thing to bear in mind is that median conversion varies a ton. Even in January 2024, the best-converting game - Murders On The Yangtze River - did 9x as well as the median, and the least good - Unforetold: Witchstone - did 1/20th as well.

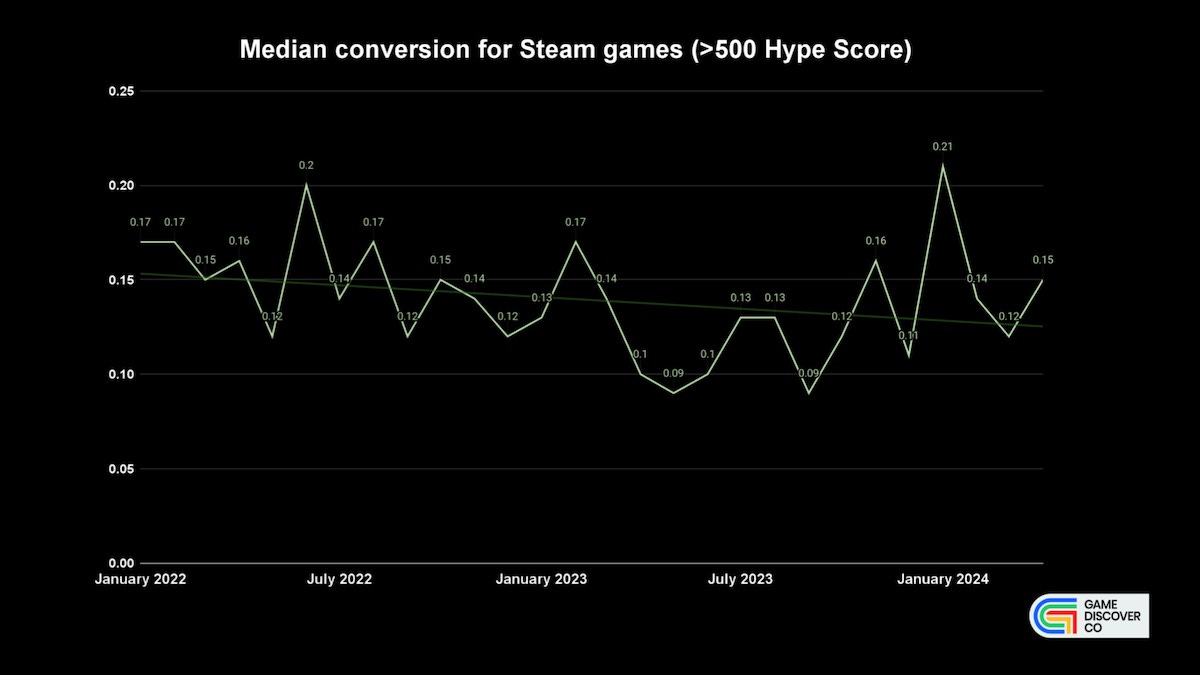

But laying this data out over time, and using a ‘line of best fit’ (above) - yes, it does appear that median conversion is dipping somewhat.It’s gone from just over 0.15 at the beginning of 2012 to around 0.125 most recently. (A just over 15% drop.)

What does this mean, really? I guess you could say ‘all things being equal, it’s a bit harder to get a return on each 10,000 wishlists gained than it was 2+ years ago’. It’s not a precipitous change, but it’s a slight one - and we’ll see what happens this summer.

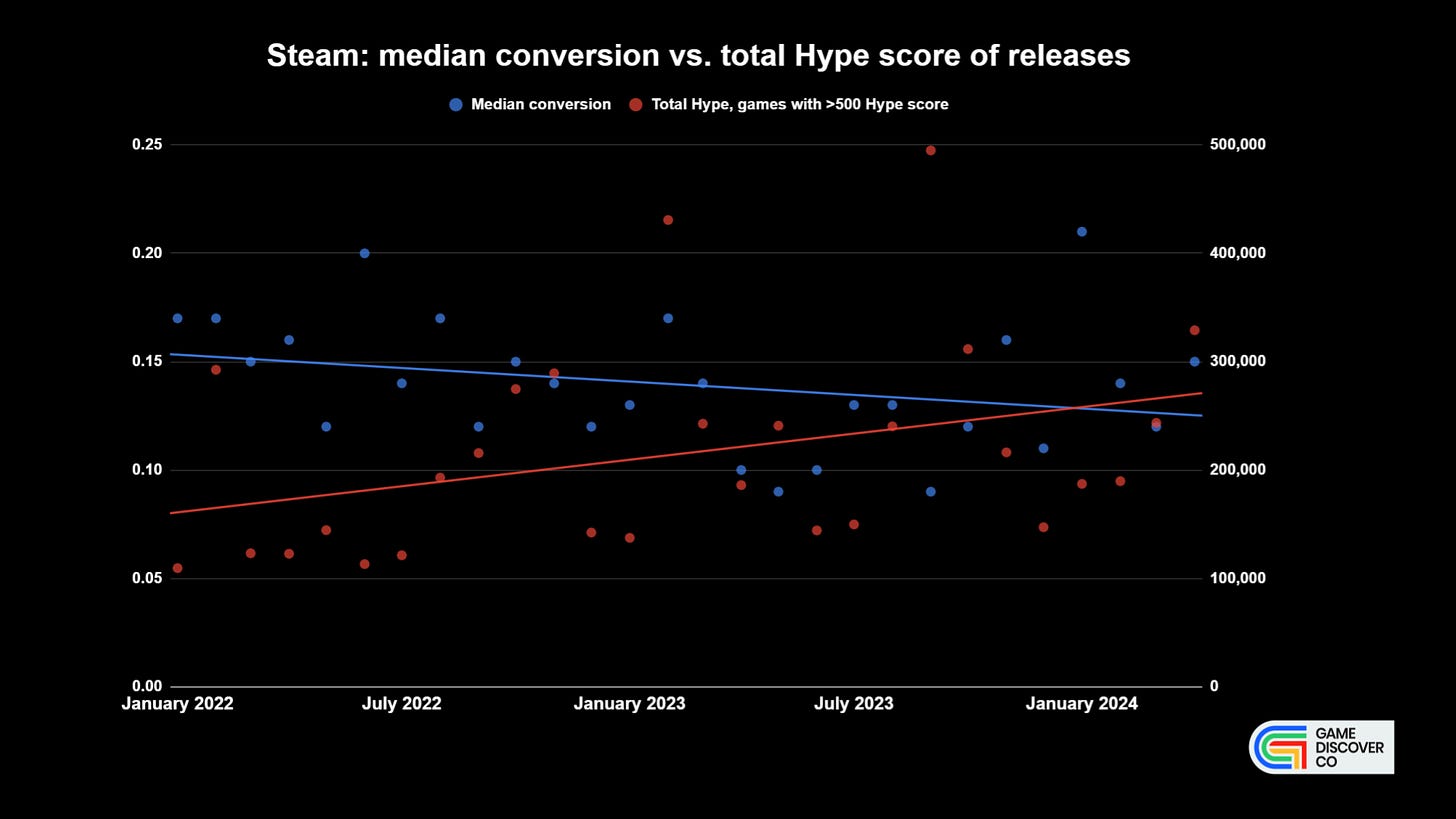

We also wanted to look at conversion compared to total Hype (aka total wishlists / followers) to see if it’s cumulatively more crowded. (If we connected the data points connected here, it’d be a giant mess, so we’re just showing ‘Line Of Best Fit’.)

Interestingly, when we looked at median Hype score per month (not shown here), it didn’t budge much between 2022 and now. But the overall total did increase quite a bit (red line above) - doubtless skewed by a handful of monster releases* in certain months.

(*September 2023 is the massive standout here, with Starfield, Party Animals, and Payday 3 all at >50,000 Hype score, and Lies Of P, Mortal Kombat 1 and EA Sports FC 24 at >10,000 Hype score. Those numbers add up!)

Of course, we still believe that the biggest competitor for your new game is the high-quality older game in the same genre as you. Especially if that game a) has been updated repeatedly since launch, and b) is available on discount sales regularly.

But it’s also good to understand - there’s nothing apocalyptic going on with overall conversion rate of Steam games. Our conclusion: it’s always varied massively, and the median is dipping a bit, but you should still take pre-release interest seriously.

Besiege: latest DLC performance & best practices!

Over on the GameDiscoverCo Plus Discord, friend of GDCo Stefan Metaxa popped up with some learnings from the brand new water-themed DLC for hit physics building and destruction game Besiege. So we asked nicely, and he said we could reprint it here.

Besiege is one of those long-term success stories which lends itself really well to DLC set in new environments. And the team announced it and shipped the $10 add-on all within a few weeks.

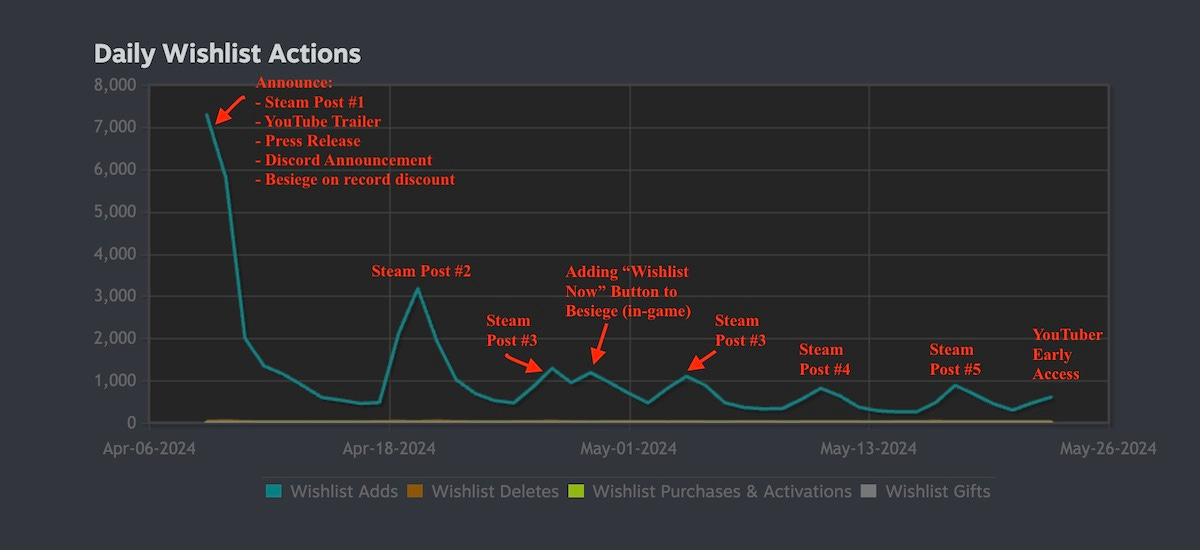

Here’s Stefan’s annotated graph for wishlists on the DLC, which sported 50k wishlists when it launched on May 24th - a pretty high number for just 6 or 7 weeks of promo. Remember, DLC is wishlisted and reviewed at markedly lower rates than base games:

Stefan notes: “The Steam news posts [and an in-game ‘wishlist DLC’ button] had a significant impact on wishlists and formed the backbone of our 1.5 month campaign - as you can see from all the mini spikes”, and went on to point out some useful things:

DLC revenue contributes to the base game’s positioning in Top Sellers - giving “double visibility”, as the DLC also appears on the list as a standalone

DLC doesn’t show up in the front page Steam feed for Popular Upcoming, and only shows up in New & Trending for people who already own the base game.

For big enough games, you can ask for a curated marketing message from Valve (popping up for existing Besiege owners.) Stefan sez: “That was the largest source of traffic to the Splintered Sea page for the DLC’s launch week.”

As for the financial effect, Stefan explains: “DLC sales beat our internal expectations and has had a significant impact on Besiege's overall revenue - mainly as we now have something selling at $8 on discount, where the base game sells at around $4 on discount.”

He’s right - yield improvement (as well as juicy new content for all your fans!) is often a lot of the point of DLC. Unless you have a fanatical fanbase, only a single digit percentage of existing owners will pick up any new Steam DLC.

But with the addition of the DLC - and a new Supporter Edition bundle for the game, which was arguably underpriced at $15, and regularly has 75% off sales - you can now pick up a $15 bundle with lots more goodness, instead of the on-sale $3.74 base game.

So that’s really going to help new player spend over time, as people choose beefy deluxe versions over the basic, cheap SKUs. (We did some napkin math(s) on DLC yield upgrades back in 2022, for anyone wondering about the general size of the boost.)

Oh, and Besiege shipped a free update with some major sound-related upgrades when they put out the DLC and Supporter Edition. Free updates are always a good idea, to delight the community & stave off those who think you ‘just’ make paid DLC now…

The game discovery & platform news round-up…

Finishing off the free newsletters for the week, here’s some discovery and platform news that fell out of the cupboard, and into your inbox:

The latest Footprints.gg ‘trad media’ mentions chart is headed by Call of Duty: Black Ops 6 (more on this shortly!) - with the Genshin Impact-like Wuthering Waves, Ubisoft’s new shooter XDefiant (getting quite a lot of interest!) and MultiVersus’s relaunch also charting strongly.

According to SteamDB’s Pavel Djundik: “Steam is still working on [video] clip recording. It supports background recording, includes timeline markers in supported games for various events. Clips can be shared similar to screenshots, via the Steam community.”

PlayStation’s Days Of Play 2024 announcement has a host of PS+-related reveals: the PS+ Essential games for June (SpongeBob Squarepants: The Cosmic Shake, AEW Fight Forever, Streets of Rage 4), PSVR2 games for Premium subs (inc. Walkabout Mini Golf, The Walking Dead: Saints & Sinners) & PS2 ‘classics’ for Premium (Tomb Raider Legend, Star Wars: The Clone Wars, Sly Cooper.)

Art game creators Santa Ragione are not having fun: “How many more indie game masterpieces must fail to sell more than 5,000 copies on Steam before we start addressing the huge discoverability problem that is literally killing the medium?” (We think they want more taste-based curation, citing “insidious commercial misappropriation of cultural infrastructure - Steam Awards, Steam Festivals, Steam Curators.”)

Xbox decided on an early confirmation that you’ll be able to play Call Of Duty: Black Ops 6 if you have (anything except the Core level of ) Game Pass. More on the title & release date are due June 9th after the Xbox showcase. (We’re still wondering if Game Pass pricing will go up between now and CoD’s release.)

YouTube has officially rolled out its ‘Playables’ on the platform, essentially a Game tab for the video platform: “Head to the main YouTube Home page, either on desktop or the iOS and Android app and find Playables from the Explore menu.” Titles include Angry Birds Showdown, Cut The Rope & Trivia Crack.

The much-awaited Warhammer 40,000: Space Marine 2 (that's a mouthful!) has pre-orders up on Steam, and you can see the full (new) Valve 'Advanced Access' UI very clearly for the deluxe versions, which get to play the game 4 days early.

A short-notice PlayStation ‘State Of Play’ showcase is happening tomorrow (Thursday) at 3pm PT. Watch “for updates on PS5 and PS VR2 titles, plus a look at PlayStation Studios games arriving later this year. The 30+ minute show features 14 titles.” (There’s also a Sony corp presentation tonight that may be interesting.)

Here’s a great Steam microstudy: ‘How I used paid ads to reach Steam's Popular Upcoming list’. (Not convinced getting on Popular Upcoming is 100% the right goal compared to wishlist quality, but it’s good to see a granular ad spend breakdown.)

Microlinks: who is subscribing to Game Pass, PS Plus and Nintendo Switch Online, and why?; Sony is certifying an adapter to allow PSVR2 hardware to work on PCs; Nintendo announces plans for a store in San Francisco’s Union Square, breaking the ‘doom loop’ narrative. (Unless the store is being run by Waluigi.)

Finally, let’s finish with a little provocation from veteran game designer Andrew Chambers, who criticizes “the never-ending hunt for the sure bet” in the game biz right now, and highlights some awesome alternatives:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]