Data dive: inside a successful sequel launch

Publikováno: 16.8.2021

You want some more Car Mechanic Simulator? Everyone else does!

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, we’re back, Jack - and yup, we’d rather jack than Fleetwood Mac. But more seriously, thanks for supporting our work recently - for example, we’re delighted to see last week’s newsletter section about revenue estimation reprinted on GI.biz today.

What’s up next? Well, we’re working hard on some new in-depth analyses and perks - both for Plus subscribers and free newsletter readers. And you’ll see more on that soon. In the meantime - let’s get crunchy with some data, shall we?

[Reminder: our GameDiscoverCo Plus paid subscription - only $12 a month if you sign up for a year - includes the ‘Complete Game Discovery Toolkit’ eBook for members, a Steam Hype back-end for unreleased games, a neato Discord, & lots more - upgrade today!]

Car Mechanic Simulator 2021: anatomy of a hit?

We’ve talked a bit about publicly traded Polish publisher/developer PlayWay before. (Our piece ‘What PlayWay should - and shouldn't - teach us about game publishing’ was one of the more discussed in GameDiscoverCo newsletter history!) But we didn’t look into one of their successful games in a lot of detail.

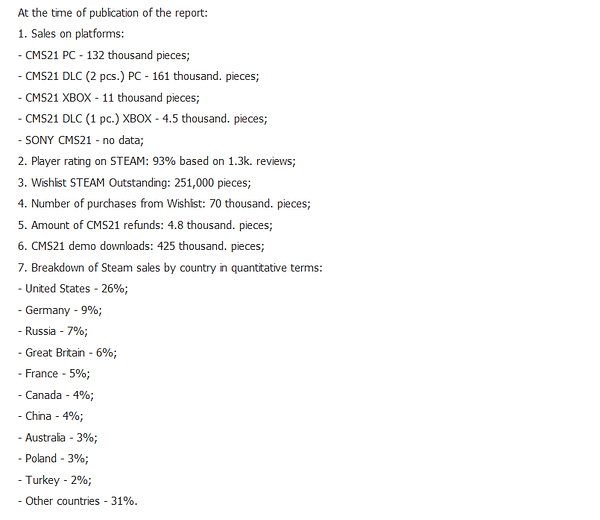

And so it was great timing that PlayWay shared with its investors some very focused and precise data on the release of its new Red Dot Games-developed Steam hit Car Mechanic Simulator 2021, as passed along to us via Twitter during the weekend:

It’s very rare to see this degree of transparency from a larger publisher so close to a game’s release - though PlayWay does it fairly often for standout games. And from that, we’re able to calculate a whole bunch of interesting things.

(Were any of you surprised that CMS 21 has sold 132,000 PC copies in just 3 days, by the way? If you look at Car Mechanic Simulator 2018, which now has 35,000 Steam reviews and a median owner estimate of 2.63 million units and $8.7 million in net sales using GameDiscoverCo formulas, you probably shouldn’t be.)

Steam followers to wishlists..

So let’s look at some graphs and data to see how this all went down:

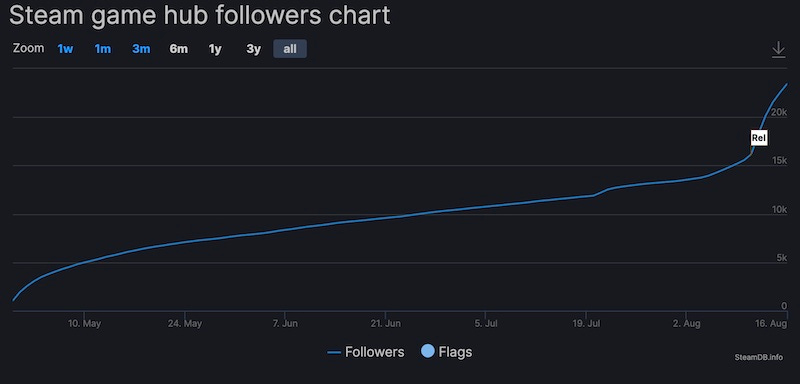

Firstly, you can see the SteamDB follower graph for Car Mechanic Simulator 2021 above. Although it only added a Steam page at the end of April 2021, the game’s followers grew extremely quickly, a clear indication the game was likely to be a hit before it was.

In fact, CMS 21 had 16,166 Steam followers on the day of release, when PlayWay says it had 270,000 wishlists. So that’s a 16x multiplier between followers and wishlists, fairly high compared to the median of 9.5x.

Our GameDiscoverCo Plus back end backs this spread up, logging it as #42 in Steam’s unreleased game wishlist chart out of 5,000+ games (PlayWay’s CEO thinks velocity is an element in this wishlist ranking, btw), but only #91 if ranked by followers. And our Hype charts for last week ranked the game #2 out of all the 190+ titles releasing, behind only Naraka Bladepoint. So we were definitely sold on it being a hit!

(Wonder why it has such a large follower/wishlist multiplier? Maybe something to do with it being a known quantity in the form of a sequel? Or lots of ‘one click to wishlist’ actions via PlayWay’s crosspromotional Steam page widgets? Or maybe there was no news to follow in the Steam news page? Either way, it didn’t affect performance.)

But what’s the hook?

But why is the Car Mechanic Simulator series popular? Well, PlayWay understands that ‘X Simulator’ games can often do well with the sim/task-happy PC game crew. And running your own garage and repairing/fixing cars is a good starting point to get players excited.

But this series is semi-secretly - and not so obviously to me - a ‘flipper’ game, like PlayWay’s even more popular House Flipper series. Check out the below ‘make $ quick’ YouTube video for the game, to get a good idea as to what’s going on. That’s the gameplay hook - and it’s a great one:

So it’s a pretty neat and unique game concept (not a lot of competition!), plus it’s got a ‘flipper’ hook that works great with players and streamers. And CMS 2021 is continuing a hit game series, where a lot of people still playing the originals would be naturally interested in a sequel.

DLC, discounts, review/sale ratios…

It was also smooth of PlayWay to launch with 2 DLC ready to go - a licensed Nissan DLC and an electric car DLC with ‘Tesla-like’ vehicles in it. This contributed to 161,000 combined copies of the PC DLC being sold, according to PlayWay.

(So if that’s 80,000 copies of each DLC. And if we think most players either bought the game, or the ‘game & 2 DLC’ package, that could imply that about 40-50% of the 132,000 near-launch copies of CMS 21 were bought standalone, and 50-60% were bought with the DLC bundle. You can actually see the bundle outselling the standalone game in the Steam top-sellers by SKU right now. That’s compelling reasoning for launch DLC to boost yield!)

One other interesting thing: CMS 21 launched with a 5% discount, which confused us slightly (games very rarely do less than 10%!) Then we realized that PlayWay is offering an additional 10% loyalty discount to players of previous versions of Car Mechanic Simulator - and a number of other popular PlayWay games like Mr. Prepper, The Tenants, etc. So they’re expecting a lot of early sales to be at 5%+10% off.

Finally, it’s worth talking about the early review/sales ratios, since we’ve been aware for some time that they take a while post-launch to ‘settle’. Players don’t review games straight away. This is why you see 1,300 reviews and 132,000 copies sold (100 to 1 sales/review ratio) as of Saturday, and over 2,200 reviews as of Monday, even though the game has probably ‘only’ sold another 25,000 to 50,000 copies.

So the game will settle towards its final, more stable reviews ratio, which I think it likely to be somewhere between 40 and 70. (More popular games are often on the higher end of the possible spectrum.) But this is a good reminder that when you look at earlier review to sales numbers for games - first 5 days or so - they may be skewed high.

Oh, and just talking about those Xbox stats briefly to finish out? Maybe the game genre is more PC-centric than console. But seeing about 10% the amount of PC sales on Xbox (11,000 units in 2 days, vs. 132,000 units on PC in 3 days) fits in with our impression of the paid market for this style of games. And then there’s reduced Xbox DLC attach - only about 20%, less than half that of PC - because it’s less easily or obviously bundled in the Xbox store. C’est la vie.

The game discovery news round-up..

Well, after going deep into one particular game, it’s time to spread our sticky little GameDiscoverCo tendrils a little wider, and check out a whole host of data and updates being made in the space over the last few days.

So let’s get right to it - before all this news blows away into a heap in the gutter, and the street sweeper gets to it:

This long Twitter thread from a solo indie dev (creator of Scrabdackle) venting - somewhat legitimately - about a publishing contract he’d been offered blew up on social media. He’s done a long follow-up thread now too. We talked about this back in December, but a) contracts are always written by publishers, and so have intentional or unintentional barbs in them b) solo devs who don’t care about console and don’t need the money/design help… may not even want a publisher? The power asymmetry is too strong on several levels.

A Steam sales graphs paragraph: David Wehle (The First Tree) shows off why “being on page 1 on the sale page [for the Nature Conservation Sale]” drove 4x sales compared to “being initially hidden like on the Tiny Teams [Sales] page”; the Jupiter Moons: Mecha devs show multiple Steam features’ wishlist effects: the Tiny Teams sale drove 2,700 wishlists for the week, their best so far.

An interesting editorial from Eurogamer, here, ‘Eight months later, I barely use any of PS5's new user interface features’. For example, discussing Activity Cards: “It's a neat idea in theory, but I can't recall ever organically using Cards to choose something to do in a game… fundamentally, cards simply aren't faster than using a game's built-in menu most of the time.” Maybe not 100% fair - but it does feel like Sony tried to innovate on complex discovery features, yet didn’t nail UI and discovery fundamentals.

A small correction to the ‘Argentinians buying inexpensive games because you can profit from Steam trading cards’ item from last week’s newsletter: I claimed the game was Super Blood Hockey, but actually it was Over 9000 Zombies!, from the same developer, which was discounted to USD 49c, which became ARS $7 (USD 7c) in Argentina with regional discounts. So.. that makes more sense.

Future Friends’ Kris Wingfield-Bennett created a new, very helpful thing: “Made a press kit template using Notion, especially for indie devs! super quick setup; no web dev exp required; free + works with a free Notion subscription; looks super nice, GIFs autoplay; inspired by presskit().” It’s a great idea to have something like this set up - you’d be surprised how tricky it is to find the right screenshots/info, otherwise!

I guess the Steam sale dates for the Halloween, Autumn and Winter sales leaked to SteamDB somehow? (It wasn’t me.) They’re claiming Halloween is October 28th to November 1st, Autumn is November 24th to November 30th, and Winter is December 22nd, 2021 to January 5th, 2022. Not 100% confirmed, but makes sense and compares logically to previous years.

Microlinks: Derek Lieu updated his game trailer specifications page for consoles/PC, hurrah, it’s ESSENTIAL; my buddies at No More Robots showed their $12 million platform revenue split for Year 4 of NMR (via a Nickelback infographic!); don’t miss submitting to Steam’s Digital Tabletop Fest before September 23rd, if your game is card/board and especially RPG adjacent.

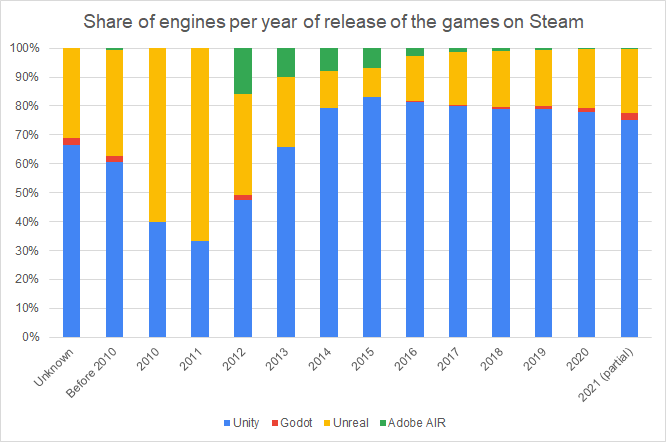

Finally, wanted to highlight that Thomas Bidaux of ICO used SteamDB & Lars Doucet’s ‘which games in Steam run on which game engine?’ estimates to do a yearly graph of engine share over time for four major engine types.

It’s frankly fascinating, and also shows how Unity ‘won’ the marketshare battle, before Unreal made a minor comeback. Although remember, this just shows ‘share as a % of all games’, not ‘share by revenue generated’, which might well look different:

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? You can subscribe to GameDiscoverCo Plus to get access to exclusive newsletters, interactive daily rankings of every unreleased Steam game, and lots more besides.]