From Supraland to Supraworld: why catalog matters!

Publikováno: 9.9.2025

Also: the most-streamed games of August, and lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back in your life, game discovery nerds, and you just can’t quit us, can you? Well, good news - rather than concentrating on ‘the new hotness’, ad nauseam, today’s lead story looks at the benefits of building a catalog of games as a dev…

And before we start, remember that GameDiscoverCo’s sponsoring our local baseball team, the Oakland Ballers, and did a game jam featuring their mascot, Scrappy? Well, the Ballers are 73-23 for the season (!) and are in the Pioneer League playoffs starting Thursday, playing the Ogden Raptors (mm, dino bones) from Utah. Go Ballers!

[WANT TO SUPPORT US? Companies, get much more ‘Steam deep dive’ & console data access org-wide via GameDiscoverCo Pro, as 80+ have. And signing up to GameDiscoverCo Plus gets more from our second weekly newsletter, Discord access, basic data & more. ]

Game discovery news: Football Manager kicks off..

Kicking off, let’s take a look at the news that broke in the discovery & platform space since last last week:

GDCo's 'trending' unreleased Steam games by 7-day new follower velocity, from Sept. 1st-8th is headed by 'we get followers by asking Bongo Cat players' title OKU. Next: soccer management sim Football Manager 26(#2), which missed a year due to engine transitions & is hotly awaited. (Average time played of FM2024 on Steam, per GDCo data? 'Only' 402 hours.)

After the ubiquitous Battlefield 6 (#3) inclusion, looter shooter Borderlands 4(#4), and F2P skateboarder skate. (#5) both release this week with good momentum, Dying Light: The Beast(#6) approaches 2m wishlists, and a Focus Entertainment Steam sale pushes up Resonance: A Plague Tale Legacy (#8).

We felt the Gamescom timeframe was underpopulated by streaming showcases compared to ‘not-E3’. So it’s interesting to see the PC Gaming Show timing one for Tokyo Game Show 2025, set for September 28th, “with publishers such as SEGA, Devolver Digital and Nightdive Studios.” There’s also an Xbox TGS streaming event.

Xander Seren digs into the ‘games delaying around Silksong’ data, noting: “523 YouTubers have played Silksong and 201 have played the [delayed] CloverPit’s demo, and only 6 played both… on Twitch, 54 streamed Silksong and 750 streamed CloverPit, and only 1 streamed both.” But the‘CloverPit delayed’ discovery boost was giant, haha.

Checking in on the most-rated U.S. Apple Arcade games of Aug. 2025 ($), Fruit Ninja Classic+ rampaged to #1, due to an AA-exclusive Bluey re-skin and associated Bluey-mania. (The rest of the Top 5 were also family-friendly: Sneaky Sasquatch, Hello Kitty Island Adventure, Solitaire, Disney Coloring World.)

Microlinks: the ID@Xbox Indie Selects demo fest hits Xbox consoles this week; submissions are now open for the 28th annual (!) Independent Games Festival at GDC; the Lenovo Legion Go 2 will get ‘Xbox-flavored Windows’ in Spring 2026. (Is that like ‘hot-dog flavored water’?)

More fuel for discussion on console affordability, via Mat Piscatella: “From Circana's Checkout service: $100k+ income households now account for 43% of US video game hardware purchases, up from 36% just a few years ago. 18–24-year-olds accounted for only 3% VG hardware purchases during the 12-months ending July 2025, down from 10% during the 12 months ending July 2022.” (Some of this is inflation, but…)

As many as 30-40% of PlayStation MAUs are still on PS4, so maybe not surprising that popular F2P shooter hit Marvel Rivals is getting a back-convert from PS5 to PlayStation 4, launching on Sept. 12th. (As some other titles like Genshin Impact are running into PS4 tech walls and bailing.)

Catching up on those Roblox Dev Conf announces, the most notable are Roblox Moments - shortform, in-platform gameplay videos where you can tap ‘Join’ to play the game instantly, and the new economic impact report, alongside 8.5% more ‘Robux to cash’ payouts for devs.

DBLTAP got some interesting thoughts on Game Pass-like services out of ex-Bethesda marketing head Pete Hines: “Subscriptions have become the new four letter word, right?… If you don't figure out how to balance the needs of the service and the people running the service with the people who are providing the content – without which your subscription is worth jack sh*t – then you have a real problem.”

One esoteric, two VERY esoteric microlinks: a new YouGov report on U.S. media says 69% of Americans scroll social media while watchin’; the history of the Choose Your Own Adventure book series; were Sega’s Golden Axe voice clips recorded by inmates on death row, and where did they really come from, if not?

From Supraland to Supraworld: catalog matters!

The PC/console game biz isn’t in an amazing spot in 2025. Quoting an Aaron San Filippo post: “Most of my studio friends had to lay off their teams this past year. The average >$5 game on Steam launched in 2020 made ~$5k compared to ~$17k for games launched in 2015… Bundles are no longer a viable strategy…. Investment’s massively down. Platform deals are fewer and less valuable. There are simply fewer paths to sustainability right now.”

We, of course, cover the brand new games that are a success - often with compelling stories behind them. But we’re also trying to cover more studios that are organically cashflow positive, even if their latest title didn’t sell 500k copies yet. Which brings us to Supra Games, the German-based dev of the Supraland and Supraworld series.

Supraland debuted on Steam Early Access in March 2018, primarily made by David Münnich, Supra Games’ founder. It’s fairly rare - a first-person, single-player adventure with Zelda and Portal influences, with puzzle solving, non-linear Metroidvania exploration elements, and a ‘you’re a tiny toy in a human-sized world’ vibes.

You can check out a 100% walkthrough on YouTube to get an idea of the gameplay/vibes. But Supraland has quietly sold over 350,000 units on Steam alone since 2018, carving out a niche with a lack of competitors (good-looking Unreal Engine first person Metroidvania, with some Portal-ish puzzle logic?)

And David was kind enough to give GDCo data on Supraland units sold in Month 1 and Year 1-Year 6, in cumulative copies sold and ‘multiplier of Month 1 revenues’. Check it out:

A couple of notable things here: first, Supraland sold 42,000 Steam units in Month 1, but has now sold basically 9x as many units, >6 years later. And secondly, revenue has also gone up a great deal. But since many later sales are discount-driven, Year 6 has ‘only’ 4.4x the cumulative revenue of Month 1’s total. (That’s still a lot!)

This is relatively normal, though, and makes the point that discount-driven catalog sales can keep strong, far after you’ve stopped updating your game and are working on the next one. This first game in the franchise settled at a $20 base price, and is regularly $5-$8 in Steam sales. Here’s the average price per unit over time:

As you can see, the later years of Supraland’s success are at average per-unit $ that are 25-40% of the initial price. But the game is still selling 50,000 units per year, and there’s plenty of players who are willing to try it (or add it to their backlog!) in sales.

That was the basis of the Supra Games business. The team - now up to 6 people, with occasional freelancers, then shipped the Supraland Crash DLC in 2020, which has sold >100,000 units, 59,000 of those bundled with the base game. (The DLC sells 15-20,000 units every year, and we’ve talked about why paid DLC is great before.)

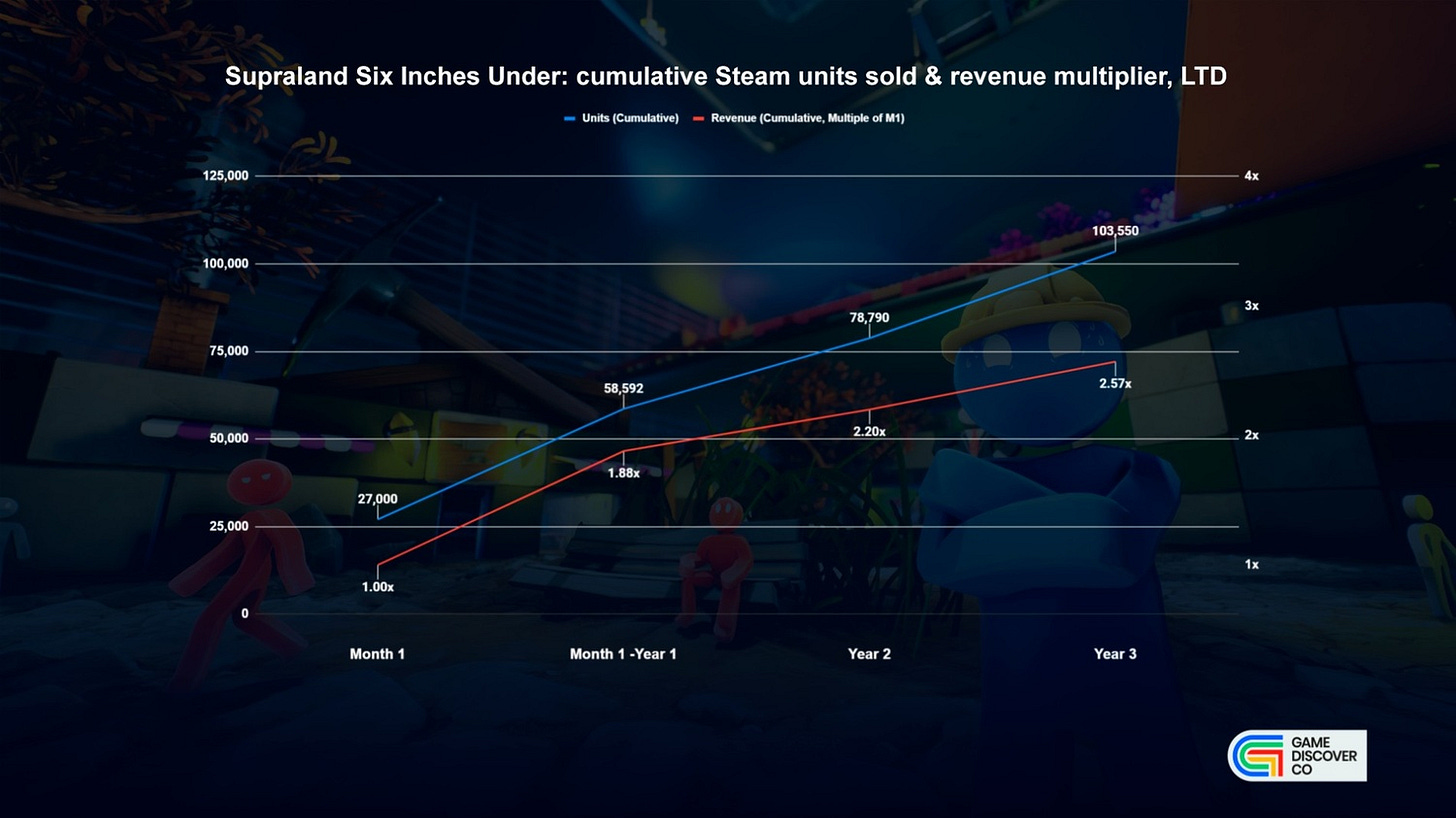

So far, so good. Next up, 2022’s Supraland: Six Inches Under was a bit of a transitionary product - a $20 ‘standalone DLC’ which started as a training exercise for new employees, but grew into full game size, and was released as such. Here’s stats:

This game peaked at around 2,000 CCU, and seems to have attracted mainly fans of the franchise, but really executed well. It’s hit >100k units on Steam alone, but its LTD revenue multiplier is ‘only’ 2.6x that of Month 1, showing it as quite frontloaded.

Nonetheless, the game even made it into Xbox Game Pass for a bonus payday. And even if it took 27 months for 6 people to work on, it’s clearly a test of working with a larger team - and the end result was great (Overwhelmingly Positive Steam reviews!) And it’s another title to accumulate catalog $ - here’s the price per unit over time:

So, after Six Inches Under was a kinda ‘Supraland 1.5’ experiment, the team started working on a proper sequel, Supraworld, using the newest Unreal Engine tech, continuing to iterate on their formula - see below influencer video.

This just shipped in Early Access (minus localization, with WIP tech issues) on August 15th, 2025. It’s started with Very Positive reviews & 1,600 CCU peak CCU, which is… fine. (And above the lifetime top CCU of Supraland, which topped out at 1,400 CCU, despite selling loads over time…)

Which gets us to the sustainability point. Supraworld has done decently, and we’d expect it to have extra interest at 1.0. But interest in Supraworld might lead cost conscious players to try similar games to it, if they don’t want to spend $30 right now. And, guess what - Supra Games also gets 100% of the royalties on those games!

And as David told us: “Supraland 1 constantly has the most players from the franchise in the past 1-2 weeks now… there is a big increase in interest.” And, even better: “Six Inches Under numbers went way up, and it's the most sold game [by units for us] so far in September” - helped by a Daily Deal.

In other words, Supra Games are in the catalog business, as well as the new game business - and it’s symbiotic. Attention for Supraworld attracts people to the entire franchise. Some will play earlier discounted titles like Supraland and tap out, but some will pick up the whole suite of games over time…

Clearly, this is an almost 10-year journey started with a hit game from a solo dev. So it’s not replicable overnight. But the story here isn’t whether the latest game was a big hit or not. It’s whether its catalog makes the whole business work. And folks - in this case, it does.

Streaming games in August: hallo, Battlefield 6…

Once again, we’re partnering with livestream analytics platform Stream Hatchet to look at the Top 100 most-streamed games from August 2025, analyzing the big (non-China!) game video streaming platforms like Twitch & many other regional outfits.

The Top 10’s above, and here’s the full list of the Top 100(Google Drive link) with GDCo annotations. Looking at the highlights from August, analyzed in part by Stream Hatchet’s Mark Rowland:

Battlefield 6 is already making waves & it’s not out yet: even ahead of its release in October, EA’s shooter franchise reboot managed to hit the #9 spot, with 54.2m hours watched in August. (Multiple Beta sessions helped, of course.)

GTA V and League of Legends edged down, as Roblox goes up: our typical top titles are in a similar order, with reduced hours for the Top 2. But Roblox pushed Valorant down a spot to claim #4 this week, with 85.6m hours watched across the platform (+10%) - many from leading hits like Grow A Garden & Steal A Brainrot.

Key GaaS titles surged on new expansions and updates:World of Warcraft's Midnight expansion announcement earned it the #12 spot, up 85%, with 45m hours watched. Meanwhile, Path of Exile 2's expansion & free weekend was a crowd-pleaser, landing it at #29 with 14.7m hours watched - 30x last month!

New games showing up on the most-streamer charts in August? We collectively spotted Mafia: The Old Country (#41, 8.1m hours), NBA 2K26 (#47, 6.5m on Advanced Access streamers), and Metal Gear Solid Δ: Snake Eater (#53, 5.7m), with the OG Hollow Knight jumping 6.3x to #59 with 4.6m hours on excitement for Silksong, haha.

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]