How does a VC see game discovery?

Publikováno: 9.3.2022

We talk to Transcend Fund about how they evaluate and fund games.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the jungle, folks - we’ve got fun and (video) games. It’s time for your second instalment of the week for the GameDiscoverCo newsletter, following Monday’s missive on Yacht Club’s admirable transparency.

We’ll be back on Friday for our Plus subscribers, with a newsletter analyzing some of this week’s new indie hits (hi, Core Keeper & Have A Nice Death!) But we’ll kick this newsletter off with something we haven’t done before - an interview with a VC funder about their approach to understanding discovery and funding.

[Help us flourish, and get analysis, data, and peer feedback all at the same time? Our GameDiscoverCo Plus paid sub has a data-rich weekly game trends analysis, interactive Steam ‘Hype’ charts, two eBooks, a member-only Discord & more. Sign up today!]

Transcend’s Shanti Bergel talks discovery, funding

A few weeks back, we were intrigued to see that new studio Gardens had got $4.5 million in seed funding. The studio “was announced as a remote-first studio by co-founders Chris Bell, Lexie Dostal, and Stephen Bell”, with a heritage that includes Bell’s lead design work on Thatgamecompany’s Sky: Children of Light.

This got us thinking. We haven’t talked about venture capital much in our PC/console and VR space, and it’d be great to hear what VC folks were looking at funding, how they see discovery, and more. So we reached out to Gardens’ lead funder, Transcend, and its managing director Shanti Bergel for a chat.

For a VC, Shanti has a lot of direct game business experience, having formerly been a biz dev and VP at Three Rings (woo, Puzzle Pirates!) and Playfish/EA, Funplus & more. And the VC firm he runs with Andrew Sheppard (Kabam) has an interesting diversity of investments.

Bergel says “we call ourselves an ‘audience first’ fund”, and Transcend is the sole outside funder of Possibility Space, the recently announced studio from Jeff Strain (Guild Wars, State Of Decay) that has an intriguing line-up of industry veterans and - again - a remote-first attitude to making games. Other notable Transcend investments in our space include Thatgamecompany (Journey/Sky) and Stress Level Zero (VR hit Boneworks.)

So firstly, why fund Gardens, which throws around fairly indie & boutique game names like Blaseball and Edith Finch in the dev announcement? Isn’t that a little… niche? Bergel notes, quite fairly: “All venture capitalists are interested in extremely outsized commercial outcomes.”

So though he’s invested in a project that may have an ‘indie look’ to it, he points out that Chris Bell was lead designer on Sky, which “is a monstrous commercial hit - I don't think it's as well appreciated in the West because a lot of its commercial success came in China.” (Indeed, since we talked, Thatgamecompany added a gigantic $160 million funding round!)

And track record clearly matters in this space. Thatgamecompany’s President Jenova Chen, notes Bergel, “is what we mean when we reference a visionary, talented person in the industry. I think most of us look up to people like that, and… it's amazing when you have that strong vision and you're able to realize it, and it turns out to be commercially relevant.”

But beyond that, are VCs looking primarily for multiplayer games to get the kind of reach they’re looking for, in order to generate strong revenue and returns? Bergel says not necessarily so, but it can help a lot: “Multiplayer is a flavour of social in some regards. Social is a very strong reinforcement mechanism, not just in games but in your life. We find that the idea of playing games together is one that is very natural.”

This doesn’t have to be a crazy big MMO. Heck, Transcend even funds a chess app, Chess Universe. That the game has a way to scale players significantly is key, though. As Shanti notes: “If you ever want to make it big, you're going to have to get at least one more person on your side, and then ten more and then 10,000 more. In venture, you're going after scale, so scale implies a whole bunch of things.”

And for VCs to invest, it really is about opportunity for viral discovery and how you can both massively scale and retain players. Bergel notes: “There's this theory around ‘social objects’, where if you drop a Frisbee in front of a bunch of people, they'll probably start playing Frisbee. That's a high [level] concept that we do keep in mind, when we're assessing whether or not we think something would be big. How will you bring it? How will you make people care, not just today, but for a long period of time?”

So what I took away from the conversation is that an ideal investment would have a) a track record from founders, b) an obvious way to scale and retain players aggressively, and c) a unique approach to the increasingly universal video game market.

As Bergel notes: “What used to be a hobbyist audience running hardcore franchises [has become] everybody with a connected device, which is trending toward just about everybody. And when you think about the type of content that appeals to that many people, the games industry stops being about tiny slices of content.”

And VC-funded titles can appeal to the core player (like Boneworks), but they certainly don’t have to. Cozier themes can be surprisingly broad - Bergel notes: “We're also an investor in a company called Singularity Six, that's making a game called Palia which is starting to get some some buzz. It’s a… nonviolent social gaming experience in an MMO form, and it turns out that a lot of people are interested in that.”

He adds, regarding interest in Palia, which was founded by former Riot Games execs: “I think that's a function of a great team building the right thing. But also… we grew up so fast as an industry that we forgot there was a whole bunch of other folks who don't want to plant the same old things - they are interested in different types of experiences.”

Finally, even venture capitalists are fine with you being on a different scale to them, and not needing them. As Bergel concludes: “There's all these different ways you can succeed - you can have a little business that's two people and never raise venture funding. But at the venture level [at Transcend] we're not alone - there's probably 20 venture funds that focus on games and are from the industry. So that's really cool, because if you miss out on one, there's more people to talk to.”

So there we go. In my mind, a lot of this investment interest is being driven by the value of IP and top game devs to even bigger companies. This is due to the insane scalability - and appeal - of games in the 2020s. And that seems largely good for the medium, whether you’re at the two-person or multi-million $ VC investment scale.

Meta Quest’s promising game revenues, visualized

We’re delighted to present a final follow-up to our two-part analysis of the Meta Quest VR game market, after an initial analysis from Cassia Curran of the Curran Games Agency, and a follow-up with survey results and opinions from VR game devs.

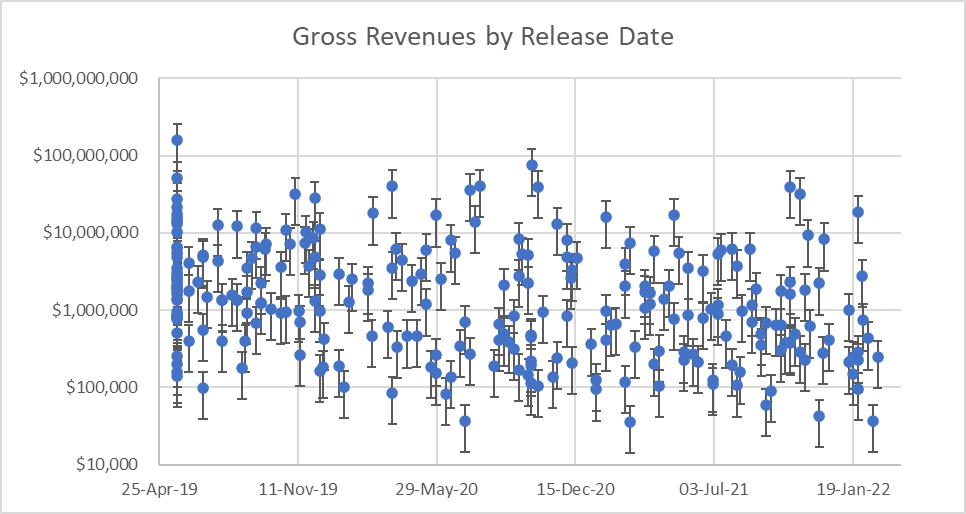

One of the most-asked for bonus graphs after the first Quest article was a mapping of our estimates for gross Quest game revenues using a non-linear Y axis. (The first version was linear, and the big games like Beat Saber or Resident Evil 4 VR made the smaller games difficult to read, revenue-wise.)

So that’s exactly what Cassia did for us (above!). She grabbed a fresh set of data from the 350-ish Meta Quest Store VR games, and “made a scatter graph of each game's gross revenues by its release date on a logarithmic scale, with error bars showing the standard deviation of the ratings multipliers reported on the survey results.”

Reminder that these estimates are based on ‘sales are 110x-ish the number of store ratings’, and as Cassia notes on the veracity of this: “You can see that while the ratings multipliers [in the survey results] varied from 50 to 200 or so, they are still banded close enough together for us to get an idea of which games have performed better than others.”

Some comments on the results, and some extra bonus data based on this exercise:

Using the 108x median ‘ratings to sales’ multiplier across all 350 games on Quest 2’s official store, we can calculate a median game sales number of 59,900 units, and an average of 179,000 units. (Median, which is the 50th percentile of the ranking of games sold, is a more realistic number to look at, btw.)

As for gross revenue across all Quest games, the median was $1.02 million, and the average was $4.22 million. (Remember this is before 30% platform cut & misc. other tax costs, etc!) This looks - well, very good. One big reason is the supply/demand effect of Meta being so careful with the amount of games it launches on the ‘main’ Meta Store vs. unlisted games via App Lab, of course.

As the amount of games increases, newer title revenue may inevitably not match the early pace. The median LTD gross revenue of a Quest title released in 2021 is $548,000, and median units sold is 29,000 according to this (rough!) methodology. But we’d require a lot more complex analysis to work out how it’s scaling over time.

Anyhow, these numbers are promising. And we’re convinced enough that we should keep an eye on this, so we’ll be rolling out weekly Quest charts (by added # of reviews for ‘new’ and ‘all’ games) to our Friday Plus newsletters in the next couple of weeks.

The game discovery news round-up..

Before we start, a big shout-out to Itch, Brandon Sheffield & everyone contributing games to the Bundle for Ukraine (above), which is nearly at $3 million raised for the International Medical Corps and Voices of Children, and will go way higher. Kudos.

And now, let’s take a look at various ‘discover-ish’ things happening in the space:

Ah, Valve’s ‘Steam in 2021’ year in review hit, and it’s a gigantic one. Almost too much to summarize, but: hours played were up 21% YoY to 38 billion; total spend up 27% from 2020; 2.6m new purchasers each month in 2021 (flat year on year, but.. pandemic); 69 million daily active players, and lots more ‘new feature’ summaries besides. Phew…

Actually, one more chunk of stats: Chinese Steam devs “have seen a 300% growth in sales from non-Chinese markets in the past year”; Steam delivered 33 exabytes (!) in 2021 - 30% up on 2020; there are 48 million game controllers registered by Steam users being used on 10% of all play sessions; Remote Play Together now means “shared gameplay has made up 34% of all remote play sessions”; new VR users grew another 11% in 2021, with unique play sessions up 22%. *exhales*

We talked about ‘season passes’ becoming big in mobile after originally blowing up in Fortnite, right? Well, according to SensorTower: “Half of the top grossing mobile games worldwide in 2021 utilized a season pass amongst other monetisation mechanics implemented in the games.” It’s now spread from midcore to casual mobile games. Maybe more PC/console games should be looking at this?

Microlinks: Netflix is launching a daily interactive video trivia series called Trivia Quest; GOG is rolling out nicer-looking, more interactive sale (‘promo’) pages; Oculus is playing up the social side of Quest gaming with ‘Quest Night’, which they are calling “game night evolved”.

You know how getting a game on Stadia as a dev/publisher has been a pain because of the Linux requirement to be cloudstreamed? Well Google “appears to have built its own solution for running Windows games on Stadia. Google is planning to detail its Windows “emulator” for Linux next week at the company’s Google for Games Developer Summit on March 15th.” We’ll find out more then.

Looks like Metacritic put out its 12th annual game publisher rankings, for those who like clicking ‘next’ a lot and trying to see where their company is. It’s fun overall, but obviously ranking and sales aren’t always correlated - and there’s some confusion when publishers solely do physical distro of games.

There’s some fun number-crunching in this VGInsights article on the 44,000 game developers on Steam. Who are they? “57% of all developers on Steam haven’t even made $1k in gross revenue. On the other end, you have 1,600 developers whose games have made more than $1m in gross revenue.” Lots more data within!

What should you spend money on if you have a small marketing budget? HowToMarketAGame’s Chris Zukowski has an opinion on that, and it includes capsule art & an announcement trailer as a ‘must’, and also release trailers, entering online festivals, maybe paid ads, and maybe external PR/consulting. But not physical events, at least not for a directly mappable upside. (I agree.)

An important GDC-related reminder from Thomas Bidaux: “The U.S. changes to summer time on the 13th of March 2022. The UK and the EU change on the 27th of March. So... if you are trying to arrange meetings in the U.S. today, that'll happen after the 13th of March but before the 27th... say... during GDC... double check the time.”

Microlinks, Pt. 2: the BAFTA Game Awards nominees are out, headed by It Takes Two, Returnal & Ratchet and Clank: A Rift Apart; the Japanese-centric New Game Plus Expo streaming event is returning on March 31st; TikTok owner Bytedance, which purchased standalone VR company Pico recently, is partnering with Qualcomm on “hardware/software to enable a global XR ecosystem.”

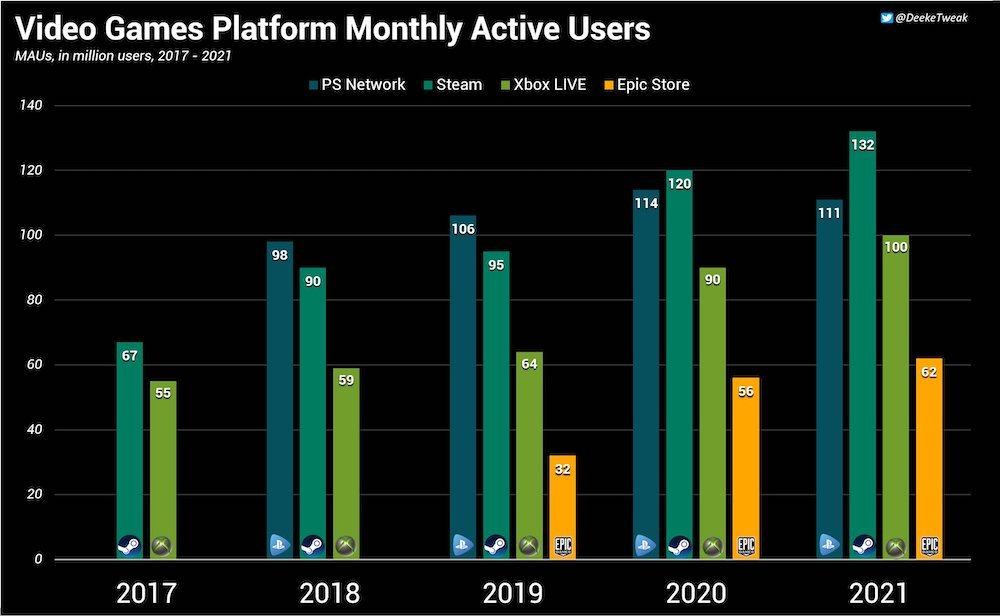

Finally, Derek Strickland over at TweakTown put together this graph showing MAU comparisons between PlayStation, Steam, Xbox Live & Epic Games Store, based on Steam’s new numbers:

Of course, there’s a few caveats - particularly that EGS’ MAUs are likely Fortnite-dominated - but it’s still very interesting! As Derek notes: “Steam's MAUs were higher than PlayStation's year-end numbers [&] Steam grew by 12 million MAUs in 2021.”

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]