How Dungeon Clawler 'grabbed' >200k sales in just 2 months

Publikováno: 28.1.2025

Also: performance marketing analyzed, and a bunch of useful news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re so back, and it’s time for West Coast-style affirmations of positivity: we love covering this space, no matter how complex, and we’re very happy to have you all along. (We will not, however, be developing an Esalen-like cult around GDCo. Sorry.)

And before we start, we loved this game discoverability quote of the week, from Daniel Cook: “Developing a game: 1000s of inspirations and life experiences fused into a unique and multi-faceted gem via an epic soul breaking journey. Selling a game: List the one game you copied and how your clone is better.” Srsly.

[AS ALWAYS: we’d appreciate support for GameDiscoverCo by subscribing to GDCo Plus. You get basic access to our ‘core’ GDCo Plus Steam data back-end, full access to our second weekly newsletter, a link to our peer Discord, eight game discovery eBooks & lots more.]

GameDiscoNews: Doom & Ninja Gaiden show off

So first, we do the ‘lots of links’ thing. And here’s a selection of the game platform & discovery news we have for you today:

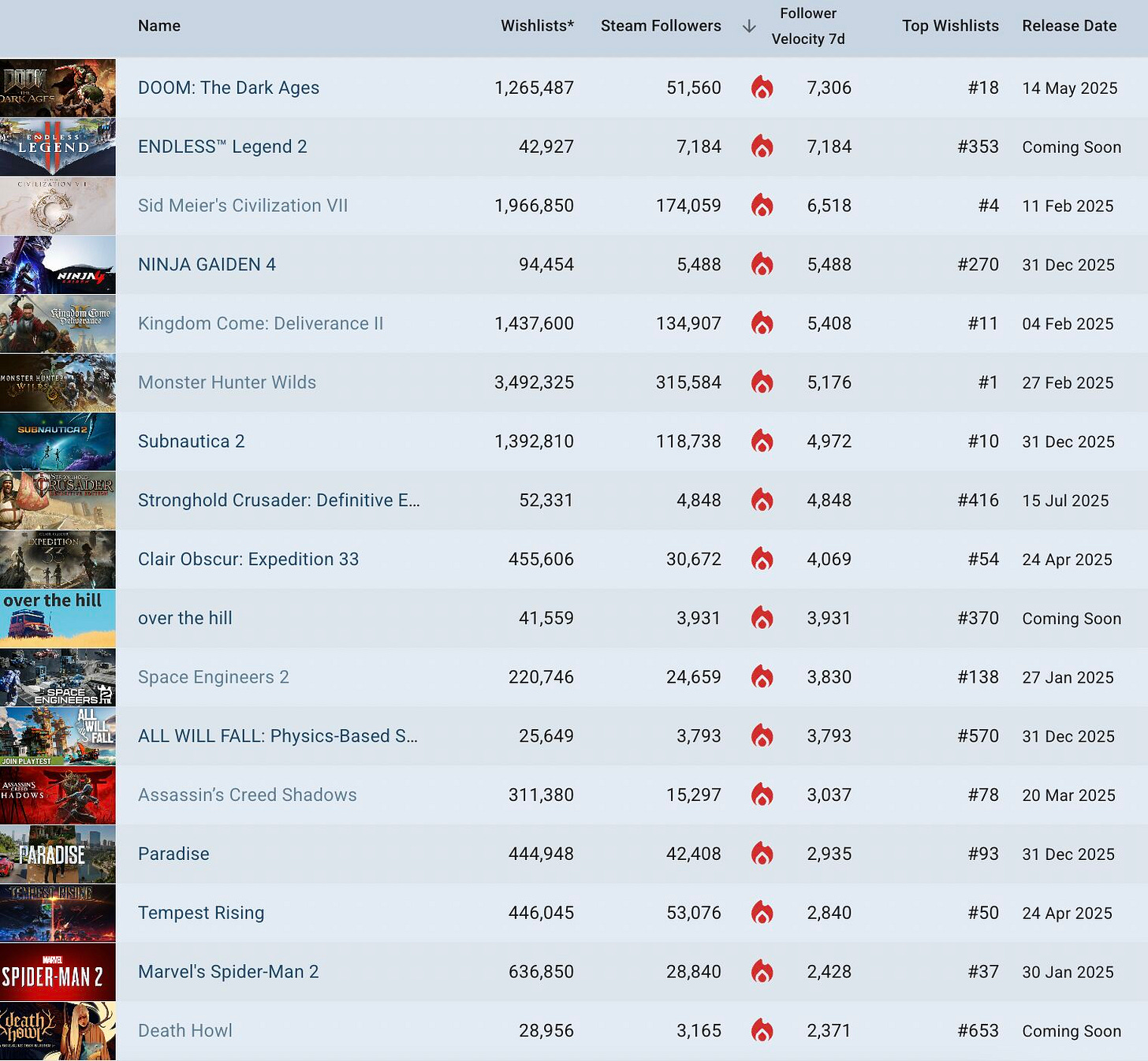

Looking at GDCo’s 'trending' unreleased Steam games by 7-day follower velocity, Jan 20th-27th(above), last week's Xbox showcase meant that the already-announced Doom: The Dark Ages (#1) and the newly debuted, Xbox-published Ninja Gaiden 4 (#4) both got some good publicity juice.

A surprise reveal was strategy sequel Endless Legend 2 (#2) from Amplitude and Hooded Horse, which picked up >7k Steam followers. Elsewhere: Over The Hill (#10) is a neat-looking indie Mudrunner-ish offroad driver from the Art Of Rally devs, and All Will Fall (#12) is a survival physics city builder (lotsa genres!)

No great surprise here, but Xbox’s Phil Spencer has confirmed the company will be supporting Switch 2. VGC points out the company has “committed to releasing Call of Duty games on Switch 2 via its agreement with the FTC”, and Spencer also said he’s “really looking forward to supporting them with the games that we have.”

Here’s a fairly big UGC reveal: “Warner Bros. Games has announced official PC modding support for Hogwarts Legacy… a creator kit launches on January 30, alongside a mod section in the game's main menu from which selected mods can be downloaded directly.” (It’s powered by CurseForge.)

Steam’s ‘top new games of December 2024’ sales page is here, and we particularly like poking around the top new DLC page, which includes three ‘Legendary Lords’ for Total War: Warhammer III (hi, Gorbad Ironclaw!), some new offshore Ready Or Not maps & Euro Truck Simulator 2 hitting up Greece.

There’s a notable Sean Hollister editorial at The Verge, suggesting that handheld PCs need to ‘unite’ on operating system, screen (1080p-or-lower HDR OLED), chips & battery, and price to more effectively compete with the looming Switch 2. But will they?

ICYMI: Epic “has announced a fresh push to convince app developers to launch their games on the company's fledgling mobile store”, featuring games both paid and free. Also: if you go on mobile EGS, the company is covering Apple’s €0.50 Euro install cost in the EU for iOS games with >1m installs, for the first 12 months.

Circana’s Mat Piscatella with an update on post-Game Pass U.S Call Of Duty results: “Black Ops 6 in 2024 actually outsold 2023's MWIII in full game dollar sales, with sales share shifting to PlayStation. Subscription spending did see a bump (+11% in Dec, +4% for the year), and Xbox Series hardware did not get a significant boost.”

Here’s some puckish data from UGC analyst David Taylor: “With this much demand for its top IP being captured in Roblox, what's the point in Netflix having its own game subscription? Players spent 1300% more time with [unofficial] Squid Game [experiences] on Roblox than they did with Netflix's own game, Squid Game: Unleashed.”

On the theme of ‘Xbox Series S needs feature parity’ (which we’re fascinated to see GTA 6’s attitude to), looks like Baldur’s Gate 3 has managed to squeeze split-screen multiplayer into the latest Xbox Series S patch, after getting a (rare!) waiver to not include it on initial Dec. 2023 launch.

Microlinks: Discord appears to be testing a virtual currency system called Orbs (sadly not ‘Discorbs’); this compilation of possible Switch 2 sales estimates for Y1 ranges from 13m to 18m units; this very unofficial, <$200 open-source PlayStation 1 FPGA console - with N64, Saturn also emulatable - is getting hobbyist buzz.

How Dungeon Clawler grabbed >200k sales, fast

Over the next couple of weeks, we’re going to be featuring games (or publisher catalogs!) that have gone for the ‘sharp, catchy, gameplay-led’ approach to success. Why? Well, understanding market trends and reacting to them swiftly is a key 2025 strategy.

And we’re starting with roguelike claw machine deckbuilder Dungeon Clawler ($10 on Steam, $5 on iOS/Android), which has racked up 165,000 units sold on Steam and 80,000 on mobile (45k iOS, 35k Android) since its Nov. 2024 release. And per GDCo estimates, it’s in the Top 10 highest-selling new games on Steam that debuted in Nov.

In fact, although it’s not a ‘tens of millions’ grosser, it’s already returned 500% of dev costs to Stray Fawn (The Wandering Village), the Swiss studio who made it. GDCo has previously covered Stray Fawn’s successful ‘validate, hype release’ approach to picking subgenres. And it’s obviously worked out for them again here - there is skill at work.

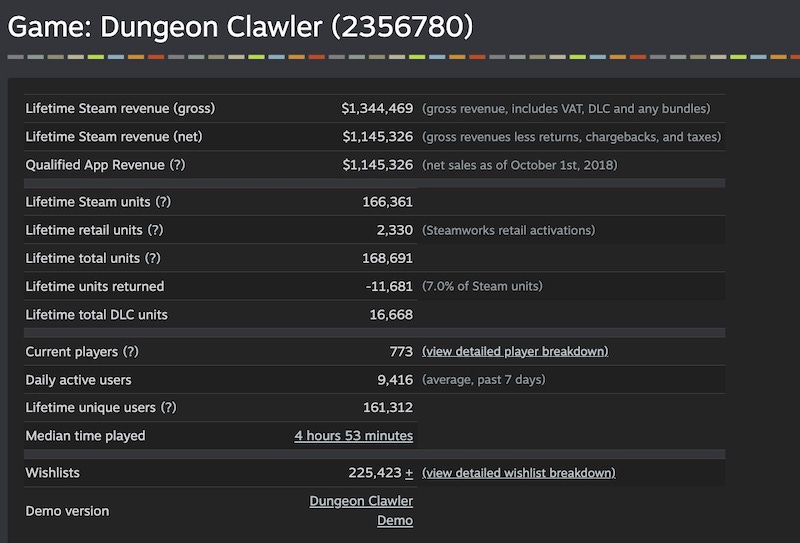

Before we get all bullet-point-y, let’s crank out some Steam back-end data goodness. Firstly, here’s the overview page for the Steam SKU of Dungeon Clawler:

This all looks very good - refunds are on the lower side (according to our refund survey, which we’ll be publishing next week) & median time played is great at ~5 hours. (Reminder: ‘net’ Steam revenue in this view is before Steam’s 30% cut.)

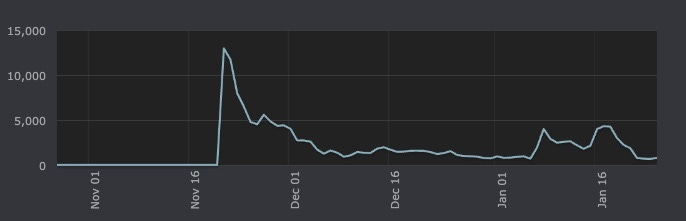

We also think the ‘sales over time’ Steam graph (above) is notable because it never really bottoms out below ~1k sales per day. And it has some really nice ‘long tail’ spikes from Japanese streamer and social media pickup earlier this month. (Overall the game is 31% U.S. buyers, 19% Japan, 9% China, 8% Germany, and nothing else >4%.)

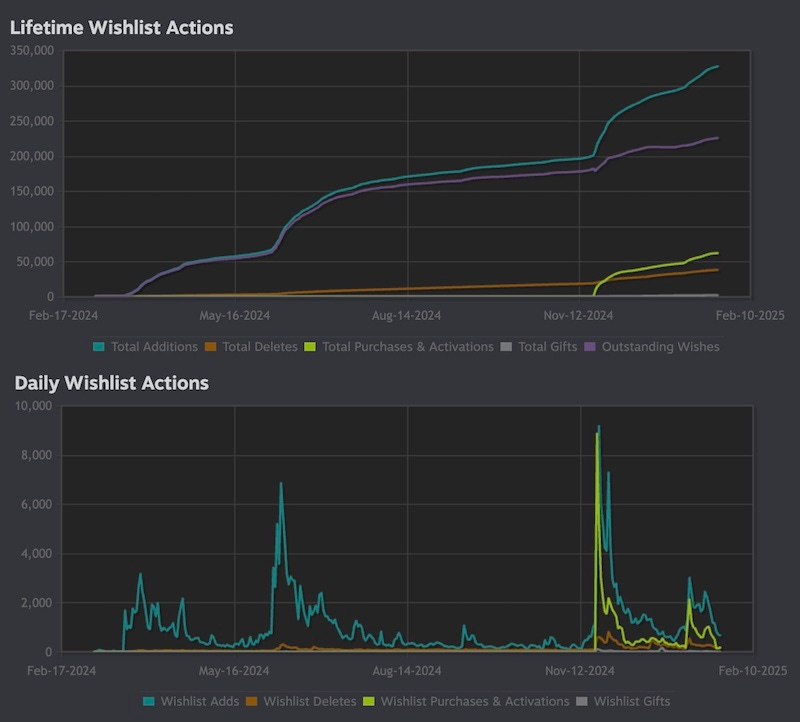

Finally, it’s fascinating to see Dungeon Clawler’s wishlist scaling, pre and post-release, from both a total additions and incremental daily adds point of view:

Philomena explained to us how ‘public demo’ and influencer-led the interest was: “The early wishlists are from Deck Builder Fest and influencers… the big spike is Next Fest & more influencers.” And then finally, the Nov. 2024 Early Access launch is where the green ‘purchases’ line starts rocketing up, haha.

OK, so that’s the data. So why the standout sales? Let’s try to break down the reason why the game has done so well:

The ‘X meets Y’ upfront hook is incredibly strong: as reviewer Rogueliker says, the game is part of a “new breed of luck-infused rogues. Where Peglin repurposed pachinko and turned it into an RPG, and Balatro remixed poker into a game of solitaire, Stray Fawn’s newly released early access game revolves around the claw machine.” Every time you grab your inventory from the machine, you can play it against a bad guy!

The combination of physics-based gameplay & roguelike progression is clever: the Dungeon Clawler team say there’s one game that stood out, because “handled deckbuilding in a unique way and also introduced physics to the genre: Peglin.” So after a team trip to Japan & much claw machine time, they spotted a perfect mashup.

While players love RNG, there’s still skill involved in Dungeon Clawler: since I’m terrible at claw machines, I asked Philomena - is the core mechanic too tricky to control? She said: “I feel like you can get pretty good at handling the claw, to a point where you can almost always get out what you want (given it dropped in a good position).” And there’s strategy, since: “It's easy to get greedy and make risky decisions.”

But yes, game quality and complexity also matters. And if your game is deep and replayable enough that notable YouTubers like Blitz are organically creating more than 20 videos highlighting different aspects of it - then you’ve nailed that part of it. (Note how the in-game powerups are good streamer hooks for their audience, too…)

Dev size? The core Dungeon Clawler team is just 2 people: 1 full time game designer & programmer (Micha) and 1 part-time artist (Larissa). Philomena says “they got help from our composer and marketing team”, but it’s actually a small subteam of Stray Fawn, which more normally creates ~$20-$25 strategy games - and now publishes some too.

It’s also very interesting to see the premium iOS/Android SKUs of Dungeon Clawler - ported by Ateo - sell decently, even if it’s ‘just’ $5. We’ve recently seen Balatro debut very strongly on mobile, as it hits 5 million sold, and it does seem like premium PC games that get a lot of influencer or online video interest can sell on mobile.

We asked Philomena about where this came from, and she notes: “We… built up a fairly big Discord community (18k members) and are doing some special mobile-only challenges in there”, but a lot of it - besides some smaller post-launch platform featuring - just seems to be people hearing about the game and searching for it on their phone.

Of course, anyone at a larger company may look at this and say, pshaw, this game has only netted ~$1 million so far. That’s hardly cause to charter a yacht and head for the Riviera? To which we’d reply: sure, but it’s a success story on multiple levels, including player response and financial, for the bootstrapped firm that made it.

And we do think the future of PC and console games, outside of the giant franchises and occasional breakout exceptions, is going to be a lot scrappier than most of us would care to admit. So that’s why we’re going to continue to feature games like this.

The state of PC/console performance marketing?

Finally: we don’t talk that much about paid marketing for PC & console games, largely because trackability can be, well, tricky. But one (paid) service that does meaningfully measure spend and results is Gamesight, and they’ve just put out their ‘State Of Performance Marketing’ survey results(free reg. req.) for 2024.

In short - Gamesight anonymously rolled up all of the campaigns tracked using their site last year, and created a bunch of data points and takeaways. Here’s some key ones:

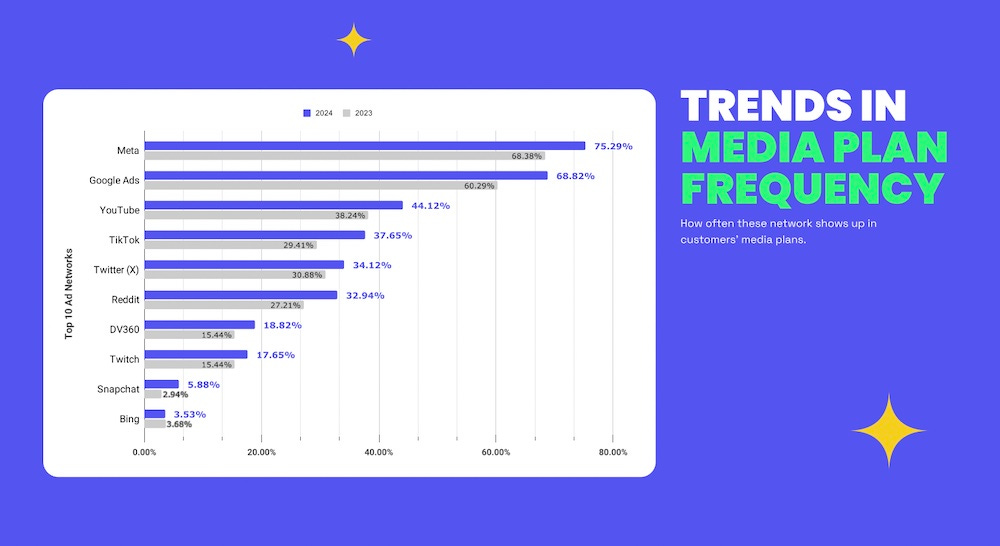

Meta and Google Ads are by far the most-used paid advertising: in 2024 (above), 75% of game ad media plans tracked by Gamesight included Meta (Instagram, Facebook, etc) in some way, and 69% Google Ads. Further down: YouTube (44%), TikTok (37%), Reddit (33%), and Twitch (18%).

Twitch’s conversion is strong, though it’s more targeted: Gamesight notes: “Twitch drives a 3x higher conversion rate compared to other major platforms in 2024, outperforming competitors like YouTube, Meta, and TikTok.” But the audience is pretty game focused and ads are unskippable, so perhaps that’s partly why?

Sponsoring influencers is still a potent possibility in this space: the survey says: “The conversion rate of Influencer Campaigns (4.25%) surpasses the rates of almost all of the 2024 Top Ad Networks except for Twitch and Google Ads.” Of course, Gamesight has an arm of the biz specifically doing that, but hey, it’s still data.

Anyhow, file this under ‘difficult to get any data on this, and even this data is a little apples to oranges-y in terms of comparing advertising sources, but it’s way better than having no data at all’? That’s where we’re filing it, at least! (Also, we said ‘data’ too many times.)

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]