How Escape Simulator hit 'escape velocity' & sold 2 million copies

Publikováno: 6.3.2024

Also: the most-streamed games of Feb, & lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

‘Hey, you, it’s the GameDiscoverCo crew’. We’re in no way as cool as the Rock Steady Crew, but more skilled with Steam back-end navigation. Tho breakdancing? We cede the (shiny) floor to them…

Anyhow, we got nearly 55 responses to our Steam ‘wishlists to sales’ surveyso far, but we’re looking for 100+ before we close it at the end of next week. Please help out and fill it in - it’s completely anonymous, and we’ll be sharing info only in aggregate.

[PSA: yes, you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data site for unreleased & released games, weekly PC/console sales research, Discord access, seven detailed game discovery eBooks - & lots more.]

How Escape Simulator sold 2 million copies…

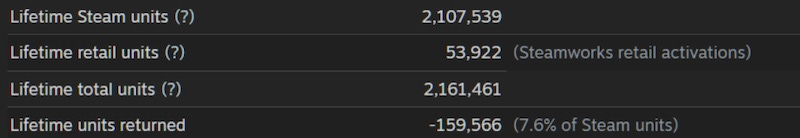

We sometimes wonder whether the games we are covering are a surprise to you. And here’s a prime example: are you aware of Escape Simulator, a $15 PC co-op escape room game with a popular user-generated content community, free IP collabs with both Portal (above) and Among Us, and, yes, over 2 million copies sold? Here’s proof:

Rather than just guessing, we got this info direct from Pine Studio, the Croatian & remote studio responsible for the game - which has done tremendously well on Steam since its October 2021 launch, partly thanks to aggressive and generous dev support.

Oh, BTW, the devs also gave us info on regional buyers for Escape Simulator. North America is 35% of the units, followed by Asia with 23.3%, Western Europe with 20.4%, Latin America with 6.6%, and down from there. (It’s a worldwide phenom.)

One oddity, before we continue? Many of you are used to looking at Steam review #s multiplied by 60 and saying ‘oh, maybe that’s the sales for that game’. But Escape Simulator ‘only’ has 11,900 Steam reviews for its 2+ million sales. Wow, 177 copies sold per review is a hecka outlier. (We rarely see >100x, tho we’ve seen as low as 15x.)

As to why: we asked, and Pine suggested, sensibly, that it’s down to “different genres having a different player profile who is more likely to [review].” In particular, since this is a co-op game, many people invite friends who are casual players, and probably don’t want to extensively review the game. (It’s a great escape room platform! That’s it!)

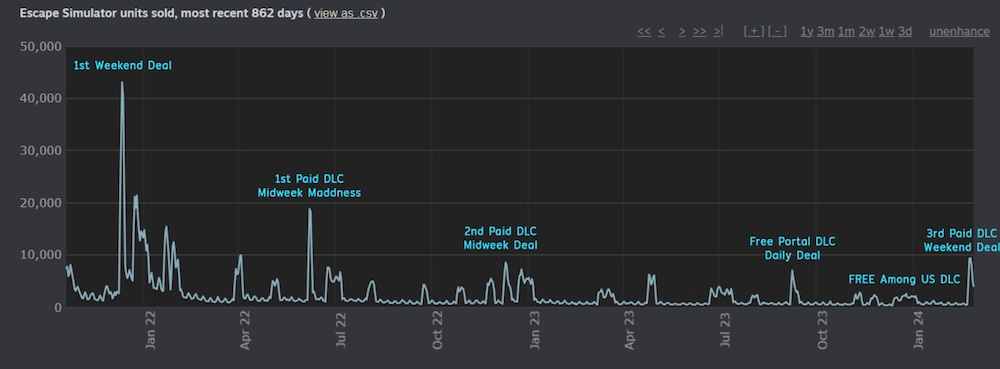

Anyhow, next up is everyone’s favorite graph, ‘annotated Steam units sold over time with the event that contributed to the spike’ for Escape Simulator, as follows:

Escape Simulator’s overall DLC includes three $4.99 paid DLCs (Steampunk, Wild West, and Magic), and the two free, IP-licensed ones (Portal and Among Us.) Maybe you’re surprised that the latter two are free?

We did ask about that, and the devs said: “We made those DLCs free because our goal is to reach new players - they still need to own the game to play the free DLC. It doesn’t monetize our existing players, but it does get them back in the game and talking about it.” Oh, and they said the Portal & Among Us DLCs were “way too much fun to work on!”, haha.

The general vibe we’re getting here is of a team that’s made an escape room ‘platform’, had it hit big, and doesn’t necessarily need to push aggressively on revenue. (The non-discounted ‘base game + DLC’ bundle is only $26, even outside of discount sales.)

We also wondered about having both Steam Workshop user-created levels and paid DLC - is that an issue for monetization? No, they say: “Our community has created some insanely creative… and fun rooms… If anything, community content pushes us to produce even better paid DLC, as we have competition.” (And, of course, the DLC is always going to be more ‘front and center’ on the store and better explained and packaged.)

What they do to differentiate DLC from the UGC rooms is to “pick themes… that have not been represented in the core group of rooms and assets.” So in the past, “even though [UGC] creators were able to create a Wild West room, they had to do so with assets from other themes or provide their own models.” Thus, Escape Sim’s Wild West DLC is a cut above. And it’s working - the team is “very happy with sales of the paid DLC”, citing attached rates of >30%.

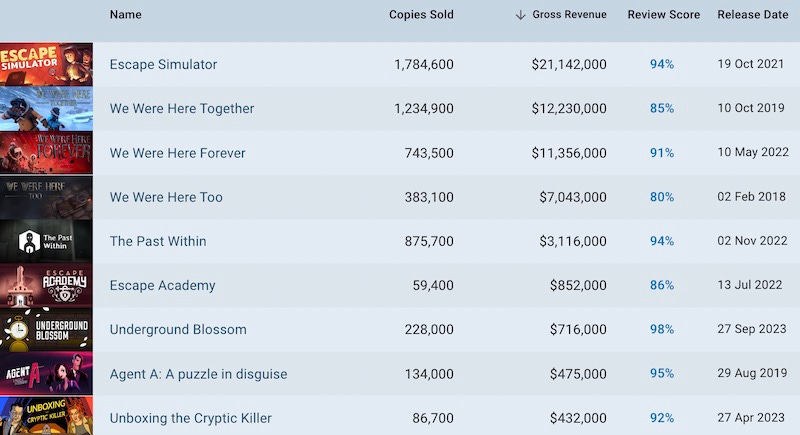

Finally, what’s the rest of the co-op ‘escape room’-ish market like on Steam? Well, here’s our GameDiscoverCo Plus estimates (interactive chart, paid sub needed) of players and revenue for all titles with the ‘Escape Room’ Steam tag in its Top 8 tags:

Our own estimates likely under-play Escape Simulator’s revenue. But it’s interesting to see how top-heavy this market is in general, right? The We Were Here co-op puzzle exploration series (previously covered by us), and Rusty Lake games like The Past Within (also analyzed by us!) are the other games we think have grossed >$1 million on Steam.

What these games have in common are a joyful, combat-free exploration of discovery and, uhh, escape, anchored by the ability to play online co-op. As Pine Studio notes of their audience: “More than 75% play co-op, and we believe that that’s a big reason for the success of the game.”

And yes, GameDiscoverCo is going to keep preaching online co-op as a key scaling feature for today’s PC/console. But in the short-term, let’s celebrate the Escape Simulator devs as a team who have got millions into a v.successful game platform designed for, uhh, getting out of places. Aand… let’s vamoose?

What’s the most-streamed games in Feb. 2024?

It back: we collab-ed again with livestream analytics platform Stream Hatchet - which grabs data from lots of game streaming platforms: “Twitch, YouTube Live Gaming, Facebook Live, AfreecaTV, Kick, Steam, NaverTV, Trovo, Rooter, Nonolive, Openrec, Loco, Mildom, DLive, VK, KakaoTV, Garena LIVE, Booyah.”

The Stream Hatchet folks wrote about the Top 20 most-streamed games of Feb.2024, and again gave us a much bigger list of the Top 100 games(Google Drive doc), which we’ve annotated. This time, here’s the things we noticed:

Valorant surged in interest, thanks to eSports: Riot’s first-person hero shooter - which has been a gigantic off-Steam PC hit - was at #3 in February, up 61% to 109 million hours watched, due to the Valorant Champions Tour 2024 kicking off. (Counter-Strike 2 was also up 42% to 100m hours (#4), maybe due to its Arms Race update.)

Last Epoch’s 1.0 update exploded its streaming popularity: the Diablo-ish ARPG hit 1.0 in February, and saw 15.5 million hours played (#24), 76 times its January total (!) It topped out at 264,000 CCU on Steam (wow!) at the end of February btw. Alongside it, Helldivers 2 (#25) hit 5x its January numbers, and >15m hours overall.

Top debuts included Skull & Bones, Nightingale, Persona 3 Reload: Ubisoft’s oft-maligned Skull & Bones (#39) had 8.2 million hours streamed in Feb, with survival MMO-lite Nightingale (#42, 6.6m hours) Atlus’ Persona 3 Reload (#46, 5.7m hours) also debuting well. Elsewhere on debuts? Good stuff from Granblue Fantasy: Relink (#50), Pacific Drive (#51), Balatro (#68), and Supermarket Simulator (#69).

Other than that, notable trends included declines from some smash-hit titles like Palworld (#14, down 70% but 24m hours still!) and Lethal Company (#41, down 66%, 7.1m hours), and Steam Next Fest demo breakouts from Dungeonborne (#57) and Realm Of Ink (#84) helping those unreleased games hit the streaming charts.

The game platform & discovery news round-up…

Finishing up for this week - for free newsletters, at least - let’s take a look at the top discovery and platform news catching our eye:

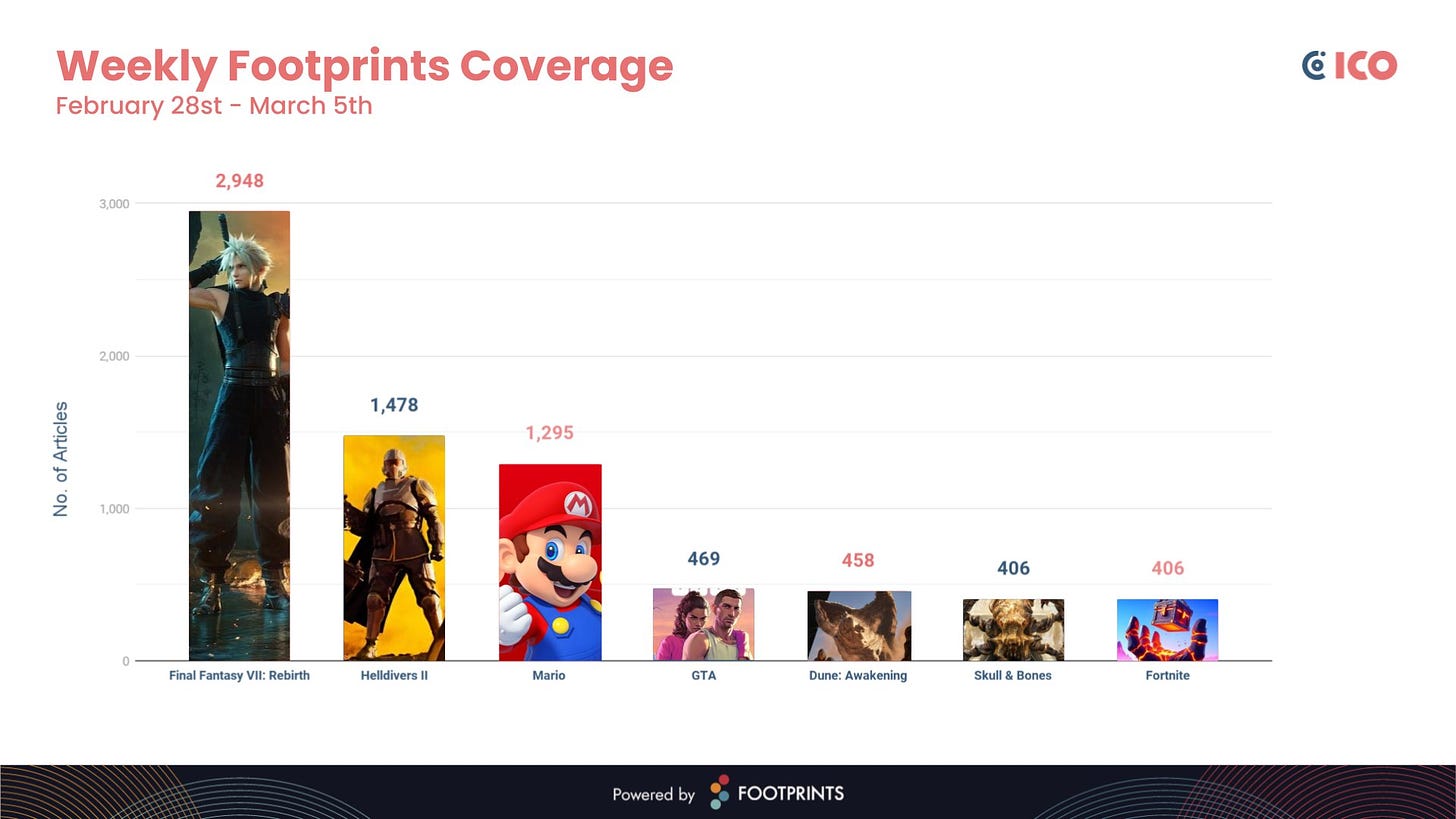

As you can see (above) via Footprints.gg, ‘trad games media’ coverage was dominated by the PS5’s Final Fantasy VII Rebirth this week, with Helldivers 2 re-emerging due to mech excitement & GM shenanigans, and MAR10 (that’s Mario Day, folks) spawning a bunch of articles about Nintendo’s celebration.

Remember Epic saying a European subsidiary made an Apple dev account to publish Epic Games Store & Fortnite for iOS? Well, Apple just shut it down, citing Epic being “verifiably untrustworthy”, and Sweeney & friends are proper mad: “This is a serious violation of the DMA and shows Apple has no intention of allowing true competition on iOS devices.”

The latest Xbox Game Pass debuts for March include baseball game MLB The Show 24 (a Sony franchise that’s multi-platform already, largely because MLB insisted on it), Lightyear Frontier, & Control Ultimate Edition. Also: today’s Xbox partner preview showcased the OG S.T.A.L.K.E.R. series coming to Xbox, final confirmation on Final Fantasy XIV’s March 21st Xbox Series debut & more.

The UK’s Digital Entertainment & Retail Association put out a ‘state of UK game biz in 2023’ report which included interesting data: firstly, console hardware sales trends: “PS5: +55.2% YoY [year on year]; Switch: -16.7% YoY’ Xbox Series: -14.2% YoY”, secondly, retail/digital splits for AAA games: “33% of EA Sports FC 24's sales were via boxed stores (Amazon, GAME etc), while 44% of Hogwarts Legacy's sales were boxed. Spider-Man 2 was nearly 54% physical.”

Game dev layoffs: the situation is rough, and not improving. IGN did a piece on the human impact of ‘regular folks’ getting laid off from their jobs, and Anthony Gowland pointed out on LinkedIn that it’s not just highly-staffed AAAs cutting fractions of staff: “There are established indies with track records closing down cause they can’t raise funds to survive.”

Steam miscellany: the platform hit a new ‘concurrent users’ record last weekend - 34.65 million CCU online, with 11.14m playing in-game; all games on Steam now need to have a rating in Germany - check your old titles if unsure; a cross-platform integrated Steam shopping cart (& ‘private app’ functionality) is now 100% rolled out.

Top mobile games for February 2024? MobileGamer.biz compiles AppMagic data on both top-grossing (Honor Of Kings, Monopoly Go, PUBG Mobile) and most-downloaded (Royal Match, Roblox, Blox Blast - and, uh, ‘Wood Nuts & Bolts Puzzle’, we’re not making this up.)

More rumblings of PlayStation VR 2 being ‘abandoned’ via this IGN article, which pegs the lack of exclusives to the low install-base. An anon dev: “No one's really… getting behind it to do AAA games, which are $20-30 million starting… You cannot recoup with the amount of people that have VR right now.” (It’s getting some ‘also on Quest’ titles, of course. But fans who paid $550 wanted more.)

We enjoyed this piece on ‘finding your PC/console audience’ from Matthieu Bernhard, echoing the idea of defining your ‘game statement’, so “you provide a guiding beacon for your development team, marketing efforts, and community engagement.” (The ‘this is why the game is great, in a nutshell’ approach - relatedly, ‘help, I’m in a nutshell’.)

Varying microlinks: a data-filled look at why the mobile game market isn’t as bad as some people claim it is; why Sweet Baby Inc. isn’t forcing DEI onto the game market, actually; a handy English-language overview of Love Is All Around, the Chinese FMV dating game which sold 1.6m copies and is “a wholesome romance drama… for guys… that’s funny!?” (Tho “It’d score minus points on the Bechdel test.”)

Finally, we’re trying to chat with the devs of Kingmakers, the unreleased ‘modern tech vs. medieval soldiers’ game whose debut trailer - and inevitable Army Of Darkness comparisons - set off one of the biggest interest storms of 2024 so far.

Meanwhile, the game, which looks to have 300,000+ Steam wishlists after just two weeks on the store, did an engine and tech overview with Digital Foundry (very transparent). And it’s fascinating to see what a small team can do with a catchy idea:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]