How LORT rode the chaos to a Top 5 Steam launch in 2026 (so far)!

Publikováno: 3.2.2026

Also: a GDC survey (and thoughts), and lots of platform & discovery news

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re definitely back, folks, and another week of what can only be called ‘lots of PC and console discovery news’ is upon us. Our lead story today is a world first for GameDiscoverCo, because real-life data used in it includes… biometrics?

Before we start, here’s an all-timer ‘making of’ video - John Romero & friends on the making of 1991’s Catacomb 3-D, id Software’s “first texture-mapped first-person shooter”, pre-dating Wolfenstein 3D & Doom. Best YouTube comment is re: John Carmack’s video background: “[he] optimized pathfinding in his house by removing all the obstacles.”

[FREE DEMO OF GDCo PRO? You too can get a free demo of our GameDiscoverCo Pro company-wide ‘Steam deep dive’ & console data by contacting us today-~90 orgs have it. Or, signing up to GDCo Plus gets the rest of this newsletter and Discord access, plus more. ]

Game discovery news: Darkhaven, ReBlade = new!

OK, let’s get real, and zoom around the trending platform and discovery news, starting about now:

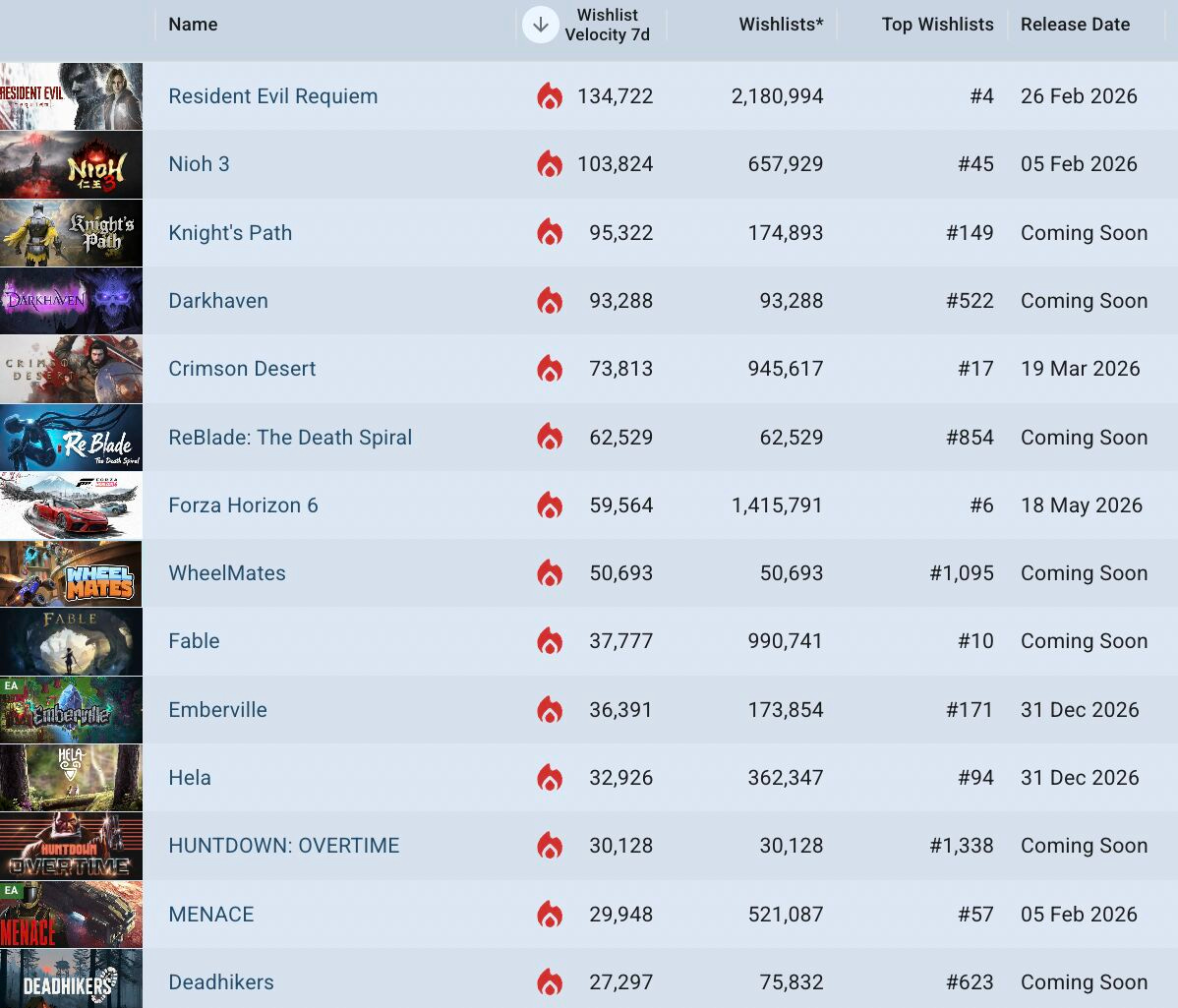

According to GDCo Pro's 7-day unreleased Steam game wishlist charts (Jan 19th-26th), Resident Evil Requiem (#1) added 135k wishlists this week, with momentum from samurai slasher sequel Nioh 3 (#2), out this week, and more interest in v.indie medieval-ish combat ARPG Knight's Path(#3).

Brand-new entries? Darkhaven(#4) is a Diablo-ish isometric open-world ARPG from some of the actual Diablo creators, and ReBlade: The Death Spiral(#6) is a Chinese cyberpunk zoomed-out action-er with very impressive visuals. And WheelMates(#8) is novel - a co-op only adventure where you play mini RC cars.

Nintendo’s latest financial results reveal “Switch 2 sold-in around 7.01 million units” in Q4 of 2025, hitting 17.4m LTD, & slightly less than Switch 1 managed in its first holiday season (7.2m), “due to softer sales in some Western markets.” Price differences vs. Switch 1 are a lot of it - a cheaper JP-only Switch helped sales there. But it’s also, as Newzoo’s Manu Rosier noted, “normalization” from a fan-first start.

Does your game become ‘scarier’ for new players to buy if you have ~70 billion DLCs on your Steam page? Paradox discussed this in its latest financials call, agreeing it “might be a bit off-putting”, but noting they “do bundling to get different types of starter packs”, as well as more experimental DLC subscriptions.

Epic Game Store’s 2025 year in review reveals “player spending on third-party PC games grew 57%, reaching an all-time record of $400 million”, as EGS boss Steve Allison talks aspirations of 25-30% market share. Average MAU for PC Fortnite/EGS was 67m, down 1% YoY, and Fortnite players cross-spending with the 20% Epic Rewards really helped EGS in 2025. But that’s still $ paid to devs!

There’s also a ranking tier for top-grossing* PC games on EGS, and the Top 5 are Fortnite, Wuthering Waves, Honkai Star Rail, Rocket League, & Genshin Impact, showing EGS’ reach in AAA/F2P. (*On EGS: “Developers who process their own in-game payments keep 100% of their revenue” , inc. Marvel Rivals, Valorant & more.)

Meta VR hangover: CTO Boz fessed up to a “lack of focus”over all the use cases for VR, saying third-party VR content and Horizon Worlds on mobile are “two much more focused bets”. Related: the Horizon (Worlds) Feed in the VR operating system is being “gradually sunset”in favor of a ‘third-party app’- first UI.

Xbox things: True Achievements says that almost 40% of Xbox games released in 2025 were ‘easy Gamerscore titles’, an issue PlayStation also suffers from. (We didn’t realize devs can go from 1k to 5k Gamerscore with title updates!); the next Game Pass titles include High On Life 2, Madden 26, and Avatar: Frontiers Of Pandora.

Y’all know that SteamOS (based on Linux) works great playing Windows games on PCs - handheld and not - via emulation. But separate Linux gaming project Bazzite is further self-organizing as part of the new Open Gaming Collective, which includes some elements also funded/used in SteamOS. Worth watching.

Microlinks: in ‘games as platforms’ news, World Of Warcraft is getting a Prop Hunt-like mode later in 2026; Fellow Traveller is doing a Story-Rich Showcase streaming event as Summer Game Fest-adjacent; for marketers, plz note that AI is highly inconsistent when recommending brands or products.

How LORT rode the chaos to a big Steam debut!

We were pleasantly surprised to see “1–8 player co-op action roguelite” LORT, from the 8-person studio Big Distraction, have a strong ‘pop’ on its Jan. 21st Steam Early Access release. The game topped out close to 10k CCU five days after release, but even made 7.5k CCU last weekend with lotsa organic influencer interest, showing staying power.

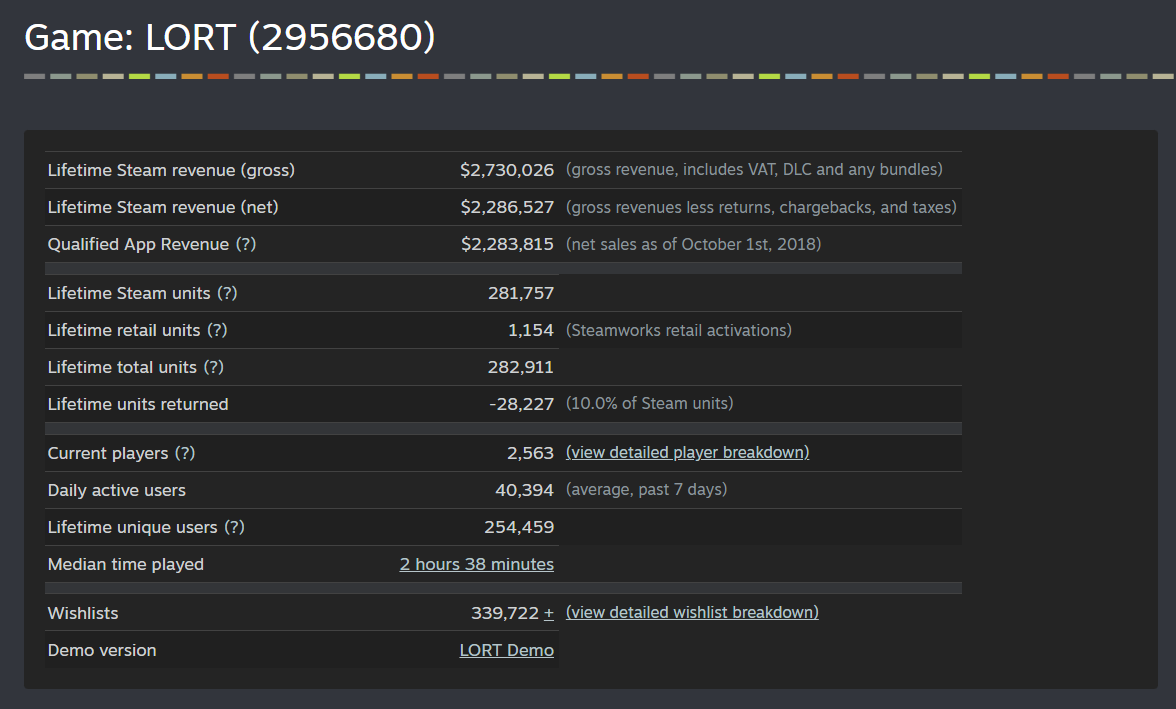

That’s good going for the $15 USD game (discounted to $10 for launch.) In fact, GDCo has LORT ranked #4 by units sold for Steam debuts so far in 2026. So we chatted to Big Distraction’s Shak Khavarian - a former brand director & marketing lead for Fortnite - and he showed us the game’s current Steam stats, inc. 281k units sold:

On other stats: we see 68% player overlap with Risk Of Rain 2, 61% with PEAK, and 45% with Schedule I. And regionally, the devs told us the U.S. is at a whopping 61% of all players, followed by Canada (4%) and German, Russian Federation, Australia, Japan, China (3%). (A tad surprising it’s so U.S.-first?)

Now remember, this is still early in (less than two weeks into!) Early Access, with updates & a 1.0 version to come. We’d expect LORT to gross at least $10-$15m on Steam alone over time, with some decent possible console upside from there…

But how? We talked to Shak both before release (as part of a deal we have with 1UP Ventures where studios in their portfolio can ask us questions!) and after launch. And we came to the following conclusions:

A co-op focused PvE genre entry = the correct point of entry: there’s been a rich recent heritage of ex-AAA folks not performing with vs. games, and Shak told us: “We’d done PvP live service games before and didn’t think it was right for us or the right path for a new indie studio… PvE is where we were having the most fun.”

Priced the game aggressively, to hit maximum reach early: Shak notes: “A lot of comments on our early social posts were asking if the game would be free or saying $10 or less”, and it was frustrating, since it’s a deeper 2+ year dev cycle game. But they wanted to provide “overwhelming value”, and so $15 → $10 it was.

Intelligently scoped for a Risk Of Rain 2-like market hole: Shak noted that they thought “a lot of new studios chose games that were too ambitious”, and they spotted that “Risk of Rain 2 is a great [action roguelike] game with >10 million players. And Muck* was a hybrid F2P version that doesn’t seem to be talked about enough.”

So the team went for a game that “scratched that [Risk Of Rain 2-y] itch (3rd person perspective, random powerups, boss/map loop).” And having seen a version a few months before release that looked a little more basic/sketched out, I can say that they really executed on both the visuals and the chaotic goofiness, and that helped virality a lot.

(*Fun fact: Muck was made by Danidev, who is absolutely not Megabonk creator Vedinad if you listen to his official statements. But absolutely is, if you don’t.)

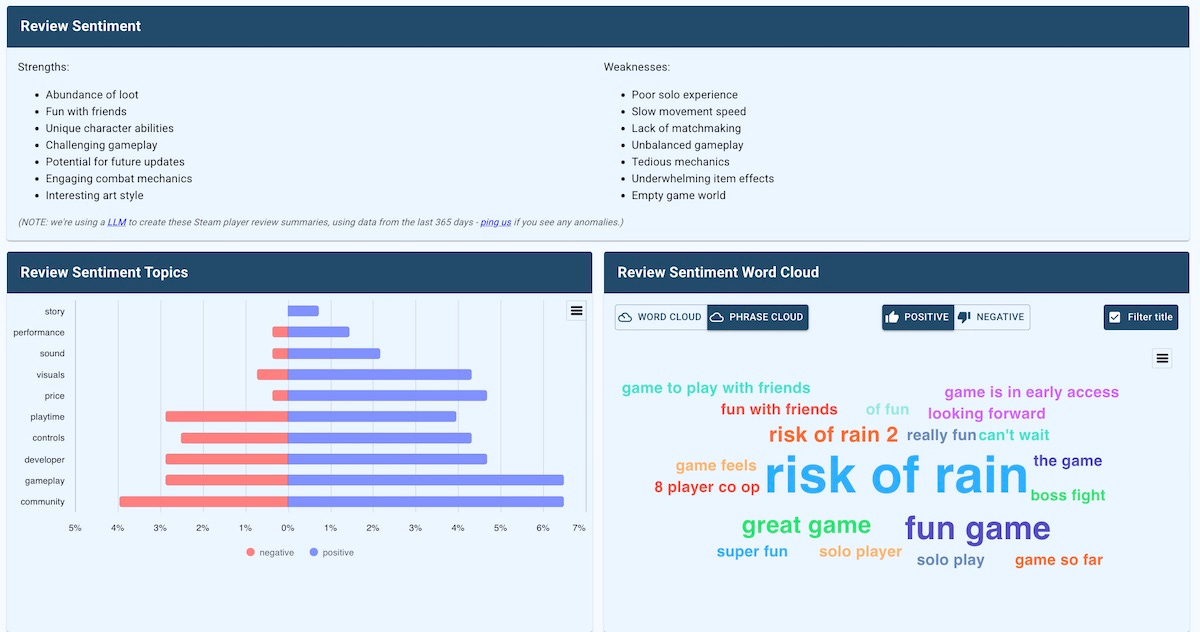

Of course, everything’s not wine and roses. There are some initial ‘single-player is too hard’ tuning issues, lack of public co-op lobbies, and particularly some general balance tweaks needed. Thus, the game is running ‘only’ 76% Positive on Steam as a result, just under the Very Positive line of 80%.

Putting all that launch data through GDCo Pro’s Steam review sentiment analysis box, we do indeed see a lot of that in microcosm - a lot of Risk Of Rain 2 mentions in the phrase-based word cloud, in particular:

And this also wasn’t a zero-spend launch, paid marketing wise. VC funding enabled the Big Distraction team to directly spend (very low six figures) on paid influencers, with help from Moonrock & Jestr, as well as internationals Black Soup, Active Gaming Media & VSOO Games.

On how to pick the right paid influencers, Shak explained: “We looked at creators we thought would like our game - roguelite and co-op gaming groups. Multiplayer is harder to show in any game (coordination, editing, etc.) so we biased towards that… I let my partners manage the CPMs/metrics and make sure we were going with the best bang for the buck.”

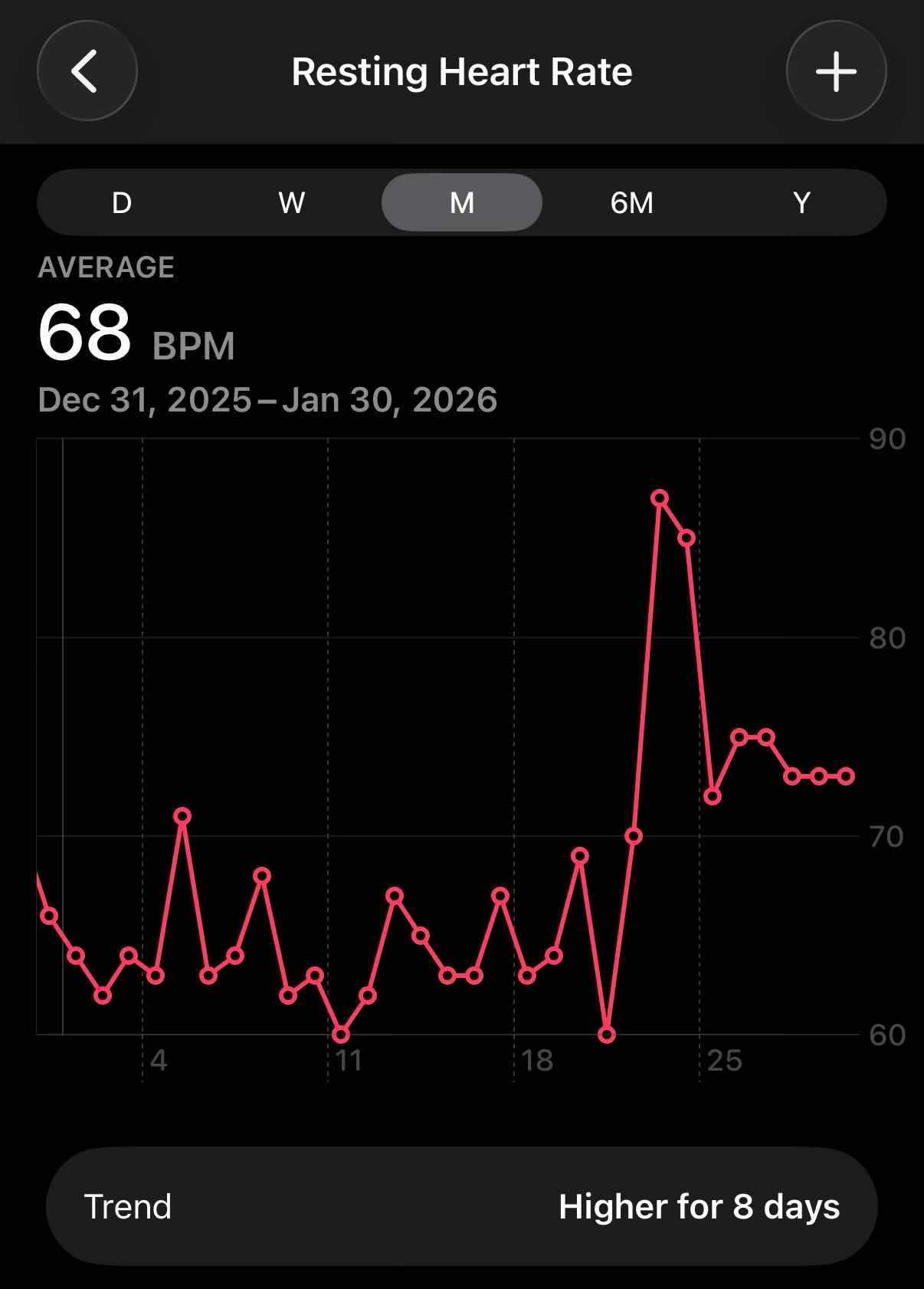

To end, we have one other special graph to share. Shak happened to mention that he’d just checked his Apple heart-rate monitor, 8 days after the game came out. So folks, here is what launching a (hit!) game on Steam does to your stress levels:

GDC’s state of the biz - and the state of GDC…

This final section is a two-for-one, because Game Developers Conference put out its annual ‘2026 State Of The Game Industry’ survey, and we can use the results to talk a little about what GDC* means in 2026, thanks to a timely LinkedIn piece we found.

[*Normal caveats apply here: I was intimately involved in GDC and its related media at various levels from 2005 to 2020, when I left to found GameDiscoverCo. And yes, it’s a coincidence that the acronyms are similar - I’m not a monster.]

I’d highly recommend you check out the SOTI survey, which was answered by ~2,300 people, cos it’s a snapshot of the GDC attendee - 54% U.S., and 34% of those based in California, with Washington and Texas some other bigger states. In other words, many traditionally salaried, longer-time game industry employees. And notably:

28% of all those surveyed have been laid off in the past two years (and 33% of those in the U.S.)

50% of all those responding said their current (or most recent) companies have conducted layoffs in the past 12 months.

74% of surveyed students said they’re concerned about their future job prospects in the game industry.

There’s a LOT of other great data in the full survey, including discussions on AI use, game engines, target PC, console & mobile game platforms, and more. But what I really wanted to highlight was this thoughtful LinkedIn editorial by Brooke Van Dusen, an ex-Twitch staffer who runs a process-based ‘external dev’ wrangling biz.

He acknowledges the U.S. politics, cost & safety issues which are strengthening headwinds against the event recently. Then he discusses “the economics underneath”, and I agree with him on the biz-specific structural issues affecting the show.

As Brooke notes: “Conferences survive on deal flow… That math only works if deals are happening. And at this point, it's not exactly a secret that they haven't been. VCs have checked out completely. Publishers are making fewer bets. Platforms are doing fewer deals.”

He concludes: “Funding rounds are smaller and more metrics-driven… By the time a game hits a conference, the market has often already decided whether it cares… So here's the open question: if deals are data-driven and discovery is online, what role do large conferences play going forward?”

Getting together in person is important, and I’ve had some vital conversations at events in the last 12 months that I wouldn’t have had elsewhere. Oh, and some GDC talks are amazing, and I spent 10+ years helping with that! But I also grok Brooke’s “hotel lobbies… filled with sales people talking to each other” vibe. And that’s.. structural?

[We’re GameDiscoverCo, an analysis firm based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide real-time data services for publishers, funds, and other smart game industry folks.]