How much busier is Steam for 'significant' games?

Publikováno: 9.7.2024

However... you define that? Also: the big streaming games of June and lots more.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Hello, summer readers of GameDiscoverCo’s newsletter, clearly sipping your sangria somewhere. Reminder: we’ll send one free (Tuesday) and one Plus-exclusive (Friday) newsletter for the next few weeks, so that your poor inboxes can get a little rest.

Oh, and before we start, big shout-out to the HowToMarketAGame crew, who used GDCo Hype and conversion data to ask ‘Should you launch your game directly after Steam Next Fest for maximum buzz?’ To which the answer seems to be ‘Lots of games do it, go right ahead, not a big difference - it’s really your long-term trajectory that matters…’ Fair!

[PSA: yes, you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data site for unreleased & released games, weekly PC/console game trend newsletters, Discord access, eight detailed game discovery eBooks - & lots more.]

How much busier is Steam for ‘significant’ games?

So, GameDiscoverCo specializes in grabbing and interpreting data about PC and console games, finding the ones that are doing well (not always from ‘the usual suspects’!), and then talking to them about how they did it. Those are ‘micro-profiles’.

But we also like taking a ‘macro’ view from time to time. And when a client recently asked us a simple question: ‘How much more crowded is the Steam market for significant new releases in 2024 vs. previous years?’, we produced our measuring sticks eagerly.

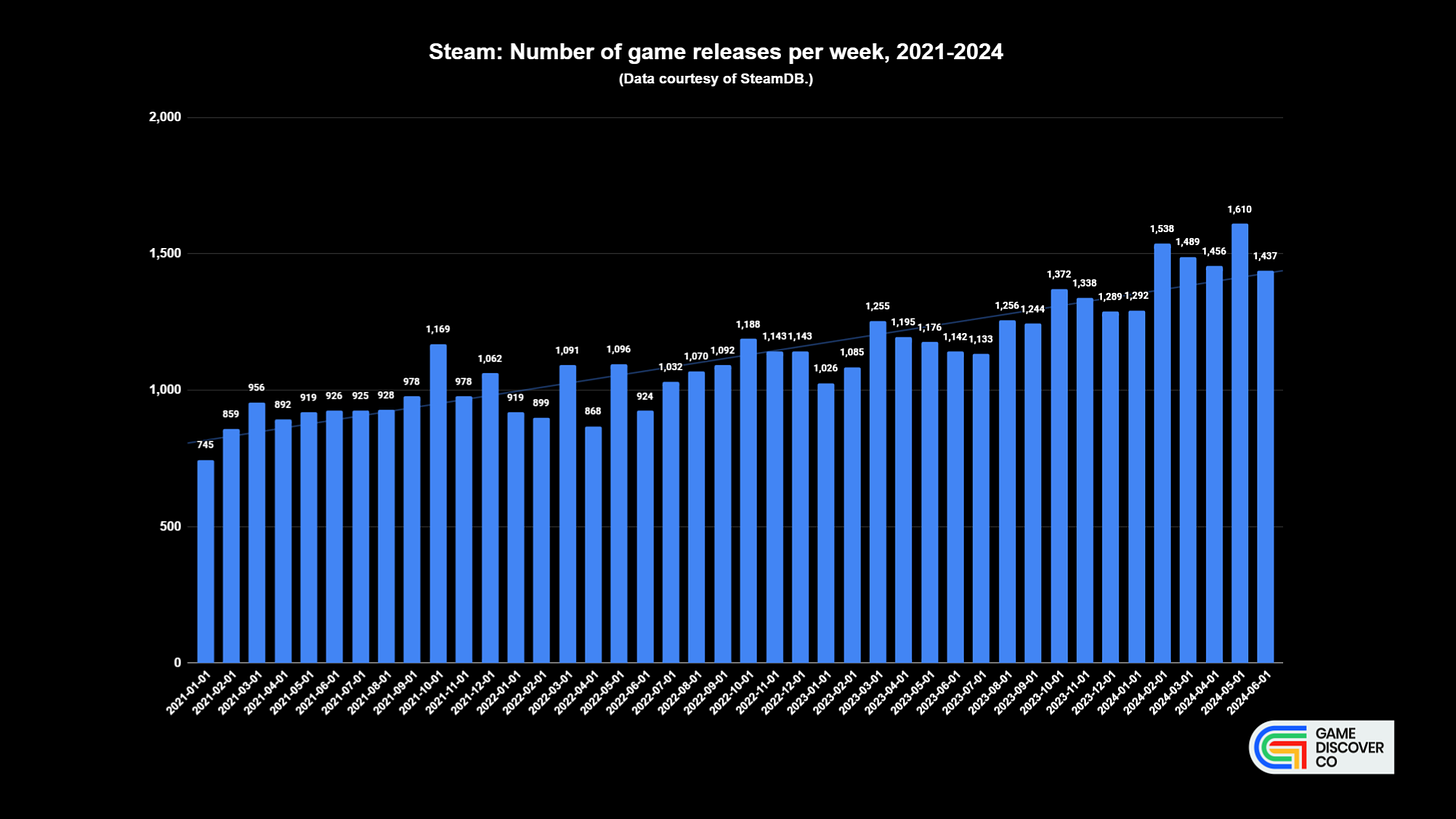

Firstly - and we used SteamDB’s data here because we think it’s the cleanest public view - you may have heard that there’s more new video games than there used to be! For example, 745 games debuted on Steam in January 2021, compared to 1292 in January 2024 - up 73%. (January’s generally the quietest month of the year, btw.)

All of these titles paid Valve $100 to be on the platform, sure. But some are more of a ‘first game bedroom programmer’ try-out, and others have a larger scale of dev and marketing behind them. How can we distinguish the difference, for new games?

Well, one thing we can do to determine ‘significant new releases’ is look at how many Steam followers that games have on launch. Followers is a 100% public stat, and as we’ve explained: “the vast majority of wishlists for unreleased Steam games… are between 7x and 20x the followers, with an average of 12.37x and a median of 12x.” And… here we go:

This is every month from January 2021 until June 2024, with the number of games with >1,000 followers, >2,500, >5,000 and >10,000 launching in that particular month. Some takeaways:

The number of games launching with >10k followers hasn’t gone up much: we’re not tracking how long it took to get >10k followers (that’s often >120k Steam wishlists!), but there’s almost always 15-20 of them debuting per month.

But the >1k follower cohort is rebounding better, post-COVID: it’s tricky to read, due to the early 2022 release drought that seems to be down to COVID & the ‘Omicron surge’ hitting and delaying a lot of plans. But May 2024 had an all-time peak of 130 games launching with >1k followers (>12k wishlists, roughly).

The general picture is ‘high-profile game releases are busier, but not much busier’: looking at ‘size of interest on release’, we’re not seeing 73% more games with 10k followers launching, despite 73% more games being released.

So that’s one way to look at the new Steam games being released over the past three and half years or so. But this isn’t how successful new PC games are - it’s just how many followers they had when they hit the market. Is there a way to see if actual results are changing?

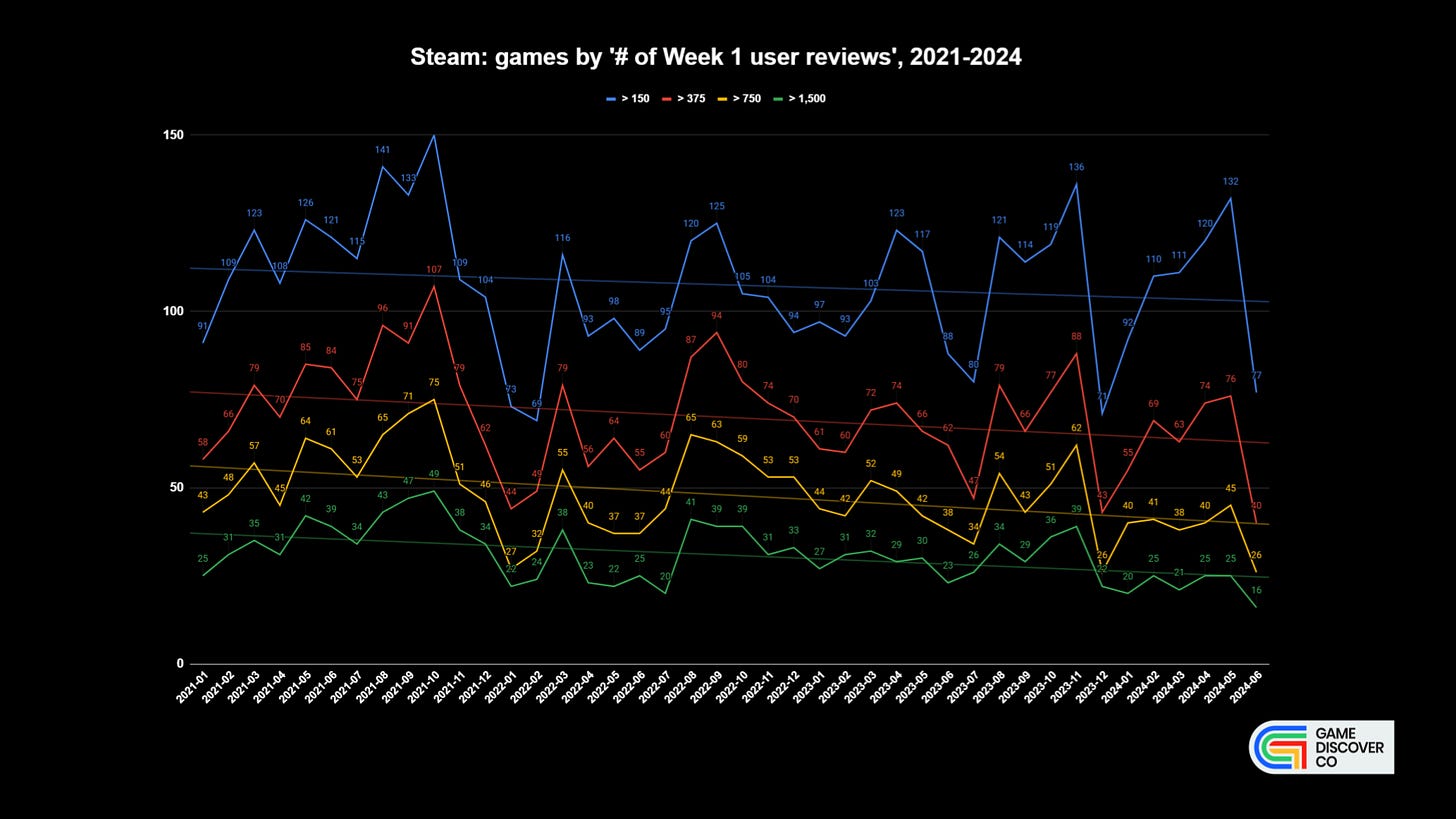

There is, in fact, and that’s ‘number of Steam player reviews in the first week of a game’s life’. We’ve been capturing this for a few years too, on a month by month basis, and here’s what we see:

Again, not all Steam reviews map perfectly to interest, and we’ve published a lot of research on this. But in general - more reviews means more copies of a game sold. And what we’re seeing here is broadly flat - or slightly declining - launch trends.

Still, these two warring stats - follower count slightly up, # of reviews slightly down - make sense if conversion rates are dipping slightly over time*, which we actually documented in a recent newsletter. This is another view of the same trend.

(*Although bear in mind that some of the high-follower titles like The First Dwarf end up underperforming, and some smaller-follower titles like The Exit 8 end up becoming a ‘surprise’ hit. It’s not the same games featured in the same-color bars in both graphs.)

The next question is.. are there just a set amount of ‘big new games’ that can even exist in this market? The overall PC market is still up, if you are to believe Valve and us. But we’re not seeing it in these ‘new game’ graphs, right?

Well, we think that the Steam-wide YoY revenue increases are happening in two places. In majority, it’s in back catalogue which is robustly discounted and tied in to DLC and IAP. And in minority, it’s in a small amount of outliers - Helldivers 2, Palworld, etc - which are grabbing outsized attention and revenue in the market.

There’s still room for everyone else, if you’re sized right. For example, our Plus back-end is tracking 18 new Steam games released in May that grossed >$1 million - and 30 that grossed >$500k. But for us, ‘sized right’ is the ponderable question du jour, rite?

The most-streamed games, June 2024 edition…

Every month, we collab with livestream analytics platform Stream Hatchet - which grabs data from lots of (non-China) game streaming platforms: “Twitch, YouTube Live Gaming, Facebook Live, AfreecaTV, Kick, Steam, NaaverTV, Trovo, Rooter, Nonolive, Openrec, Loco, Mildom, DLive, VK, KakaoTV, Garena LIVE, Booyah.”

The Stream Hatchet folks wrote about the Top 20 most-streamed games of June 2024, and once again us a full list of the Top 100 games(Google Drive doc) for us to noodle with. We love this data! Here’s what we noted, this time out:

Elden Ring’s DLC launch sent streaming through the roof: we know the Erdtree DLC was big, but don’t underestimate the effect of 122 million hours of watching (#3, 3.83x more than May!) on extra interest & sales for FromSoft’s megafranchise.

Chained Together punched way above its weight: we’ve been talking about indie co-op ‘masocore’ hit Chained Together in the Plus newsletter, and this intentionally frustrating $5 game - a further twist on the Only Up! formula - made #25 with a whopping 15.8 million hours watched in June.

Online titles dominated new appearances for June: top new games included dungeon explorer Dark & Darker(#30 w/12.5m hours watched), slick Conan Exiles-ish survival game Soulmask(#49, 5m hours), WoW-adjacent PC & mobile fantasy game Tarisland(#58, 4m hours), and social sandbox MMO Pax Dei(#86, 2.1m hours).

Beyond the online, co-op, survival, MMO-y space, there were a couple of other ‘different’ new entries, though. Firstly, The Chinese Room’s psychological horror story game Still Wakes The Deep got to #75, with 2.5m hours watched.

And secondly - and most fascinatingly - Cricket 24 (yes, a proper 3D cricket sim) made it to #95 with 1.9m hours watched. It’s not a new game, but we’re guessing the Cricket World Cup - and the game appearing on both PlayStation Plus and now Xbox Game Pass - inflamed national passions for closely simulated googly-s.

The game platform & discovery news round-up…

Let’s finish things out in style by looking at a whole heap of game platform and discovery news, which goes a little bit like this:

PlayStation released its top games of June 2024 on the PS Store, with Elden Ring rocketing back to #2 in North America and Europe due to that DLC, V Rising’s console release making it to #6 in both territories, and MultiVersus topping the F2P chart thanks to its relaunch - tho it’s tailing off swiftly now.

We loved this piece from Another Crab’s Treasure’s Paige Wilson, guesting on Victoria Tran’s community newsletter to talk “getting buy in from their teams when it comes to content creation, and clearing the mystery on how it works.” (And great debug screens (above) - we covered this game’s smart virality a few weeks back.)

Circana’s U.S. video game data for June 2024 is out now, and “total spending fell 6% in May 2024 [YoY] to $4.0 billion”, with a 40% decline (!) in hardware revenue. Mat Piscatella adds, time-adjusted after 43 months: “[PS5] unit sales lead those of [PS4] by 8%, while Xbox Series trails Xbox One by 13% and remains slightly behind Xbox 360.”

Microlinks, Pt.1: Roblox added new Economy and Funnel event analytics for devs to use; Impress Games set up a useful interactive Steam indie game publisher list; Meta is moving all Quest VR games previously shipped in App Lab to be discoverable on their ‘main’ store on August 5th.

Analyst firm Naavik put out two good longform pieces recently: on Zenless Zone Zero’s gacha monetization vs. other MiHoyo games, and on Chinese AAA PC/console games increasingly targeting the West - think Black Myth: Wukong and friends.

Nintendo’s post-financial results Q&A is now available in English [.PDF], and most of the answers are pretty milquetoast, but here’s an interesting Shigeru Miyamoto quote from it: “What's important is not what Nintendo games people buy, but how we can encourage people around the world to choose Nintendo.”

Steam minutiae you might have missed: the Global Topsellers page shows the highest-grossing Steam games in real-time by revenue, whereas the Top Sellers page shows the highest-grossing games in the country you are located in. (Tada!)

Microlinks: three new games, including Temple Run: Legends and Vampire Survivors+, come to Apple Arcade in August; recent changes to content moderation are causing problems for some Roblox UGC creators(second story); June’s top-grossing mobile games headed by Dungeon & Fighter Mobile ($163m!)

Here’s some good info from VGInsights about the rise of the co-op game: “Only 6% of Steam games released in 2023 were co-op, but they make up 36% of the units sold.” Sometimes online co-op is more ‘incidental’, but as they note, some top recent games like Helldivers 2 and Content Warning are particularly ‘co-op first’.

In the UK for June, PC/console sales wise, “Elden Ring sales leapt nearly 470%, boosted by the Shadow of the Erdtree DLC launch.” But, per Chris Dring, “Another low month for console sales. PS5 is still No.1… [and] all 3 consoles are down in sales compared with June 2024.”

We foreshadowed this last week, but yep, Apple briefly rejected the Epic Games Store iOS notarization submission, allegedly “claiming the design and position of Epic’s ‘Install’ button is too similar to Apple's ‘Get’ button”, before Apple waved it through, although they maybe don’t like it still? (Get a room, guys?)

Esoteric microlinks: why the massive VidCon creator event felt ‘different’ this year; how celebrity book clubs actually work - and is their influence waning?; how the NDA became “the defining legal document of our time”.

Finally, supercar company Rimac has been showing off a new Robotaxi concept, complete with an in-car Xbox dashboard (!) Mind you, Xbox told Eurogamer: “We currently have no plans for an Xbox Rimac dashboard”, and called it a mockup.

So yes, after Tesla removed in-dashboard Steam from select models, this is another tragic blow for the ‘I want to play Halo instead of using the car GPS’ crowd, if they exist beyond tech moguls’ fevered imaginations. (There are dozens of them… DOZENS!)

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]