How Sker Ritual's 1.0 release redefined 'sleeper hit'

Publikováno: 7.5.2024

Also: some estimates on players for Epic Games Store & lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Greetings, all, to this week’s set of GameDiscoverCo newsletters. And to quote No. 6: ‘What do you want? Whose side are you on?’ Well, we want information (like No.2 does), and we’re on ‘your side’ - if ‘your side’ is ‘more information in general’. (But who is No.1?)

We’ve got a packed week for you - looking at two platform-related data sets and two games that have broken through the cacophony of new PC/console games out there. And we start with a fascinating ‘late standout’: Wales Interactive’s Sker Ritual.

[REMINDER: yes, you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data suite for unreleased & released games, weekly PC/console sales research, Discord access, eight detailed game discovery eBooks & lots more.]

Sker Ritual: what a massive 1.0 bump for this indie!

As GameDiscoverCo Plus subs know, as part of our Friday Plus newsletter ritual is poking at Steam’s top-selling games by revenue, to see if anything surprising jumps out. Late last month, stylish first-person zombie shooter Sker Ritual’s 1.0 bump was that game!

We’ve surveyed Steam Early Access to 1.0 transitions before. You may remember that the median title sells about 0.7x its units in the first 3 months of 1.0 release, compared to the first 3 months of Early Access. But the top 5% can go 5-10x better, or more.

Well, as visualized by SteamDB, here’s the Steam concurrent users for Sker Ritual. What a contrast from its October 2022 Early Access debut (237 max CCU), to that 1.0 jump starting on April 18th 2024, and maxing out at 5,992 CCU on the 21st:

That’s pretty rare (top 1%?), and it rocketed the game into Steam’s real-time Top 10 grossers. Wales Interactive’s Ben Tester tells us “it's been a big success for us, with units well into the hundreds of thousands sold” across both PC and the just-launched ‘new at 1.0’ PS5 & Xbox SKUs.

Interestingly, GameDiscoverCo console estimates indicate it’s doing pretty decent on PS5 as well, rare for a digital-only indie title. It’s made it to six figures sold on that platform already, ~50% U.S.-based, according to our data. So what’s going on here?

The main thing that’s going on: pent-up demand for single player/co-op Call Of Duty: Zombies-style games, as the ‘war x zombies’ modes for Activision’s giant shooter franchise - modes originally pioneered by Treyarch - have been a player favorite. (People also miss the ‘OG zombie modes’ for CoD, as it’s strayed over time.)

It turns out there are big YouTubers who run 100% zombie game-centric channels, and Wales Interactive tapped into them, sponsoring videos from CodeNamePizza(922k YouTube subs) and from MrDalekJD(2.69m subs) for 1.0 launch. (They describe this game as part of the ‘round-based zombies’ sub-subgenre, btw.)

But from there, things really took off, as the game “received organic coverage from the likes of MrTLexify, CDawgVA and NoahJ”, according to Ben. We grabbed data on the highest-view YouTube videos we could find, and can confirm - this game picked up a bunch of additional organic interest on YouTube.

What’s more, if you look at the Streamscharts data for the game, you’ll see a giant ‘live streamers’ spike just after release, and Sullygnome details massive Twitch streamers like xQc, Lirik and Sodapoppin’ giving the game a go, with 325,000 hours watched in the last month.

That’s not enough to make it to our regular ‘Top 100’ live-streaming charts in April. But a lot of this interest - especially on YouTube - was hyperfocused, in a good way. Basically, it’s: ‘you know that CoD Zombies mode you love - there’s an indie title that does it just as well?’

So we do believe this was a gap in the market that appeals to AAA players. You won’t have seen a bunch of chatter about this game in many ‘filter bubbles’, but it’s selling. And it’s amazingly well-honed for a core dev team of just five people.

Here’s some other key takeaways from questions we asked Ben at Wales Interactive:

The game blew up now partly because the team were ‘keeping their powder dry’: although “the content jump to 1.0 wasn’t as significant as you might think”, Ben says: “We held back from pushing too hard during Early Access, because our priority was ensuring the game was the best it could be first.” (And console SKUs were key?)

The core dev team of 5 have working iteratively on multiple projects: it’s from the same team that made first-person survival horror Maid Of Sker, and Ben says:: “Maybe we’re so efficient these days simply because we’ve been a close team for such a long period of time.” The game looks just great for a Unity-based indie title, and with almost 10 years of experience building titles, this action-y pivot paid off.

Even if you pick the subgenre right, you have to deliver on the content: Ben notes that at least one of their big paid launch streamers “loved the game so much and decided to keep playing and create even more organic content afterwards.” Some well-timed promo with a Steam Daily Deal and FPS Fest also helped, of course.

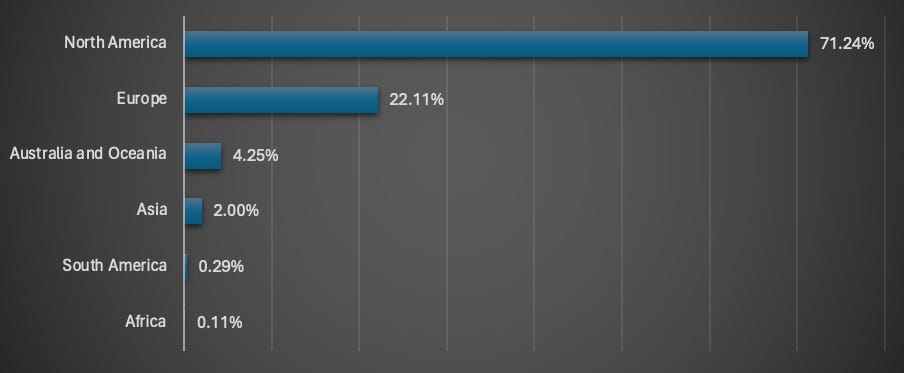

As for other notable data - Wales Interactive mentioned that refunds were sitting at around 12% on Steam for the period around 1.0 launch - decent. And they shared this breakdown of Steam players so far, which we suspect maps well with Call Of Duty’s core markets - big in North America and Europe, not so much in Asia:

To end, possibly the biggest takeaway we have - besides co-op being a wonderful multiplier for interest, when you get your product-market fit correct - is how competitive AAA-adjacent ‘small team’ games can be, even for ‘hardened’ core gamers.

If you were to say: ‘we’re just taking these 5 (special!) people, and we’re going directly up against a mode from a multi-billion dollar franchise, with full online co-op’, you might get some weird looks from management. (Let alone having it be graphically competitive!)

Sure, we’re not saying Sker Ritual is going to gross billions. Today’s busy market means that an incredibly small amount of games do. But we wouldn’t be surprised if it does $20+ million gross LTD after 3+ years, and makes a lot of zombie-lovin’ FPS players very happy along the way. And ROI-wise, that’s a big win… right?

How big do Epic Game Store giveaways scale?

As you may be aware, Epic Games Store on PC has been giving away games regularly for years, now. The reason: it helps people remember EGS, hop on to claim their games, and hopefully retain on the platform!

In EGS’ 2023 store ‘year in review’, they noted: “We continued to partner with a variety of talented developers and publishers to bring our users 86 free games last year, worth over $2,000 USD total. More than 580 million free games in total were claimed this year.”

And you’ll sometimes see ‘claim numbers’ from specific games - for example Total War: Troy revealing 7.5 million claims back in 2020. (And the median of last year’s giveaways is 6.74 million claims per free game - tho we’re sure it varies a LOT!)

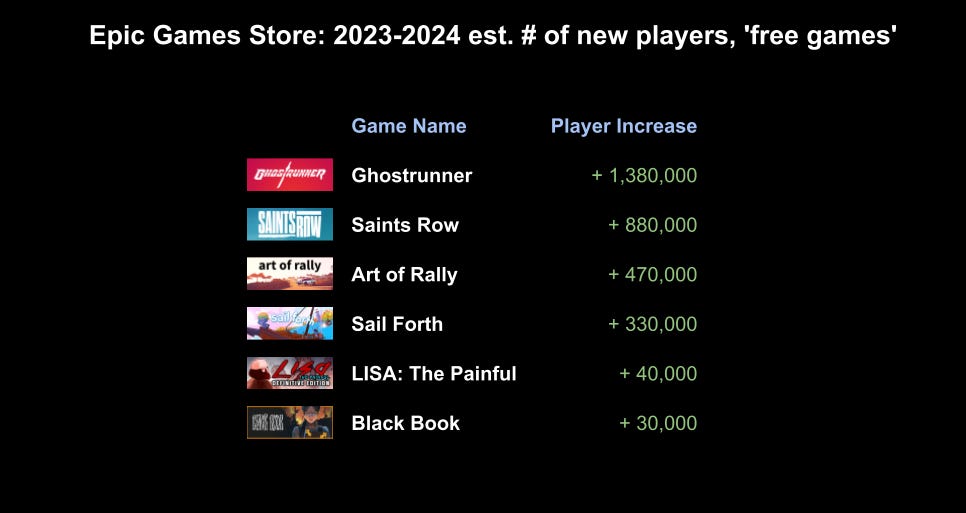

Anyhow, a GameDiscoverCo acquaintance has used data from things like reviews and achievement data, trying to extrapolate how much recent (mid-2023 to now!) Epic Games Store giveaways are actually played, versus just ‘claimed’. The chart’s above - some comments:

As you’d expect, AAA-ish action games lead the way: our contact thinks Ghostrunner was played by almost 1.4 million players after its first giveaway, and Saints Row by an impressive 880,000 folks, overall. Some good extra reach here - Ghostrunner’s was timed to be just ahead of the sequel’s release.

Certain indie titles still pick up a lot of interest, though: we were impressed to see stylish retro 3D rallying game Art Of Rally at almost 500,000 players, given it’s a relative niche. (The kind of game that people are tempted to try out, perhaps?)

‘Trad indie’ games have some interest, even when free: we’re seeing LISA: The Painful with 40,000 actual players via the EGS ‘free games’ program, and Black Book with around 30,000. Those are some decent eyeballs.

Would we stake our life on these numbers? Certainly not. But we think they’re fairly indicative. And, to be clear, we don’t think X million people claiming games on EGS and then only ‘10-15% of X’ playing them is a negative.

In fact, we’ve discussed similar for Humble Choice - where all the bundled games are added to Steam every month by subscribers, but only 1 or 2 are played by most people. That’s fine*, because players are redeeming what they can, and then picking and choosing the most relevant titles to play.

(*Although sure, you can argue about whether gradually building such giant catalogs of unplayed games is incrementally turning people off buying brand-new full priced ones.)

The game platform & discovery news round-up…

Finishing things up for Monday, we’ve got a whole mess of interesting game platform and discovery links. Let’s dive deep into them, right now:

Since we last sent out a newsletter, a thousand years of ‘Helldivers 2 x Steam x PSN logon hell’ have lapsed. Sony has reversed the decision now, but a post-release imposition of PSN logons that excluded 177 (smaller!) countries & the resulting ‘moral panic’ were a big mess for both PlayStation and for the devs. Ouch.

Stream Hatchet’s Q1 ‘who’s been streaming which games?’ report shows a fascinating graph (above) for Week 1 interest vs. ‘later’ for Q1’s new releases. And look at Supermarket Simulator’s continued growth - quite the outlier, huh? (Lots of roleplaying opportunities for streamers there!)

How do we know PlayStation and Xbox sales are dropping? Another data point - AMD, which provides chipsets for both, also agrees: “If you look at gaming, demand has been quite weak… also inventory issues. We guided down more than 30% in the first and second quarters, and the second half will be lower than the first half.”

Staking out the ‘not early June’ streaming showcase timing is THQ Nordic, which announced an August 2nd showcase featuring “world premiere announcements, updates on previously announced games like Gothic 1 Remake and Titan Quest II, and even some surprises.” (Less clustering is good, right?)

We haven’t talked about the U.S. TikTok ban yet - partly because it’s very unclear it’ll happen f’realz - but Polygon has a good piece on it and games. Gamesight’s Adam Lieb notes of its advantages: “The algorithm - the mysterious man behind the curtain - does allow content to get surfaced to more people, regardless of following.”

More ‘Switch 2’ leaks? A Chinese peripheral manufacturer is claiming: "the cartridge slot of the Switch 2 will support backward compatibility with physical Switch game cartridges, ensuring compatibility with players' existing game libraries, including digital versions." (We’re hoping for digital - but hadn’t thought about physical.)

Quest VR things: Meta Quest 3 was used for SteamVR almost as much as Valve Index in April 2024; the Meta Quest+ monthly game sub titles for May include Vacation Simulator (yay!) & Stones Of Harlath - plus almost 15 titles permanently in the library.

Need to know about advertising strategy on Facebook, Instagram and Reddit for your crowdfunded game? The Crowdfunding Agency has a helpful, in-depth article on that very subject. (We think paid ads can work for crowdfunding, because the average pledge amount can be high!)

The most-played Steam Deck games of April 2024 include Stardew Valley at the very top (new patch!), followed by Fallout 4 (ditto), Balatro, and Baldur’s Gate 3 - with most of the rest of the chart being older ‘evergreens’, except Helldivers 2.

Esoteric microlinks: does anime deserve better from video game licensing? the New Yorker on Unreal Engine and ‘video games simulating reality’; Netflix is apparently teasing a larger Netflix-themed ‘destination’ in Robox, including One Piece and Stranger Things.

Finally, noted games, tech, and munitions (!) YouTuber Ahoy, who only uploads videos a handful of times per year, is back with an interesting one - ‘What genre is DOOM?’, as defined by contemporary descriptions. More ‘definitional genre’ talk, plz:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, devs, funds, and other smart game industry folks.]