How The Planet Crafter hit 1 million sold, post-1.0!

Publikováno: 24.6.2024

Also: some thoughts on market growth & lots of platform/discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Another fine week in the world of PC and console video games, and GameDiscoverCo is delighted to have you along for the ride. This time, we’re starting out with a look at yet another micro-indie title that has sold a million units on Steam. (So boring, huh?)

Before we get started: we do, in fact, doomscroll LinkedIn to look for ‘good content’ (and sometimes find it!) So we enjoyed UK comedian Michael Spicer’s video on it: “Is it trying to be a social media site or is it trying to be a job posting site? Well it seems like it's attempting both at the same time, and is therefore being quite bad at both.” (It’s fiiine.)

[PLZ NOTE: you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data suite for unreleased & released games, weekly PC/console sales newsletters, Discord access, eight game discovery eBooks & lots more.]

The Planet Crafter: how it sold 1m units, after 1.0!

Firstly, some context: Miju Games is a small French PC game dev founded by a couple, Amélie & Brice. Their first game, adorable-looking ‘witches x memory tests’ local multiplayer title Abracadabrew, came out in late 2020, and… didn’t get anywhere.

But try again they did, and first-person“space survival open world terraforming crafting” game The Planet Crafter launched in Steam Early Access in March 2022, and went 1.0 with a bang - adding online co-op - in April 2024. So much so that the devs - now augmented to 6 people - announced 1 million units sold a couple of weeks ago.

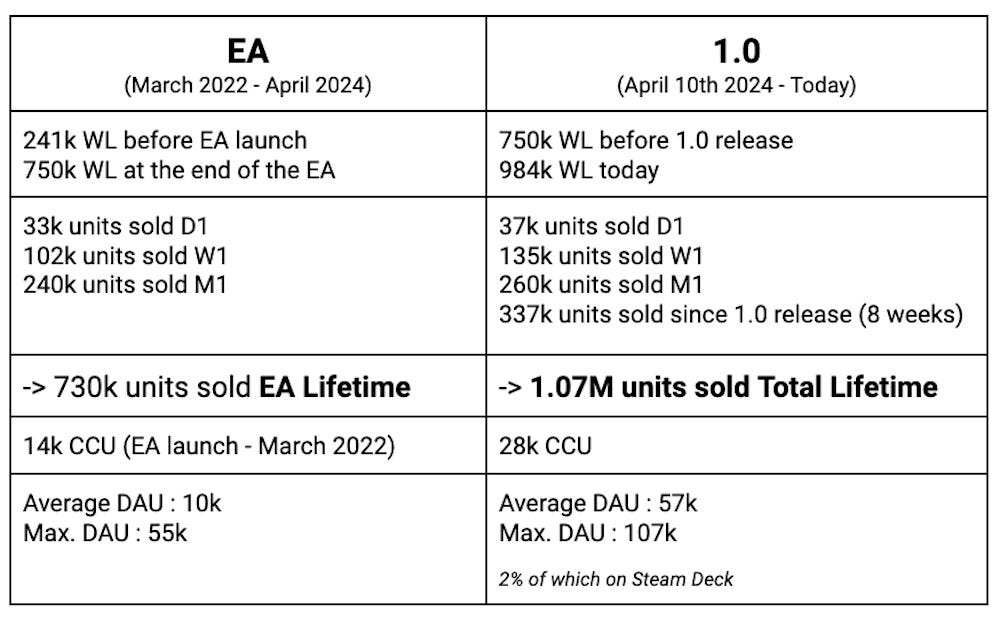

We were delighted when Miju’s Brice reached out at the start of June, and said he wanted to provide detailed data on how the team reached such a great milestone. Let’s start with some topline data pulls:

A few interesting takeaways from this mass of data on the game, which gets a lot of initial comparisons to ‘a super-indie Subnautica, but on a dusty planet’:

The game started out very strongly: 33,000 sales on Day 1, and 102,000 on Week 1 from a 240k wishlist balance is significantly (>2x) above average.

Planet Crafter was a game with a notable 1.0 bump: 32% of its units have been in the last 2 months! Despite a big EA start, its 1.0 numbers are tracking >50% ahead of the 0.7x median we generally see.

It also doubled its all-time high CCU after 1.0: that’s from 14k Steam concurrents (during Early Access) to 28k Steam CCUs (shortly after 1.0 launch). No doubt that adding co-op really helped - look what it did to Project Zomboid.

When we asked Brice about Planet Crafter design inspirations, he explained: “Subnautica of course… and other survival titles like The Long Dark. Don't Starve Together was a big inspiration too: like in Planet Crafter, most of the threats come from the environment and how you manage to survive by exploring and crafting.” He also cited automation games “like the sublime Factorio” and idle titles like Universal Paperclips.

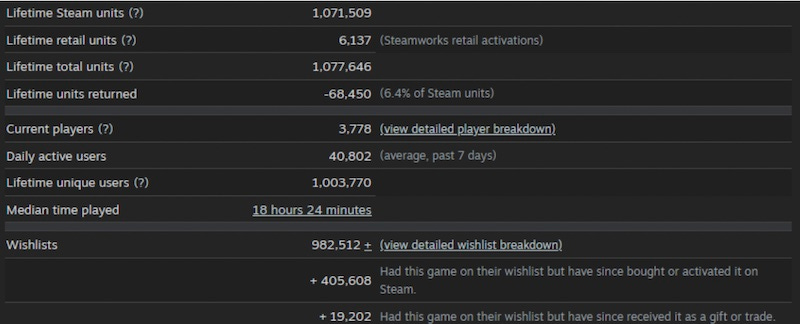

And just to remind everyone - Planet Crafter succeeds because it’s a large, complex, genuinely great game - no matter how big the size of the team making it. It still has Overwhelmingly Positive reviews (95% or more!) on Steam, and check the stats:

One thing might stand out here - the median playtime of >18 hours. That’s some serious value for a $23 game. And while we’re not saying ‘hours per $’ is something everyone tracks - they don’t ignore it either?

BTW, the regional breakdown on this title: 29% of the units sold are in the U.S., 11% in Germany, 7% in China, 6% in France, 5% in the UK, 4% in the Russian Federation and Canada and Japan, 3% in Turkey and Australia. (Nothing too surprising here?)

But how on Earth did such a tiny team make a giant title like this? Brice agrees that of the 18 months The Planet Crafter was in development: “The most difficult thing was to scope the game… So we focused on the core loop and ‘feelings’ of the game.”

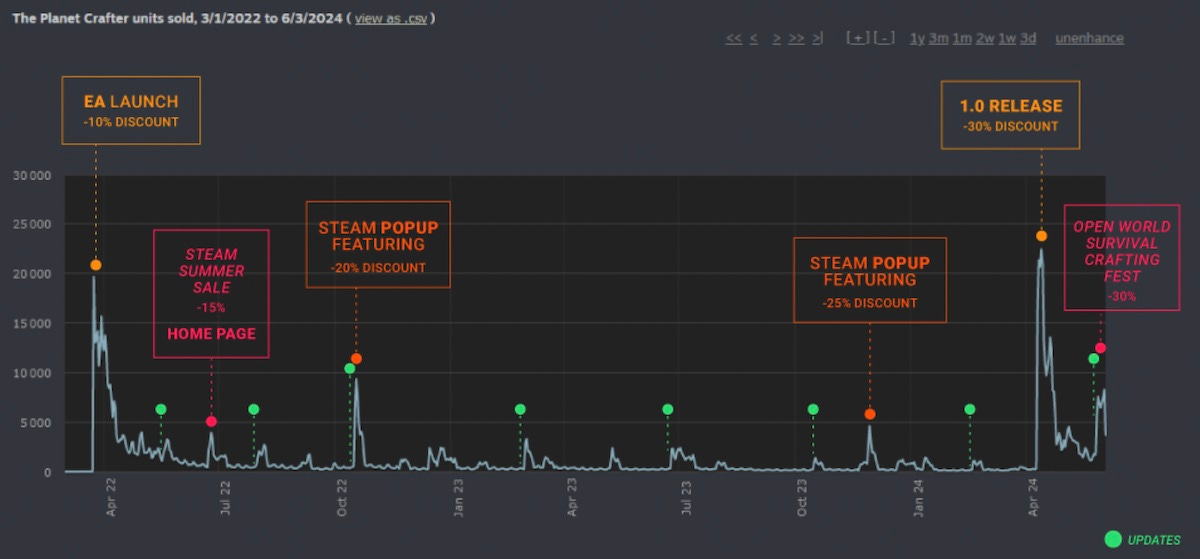

Here (above) is a nicely annotated look at sales of The Planet Crafter all the way through EA and 1.0. Our notes: the game had a very strong ‘long tail’ on Early Access launch, and the double whammy of 1.0 and then a Steam Fest kept >1.0 sales high.

This also shows the reason why you want to do plenty of updates throughout Early Access - timing patches to a discount can be a real discovery boon. As for what happened at 1.0, Brice filled us in:

Additional Steam featuring kicked in, thanks to the game’s success: after asking, “Steam offered us the Early Access hub take-over and a place in the News Pop-Up, which helped a lot.” Good to remember that you can sometimes get take-overs on subpages!

Success was not driven by ‘trad media’ for 1.0: “Several magazines and websites relayed our 1.0 date press release, but we did not have much [traditional] press coverage overall.” Only PCGamesN and CanardPC really gave the game notable extra love?

Paid streamers augmented an impressive organic uplift: with a200k€ budget, there was great viewer reception, and “we noticed bumps (sales / WL / CCU) following big streams such as Wankil Studio (FR)… Other influencers [played] the game [organically] on their own (Squeezie + Locklear (FR), JackSepticEye (EN)).”

We didn’t really talk about the ‘feelings’ behind the game’s success, although Brice referenced it in passing. Our take: players love the idea of starting from scratch and battling against the elements to make something from nothing.

And terraforming (with Mars-like ‘echoes’) is a big cultural touchpoint - especially as we’re ruining our current planet (ahem.) You do eventually make plants, insects and even animals as The Planet Crafter progresses - here’s a guide to the post-1.0 animals.

So there you have it. For us, the takeaways - besides ‘just make a great game, duh!’ are the following: surprisingly small teams can make ‘big games’; find ways to add co-op later to your single player game to turbocharge it; players will forgive a lot, graphics wise, if your intent, UI and gameplay is ‘on point’. And: terraforming good?

The PC games market: is it actually on the way up?

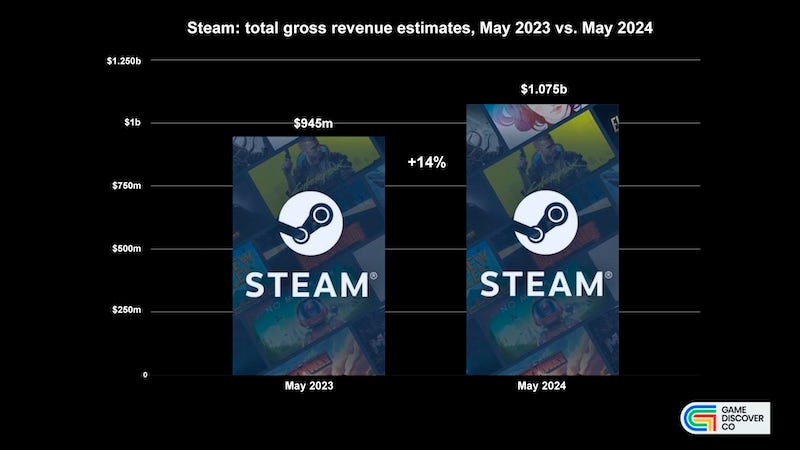

We were talking the state of PC games with a client, given Steam’s recent official ‘Business Update’ showed that 2023’s regional sales were anywhere from 13% to 23% up, year on year - and their global revenue chart (with no axis!) was trending up.

This is interesting, since it’s following several reports of the U.S. and European market for PC & console games - from Circana, GSD, GfK & friends - being down year on year. (But PC is rarely split out explicitly, in public explanations of this scenario.)

It’s very likely that console as a whole is flagging. But we thought we’d try estimating May 2024’s Steam gross platform revenue vs. May 2023’s - and came up with $1.075 billion for May 2024, up 14% from May 2023’s $945 million.

For some, this might be unexpected, especially given the layoffs we’re seeing in the traditional game biz. But here’s two reasons why it could make sense:

Other public estimates - often for established Western territories - don’t include a lot of emerging countries where spend is increasing more swiftly.

Some of these public estimates are based on opt-in data from larger companies, and a lot of the recent revenue growth on Steam is from much smaller players.

Of course: it’s possible we could also be wrong - because we're having to do a lot of abstract estimation here. But we're trying to add up individual revenue from every single Steam game on every day to get this estimate - so it’s pretty comprehensive.

And in other words, when Steam says a bunch of emerging countries have new users up >150%, and when Planet Crafter has sold a million units from a tiny two-person team, there may be growth in the platform that is just difficult to see.

The other issue here, honestly, is: where’s the extra Steam revenue located, and is it accessible via any kind of strategy? When we covered Devolver’s financials recently, they mentioned “back catalogue revenue growth at over 15% a year for the last five years”.

So back catalogue may be a big part of this growth - check! But if the market is up, but for new games it’s subdivided in less predictable ways, among a much more diverse set of tiny, medium, and giant developers - how do you access growth?

The answer to that is tough. Having a giant back catalog that monetizes well, or simply existing GaaS games that quietly do great, is awesome. But that’s more of a situation than a strategy. And that’s the long-term challenge for the whole game biz.

The game platform & discovery news round-up…

And before we conclude today’s newsletter, let’s take a look at the major game discovery news of the last few days, shall we? Here we go go:

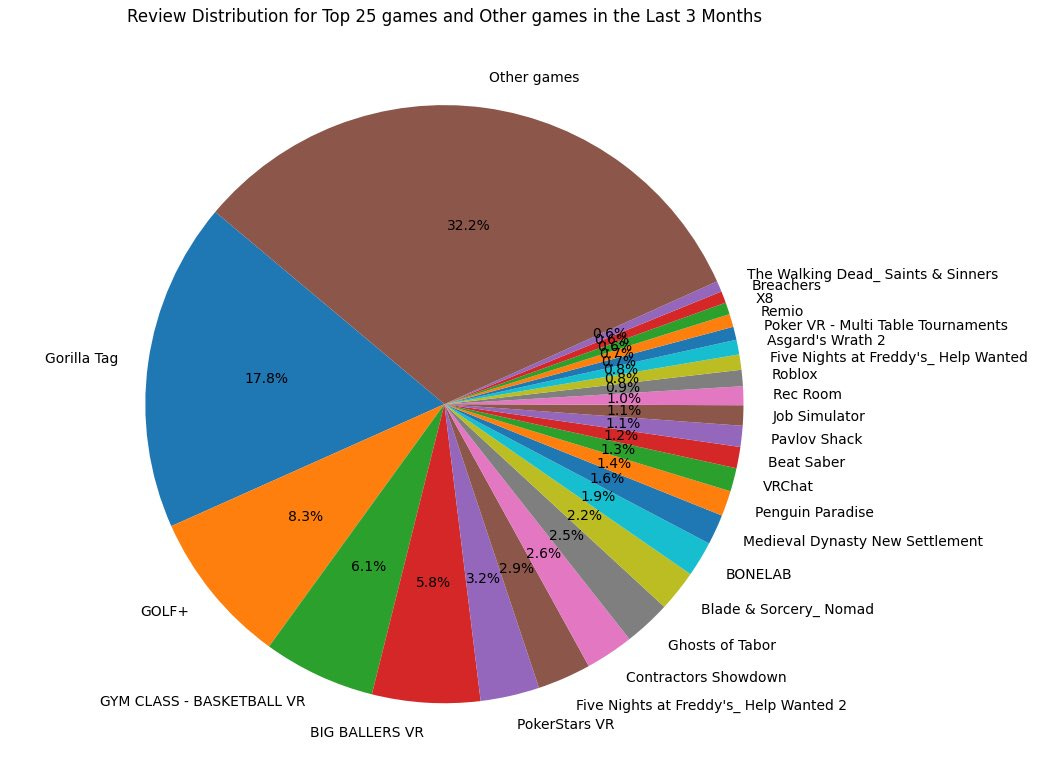

Over on Twitter, CIX did a reviews breakdown for the top Quest games (above), headed by Gorilla Tag and GOLF+, though as somebody points out: “some games offer incentives for users to leave reviews (such as free DLC or in-game cosmetics) which may inflate their numbers.” (It’s still directional, tho!)

Fancensus looked specifically at the games featured at ‘not-E3’ with the highest # of console dashboard appearances, noting: “Sony are still heavily supporting Call Of Duty with Black Ops 6 being the second most visible product on PS5 stores, even though this is now a Microsoft owned franchise.”

A couple of good new GI.Biz pieces by (or interviewing!) GDCo Plus subscribers: Wout van Halderen (Playstack) on ‘Tips for navigating the PR landscape’, and Tony Gowland (Ant Workshop) talking ‘'Singles, not albums': A guide to making smaller games’.

An interesting milestone on ‘Xbox going multi-platform’: although Minecraft isn’t a graphically intensive game, it’s lacked a PlayStation 5-specific version. Until now, with “the first preview of a native version of Minecraft for the Sony PlayStation®5” now available. (We do feel like ‘console wars’ partially blocked this before?)

This Android Central post about PSVR2 claims that “only two PSVR 2 games are in [in-house] development at Sony”, noting that previous internal studios that did major VR games like London Studio or Firesprite were closed down or had select layoffs. (Perhaps not a surprise that this lacks first-party priority.)

Xbox consoles have always been most popular in the U.S. and UK, and less so in the rest of Europe. Here’s further evidence of that: “Launch aligned total after 4 holidays on the market [in France]: Xbox - 0.8m; Xbox 360 - 1.1m; Xbox One - 1m; Xbox Series - 0.7m.” Recent comps may be close to 90%-10% in favor of PlayStation 5.

Tinybuild’s head Alex Nichiporchik continues being public about the publisher’s pivot to ‘1000 hour games’, citing 3 million wishlists across the portfolio since the start of 2024, explaining why they use Steam Playtest - and lots more strategy tips.

European hardware & game sales estimates from May 2024? “Down 17%… mostly due to the fact Zelda came out last year”, as “Console sales also dropped by over 40% year-on-year… with Switch down the most (because of the Zelda comparisons).”

Post-COVID, B2C physical game events continue to become (on the high end!) only semi-essential: PlayStation confirms it's skipping Gamescom public booth space again this year, joining Nintendo in doing so among the major console hardware platforms. (Both companies do lots of B2B around the event, of course.)

Microlinks: Antstream Arcade is bringing its ‘classic game’-streaming app to the iOS App Store, after Apple changed its cloud-streaming rules; Google is making your movie and TV [& video game!] reviews visible under a new profile page; Sony teams up with Qualcomm for a ‘Spatial Content Creation System’ AR headset.

Finally, did you know about the complex battle over Ms. Pac-Man’s IP rights? We’re totally not joking, and Drew Mackie has written a giant, awesome article all about it, and “what made [Ms. Pac-Man] unique as a female video game protagonist.”

For example - below (left) is Ms. Pac-Man and Baby Pac-Man in the original Pac-Land arcade game. And (right) is ‘Pac-Mom and Pac-Sis’ in 2022’s Pac-Man Museum+. Wow.

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]