In-depth: a discovery 'playbook' for Steam & console games

Publikováno: 7.8.2023

Also: a follow-up on Switch physical sales, and lots of brand new discovery news...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We know we’re deep into ‘traditional summer holiday’ time for many parts of the world right now. So don’t worry, we won’t stretch the GameDiscoverCo newsletters too big over the next few weeks, content-wise.

But we still have plenty to talk about with all you wonderful folks. And we start the week with a more wide-ranging guide to how we see Steam and console discovery and marketing working in 2023. (You are welcome, as always, to disagree.)

[A word from this station’s sponsors: you too can get access to our GameDiscoverCo Plus subscription, featuring loads of Steam pre & post-release data, weekly sales analysis research, an exclusive Discord, & more. New Plus subscriber prices will go up at the end of August, btw…]

A discovery 'playbook' for Steam & console games

Imagine that you’ve just started looking at the PC and console game space for the first time. What are some wide-ranging best practices that GameDiscoverCo would recommend to ensure your game does as well as possible in a busy market?

One of our clients recently asked us to write down a ‘playbook’ to get a company-wide level set on our general impressions of good approaches to the biz. So we did just that - and by kind permission, here it is, divided into three sections for easier reading:

Part 1: pre-release PC (& console) discovery essentials?

Put the game ‘out there’ by announcing 12-18 months before launch: short campaigns aren’t enough time to get people excited: you need some time in market and multiple ‘bites at the cherry’ with streamers and demo

appearances. (Can’t do 12-18 months? 6 months is the absolute minimum.)Announce the game with a gameplay trailer: you want to have a trailer - or at least a Steam ‘lead video’ - with some amount of gameplay in there, and you want to have a fully featured Steam/console website on launch. I know that sounds difficult, but you can mock up footage or only use a small fraction of the game for the gameplay. The gameplay is the thing, nowadays.

Streamers playing your game (or TikToks about them, etc!) are a lot of the organic reach nowadays: it’s super-important that your games are streamer friendly - or alternatively in a core ‘deep, strategic’ Steam genre. (One of those two! And the second still means there are still streamers who will play your game, just niche ones with a lot of interest in that subgenre.)

Try to get at least two demo ‘rotations’ before release & heavily push them with streamers while you do it: we recommend one inclusion in a Steam Next Fest, and one demo (ideally before then? or after can work…) in a quieter time, so you have a bigger change of getting streamer interest.

Having YouTube/Twitch folks play your game a long time before release is great for organic reach: there’s no problem with releasing a demo for your game 9 months before you launch. It’ll hang out on YouTube, improve your organic wishlists, and give people something to look forward to!

Part 2: how ‘hook’ and genre for your game really matters

Picking genre and replayability is incredibly important: the days that you can ‘muscle’ a game to success using paid or inventive marketing are probably over. So the right portfolio plays a really big part in success - and picking games that are in inadvisable genres or lack ‘hook’ can doom a game very early on in its lifecycle. Marketing/PR matters, but as a multiplier on the game’s inherent hook or marketability.

‘Deep’ games with replayability are the ones getting the best debuts: for people to want to spend $20-$30 in today’s market, they often need perceived depth to want to buy. This means shorter, single-play games are at a big disadvantage, and deeper, more complex games with layers of gameplay systems, strategy, and co-op gameplay are at a major advantage. Don’t presume you can outrun the trends just by having a great game.

If a game isn’t scaling in terms of Steam wishlists and followers early on, it’s less likely to do well: we’re not saying it’s impossible, because there are always exceptions - especially if there are sudden pickups of big YouTubers, or perhaps a viral TikTok because there’s a clever hook in the game that people haven’t noticed. But in general - wishlists are indicative, even early.

You’re unlikely to see significantly better ‘individual console’ game sales than PC (Steam): in today’s market, there are very few games* that perform better on an individual other console than Steam. So we do think having Steam as the ‘lead platform’ in your head can really help. (*It does happen though - generally for VERY large or AAA-adjacent games on PlayStation, or for particularly breakout games on Switch - but it’s <5% of all titles.)

Part 3: further down the spiral on discovery specifics?

Making regular Steam news page updates is important: we recommend at least one Steam news page update per month, talking about what’s going on with the making of the game. You can peep best practices by looking at Steam news for games like The Riftbreaker. Talk about development and game features and involve the community.

Physical B2C events are great for connecting with the community, but not a major reach boost: we’re just noting that we don’t tend to see good wishlist or interest boosts associated with exhibiting at B2C events. They can help by exposing you to press and streamers, but their value appears more abstract that you might think, due to the limited amount of people they can reach vs. online.

Store featuring is a major boost to sales, social media first-party features less so: while it’s nice to get mentioned on official YouTube channels, social media, etc by console partners, we don’t think it really moves the needle much. The only thing that does? Actual store featuring, where people buy the games. (Both for Steam and consoles.) This extends to post-release too with sales.

Build a community you can interact with and use them to help improve the game: it really goes better if you can set up a Discord, chat to your audience, show them early copies of the game, and iterate from there. There may be some types of game this makes less sense for. But that in itself is sometimes a red flag?

So there you go. I’m sure there’s some things you might quibble with here - feel free to send us a note or comment, and we may run a second article. But we feel like it’s still a good high-level view of where we see the market, in abstract.

Follow-up: Nintendo Switch - how about physical?

We had a lot of good feedback for the ‘state of Switch eShop’ article we ran early last week. And we wanted to briefly follow-up on one thing a few people raised - the fact that for some games, Switch physical box/cartridge sales are still pretty important.

Regarding this, GI.biz head Christopher Dring was kind enough to comment and add some physical stats: “In Europe last year [according to GSD & GI data], out of the biggest third-party Switch games (Mario + Rabbids, FIFA, Just Dance, LEGO Star Wars) released, over 80% of sales of these games were via physical stores.. [though] Nintendo obviously doesn’t share digital first-party figures.”

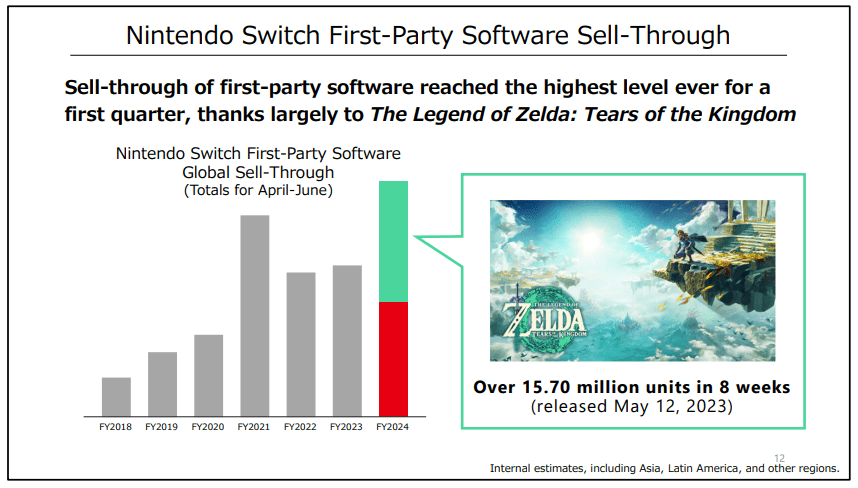

So if you do have a big brand third-party Switch game like these, and can get wide retail distribution, then you may do well. (For context: the brand-new Nintendo results [.PDF] show 52.7% of all Switch game revenue as physical, and a whopping 88.8% (!) of Switch game revenue as first-party, partly thanks to the Zelda launch.)

And it’s true that a big part of the audience for Switch is physical game-centric - because there’s a lot of kids playing whose parents want to track purchases, you can switch cartridges between multiple children’s devices, etc. This favors first-party games, and you’re obviously missing that by just digitally distributing on the eShop.

The caveat to this is that physical video game retail is crumbling. Both GameStop (U.S.) and GAME (U.K.) are pivoting beyond games. And here on the West Coast of the U.S., big stores like Target are increasingly moving to digital purchase cards for games. (And physical titles are difficult to get to for buyers, since staff need to unlock displays to retrieve them.) Still, there are opportunities here.

For those games that can’t get wider physical distro, they might pick up ‘boutique’ online distribution via other collector-centric physical companies, which include (*deep breath*, thanks to Embracer’s Martin Lindell for pointing some of these out): Limited Run, iam8bit, Super Rare, Strictly Limited, 1st Press, Premium Edition, Special Reserve, Game Fairy, Red Art Games, Hard Copy Games & more.

And since the physical Switch copies can sell for twice the price of digital, there’s still money to be made here. In fact, some smaller Switch devs may make >half of their total Switch revenue on the physical deal. There’s also the question of this market becoming over-saturated, too… but you take your wins where you can get ‘em?

The game discovery news round-up..

Finishing up for this newsletter, let’s take a look at some of the latest game platform and discovery news we think is notable, starting with the following:

Nintendo’s Q2 results (mentioned above) were a real company highlight, with 18.5 million units of Zelda: Tears Of The Kingdom sold, and the Mario movie also helping boost profits 82% to $1.3b. On the hardware side, Nintendo sold “3.91m Switch units during the three-month period (short of the 5.68m managed in Q1 FY21), which is up 13.9% year-on-year and brings the life-to-date total to 129.53m.” Also: DomsPlaying spotted that Japanese Switch hardware sales were up 66% year on year, with YoY HW sales in the West actually slightly down…

Ars Technica spotted a fun Steam fact: “Linux has surpassed macOS for the No. 2 spot, according to Steam's July user hardware survey… Windows was still reported by 96.21 percent of users' systems… Linux managed 1.96 percent, while macOS accounted for 1.84 percent of machines.” How come? Well, the ‘SteamOS Holo’ operating system, which is what Steam Deck runs on, is 42% of that Linux total. Aha!

Did you notice that Respawn and EA’s Star Wars Jedi: Survivor is coming soon to PlayStation 4 and Xbox One, after its success on ‘current-gen’ Sony and Xbox consoles? (GameDiscoverCo estimates the PS5 and Xbox Series versions of Survivor sold >1 million units each already - so that makes a lot of sense.)

Twitch is cracking down further on gambling, and of particular note to us video game creators: “Promotion and sponsorship of skin gambling is also now prohibited.” Glad to see movement on this, since, as Sharpr notes: “A recent survey indicated that 54% of respondents were introduced to gambling through content creators, and 71% of them placed their first wager between 13- and 17-years old.”

Popular indie game YouTuber Wanderbot just did a longform blog post on ‘how to send cool [physical] things to creators’. Lots of good tips in there, and he notably and fairly notes: “They won’t tip the scales on whether or not I’ll cover a game, but it will make me appreciate the games tied to a really great gift even more.”

How many VR headsets did Meta sell in the latest quarter? Nobody really knows, but extrapolating from previous financial disclosures on revenue splits, ARInsider guesstimates that in Q2 2023, Meta sold approximately 420,000 Quest 2s and 20,000 Quest Pros. Which is.. fine, but not stellar?

Yes, Twitch streamer Kai Cenat caused havoc in New York when getting his fans together in person for a giveaway. But what was he giving away? “An earlier video posted by Cenat from the inside of a vehicle showed him talking about multiple PS5s he intended to give away ,while showing off a huge stack of $100 gift cards.” Conclusion: PlayStation 5s - as well as Kai - have cultural clout right now.

China’s government crackdown on social media & games might be continuing for minors, since “Chinese regulators have proposed rules that would limit the smartphone screen time of people under the age of 18 to a maximum of two hours per day.” Although when this came up before, Tencent and NetEase said under-18s were a very small percentage of its game revenue. (And enforcement will be very tough.)

Metaverse MarCom has a new interview with Roblox UGC designer Junozy, who “is approaching 35 million UGC sales”, and has worked with Barbie, Elton John, Imagine Dragons, Charli XCX, and more. Lots of great tips in here: “This is a mistake that I see brands make all the time… overpricing and overstocking Limited items.”

Finally, for fans of classic pixel-art 2D fighting games and side-scrollers, we love this collage by Billy Goh of “the ‘character completely engulfed in flames’ sprites from various fighting games.” It’s a look:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]