In-depth: Game Pass stats, probed & deconstructed

Publikováno: 28.3.2022

We do enjoy giving them a once-over.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back, my esteemed colleagues, to a post-GDC and post-Oscars reality. And oof, there’s a lot going on about both on social media. Luckily we’re here to breeze past the dialogue, and bring you some snappy trends from the world of game discovery.

At GDC, delighted that my buddies at the Video Game History Foundation were there to grab a bunch of exhibitor handouts for posterity. In an era where we’re even getting blockchain Wizardry games (?!), great to have VGHF - profiled here as they hit 5 years old - documenting things. (Support ‘em with $ or donations of old game dev material!)

[For a little while longer only, get 30% off the first year of GameDiscoverCo Plus deal for the next 30 paid subs. You get data-rich exclusive newsletters (what’s really selling & why?), custom Steam/console charts to rank and export, two eBooks, a member-only Discord & more.]

Game Pass: first-party, external views from GDC?

So if you’re wondering what’s up with Microsoft’s Game Pass subscription service, there was a whole bunch of new data about the platform, thanks to Game Developers Conference last week.

As a starting point, you should check out ‘Game Pass: Maximizing Your Game’s Total Value’, presented by Microsoft’s Joyce Lin and Eugene Kim, which could best be described as a light and breezy Game Pass ‘infomercial’. It uses a series of Xbox internal stats to show why MS believes that all developers should consider coming to Game Pass.

It’s on a relatively less-trafficked YouTube channel, ‘Microsoft Game Dev’, so only has about 2,200 views so far. It pitches Game Pass as a veritable ‘Swiss Army knife’ to fix discovery problems, featuring slides such as this:

Oh, and before we continue looking at the data in the presentation, might be worth looping back up to the top image from the talk: the 100+ third party ‘Game Pass at launch’ titles in 2020 and 2021 seeing ‘3.5x audience lift vs. Steam in the first 30 days’.

We believe it means that the unique median number of players on Steam was, for example, 20-50k on Steam in the first month, but 70k-175k on Game Pass. (There’s no way for us to know the real number here, but our guesstimate is within that range.)

Anyhow, the juiciest slides start about seven minutes in, and we don’t have space to show them all. But here’s a Tweet with four of the most notable ones, and we’ll list some of the main takeaways on ‘more reach’:

Game Pass members play 40% more games in the 90 day period after joining, and explore ‘30% more genres’.

‘Already on Xbox’ titles entering Game Pass will see an average lift of 8.3x players, with lowest being 1.6x and highest being 28x.

Social conversation around a game goes up 3x when you appear on Game Pass.

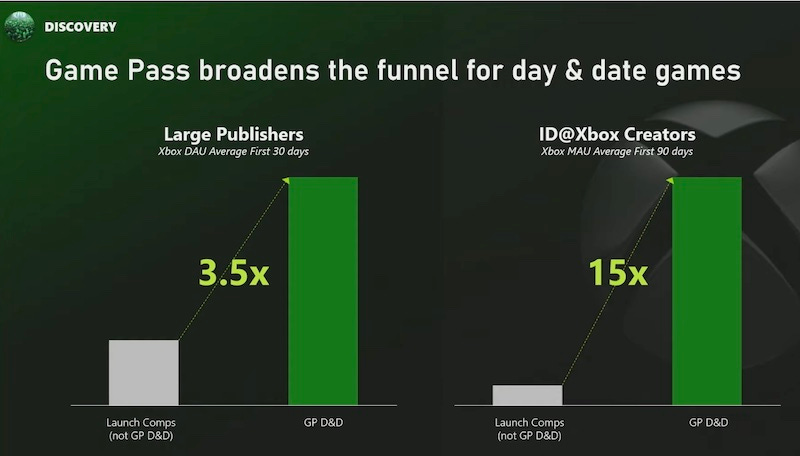

One slide we did want to showcase was MAU increases for Game Pass. It’s especially notable for indie (ID@Xbox) creators, which isn’t too surprising:

How about Game Pass & monetization, though?

All of this make sense. Where it gets a little more interesting is in the ‘do Xbox Game Pass players spend more money?’ conversation. Firstly, Xbox notes that total PSM (‘post-sale monetization’) for DLC and IAP goes up 2.8x in the 90 days after joining Game Pass, 50% of it from Game Pass members who didn’t play the game previously.

(Which I don’t think should be controversial, given the extra eyeballs on your game. If you make a lot of $ with those mechanics, popping in and out of Game Pass is eminently worth it if you can get the right deal, at the right time in your lifecycle.)

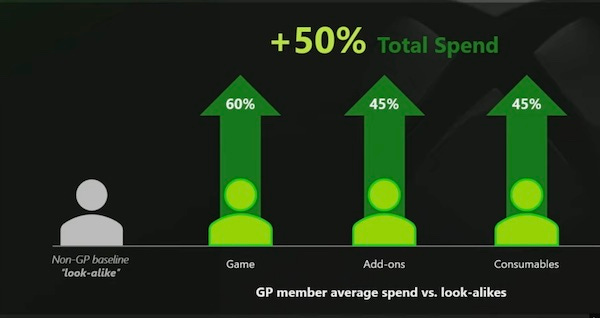

In addition, Xbox specifically says that Game Pass players spend 50% more on games than ‘lookalike users’ who are not in Game Pass:

This is probably one of the only stats in the presentation that I’m a little vaguer on, since finding real ‘look-alikes’ is not very easy, one would imagine.

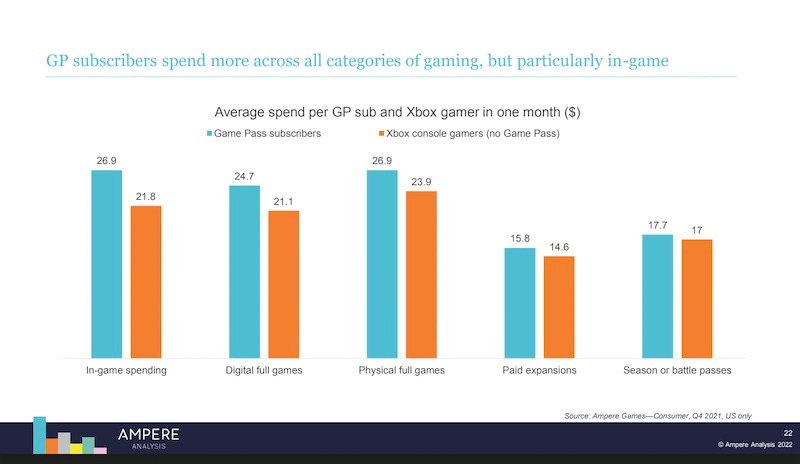

However, Ampere Analysis’ Piers Harding-Rolls, whose firm has a ‘game subscription’ research service - did an excellent GDC presentation last week (.PDF mirrored here, thx Piers!) including the following slide. It agrees on the direction of travel, if not the exact numbers:

Piers also concludes in his research that Game Pass is a whopping 60% of the current market for game subscription services, btw - with Apple Arcade (9%) and Google Play Pass (7%) the closest competitors. Quite a market lead.

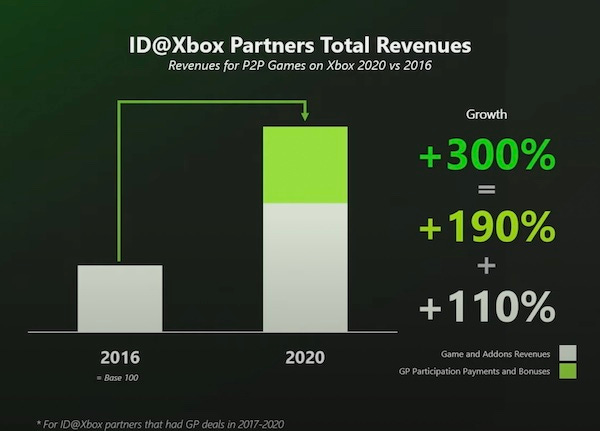

But where I’d like to end this discussion is on a couple of specific data and conversation points. Firstly, this Xbox slide showing upside for ID@Xbox Partners who had Game Pass deals:

And secondly, Phil Spencer, in the wholesomely named ‘Empowering game creators in everything we do’ talk, saying: “I also want to make clear to people that are out there that for us at Xbox, there's not one business model that we think is going to win. I often get asked by developers ‘if I'm not in the subscription, am I just not viable on Xbox anymore?’ It's absolutely not true.”

To which I’d say - how about ID@Xbox premium-only titles without Game Pass deals? I’d love to see a graph of their 2016-2022 growth on a ‘median revenue per game’ basis. What would that show? Is viability increasing dramatically for those who don’t interact with Game Pass, or is it a nexus that is drawing in most titles over their lifecycle? (It can’t be simultaneously incredibly good and also unimportant to success.)

Conclusion: how does Game Pass impact the biz?

I suspect that folks at Xbox have been taken aback at times by the levels of unease towards Game Pass - at least privately - from devs and publishers that don’t understand what is happening to their business right now.

And I wish Microsoft as a company wasn’t such a ‘good feelings only’ spin factory - especially public-facing - which is one of the reasons that I reflexively want to push back against them. (But hey, I’m the pessimist realist, let’s not forget.)

But I think I finally understand where we’re at. We have a supply/demand imbalance in the wider video game market, as I talked about a couple of weeks ago. This is the major, underlying trend. There’s too many premium PC/console games out there for devs to get great ROI on all their new titles launched in the open market, given the increased investment in this space.

So companies are relying - increasingly - on a few megahits, or on GaaS titles tuned for long-term monetization. Or on a newer source of revenue, which is guaranteed $ from platforms for subscriptions. For a lot of indies who didn’t make great money before on Xbox, this is absolutely new, helpful money, especially as Steam gets trickier.

Heck, we were just looking in Friday’s Plus-exclusive newsletter at new releases like Norco (92 peak Steam CCUs) and A Memoir Blue (16 peak Steam CCUs). These are Game Pass Day 1 titles - and likely to make the majority of their revenue from Xbox’s lump payment, at least in the medium-term. (Game Pass didn’t cause this, btw.)

But due to this confluence of events, the market is creating a different supply and demand issue here on the B2B side of things. Alongside an enthusiastic Game Pass player base, here’s a large and increasing supply of devs who want to be on the service - and a necessarily limited demand from Microsoft for new games from third parties.

So yes, the excellently curated Game Pass does help solve for discovery. Being in it or not can be a ‘value add’ lifecycle management question for many, not an existential profitability question. But for smaller devs, if it’s the latter, it fundamentally changes the balance of power in platform/dev relationships. And we’ll get to what this means in a (delayed, sorry!) newsletter in a week or two.

A Steam triad: discounts, Next Fest, Deck

While we’re not aiming to be a parish newsletter* for Valve, it turns out there’s a few things going on with the Steam platform that we should all be aware of. So thought it might be useful to compile them! (*Incredibly obscure Charlie Brooker/Edge Magazine joke.) Let’s see:

It’s March 28th, 2022, so Steam’s discount rules have changed: “Starting on March 28, 2022, the time between discounts run on Steam will change from six weeks to 4 weeks (28 days)… This discount cooldown period applies to all types of promotions and discounts across Steam, with the only exceptions being our four major store-wide seasonal sales: Lunar New Year Sale, Summer Sale, Autumn Sale, and Winter Sale..”

The June 2022 version of Steam Next Fest is confirmed for June 13th-20th, and there’s a notable eligibility change to bear in mind: “All upcoming unreleased games are eligible. There are no restrictions based on your anticipated release date. Games can only participate in ONE Next Fest (ever), so choose the Next Fest that works best for your release timeline: June, October, or February.” This stops people gaming the ‘once per year’ rule by slipping release date.

Steam Deck is adding opt-in feedback for Deck Verified ratings, though Valve mentions clearly: “The data collected by this system won't directly change the Deck compatibility category for a title. In other words, we're not crowdsourcing the compatibility testing process, but instead checking in with the crowd to confirm whether the process we've built is enabling the experiences we all want it to.” Logical.

Oh, and you get a lot more Steam sales feedback as a Plus subscriber, but our data/ops co-ordinator Alejandro posted the latest Steam weekly charts on Twitter, for a handy snapshot. In short: Elden Ring still dominating, Ghostwire Tokyo & Core Keeper the newer hits, Dread Hunger the Chinese player-led multiplayer hit du jour.

The game discovery news round-up..

Finishing up for this packed newsletter, then? Let’s check out the large amount of game platform & discovery things - many of them GDC-related - that we have to round up since the middle of last week:

In ‘Game Pass response from Sony’ news, Bloomberg is claiming that the PlayStation Plus/Now reboot, codenamed Spartacus, will debut as soon as this week“with a splashy lineup of hit games from recent years.” And: “Sony’s new service will combine two of its current offerings, PlayStation Now and PlayStation Plus. Customers will be able to choose from multiple tiers offering catalogs of modern games and classics from older PlayStation eras.” We await it.

The Apple vs. Epic suit will never ever be over, and “in a new [appeal-related] brief, Apple declares that Epic Games lost the Epic v. Apple trial because it failed to prove wrongdoing - and not because of any legal errors on the judge's part.” More analysis here - and here - by the FOSSPatents guy, who gets deep into the ‘market definition’ issues that bedevil the case.

Congrats to the 2022 Independent Games Festival award winners (video - headed by Inscryption), and the Game Developers Choice Awards victors (video - headed by, uhh, Inscryption, above!) at GDC. Here’s a full list of winners, and Inscryption’s Daniel Mullins also did a ‘making-of’ talk for the game on site.

BTW, since I just got asked for stats by a reader: Game Developers Conference itself had 12,000 in-person attendees with passes (and no doubt a few thousand more GDC-adjacents!), plus 5,000 virtual attendees. This was down from 29,000 pass-wearing attendees in 2019, the last time the full show was held.

More subscriptions for top GaaS titles? Yes, more subscriptions: “Grand Theft Auto Online will soon have a monthly subscription service for both new and existing players… the [$5.99/month] service, GTA Plus… will get new items and bonuses such as in-game cash, upgrades, and special discounts. GTA Plus is exclusive to GTA Online players on PlayStation 5 and Xbox Series X.”

Some of the major GDC announcements were cloud dev platform-related btw - Microsoft went hard on ID@Azure, “a new program Microsoft has launched to help independent game developers and creators use the cloud”, and Amazon launched a dedicated AWS for Games product. Oh, and Kim Swift (Portal) is heading up Xbox Game Studios Publishing’ cloud gaming division, aimed to bring “unprecedented experiences to players that can only be achieved with cloud technology.” Cloud cloud cloud!

Another addition to the ‘platforms buy developers’ trend - Netflix picked up Boss Fight Entertainment, creator of popular mobile titles like Dungeon Boss Heroes. Also note the Netflix Games pitch in the announce - building “a world-class games studio capable of bringing a wide variety of delightful and deeply engaging original games - with no ads and no in-app purchases - to our hundreds of millions of members around the world.”

There were a couple of GDC-adjacent game showcases you might want to rewind if you missed: firstly, The MIX 10 had a whole buncha indie titles in one place, and secondly, the Future Games Showcase had another hour-plus of goodness, with a text + video round-up of games for the curious.

Microlinks: Google will test letting Android developers use their own billing systems, starting with Spotify; the February 2022 ‘State Of The Stream’ report shows Lost Ark & Elden Ring kicking it; according to Tomer Barkan, for “Judgment: Apocalypse Survival Simulation, over 6 years on Steam (of which 2 were Early Access)... 58% of our income came from discounts.”

Finally, after Unity’s GDC-debuting Enemies demo made me believe the Uncanny Valley has been partly forded, the below video (thx, Weird West technical designer Joe Wintergreen!) made me long to return to a world where tech demos involve… glitchy humans quizzically swallowing CG spheres?

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]