In-depth: how Dread Hunger hit 1 million sales

Publikováno: 20.4.2022

Also: a new player survey, and heaps of platform news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re midway through this week, folks. And there’s plenty going on out there in Discoveryland. So it’s time to launch the second episode of our podcast and bring you some special highlights from it - right here, right now.

Meanwhile, we’re also debuting a new discount on our GameDiscoverCo Plus paid membership, which includes a member-only Discord, massive data back-end, paid-exclusive newsletters & all that jazz. It’s April 20th? Let’s do lifetime 20% off both monthly and yearly subscriptions for the next 10 days, shall we? Avanti…

Hook and discovery lessons from Dread Hunger!

So yes, time for the second Season 1 episode of our Tales From GameDiscoveryLand podcast. (Reminder: you can easily listen in-browser via our official podcast page, and also via Apple Podcasts, Spotify, Stitcher and Pocket Casts. If you need it, here’s our podcast RSS feed.)

In this episode, recorded a few weeks back, we talk to James Tan of Digital Confectioners, one of the key creators of smash hit social deduction game Dread Hunger. He talks to me about the project’s ‘hook’, its surprise Chinese success, and post-1.0 path to 1 million units sold (!)

We’ve done a full, lightly edited transcript over on the podcast page itself. But for those with a little less time, here’s some of the top lessons that we spotted:

Hook? Use adjusted messaging, but don’t trend-chase…

When initially creating the game - which has you playing an explorer, trapped on a ship in the Arctic tundra with your crewmates, some of whom are ‘thralls’ (the bad guys!), James notes: “When we first started looking at these genres - social deduction and survival - we started by picking out the stronger genre, which was actually survival at the time.”

But “sprinkles of misinformation” were always a key part of the game. And James adds: “We really liked those kinds of betrayal moments. They gave players more room for player-generated stories about funny things that would happen. I think it's fair to say that when Among Us really started gaining a lot of traction… [we] pivoted a little bit in the marketing message.”

So this means the game’s hook is somewhat more layered/complex than just ‘find the impostor!’: “Maybe in order to survive, there are things that I'm going to need to do that I otherwise normally wouldn't. [We’re] trying to put players in that kind of situation… in Among Us: when you are the impostor, it's very clear that you know what you're supposed to do.. In Dread Hunger, it’s a lot more about subtlety.”

Complex social gameplay leads to… great retention?

The dev team - which worked on previous hit ‘shark vs. diver’ multiplayer title Depth, and included Killing Floor creator Alex Quick - were inspired, visuals and setting-wise, by the TV series The Terror, and from a ‘social interplay’ point of view by card games like The Resistance.

And it turns out that this survival/social deception mash-up spawned a game with amazing retention. James notes: “For Depth, we had an average play time, I think, about four or five hours. And then the median playtime for Depth was one and a half hours… but for Dread Hunger, we're seeing average playtimes of 30 hours, and we're seeing median play times of seven or eight hours - which is in our opinion really, really long. We didn't anticipate people would be ‘maining’ the game this much.”

But why? Perhaps it’s a simple explanation, but a very happy one for Dread Hunger: “You've got streamers playing the game, and good retention. And so when people do go in there and buy it and they're really enjoying themselves, you're going to get this constant growth pattern, basically just going up and up and up and up.”

Why a middling start, and then a major CCU ramp-up?

Yet the game wasn’t an overnight success. If you look at the CCU graphs for Dread Hunger, you’ll see a slower Early Access period - with CCUs in the low thousands, but then a crazy ramp-up starting just before the game’s 1.0 release in January 2022. So what happened?

The game was slower to grow in the West than anticipated, and James suggests: “We think what happened in the West is that there definitely was some level of burnout… from the social deception category of games. In the sense that everybody had played Among Us… and almost became burnt out on that genre.”

But you can see from the review languages of the game - and the timing of the CCU peaks - that the majority of the excitement around the game is from Chinese players. (About 10% of the reviews are English language, which presumably maps largely to sales.) So the massive take-off was almost entirely China-based.

But the fascinating thing is this - as James says: “We didn't have any sort of external publishing help with it at all. And more interestingly, we did not actually have any partners in China to help us with that at all. [Besides localizing the game into Chinese], we focused all of our PR and marketing efforts purely in the West. And so seeing the sudden rise in China was a complete surprise to us.” So what happened here?

Social deduction’s ‘hidden gold mine’ in China, unlocked…

More recently, James and the Dread Hunger team have found out more about the cultural background here: “There's a lot of history with social deduction [in China], and I had no idea. A number of years ago they used to play a game just called Werewolf and this was the real life version of this - very similar to Mafia, right?

And what happened was they had some very popular streamers just play this game in real life. And it became pretty popular. But that popularity transitioned into a TV show. So they had celebrities playing this game as a TV show, and that gained a ton of popularity as well.”

So it turns out that most young people in China are very familar with the social deception genre. And yet, there haven’t been major game hits in this genre. James notes: “There were games that [tried to take advantage of the trend] in China, as well. The problem was that they tried to take the real-life Werewolf game and just transition that into a mobile game. So it became a bit like a Zoom meeting…”

And thus, Dread Hunger stepped into the breach. It created a smash hit that’s often among the top 10 most-played games on Steam right now, if you look at daily peak CCU. (Though it’s one of the most China-centric in terms of lopsidedness, with Naraka: Bladepoint being another outlier.)

Conclusion: and further reading…

So basically: Dread Hunger was a very well-executed, complex to pull off idea in an under-served multiplayer genre. It has ended up doing decently in the West and spectacularly in China. And the full podcast & transcript has lots more, including:

The challenges of successfully community moderating a game which has role-playing, and already requires players to deceive each other!

Why Depth’s mixed experiences with extrinsic rewards (item/bonus drops) made the Dread Hunger devs move towards intrinsic ways of rewarding players.

How the concept of ‘displacement genres’ - markets that are hard to enter without disrupting the biggest games in them - made the team’s previous title, aquatic battle royale Last Tide a tough sell, timing-wise.

And thanks again to James for talking to us for this newsletter and podcast, despite being so busy wrangling his 100,000 CCUs into shape! Much good luck for the future…

The game discovery news round-up..

So let’s transition to ths second parts of this newsletter in fine style - with a cornucopia of useful links and information around video game platforms, discovery, and other such goodness:

An upfront reminder: the deadline to submit your game for the Steam Next Fest, June edition is Thursday, April 21st, 2022 at 11:59pm PDT. So if you want your game (or games!) to have demos in Next Fest, do it! Also new from Valve: a recording of a Q&A about getting the most out of your game in Next Fest.

Today was the Meta Quest VR game showcase, and TechRadar rounded up all the game trailers/announcements. A new Ghostbusters VR title and a fresh Among Us VR trailer were maybe the most notable. Although Stress Level Zero’s Bonelab (above - also on Steam!) also looks pretty, uh, out there.

GI & GSD has some UK retail/digital specifics on Lego Star Wars’ bigtime numbers: “It is comfortably the second biggest game launch of the year.. in the UK [behind Elden Ring]. And the fastest-selling LEGO game in history.” Also noted: “PlayStation was the biggest platform with 39% of sales, followed by Xbox (34%), then Switch (16%) and finally PC (11%).” (We’ve been tracking in our Plus newsletters!)

The Game Conference Guide folks have notes from their GDC attendance, with some great points: “Big events = bigger risk of getting Covid; Companies are sending representatives to in-person events, not the whole team; Travelling to your first in-person event will raise a lot of questions about safety, protection of your and others’ well-being; Interactions are weird.” Weird!

The Verge’s Sean Hollister rummages around in Steam’s top-grossing charts & elsewhere to suggest that the Steam Deck is still selling very well: “Valve’s Steam Deck has been the #2 top grossing product on Steam for five weeks because of a single day of preorder reservations, and anybody who put down an order since then… haven’t yet been counted towards that gross.”

In ‘what retro things might Nintendo put in Switch Online next?’ news, chances of it being Game Boy-related just went up: “Experts tell Ars that a pair of Game Boy and Game Boy Advance emulators for the Switch that leaked online Monday show signs of being official products of Nintendo's European Research & Development division (NERD).”

Not content with Microsoft being the only ‘let’s put ads in F2P games’ platform, Sony is apparently considering it too: “According to a new Business Insider report, the move is designed to incentivise developers to continue making free-to-play titles by giving them a way to monetise them. It’s claimed Sony hasn’t yet decided if it will take a cut of ad revenue, and that it could charge partners for data on consumer behaviour in PlayStation games.”

The ‘How To Market A Game’ crew have crunched VGInsights data to come up with the latest view on popular Steam genres/tags, and it’s ever-useful: “Steam players still really like deep strategy and simulation games. They hunger for very involved games that have a complex meta. Think 4X games like Civilization, builder games like Timberborn, Survival Craft games like Valheim, and Rogulike Deckbuilders like Slay The Spire.”

Microlinks: ubiquitous VC firm Andreesen Horowitz is starting an Entrepreneur In Residence program with a video game track and up to $1 mil funding; game documentary crew Noclip has done a video on the making of Among Us with lots of insight; Meta is working on a web version of its Horizon Worlds metaverse platform.

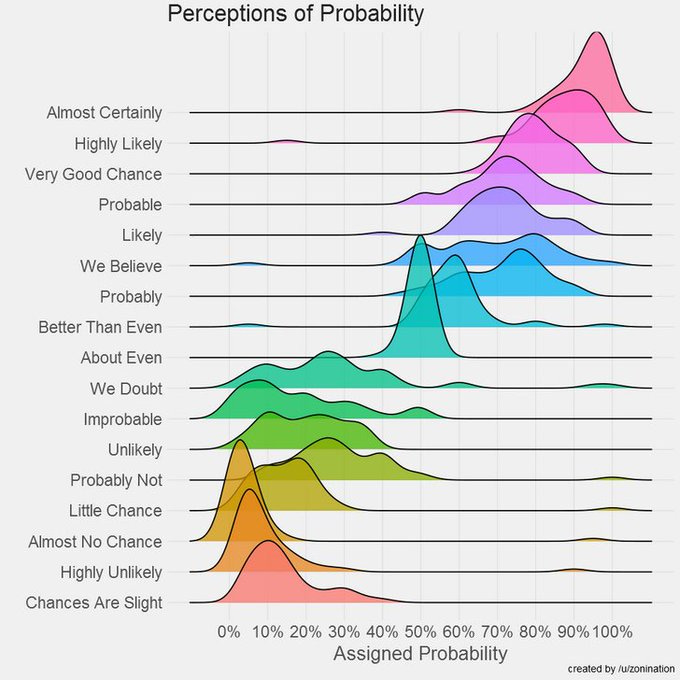

Finally, if you - like us - enjoy taking vague verbal cues and trying to work out if it means that publisher is signing your game, or that platform is giving you $$$? Good news - there’s a graph for that:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]