In-depth: how Legend Of Keepers hit it big on PC

Publikováno: 19.10.2022

Also: the UK x Microsoft x Activision discussion heats up, & discovery news galore.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to Wednesday, my fine feathered friends. It’s mid-week, and while we’re all washing ourselves in the bird bath of game platform-dom & avoiding the predatory falcons of oversaturated genres*, let’s get down to biz. (*Is this too much? - Editor.)

Before we start, a shout-out to Max Read’s newsletter for this spicy timeline re: ‘the history of Meta’s VR/AR efforts.’ Max sez:“While, again, we recommend not thinking about the metaverse, it might be useful to remind yourself of where this metaverse came from.”

[Reminder: upgrade to a GameDiscoverCo Plus paid subscription, and you can chat to colleagues and us on Discord, get our Friday ‘exclusive’ newsletter, get access to our Steam ‘Hype’ & game performance chart back-end, read multiple eBooks & more. It’s good times!]

PSA: fill out our Steam ‘reviews & sales’ survey!

First up, an important call to action for anybody with a game (or multiple games!) on Steam. We think that the ‘reviews to units sold’ ratio on Steam is higher than we were anticipating, for bigger games released recently. (Often closer to 50-60x than 30x?)

So we’re asking you to fill out this 4-question survey, and anonymously contribute the number of reviews for your Steam game(s) and how many units they have sold - no matter what the age/performance of the title.

It’s super simple, and we’re hoping to get 100-200 data points to help us track down what’s going on. So again, pleasehelp us out by filling it in. We’ll print the results in an upcoming free GameDiscoverCo newsletter.

Legend Of Keepers: behind its PC revenue success

We always like looking at success stories from smaller indie publishers that are willing to show us ‘real data’. So we were super-happy when Johann Verbroucht of French indie Goblinz reached out with data about Legend Of Keepers.

The game, which is described as a ‘roguelike x dungeon defense mash-up’, and I’ve also seen other flippantly term ‘a reverse Darkest Dungeon’ (where you’re the bad guys, not the heroes!) originally debuted in Steam Early Access in March 2020, and got a 1.0 release in April 2021.

And it’s done very well at both launch and its ‘long tail’, having been augmented post-launch with 3x $6 DLCs and a $10 ‘supporter pack’ to help its longer-term revenue. (In fact, Johann tells us that in the last 3 months, DLC revenue exceeded the revenue from the base game! DLC rocks, folks.)

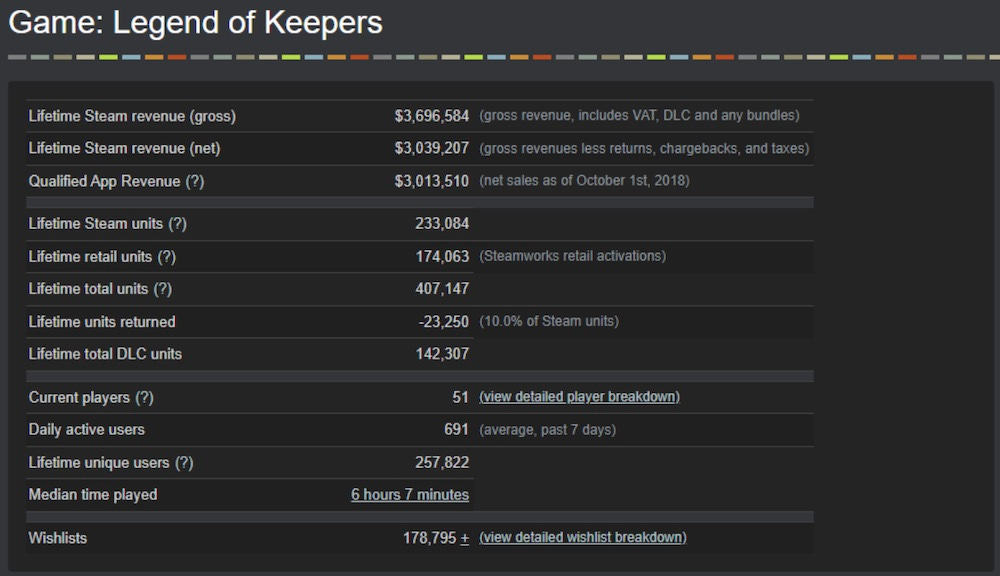

Anyhow, as a starting point, here’s the Steam back-end totals for the game. It has sold 233,000 base game units and 142,000 DLC units, and grossed just over $3 million (after refunds, and before the 30% Steam cut):

We’ll try not to go through every single stat above, or overwhelm you with data. But here’s some of the key things we spotted, from both the above text and other info:

Yes, Legend Of Keepers is replayable & ’sticky’: worth noting that a median play time of over 6 hours puts it above many publishers’ catalogs of premium games. (We think 2-3 hours can be common as a median for many titles.)

The U.S., Germany and China were the strongest country performers: the U.S. is 27% of LoK’s sales by units, followed by Germany (11%), China (10%), France (7%), the U.K. (5%), Canada (4%), Australia (3%), and downwards from there.

The breadth of DLC really helped bulk out ‘long tail’ revenue:the Supporter Pack (which is really just a ‘say thank you to us!’ bonus) has 42,000 units sold, Return Of The Goddess (Sept. 2021) has 46,000, Feed The Troll (Jan. 2022) has 27,000, and Soul Smugglers (June 2022) has around 15,000.

It looks like the DLC - ignoring the Supporter Pack - ‘only’ contributed about $320,000 to Legend Of Keepers’ grand total. But as we know, the renewed interest and the ability to upsell a ‘deluxe collection’ bundle sold many more copies of the base game. So it’s shortsighted to view that DLC total in isolation.

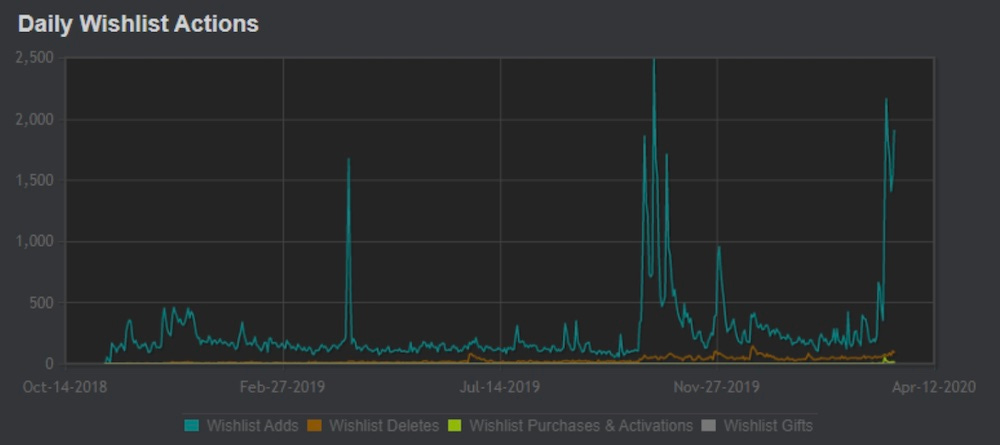

In addition, Johann provided us with pre-launch data on wishlists (above). He noted the following when it came to interest:

The game was popular on Steam page launch back in 2018, just in terms of organic wishlist traffic. Johann puts that down to Steam tag optimizations and a good initial push. (We’d add that the Darkest Dungeon-esque pitch implies much depth & strategy.)

Legend Of Keepers released a popular standalone ‘Prologue’ in Oct. 2019: this ‘big push’ exploded interest, thanks to streamer videos (which continued through EA and full launch) and Steam Discovery Queue traffic spawned by the wishlist spike.

Every little counts: the bump in April 2019 was via an email newsletter push by Goblinz (email good!), and the December 2020 bump was via the Steam Winter Sale, due to crosspromotion from other Goblinz titles. (Crosspromotion good!)

As a result, the game had 115,000 wishlists at launch, and converted well. It had 27,000 units sold and $384,000 grossed in Week 1 (& $600,000 grossed in Month 1!) in Early Access. Johann followed up on this by getting multiple Steam Daily Deal spots for LoK during Early Access - smart.

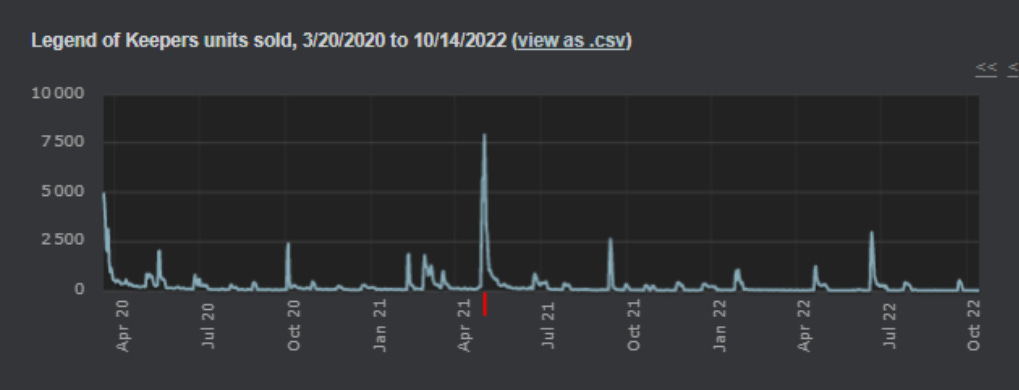

And notably, Legend Of Keepers had a stronger 1.0 launch than many other titles, grossing an additional $564,000 in Week 1 of its ‘full release’ on Steam. (I asked Johann about why that might be, and he noted Valve gave the game a pop-up and carousel ‘push’, and the Switch version launched at the same time, re-igniting interest.)

Here’s the full ‘base units sold’ LTD, with the 1.0 launch (bigger than Early Access!) marked with a red line. You can also see discounts and DLC launches spiking things:

As for things that could have gone better? Johann referenced the lack of better featuring on the Switch version (which I’ve gotta say can be tricky to get anyhow!), perhaps doing less discounts during Early Access, and the difficulty of getting streamers to re-cover the game at EA launch if they played the Prologue.

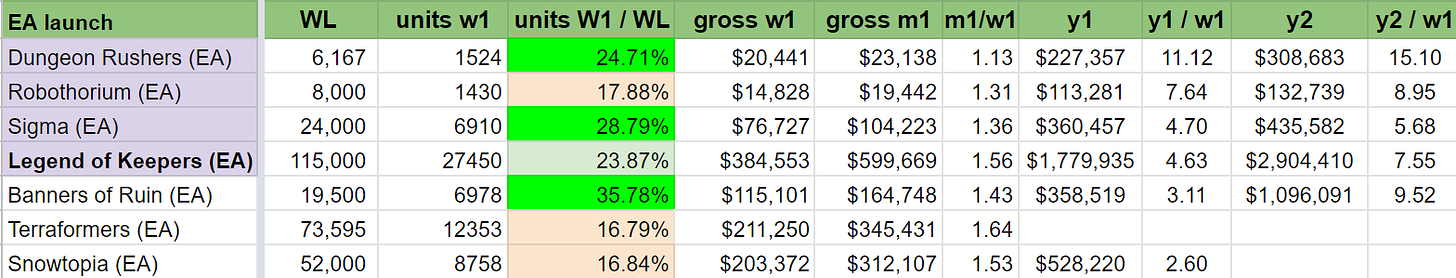

Finally, for you hardcore data freaks, Johann was kind enough to share gross revenue ‘week 1, month 1, year 1’ ratios and totals for not only LoK, but also other Goblinz titles like Banners Of Ruin & Sigma Theory, something we’ve surveyed for before.

Here’s the totals from select Goblinz games that launched in Steam Early Access, so you can peep ‘long tail’ & conversion rates - the header naming should be self-evident:

And here’s the same starting on Day 1 of ‘full launch’ on Steam. Again, headers should be self-evident, except ‘full/EA’ is the revenue in Week 1 of ‘full’ release, divided by revenue in Week 1 of Early Access:

Once again, thanks to Johann for being so transparent. And btw, Goblinz is doing kinda great as a largely PC/strategy focused indie publisher, and we hope to cover their other hit title Hero’s Hour in the newsletter soon. Onward…

British bulldoggin’: more from Microsoft x ATVI?

Listen - I really, really didn’t want to talk about Microsoft buying Activision Blizzard & antitrust issues in this newsletter. You’re probably almost as fed up with it as I am. But it requires its own section - yet again - because of the following reveals:

The UK’s Competition & Markets Authority - the same folks giving Microsoft a hard time over the MS x ATVI acquisition & its effects on cloud gaming & the ‘multi-game subscription market’, is forcing Meta to sell Giphy, saying it would “limit choice for UK social media users and reduce innovation in UK display advertising.”

This type of precedent - and an aggressive list of complaints from the CMA - has sent Xbox HQ into an obvious tizzy. (Some say Phil Spencer is now single-handedly resurrecting tourism to the UK.) It’s also prompted Microsoft’s new, lengthy, ‘we suck and PlayStation rocks’ written polemic (.PDF) to the CMA.

And there’s some interesting non-redacted data in there. For example, Derek Strickland extrapolated the following MS claim: “Xbox - ~47-50 million MAUs from a 63.7 million installed base (73% - 78% of users engaged) • PlayStation - 106 million MAU from a 151.4 million installed base (70% of users engaged).” (This is only Xbox console MAU, though - not the whole ecosystem, including PC/cloud.)

The Verge also points out Microsoft’s claims in the doc that “Xbox will seek to scale the Xbox Store to mobile, attracting gamers to a new Xbox Mobile Platform” helped by Activision & King games. (And hopefully some other antitrust rulings that will let them do it on iOS - because it ain’t happening on there otherwise.)

There’s some other notable things that come out in this latest rebuttal - for example the fact that: “The [existing] agreement between Activision Blizzard & Sony includes restrictions on the ability to place Call of Duty titles on Game Pass for a number of years.”

And there’s a lot of interesting semi-lawyerly talking points - Microsoft claims that “multi-game subscriptions are a means of payment – not a market”, so the CMA can’t possibly rule against them, based on that. (It’s always about market definitions, folks.)

Anyhow, you too can read Microsoft’s .PDF and its plaintive susurration that “Microsoft was disappointed that it was not offered the opportunity to explain these points to the CMA in detail” before the CMA’s initial comments. And know that Sony’s frontal assault on government entities to lobby against this deal is not… going unanswered?

The game discovery news round-up..

So that was a lot, and now we have to finish off the free newsletters for this week in style. Let’s spread our wings and soar effortlessly through this set of links, then:

Steam has changed the wording of its regional suggested pricing page to note that, yes, it’s not as simple as exchange rate, and “purchasing-power parity and consumer price indexes” are part of their calculus. But they have a new “commitment to refresh these price suggestions on a much more regular cadence, so that we're keeping pace with economic changes over time.” So… expect specific $ changes soon?

Big modding-related news from The Sims, which “is collaborating with Overwolf’s platform, CurseForge… to offer custom content creators and modders a moderated, curated space to share their creations with The Sims 4 community.” It’s optional, and the name branding crossover is funny to me (‘lovely cozy Sims creators, time for you to go make your mods on CURSE FORGE’), but UGC continues marching on.

Gigantic ad agency Dentsu has a report on how different generations interact with games (GameDevReports synopsis), inc. some neat art & data: “Generation Z: 37% is playing daily; 47% - weekly. Millennials: 34% is playing daily; 49% - weekly. Generation X: 33% is playing daily; 45% - weekly. 35% of Baby Boomers is playing daily, and 39% - weekly.”

Microlinks: Microsoft has reportedly laid off around 1000 employees, including Xbox staff; the latest deluxe PlayStation 5 wireless controller costs $200, for some reason; YouTube is introducing ‘handles’, “a new way for people to easily find and engage with creators and each other on YouTube.”

We’ve talked in recent Friday Plus-exclusive newsletters about the success of Dome Keeper, and now How To Market A Game has an excellent ‘how they did that’ article and a follow-up ‘some other ways they did that’ article. Lots of handy lessons here, in these feral times of 200+ new games a week…

Judging by UK hardware sales, supply chains are loosening up a bit for consoles: “Sales of games consoles surged by 41% during September. GfK panel data shows that over 176,000 machines were sold. PS5 remained the best-selling console, with sales up 9% over August… Xbox Series X and S.. saw a significant 104% jump in sales [MoM],” But YTD console sales still down 35.5% in the UK!

Gigantic consulting firm Bain has a ‘future of games is bright’ showcase with plenty of interesting trend data (including the above graph!), and this claim: “Though gamers have historically trended younger, our data suggests fewer gamers are aging out. This change will likely be supported as gaming becomes the foundation for other media and nonmedia experiences.”

Oh yes, more Netflix stuff. Firstly, the company’s latest shareholder letter (.PDF) talks about games: “With 55 more games in development, including more games based on Netflix IP, we’re focused in the next few years on creating hit games that will take our game initiative to the next level. More generally, we see a big opportunity around content that crosses between TV or film and games.”

Secondly, Netflix’s Mike Verdu turned up at TechCrunch Disrupt and had some interesting things to say: firstly, that Netflix is “seriously exploring a cloud gaming offering… It’s a value add, we’re not asking you to subscribe as a console replacement.” And secondly, the announcement of a new internal Netflix studio in Southern California, led by former Overwatch exec producer Chacko Sonny.

Final microlinks: only PC players need a registered phone number for Modern Warfare 2; Russian government collides with reality, rejects plans to fund a 'national game engine'; Xbox doing sterling work with its latest accessibility showcase.

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]