Just how big have PC & console game catalogs got?

Publikováno: 8.1.2024

Also: lots of discovery news, from Apple Vision Pro to Fortnite's first-party games.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the second week - and first full work week - of 2024, my comrades in video game discovery. Hope you’re settling back to work with a sense of serenity for what is likely to be another interesting, but complex year for PC/console video games.

BTW, want to know what the big new Steam games for Q1 2024 may end up being? If you’re a GameDiscoverCo Plus subscriber - or want to sign up now for our paid service - you’d have access to last Friday’s sub-only newsletter on that precise subject.

How big has Steam’s catalog got & to what effect?

You may have seen some headlines recently that over 14,000 new Steam games were released in 2023 - that’s 38 new games per day! Which sounds overwhelming, and to some extent is - tho lots of these are more casual ‘hobby projects’, of course.

But as we’ve discussed at length before, supply and demand matter. Example: in the U.S., the final episode of ‘sitcom about nothing’ Seinfeld had 76 million viewers, back in 1998. Why? Epochally great show, but low supply of content (a few TV channels, no online video) & high demand for TV. Those concentrated viewer numbers? They no longer exist.

And, just as the choice of visual media has exploded - also to include easier on-demand watching and YouTube and TikTok - the cumulative choice of PC and console games has gone through the roof, leading to different dynamics. So why does that matter - especially the ‘cumulative’ bit?

Well, if you released a game on Steam in 2016, there were somewhere between 3,000 and 6,000 other titles to duel with. At the end of 2023, it’s much closer to 80,000 titles, within the very same interface - and more demand, but not 15x the player demand. (Also: you’re competing with older, much-updated games in the same genre.)

In practical terms, what does this mean? We believe there’s two things:

A marginally increasing amount of new hits, but coming from all development budget sizes: you’ll see micro-budgeted hits at lower price points & ‘professionally funded’ games - of which there are drastically more - having worse median revenue. (We don’t have good ‘real’ data on the latter - though on the former, Valve showed ‘>$10k in 2 weeks’ games increased in frequency, up to 2020.)

More reliance on discounting back catalog, but ‘revenue per title’ decreasing: as an example: ‘a major indie game publisher’ had - GameDiscoverCo estimates - nearly 40 'catalog' games on Steam in 2020, at an average gross of ~$1 million each for that year. But in 2023 it had 70 ‘catalog’ (not released that year) games, at a <$600k average. So: overall ‘catalog’ revenue was up 10%, across 75% more games.

These are the macro-trends we’re seeing. And we think the ‘cumulative games on platform’ point is still massively underdiscussed, btw. But luckily, GamesIndustry.biz just asked us for our 2024 predictions, which tie in to this very point.

So quoting liberally from, uh, ourselves: “Players are often happy to buy discounted games or less expensive micro-indie hits like Vampire Survivors or Lethal Company rather than a new game for $20-$30 (or more). And many consumers play a main games-as-a-service title (free-to-play or paid). They're less motivated to change it for another, unless they can bring their friends along.

The good news for those doing this in 2024: graphical fidelity and company size may not predicate success, so tiny teams can have massive success making a game anywhere in the world. The bad news? You're competing against thousands of those tiny teams, and 'long tail' revenue is being affected by the sheer amount of titles on the market. And that'll be 'the new normal,' in 2024, 2025, and beyond.”

How about console catalog size trends over time?

So far, so ‘good’. But you see less discussion of exact catalog size on game consoles, partly because it’s more difficult to assemble. Luckily, in the course of our research, we’ve managed to build up robust catalog sizing for Switch, PlayStation, and Xbox.

Firstly, as you can see (above), Nintendo Switch’s lower barrier to entry and ‘small indie’-friendliness has made it a favored place to port smaller titles, and led to 2,600 games getting added in 2023, for a total of over 11,500 Switch games.

(If you released a game in the very same eShop in 2018, you had somewhere between 500 and 1,500 games to compete with - which explains why devs who released a Switch game in 2018/2019 were so bullish! >100k full-price unit sales outcomes were common, unlike now, when discounts can be the sole/primary discovery driver.)

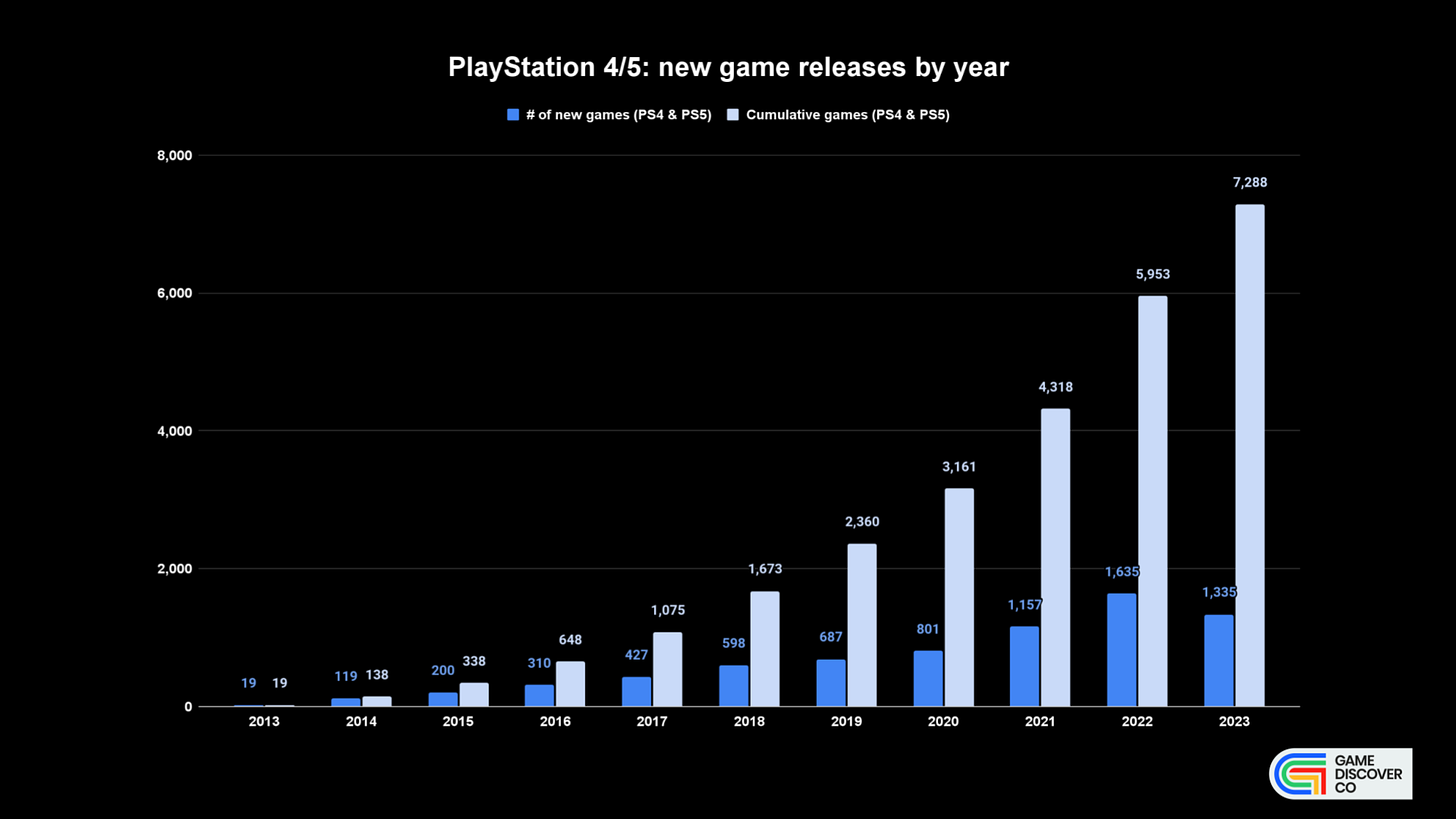

As for PlayStation 4 and 5, according to GameDiscoverCo & GamingAnalytics.info data, the numbers aren’t quite so large, but have very similar trending, with >1,300 PlayStation games added in 2023, for a total of over 7,000 titles.

2023’s 1,300+ new releases are actually down somewhat from 2022’s 1,600+, and we think this is due to Sony cracking down on new PlayStation ‘Trophy shovelware’, where gamified players would get Trophy achievements from playing simple, cheap titles. (Here’s the dev announcement Sony made at the time.)

Finally, it’s a similar story on a lesser scale for Xbox One/Series titles, which have gradually scaled, adding about 950 games in 2023, for a total of nearly 6,000 titles on the Xbox hardware platform, ignoring PC Game Pass & PC ecosystem games from Microsoft. (This is about 5x the number of games available in 2018.)

Obviously, with the Xbox OS’ dashboard focus on Xbox Game Pass, which has more than 400 key titles in it, including a lot of great Day 1 games, it can still feel like it’s difficult to break out if you’re selling your game standalone.

But we’ve heard Xbox can actually sell marginally better than PlayStation for some indie-style titles not on Game Pass. Still, we’re talking <5,000 to 15,000 units for the vast majority. And on the higher end of AAA hits, PlayStation absolutely outsells Xbox handily, especially for franchises with international reach like Resident Evil.

Anyhow, let’s finish this off with a look at these cumulative numbers - at least from 2013 onwards - in one handy graph. You can see Steam is way ‘ahead’ of the others on sheer choice. But the scaling is still significant & real in all four cases.

And one thing we should re-reference in closing: the way the industry got around this (intentionally or not!) in the past was to launch new, incompatible hardware. How so? When the Nintendo 64 came out, your Super Nintendo was a legacy device, and you started buying games again, from scratch, often even in the same genres.

Now that game hardware is sufficiently sophisticated, software delivery is digital, and backwards compatibility is much more possible, we don’t think this is happening any more* (*Unless Switch 2 does something really wacky!) And your new game is often competing with your previous game in the same genre - which may be on sale cheap.

So this permanent change requires us to permanently change our thinking about how games are funded and sold. Will there still be lots of profitable and big hit games every year? Absolutely. But the ‘no-reset’ console/PC generation shifts the kind of full-priced games that players want to pick up. And like you, we’re pondering how.

The game discovery news round-up…

Continuing this fine Monday, we do have a few game platform and discovery news tidbits to show you after that extended holiday. And here they are:

Sony’s official highlights reel of upcoming PlayStation 5 games for 2024(above) is worth checking, featuring big hitters (Final Fantasy VII Rebirth, Team Ninja’s Rise Of The Ronin) alongside titles you might not have spotted (South Korean-dev first-party ARPG Stellar Blade) & notable remakes (Bloober Team’s update of Silent Hill 2.)

Late breaking news: Apple’s Vision Pro mixed-reality headset will be available in the U.S. on February 2nd for $3,500, and besides advertising ‘play Apple Arcade on a virtual screen’ as an option, “new spatial games, including Game Room, What the Golf?, and Super Fruit Ninja… transform the space around players, offering unique and engaging gameplay experiences.”

As we spotted on Friday: “Steam just added 'Boomer Shooter' as an official tag (OK boomer!).” Steam adding official tags is relatively rare - only five were added in 2023, with Extraction Shooter being the only major one. And the phrase ‘boomer shooter’maybe came from a 4chan meme & only indirectly references ‘boomers’?

Boy, there’s a lot of good games coming out in 2024, and we found this Eurogamer round-up of the most-anticipated to be pretty helpful. The picks range from the obvious (Hades 2, The Last Of Us Pt. 2 Remastered), to the less so (The Mermaid’s Tongue, Flock), and there’s also a ‘games probably not coming out in 2024 but you never know’ section, inc. Wolverine, Dragon Age: Dreadwolf, and Metroid Prime 4.

Since it’s >a month after the launch of Fortnite’s ‘Big Bang’, let’s check back in on CCU (concurrents!) for its first-party modes: yesterday, its OG modes were doing good (Battle Royale: 655k CCU; Zero Build Battle Royale: 559k CCU; Ranked Battle Royale: 362k CCU), but the newcomers were fading a bit (LEGO Fortnite 153k CCU; Rocket Racing 63k CCU between its two modes; Fortnite Festival 50k CCU.)

GameDiscoverCo’s very own Mor noted that: “Steam just reached a new top CCU peak for the platform” on Sunday, Jan 7th at about 2.30pm UTC, “with 33,675,229 connected users (previous CCU peak was 33,598,520 users).” Of those: “10.6 million users were playing a game.”

Xbox is coming out firing in 2024 on Game Pass, with some big older AAA-ish games (Assassin’s Creed Valhalla, Resident Evil 2, Hell Let Loose) making it to the service. There’s grumbles that epic Atlus RPGs (Persona 4 Golden, Persona 3 Portable) are leaving - but Persona 3 Reload is arriving on GP next month to make up for it!

The Install Base crew clocked that PlayStation has a map showing most popular games per country by hours played on PS4/PS5 in 2023 - lotsa Fortnite, FIFA 2023, GTA V and CoD in there. (GameDiscoverCo’s current PlayStation global Top 5 by DAU? Fortnite, EA Sports FC 24, Call Of Duty: MW II/III, GTA V, Roblox.)

As summarized by The Verge: “Netflix is reportedly considering putting ads into its free games -but it would only be for those subscribed to Netflix’s ad-supported plan, according to a report from the WSJ… [they’ve also] tossed around the idea of adding in-app purchases to games and charging extra for its more ‘sophisticated’ titles.”

AppMagic & MobileGamer.biz rounded up the top-grossing mobile games of 2023 and the top-grossing mobile publishers of 2023, and Tencent is #1 publisher, “followed by NetEase and Playrix for the fourth year running. Mihoyo and King remain in fourth and fifth, while Monopoly Go and Royal Match’s rampant success saw Scopely up 14 places to sixth and Dream Games up 22 spots to ninth.”

Follow-up on our recent localization piece: a French journalist contacted us to point out that French (and other languages!) use more characters than English. So you have to be ultra-careful that translations of Steam capsule text don’t ditch key features. (He found a game that dropped ‘procedural generation’ in translation!)

Finally, you may be aware that there’s a real Nintendo PlayStation out there - “the final collaboration between Nintendo and Sony before their plans for a Super Nintendo CD-ROM system fell apart over licensing deals.” Well, YouTuber ‘James Channel’ decided to hack together, uh, a much more unholy version of the idea. Seriously, just check it out:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]