Lessons from a disappointing game launch: Spire Of Sorcery

Publikováno: 17.1.2022

Some honest feedback from the dev.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Salutations and felicitations, my kind subjects. Welcome back to the kingdom of ‘learning things about video game discovery in textual form’. And thanks for the feedback on the Project Zomboid success story piece - always nice to see local lads made good, etc.

We’re switching things up for this newsletter, because… it’s always good to see when things go well. But we also need continued honesty and transparency when things don’t go as great as we all hoped. And we have a special guest in to help us with that…

[ALERT: only 12 hours left for our 20% off yearly subs deal on the GameDiscoverCo Plus subscription. Lots of extra perks (newsletters, data, Discord, etc) & one new subscriber gets a lifetime (paid) subscription for free. If you missed it, we’ll have another deal in early Feb.]

Spire Of Sorcery: analyzing a disappointing launch

So, we’ve been chatting to Sergei Klimov, head of studio at Charlie Oscar recently, since we’re planning to run something soon on their search for a publisher for Gremlins Inc. 2, the sequel to their popular multiplayer PC ‘digital strategy board game’ (>5,000 Steam reviews since 2015).

And we got to talking about Spire Of Sorcery, a ‘turn-based party RPG with deck mechanics’ which Charlie Oscar launched into Steam Early Access in October 2021, and.. really hasn’t gone as planned. Having 80,000 Steam wishlists on launch and then selling less than 1,500 copies in launch week, as Sergei notes below, is… no bueno.

In fact, in GameDiscoverCo Plus’ post-release charts for that month, Spire Of Sorcery was an outlier, ranking 71 out of 71 games (with >500 Hype points) for our ‘Hype To Reality’ ratio & ending up with a 0.01 score. (The HTR score calculates a game’s performance vs. pre-release expectations - median is roughly 0.15 for non-tiny games.)

But to his credit, the very practical and honest Sergei has worked through the Kubler-Ross model about this turn of events. And he’s written up for us what his team believes went wrong, with lots of specific takeaways for all. So… take it away, Sergei:

Intro: Gremlins Inc. & the itch to do something else

“We shipped Gremlins, Inc. in 2015 in Steam Early Access, a full release in 2016 and intensive development throughout 2016 and 2017. By the end of 2017, everyone was tired of steampunk and multiplayer, and we had an itch to make our next game something very different.

We know a lot of dev teams who did the same thing, and on reflection it seems like a Bad Idea. Following a successful multiplayer-centric board game, we went for a single-player indirect control strategy. That was pretty stupid in a number of ways:

different genre

different profile

a much longer dev process

Our advice to others would be to compound on the success of your existing game, making what’s strong even stronger. Ideally you will bring in an external advisor/someone who can think as an investor. And we bet they would say “hey, use your advantages to get more successful!” rather than “oh sure, change the platform, format and genre, it will be fun!!”.

The success bias & (lack of) prototype

We spent a good year with the paper prototype of Gremlins, Inc. before we went into production, but we completely forgot about it.

When we started the production of Spire of Sorcery, we felt we had “the touch” - we just needed to produce the game and ship it. Prototyping is for people who couldn’t make their first game work! That success bias alone cost us 2 years of development.

Our basic advice to avoid this would be to talk to other developers… but the thing is, we did that. It’s just that when you’re successful with one game, you tend to ignore all the comments that you don’t like, even if you get the good ones.

So a more solid advice would be to – regardless of whether you need it or not – pitch the second game to a publisher/investor. These people, being asked to give money, will ask all the same questions, but you won’t be able to wave them off!

Essentially, if you’d have asked me in 2018 about the gameplay of Spire of Sorcery, I would only give you either a description of the world, or a list of features, but not the actual core loop and flow. And anyone giving me money would have stopped right there and demanded a properly structured vertical slice or GDD.

A paid Beta on Steam?

By the end of 2019, we wanted to get the game into the hands of our players. The advice from Subset Games to engage your players as early as you can is truly great!

However, Steam didn’t have the current “keyless play test” feature back then. So we considered either a) sending out keys (like on Gremlins, Inc.) – but only 50% of recipients activated them, and only 10% provided meaningful feedback – or b) releasing as a paid Beta in Early Access as an unlisted page, which is what some studios did at that time. (You cannot find the game on Steam, but if you have the URL, it shows up and you can buy it.)

The latter is what we ended up doing. And looking back, our advice to others is not to do this. On the good side, we got 2.000 very engaged players who paid €20 to access the beta. It was a very valuable audience, filtered by preference and validated by purchase!

On the bad side, you may run into problems during beta, and may need to change the game significantly. And if you do this… some of the early adopters will get very angry with you.

No amount of disclosures (“this game may change”, “please refund if you’re trying to buy a finished product”, etc.) will help here. Just don’t risk, because if you will need to change core features, you’ll be ‘between two apps’.

So, about ‘between two apps’?

We still have to meet someone who succeeded in transitioning between two apps that are different versions of the same game.

There’s enough cases, actually, once you start looking, of games that didn’t work in EA, and got canned, with the developer opening a new version of the game as a new app. In all of these cases, there’s a bit of an angry mob coming at the team “BUT YOU PROMISED US ANOTHER GAAAAAAAAME!!!”

Generally, we think you should take money only when the game is set on its course. Early, sure. Super early, sure. But if your core loop is still evolving… or might need to change… God save you from running two apps.

Some memories are short…

Time is a subjective matter, and that’s evident when you talk to some players. We all, I’m sure, know games that were announced in 2019, where players say “they’ve been in development for 10 years!!”

After our unlisted beta on Steam at the end of 2019, we announced that we changed the concept in 2020, and then spent the whole of 2021 building the new version. To us, it was a super-intensive sprint for 12 months, with weekly builds and weekly dev updates.

This did not prevent some people in the community saying “this is unexpected” (despite detailed explanations), “this is surprising” (despite 30 dev diaries) and, the best, writing in 2021 that “I played a different game just a couple of months ago” – referring to the build from 2 years (!) earlier.

Our advice here is same as the advice from many other studios: only announce the sequels, because there early exposure provides feedback via detailed expectations. But for an experimental game, each year that you develop it in public is 3x years in the minds of some of the players. So when you ship after, say, 2 years, they would think “ah, this is a game that was baked for 6 years, must be HUGE!!”.

Releasing without an interactive tutorial!

We did this with Gremlins, Inc. and we took some harsh criticism, and built the interactive tutorial post-release, back in 2015.

We forgot about it by 2021 (same dev team! 1:1!) and shipped Spire of Sorcery also without an interactive tutorial, and again we took harsh criticism, and added it with the first big update.

Advice: do not, I repeat, DO NOT ship games in Early Access without an interactive tutorial.

Early Access launch with tech bugs?

We kept developing the launch build of Spire Of Sorcery until 12 hours before release. As it happens, we shipped the game with some tech bugs. Even though we fixed them in 48 hours, we caught a number of refunds and bad reviews just based on that (“cannot complete the game”).

Advice: if you can afford it… take a week to fix game-breaking bugs before you ship. Though in some cases, this advice is like “eat well” to a person who only has yesterday’s sad sandwich at their disposal.

Two games, one release…

We reached Early Access on Spire Of Sorcery with 80.000 wishlists, on the back of pretty huge demand for the unlisted beta back in 2019. You see, in 2018-2019, we ran weekly dev diaries, and commanded quite a lot of attention. In our minds, we were still there. And thus we also shipped at €20, without any discounts.

The reality, though, was that we ‘only’ had 24.000 wishlists from the year of 2021, when the game already had its current concept, and that previous result was for a different concept.

We also didn’t have the time for regular dev communication in the months up to EA release. So when shipping an under-promoted game with 24K wishlists, we actually thought that we were shipping an 80K wishlist highly desirable product. We thought we will sell “at least 10% of wishlists” in Week 1. Our actual sales during launch week: less than 1,500 copies.

Basically, we had “Spire of Sorcery” (2017-2019) and, let’s call it, “The Wild Mages” (2020-2021) games, which were publicly conflated as one game, Spire of Sorcery, which complicated matters on every goddamn level in communication. Should we actually have renamed the game? We don’t have an answer for that, so cannot advise anything to others.

Unbundling the situation

Examining things post-EA release, we ended up with badly mixed reviews (50-60% positive) that were made of 2 groups:

positives from people who discovered the game in 2021 – and who tried the demo before purchasing

negatives from *some* people who bought another concept in 2017-2019, and were Very Unhappy with the change of the core mechanics.

At one point we wanted to see if the owners of unlisted beta were the ones who wrote negative reviews, but it wasn’t the case. Some people wishlisted in 2018, bought the game without checking in 2021, and were very unhappy. And some bought the game in 2019, attached us change the concept, and actually really enjoyed the 2021 edition.

Our action plan: monthly updates addressing the most impactful items, as per community discussions, combined with discount sales that trigger wishlists. We released a big update in November, and another in December. The next one is coming at the end of January.

We added a feedback form to the demo, asking about what people like and what they dislike, to get actual, clear feedback from the source - and it helps a lot. We see that the people who like the concept love the original mechanics. And the people who hate the concept, hate pretty much everything – from UI to art direction and the core flow. And so we’re focusing on making happy players even happier.

With each update, our sales are picking up. And our Steam announcement news posts went from 50 to 100+ thumbs up, which is pretty great when compared to the (still not high) sales.

We think the Mixed review rating impairs the sales, of course, but also works as a sort of a filter: you only buy a 65% rated game when you’ve tried the demo, and liked it, so we’re selling to the audience that is much more likely to enjoy what we produce.

Conclusion: going forward, and our takeaway

We’re currently set to finish the game and ship full release in about 4 to 6 months. As we develop and ship monthly updates, we’re also talking to publishers to see if we can sign up with a partner and access a big bigger budget, plus get an experienced producer to take a look at the game and help us align the priorities.

We think we have a pretty awesome original mechanics on our hands, and a setting and theme (spellcasting) that makes people excited, so we’re on the right path. How soon we reach full release and how much content we can throw in there, right now depends on a bunch of external factors.

Our takeaway for others would be:

try to avoid success bias, by keeping in mind that a lot of dev teams crash with their 2nd game after seeing the 1st succeed.

get someone external, wearing an investor/publisher hat (real or imaginary), to review your new game and ask the hard questions

do not announce your game before your core loop is complete and you enjoy it and are willing to “marry it”.

do not run paid Betas as unlisted apps - use keyless playtest instead. This will save your reviews big-time.

weekly dev diaries work really well, especially in multiple languages; use this tool to build your audience

Generally, if you have a good game in X genre, build what’s strong to become even stronger. AND if so you desire… invent Y in the background, treating it like a new startup, rather than as a guaranteed success.

We think this story will end well, with the game getting its release and all the recent wishlists converting (people play the demo, like demo, and our wishlists keep growing). But the price we paid, and are paying, is so steep that we do not wish this onto anyone else. Having said that, if you showed this article to me in 2018, I’d probably ignore most of the advice. So let me try to focus on just 1 thing:

Treat your new game as if you were invited to invest in it.

What if you handed over the whole concept to another dev team? Would your description, concept and business plan still satisfy your needs to secure your investment? If yes, then probably you’re on the right track!”

Rewind: key data from Tinybuild’s AIM listing doc?

After we covered Devolver’s UK AIM stock market admission document a few weeks ago, with detailed trends on the publisher’s games, people dug it. Then we remembered - wouldn’t Tinybuild have one of these, since they also listed on AIM?

And indeed they do - it’s available on this page and is a honkin’ 159 pages in length. This dates from somewhat before Tinybuild’s March 2021 AIM float, though. So it’s a bit out of date, and therefore probably not sensible to lead a newsletter with it.

But we wanted to alert you all to the fact that it exists (mm, data!), and highlight a couple of interesting things in it:

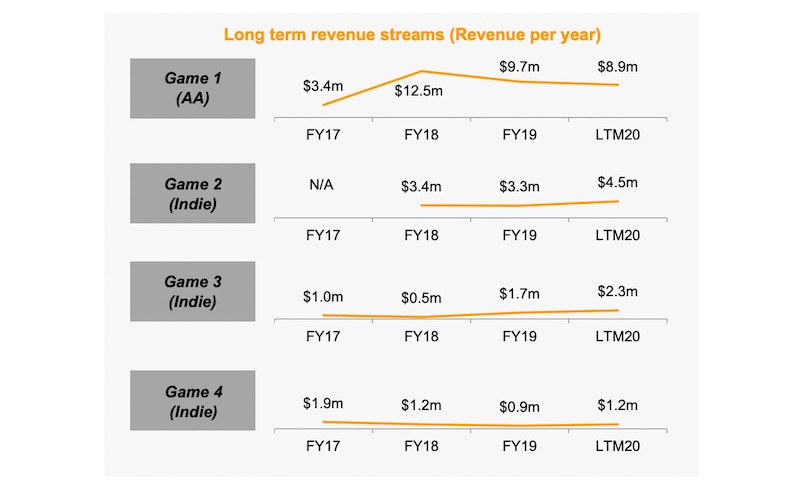

There’s some interesting discussion of “the longevity of titles released in prior years” - see above graph, with some un-named Tinybuild titles with great long tail in gross revenue. (The top one is probably Hello Neighbor, but not sure on the others? LTM is ‘last twelve months’, by the way, and FY is ‘fiscal year’.)

Talking of Hello Neighbor, the document underscores Tinybuild as not wholly reliant on that franchise: “In the six months ended 30 June 2020, revenue generated from non-Hello Neighbor franchise games has increased to more than 60% of total game revenue, and the revenue generated within the… franchise has also become increasingly diverse.”

Looking elsewhere, there’s a few fun tidbits of: Speedrunners has generated $9.4 million and 7 million downloads in its lifetime, and Graveyard Keeper“was one of tinyBuild’s top three for revenue generating titles in both FY18 and FY19, with revenue continuing to grow in the last twelve months, due to DLCs.” Ah, maybe Game 2 above is Graveyard Keeper? It has 20k reviews on Steam now, impressively.

In ‘things that make you go hmm’, Tinybuild is moving aggressively to owned IP: “91.3% of [the upcoming] titles in the Company’s pipeline are own-IP

(65.2% 2nd party IP, 26.1% 1st party IP), versus 27.5% in its released portfolio (12.5% 2nd party IP, 15.0% 1st party IP).” Not sure how I feel about that. unless the studios are working on existing Tinybuild IP, or some great deals happened.

Anyhow, feel free to poke around yourself - pages 22 to 37 are the interesting ones. I also owe you all an update on the weird ‘financialization of the PC/console game’ space trend. (It hasn’t all been wine and roses for the companies I covered in my December 2020 update on the stock market semi-bubble. But it hasn’t sucked for most of them, either!)

The game discovery news round-up..

Finishing things off for today’s newsletter, we have a whole bunch of interesting news - everything that cropped up since last Wednesday - on game discovery and platforms. Let’s poke experimentally at it, shall we?

A few Steam Deck updates from Valve - first consumer units will still be shipping by the end of February, the Steam Deck Verified program for games is in full swing, and “We've been approving another wave of dev kits, and hundreds have been shipped out in the last month (and we're continuing to approve and send out even more).”

We’ve been pretty light on NFT/crypto coverage here, because y’know: *gestures at adjacent sector of Internet currently on fire*. But here’s a couple of things we liked: the New York Times on ‘crypto enthusiasts vs. angry gamers’, and VICE’s Patrick Klepek chatting to some of the people who actually bought Ubisoft’s Ghost Recon Breakpoint NFTs.

Enjoyed this piece on how turn-based card brawler Fights in Tight Spaces (above) survived & thrived in Early Access, thanks to some clear takeaways: “Publish a public roadmap; Put information about the next milestone in-game on the menu screen; Do a full feedback pass after every milestone; Shout out community members when their suggestions were used or bugs fixed.”

Microlinks: discussing 2022’s predictions for mobile games from a platform perspective; GOG has added new ways to browse and filter the 5,500 games in its catalog ; there were more than 1,100 M&A deals totaling at least $85 billion for the game biz in 2021.

Here’s a useful piece - a ‘too honest’ guide to pitching a Kotaku reviewer from Sisi Jiang: “In a pitch email, you are not telling me what your game is. You’re actually selling me on why I should give your game more time than the 5 seconds it took to read the pitch email.” (This is very similar to the ‘does a 5 second GIF of your game make me want to find out more about it?’ game discovery concept, btw.)

Aha, a good Steam tip from Kris from Toge Productions: “Gamedevs! If you are releasing a demo on Steam, be sure to check the ‘Display demo download button as more prominent green box above the list of purchase options’ box.” Though Ivan from HypeTrain Digital commented in our Plus Discord: “having a big green box above your most important CTA (add to wishlist) may be not the best idea.” Also a fair point!

Cloning is discovery-adjacent, since ‘fast-follow’ is a super obvious - and sometimes semi/non-ethical - way to get a headstart on a game. Two new links: Ars Technica has a good piece on the cloning of Wordle and IP law, and secondly, Krafton (PUBG) is going after Garena’s huge Free Fire mobile title - the lawsuit contents get heavy with frying pan comparisons.

Microlinks, Pt.2: the DICE Awards finalists were revealed, led by Ratchet & Clank, Deathloop, Inscryption & It Take Two; more game studios are coming out in favor of the four day work week; very 18+ publisher JAST had its adult visual novel Full Metal Daemon Muramasa rejected by Steam - but GOG did take it, interestingly.

And that’s it for now! We shall return on Wednesday with more (free) newsletter goodness. And thanks - as always - for consuming our fine written information.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]