Paranormal Tales: how did it hit #1 trending on Steam?

Publikováno: 22.11.2022

Also: a look at the state of mobile discovery, and lots more.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to our only newsletter of this week - it’s true, folks. (It’s Thanksgiving week in the U.S., and updates are slow on the ground.) Therefore, we’re deeming this ‘Catch up on your GameDiscoverCo newsletter reading!’ week, and we’ll be back on Monday.

Before we get on - our 33% off dealfor new GameDiscoverCo Plus (monthly or yearly subs!) ends this week. An extra weekly newsletter, Discord, eBooks, full Steam ‘Hype’ and post-release data access? It’s your last chance to get it at this discount in 2022…

How Paranormal Tales’ announcement went good+

So, we at GameDiscoverCo have developed a ‘trending unreleased games on Steam’ algorithm for one of our clients. And the email we sent to them last Sunday had “bodycam-style horror game based on found footage”Paranormal Tales at #1.

That doesn’t necessarily mean it was the ‘top overall wishlist gainer’ for the week. But it does mean that, when we comparatively ranked the ‘Hype’ ranking increases for all 12,500+ unreleased Steam games, it scored the highest.

Which is great, because marketing lead and co-creator of the game Joe Henson just contributed a massive write-up to GameDiscoverCo [Google Doc link] on the unveiling for the game - it got over 70,000 Steam wishlists in its first week on the store.

Here’s some of the key takeaways we got from Joe’s write-up of the game’s debut:

It has a clear hook - horror & bodycam & high-quality game engine: Joe notes that the first-person ‘bodycam’ perspective: “just adds a whole different twist on horror, and it allows room to be really creative. Then there’s [Unreal Engine 5], which is hot right now. Everybody turns their head when UE5 gets mentioned - and a bodycam horror game made in UE5 is like having two hooks in one!”

The trailer does a bunch of smart stuff to help virality: these include the “muffled mic/popping sounds” of bodycam footage, fish-eye visuals, a familiar but eerie setting (“most people have walked their dog in a forest”), and some nods to lost Hideo Kojima horror title P.T.. Specifically the game’s title, Paranormal Tales can be shortened to P.T. (aha!), and the YouTube video’s description says: “My friend and I are making a bodycam style horror game inspired by P.T.”

The devs found their niche & kept ‘em warm - Joe says:“Alongside developing the game, I built a curated list of horror fans. This includes journalists who have previously covered horror games and content creators who cover horror, too. I kept some of these creators and journalists briefly in the loop about the game during those eight months.”

From there, how - specifically - did the game go viral? Walking through some of the major inflection points:

Twitter was a surprisingly big driver: an initial Tweet from the official account went viral after Joe tagged the HorrorVisuals Twitter account, who RT-ed, and then folks such as Siren Head creator Trevor Henderson added momentum. Later Tweets from folks like Jake Lucky also did great, using the messaging “two indie devs, Unreal Engine 5, bodycam horror”, in that order.

Reddit also helped out quite a bit: this r/pcmasterrace post by Joe ended up making it all the way to the front page of Reddit. Joe notes that he was a regular subReddit contributor, so he didn’t look like a flyby promoter, and “the copy for the Reddit post was very natural and actually how I felt (I was very nervous, haha).”

The press were happy to cover, especially after it went viral elsewhere:“Dozens of media sites posted about the game, including IGN, GameSpot, Game Informer, GamesRadar, and more… I purposefully waited and used the Jake Lucky tweet as a reference for how PT was ‘going viral’.”

Joe even picked up a later viral Twitter post with a hashtag: having spotted that #twitchstreamer was trending, he posted something about the game with that hashtag. He managed to pick up a ton of visibility thanks to high-profile streamers - including Lirik, Sodapoppin, Valkyrae, and Jacksepticeye - commenting on and liking the Tweet.

We do think that - for whatever reason - high quality horror games can be an under-served niche, which is helping Paranormal Tales. (Perhaps they can be big with streamers/hype, but not always convert well to sales - which makes established companies nervous to get into them?)

But GameDeveloper.com just ran something about why horror games are so big on Roblox that speaks to the genre being a big deal. And we think the area is just plain undersupplied with longer, more complex titles - with a few exceptions like The Callisto Protocol.

Anyhow, there’s one final thing that Joe said that I really wanted to highlight: “My single most significant piece of advice… don't try to sell a product (your game); instead, try to tell its story - there's a massive difference between the two.”

This doesn’t work for all styles of game, but as Joe notes, for this type of horror title: “I wanted to evoke emotions, leave room for imagination, and let the viewer be so personally invested that they had to find out more!” That’s a very good angle here.

Now the question is going to be - can Joe and his team deliver on the expectations set up by the trailer? But heck - we’d all much rather be in this situation than ‘nobody has noticed my game’, right? (Reminder: Joe’s full write-up for us has more insight.)

The state of mobile game discovery: it’s tricky!

We tend to talk about PC and console game discovery in this newsletter - and not get too far into mobile. Other people are the experts here, like Eric Seufert, whose new article ‘Mapping the post-ATT future of mobile free-to-play gaming’ is a must-read.

As we’ve talked about before, mobile is a ‘dog kill dog’ space where you need super-strong RPD (revenue per download) in order to pay to acquire new users via ads, which historically were tracked down to an individual user level.

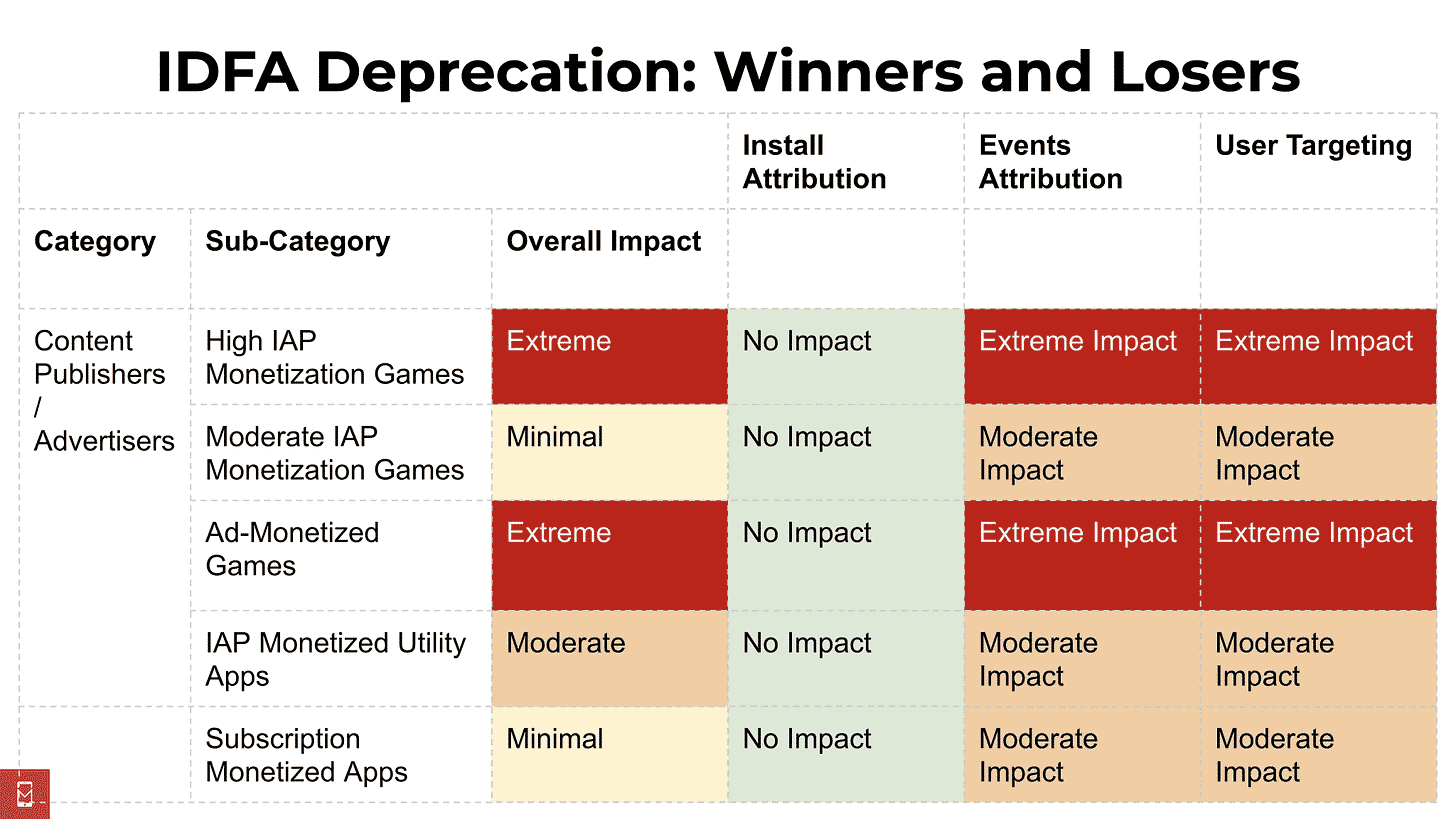

But Apple’s ad changes (via the ATT - app tracking transparency - framework & the removal of the old IDFA tracking) have really changed the game, since “advertising networks can know that a given campaign produced an install, but they won’t know which user generated that install, and they’ll learn very little about subsequent activity in the app after the install.”

So Eric’s ‘what is really going on here?’ article breaks things down neatly, as follows:

There’s three major issues in the mobile games space - they are: “A weak and potentially worsening macroeconomic environment globally; A reversion to pre-COVID engagement norms for consumer technology products; Apple’s App Tracking Transparency (ATT) privacy policy.”

Eric thinks ATT is a big part of the slowdown - larger than some suggest:“I believe — and have made the case, repeatedly — that ATT has established a permanent headwind on all businesses dependent on mobile advertising for growth”, because “users being acquired into games can’t be assumed to be curated or filtered on the basis of past in-game behaviors.”

There are concrete examples of ATT headwinds at work: Seufert notes that Playtika’s social casino mobile game business, which is more difficult to recruit players for post-ATT, dipped in a recent quarter. But its casual games were still on the way up. He thinks “the bifurcation in performance across Playtika’s portfolio is explained by ATT, and not macro forces.”

What does this mean for mobile games? One thing is that, in the absence of historical info on them, “players must be vetted for interest and enthusiasm within the game itself, ideally through early in-game behaviors.” (I wonder if this is why users are getting acquired with such outlandishly catchy but off-topic creatives, recently? Wider net?)

Secondly, a few games such as Marvel Snap are trying for viral organic growth at the expense of monetization, as recently discussed by Ethan Levy. He estimates only a $1 revenue-per-download number so far, about 10% of the monetization rates of some other CCG games that have gacha. (I have no issue with this.)

As Ethan says, “[Marvel] Snap is super friendly and rewarding to players, and wants players to make the game their #1 hobby for years” - but it’s really ‘under-monetizing’ for a game that likely costs $8-$18 for each paid acquisition on mobile. (Can organic acquisitions or increasing $ over time make up for that?)

So - a platform (Apple!) changing its ad tracking to be more privacy-friendly (while ratcheting up its own first-party ads, btw) is continuing to majorly disrupt discovery for mobile games. Games can still be tracked on iOS - it’s just way more complex and confusing. (And please: ping me to write for us, if you think I missed anything.)

The game discovery news round-up..

Finishing up the game discovery and platform news for his week, we have a whole heap of interesting things to share, actually. Here we go:

We ran the rumors a few times, but they’re true - Ubisoft is returning to Steam, initially with Assassin’s Creed Valhalla (out Dec. 6th). But they told Eurogamer they’ll provide “a consistent player ecosystem through Ubisoft Connect", and will be adding titles including Anno 1800 & Roller Champions to Valve’s platform soon.

Signs that Xbox Game Pass is changing the type of games that Microsoft’s internal studios make? Josh Sawyer says that"I never would have proposed making [medieval narrative adventure] Pentiment without Game Pass”, due to its “unusual, niche” nature. (It’s true that ‘prestige’ projects can attract Game Pass subs, tho I wonder how Microsoft is tracking ROI vs. cheaper third-party games.)

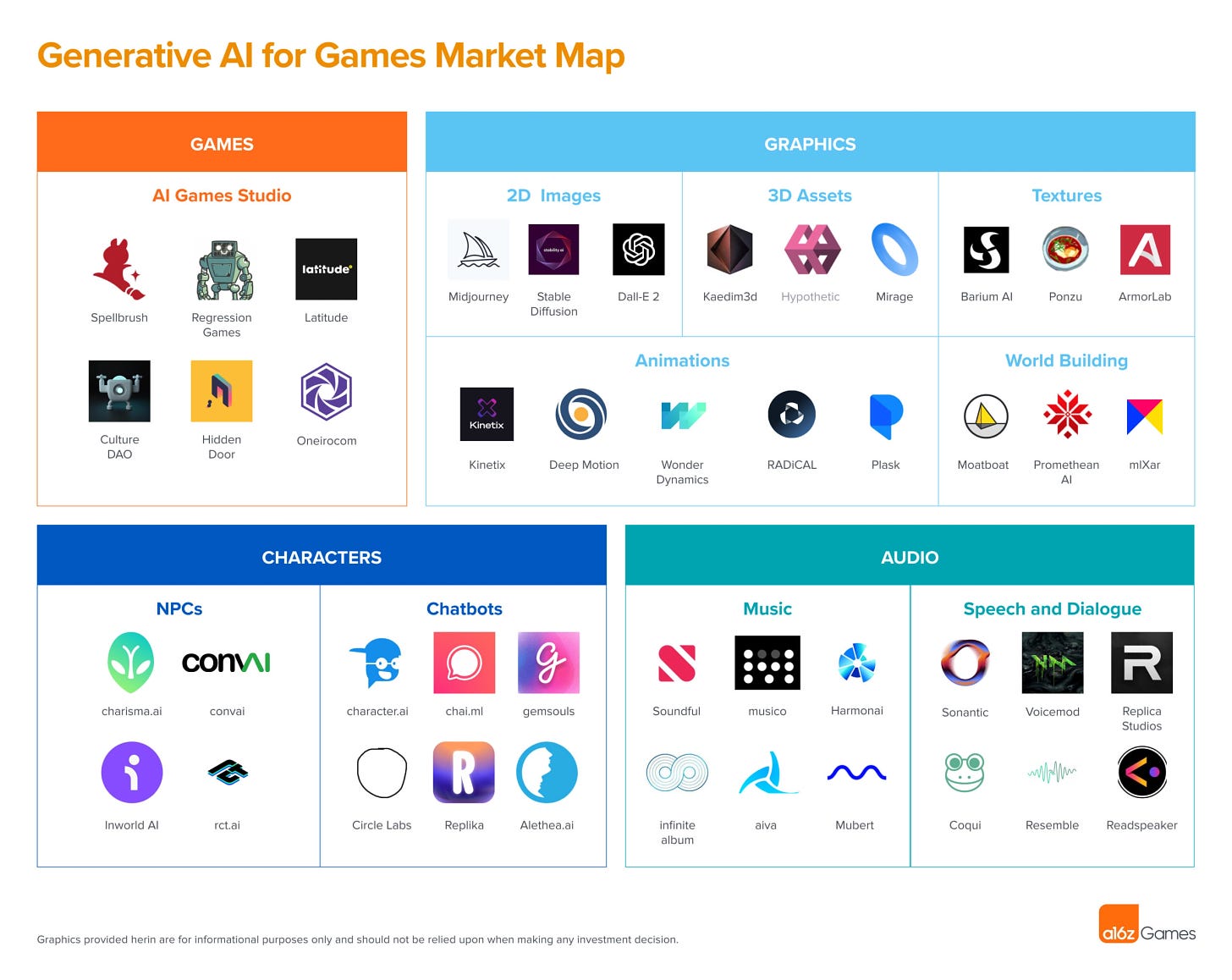

The folks at VC Andreesen Horowitz, including James Gwertzman (ex-PopCap & PlayFab) are hyping up the ‘generative AI revolution in games’ in a new article & white paper. (We think procgen is important in games, and AI sure has a lot of funding/hype, but we’re not yet sure how & if it will be industrialized.)

Somebody has more details on Sony’s edicts regarding PlayStation ‘shovelware’ - or at least - ‘swift Platinum trophy-ware’ which we discussed the other week (story #2!) It includes possible dev penalties, from ‘content is not searchable and can only be accessed via direct link on web and mobile stores’ (interesting!) through ‘content takedown’ and ‘PlayStation Partners account suspension or termination’.

Microlinks: InvestGame is tracking a slowdown in video game M&A in Q3, down 31% year on year by volume; all-in-one VR headset maker Pico may be seeing disappointing sales of the Pico 4; an Indian gaming VC is playing up the Indian game market, now “home to 507 million gamers, of which 24% are paying users.”

Xbox is approving a temporary $50 price cut for Xbox Series S - down to $249 in the U.S. - as it tries to make up an installed base difference with PlayStation consoles worldwide. (Or maybe it doesn’t see it like that any more, since PC and cloud are key parts of the Xbox ecosystem. But you know what we mean…)

Somebody in the European Union likely cattle-prodded Valve with the European Pricing Indication Directive, leading it to change Steam ‘sale cooldown’ times from 28 days to 30 days, starting January 1st, “in order to be aligned with evolving regulatory requirements”.

Xbox microlinks: a big NYT article on Xbox/Activision notes “Microsoft said that on Nov. 11 it offered Sony a 10-year deal to keep Call of Duty on PlayStation”; the less customizable home screen Xbox beta is getting more customizable; Microsoft CEO Satya Nadella says of the ATVI deal: “Our entire goal is to bring more options for gamers to be able to play [on every platform] and for publishers to have more competition.” I guess ‘more competition’ is the opposite of 'anti-competitive’, yes..

The folks at Ampere Analysis have a piece on why Netflix is looking at cloud gaming, suggesting a cloud-only approach isn’t best: “We expect Netflix to adopt [a] value-added [download and streaming combined] approach with its own cloud gaming initiative, and for it initially to be focused on the existing catalogue of mobile games.” And they predict in-game monetization for Netflix’s mobile games eventually.

Microlinks, pt.2: some of Amazon’s recent staff cuts were in the cloud-only Amazon Luna division (see above point!); 70 more games approved by Chinese government for domestic distro, including a Tencent x Metal Slug title; Epic says Google signed a $360 million ‘don’t make a rival App Store’ Activision deal, Activision says “that's false”.

Finally, not only did YouTuber Hbomberguy publish that epic 2-hour video on Roblox’s ‘OOF’ sound, we’ve now found out he was responsible for a fart joke being front & center on federated Twitter competitor Mastodon. Good job, that man:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]