PC game discovery: 5 big trends in 2021

Publikováno: 26.10.2021

We look at the big-picture story for the year so far.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back to a brand-new week in the world of game discovery, folks. As well as follow-up and link round-ups, we’re going to be trying to sum up broader trends for our lead story in this Monday (free) GameDiscoverCo newsletter. Why? We think the world of PC premium game discovery is getting - well - ever more complex.

Before kicking off, wanted to plug our GameDiscoverCo Plus newsletter last Friday, which you can access now as a paid subscriber. It’s filled with charts & analysis, but took on as its lead story something of interest to all of you: why did Daniel Mullins’ & Devolver’s Inscryption blow up to such a big hit on Steam launch last week?

If you don’t have a paid sub, help us out, click the below button, and you can read it too:

The 5 big trends in PC game discovery for 2021

We do - as you’re probably aware - do an awful lots of ‘specific numbers’ newsletters here at GameDiscoverCo. So let’s branch away from that for a second, because we want to do a couple of bigger trend pieces, for console game discovery (next Monday!) and PC game discovery (right now!)

Some disclaimers before we start: We’re biased towards devs and publishers who are intentionally trying to be profitable over time, we’re ‘pessimist realists’, we have a soft spot for indie creators who bootstrap their way to success, and we don’t love the business imperatives & moral compromises around aggressively monetizing IAP in games. So… let’s hit it:

1. ‘PC-like’ games are doing great on PC.

For a while, I felt like devs and publishers were trying to do the ‘this game works just as well on PC and console, and will sell just as well on both’ dance. And this did work for some games: the Overcooked series, for example, or a bunch of PC/Switch crossover hits like Stardew Valley.

And while Chucklefish proved it was still possible with Eastward just recently, these titles feel few and far-between nowadays. And that’s because a lot of recent breakout PC games - from ‘lumberpunk’ building sim Timberborn to alchemist sim Potion Craft and beyond - feel like they were built for the PC market first.

It’s not surprising that the PC market would gravitate towards games with greater depth, more complex controls, and a PC-centric UI. But I do think it’s a bit of a sea change for funders who are trying to calculate the multi-platform return for games. And it potentially aids bootstrapped teams who can launch on PC, see if a game does well, and then target console conversions - UI and controls permitting - later.

2. Steam is still blowing away the competition for PC ‘platform of choice’.

Frankly, at this point I figured Epic Games Store would be more of a competitor than it’s currently proving to be. Or perhaps I thought one of the other stores like GOG or even Kartridge would have stepped up. But all the data I’m seeing is that for most non-AAA, non-F2P titles, Steam is at least 90% of total revenue for ‘regular’ platform sales. (BTW: Itch.io is great for artier, experimental games, short horror titles, game jam titles & so on, but doesn’t monetize more seriously.)

EGS seems to work for much larger, graphically intensive games. But the crossover from Fortnite players to paying EGS ones hasn’t been as strong as most people thought. And while free giveaways and select exclusive launches still do great, simultaneous debuts on Steam and EGS really show Epic as lacking ‘regular buyer’ punch. (I mentioned in Friday’s Plus newsletter that Inscryption chose to debut on Steam and GOG but not on EGS, if that gives you a general idea.)

Obviously, the above may not be your final revenue %s per store. You may juice things by selling Steam keys on Humble (the ‘established’ resale place), or Green Man Gaming or Fanatical (the sharkier ‘big discounts now!’ crowd), or any number of other resale sites. But in many way, that’s still selling access to Steam - just via third parties. And Steam’s continued evolution is keeping it ahead of the competition for now.

3. ‘Long in post-release’ games can monetize better and better

When a player makes a buying decision, it’s not as if he has to pick a game that just came out for the first time last week. And if you look at the top-grossing Steam SKUs worldwide at any given time, you’ll see plenty of titles - we spotted games such as Dead By Daylight and Raft in there - that continue to shine, years after the release.

The issue here is evident: to win a buying decision over Dead By Daylight, if you want to make a 4 vs. 1 horror game? You’re competing with everything Behaviour Interactive made leading up to the game’s 2016 launch, but also the five years worth of post-release content (patches, intriguing DLC, and more.) Not to mention a continued, active user-base as a multiplayer game.

This has completely changed the long-term revenue curve for some games - as I’ve seen first-hand with Descenders. You get influencers constantly playing the game, especially thanks to new patches, paid DLC and levels, and even IAP. They then re-introducing it to a new audience, who play it for the first time… the main adjustment here is a) devs realizing you have to compete with the OGs, and b) choosing subgenres or twists that allow players to feel like it’s a fresh approach, which deserves a new look.

4. Investment is flowing into small/medium games like never before

This shouldn’t be surprising, since post-COVID valuations and investment are skyrocketing throughout the game biz. But I’ve been blown away by the amount of publishers and investors getting into the premium PC/console space in the year or more.

And it’s still a tempting place to invest. There’s a heck of a lot of talented teams and interesting games, & breakout hits without ridiculous amounts of spending are very possible (see: Valheim, Teardown, to name but a few.) And if you can hit it ‘big’ enough with even, say, one in eight games, you can likely still balance your portfolio to profitability - many of the top indie publishers are doing so.

This is great news for devs who want to get their games funded! All this ‘cheap money’ is rattling around, looking for a good place to land. And with the additional wildcard that devs/publishers can themselves land seriously high company valuations on certain public share markets (Sweden, UK, Poland, etc), there’s a tinge of a stock bubble element to his. But it largely seems steeped in genuine attempts to create ROI. (Which I appreciate, if you read my disclaimers.) So… let’s carry on with that?

5. Supply/demand means it’s not enough to make a good game

This, I’m sure, has been true for a while now. But I’m feeling it even more in 2021, especially with Steam regularly launching over 250 games per week, if you’re keeping track via ICO’s Steam newsletter.

Honestly, one of the more heartbreaking parts of getting into consulting in this space has been working with devs and publishers who shipped a perfectly good game, but can’t understand why demand for it hasn’t scaled up. They look at the (positive!) Steam reviews, an existing userbase who is digging the title, and it doesn’t make sense to them.

The answer to this, in part, is in the supply and demand around your game and adjacent titles. As I hinted above, I think there are some ‘displacement genres’ - I would count action RPGs and battle royales among them - where you literally have to get people to stop playing their favorite game, in order to start playing yours. That’s a high bar, and can significantly stunt demand.

And then there are other genres or styles or game where players switch their game of choice, but perhaps less often than you would like. So that’s the biggest question I would try to ask yourself on games nowadays as a dev or publisher: what’s your discovery floor and ceiling, based on the style and promise of the game?

For example, are you making a wonderful, niche game that won’t sell less than 1,000 copies, but will never sell more than 10,000? Or is it more like a ‘swing for the fences’ approach which could sell 750, or could sell 750,000? Balancing these risks and rewards, especially in a crowded market, is the most difficult thing you’re going to do - bearing in mind that no market is predictable, especially not such a creative one as this. But that’s half the fun… right?

Steam Prologues: a helpful (?) follow-up!

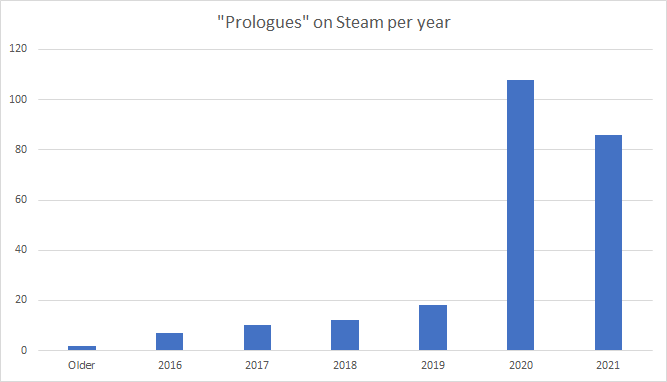

As you may recall, we did a ‘what’s up with Steam prologues?’ newsletter a couple of weeks back. As a result, we got a bunch of extra feedback and comments, and so we thought we should pass them along.

Firstly, you can see Thomas Bidaux’s data-mining above - he says: “In case anyone is wondering, like I was, there are 321 apps on Steam with "Prologue" in their name. About 40+ are not released yet. Here is the rest of them per year of release (of the Prologue app).” He also looked briefly at most common tags, which were more at the ‘genre’ level, so didn’t show much.

On the GameDiscoverCo side, we would speculate there’s another 30%+ (100 or more?) games which use the Prologue concept without using the word Prologue, across the entire history of the trend. But overall, it looks like it got popular in 2020 and has stayed similarly popular for 2021?

Other notable follow-ups are as follows:

A couple of people noted that the audience for free Prologues can sometimes be demographically and geographically quite different to your final audience. This is because of a) cost, and b) Prologues being viewable in the ‘Free To Play’ area if you use that tag/’price’.

On cost, there a definitely younger gamers/players on Steam who are looking for free games, but don’t have large allowances. (Look at New & Trending for ‘Free To Play’ games - multiple Prologues in there!) So making a standalone Prologue may attract more of these because of the entry point, and because it’s a separate app entirely.

On geography, you can get lots of people playing a Prologue from Thailand or Vietnam, for example. But those countries are not - generally - going to be big buyers of a $20 final game. (They would be more likely to consume via microtransactions, perhaps.) So it’s worth looking at country split, and considering how much it will reflect your final game’s revenue split.

There’s a few related worries. And overall, it’s possible to have super successful prologues/demos which are ‘shallow’ and lots of fun, but none of the players really intend to buy at full price - WarriOrb being potentially a good example. But WarriOrb wouldn’t have sold well in any case - the Prologue just gave it a false sense of interest as a full-price game. So… it’s complicated.

Finally, speaking to the ‘improved visibility’ angle on Prologues, Sergei Klimov (Charlie Oscar) pointed out to me on Twitter: “A big reason [to look at both demos and Prologues] is that Demo has app id with an invisible hub. So if you post screenshots, only you can see them, and if you update [the] demo – you cannot notify people who play it. Prologues are a way to avoid this hassle and have direct reach + more visibility.”

So, we don’t really know: Prologues, they’re a minor Steam visibility hack and some degree of discovery enhancement. But they clutter up the store a bit and are sometimes seen or consumed by people who don’t intend to buy your final game. That’s the take.

The game discovery news round-up..

We are, as always, practically scandalized about the volume of interesting news out there. But we’re also scandalized about how we’re going to concatenate it all to fit into the next few paragraphs. But look, we’re going to try - so here we go:

The crew at VGInsights have been delving a little deeper into ‘Steam review to sales’ ratios, using the ‘leaked’ 2018 set of sales numbers using overly exact achievement data. Some interesting stuff if you can keep the language straight: “Bigger, higher budget, better rated games tend to have higher estimation accuracy. They also tend to have lower ratios – a higher proportion of buyers leave a review.”

According to the FT’s Patrick McGee, Apple’s privacy changes are leading to big changes in iOS ads, with Apple "…more than [tripling] market share in the six months after it introduced privacy changes to iPhones that obstructed rivals, including Facebook & Google from targeting ads at consumers... Search Ads now drives 58% of all iOS app installations that can be tied back to paid ads, according to Branch."

Microlinks: a bit fiddly, but you can now play Steam PC games on an Xbox with Nvidia’s GeForce Now, via the Edge web browser; a Reddit claim that Linux players can be helpful at providing useful feedback/bugs - unsure if edge case; the StreamElements ‘state of streaming’ mini-report for September 2021 shows New World making it into the Top 10 (above), which is impressive.

Another handy new Rami Ismail newsletter would be his look at budget viability for small game devs. He doesn’t get deep into things like revenue net/gross, yet he does do a good job of philosophically explaining the issues around budget estimation: “I cannot stress this enough: the risk of your budget being too high [for publisher funding] is far less severe than the risk of your budget being too low.”

We’ve covered the Steam end of this, but Daniel Camilo has a good ‘explainer’ on GI.biz about the Chinese market for international PC, console & mobile games, given current gov restrictions. One thing I didn’t know in here: “if a game is free-to-play and monetized only through ads, at least some major app stores will allow the game to be launched on their platforms [without a gov license].”

You’ve read a lot of breathy prose about ‘the metaverse’, but how about Cow Clicker creator Ian Bogost over at The Atlantic, suggesting simply that ‘The Metaverse Is Bad’? “Real life still seeps through the seams of computers. The executives know that no company, however big, can capture all the world. But there is an alternative: If only the public could be persuaded to abandon atoms for bits, the material for the symbolic, then people would have to lease virtualized renditions of all the things that haven’t yet been pulled online.”

Microlinks, Pt.2: Google is decreasing the platform cut - called ‘service fee’ here, heh - for all Android app/game subscriptions on Google Play from 30% to 15%, starting in January 2022; WB’s Batman: Arkham Knight is the first game to be powered by white-label Google Stadia streaming; in F2P & IAP-land, enjoyed this analysis of Cookie Run: Kingdom’s 10x daily revenue boost, due in part to a voice actor marketing campaign.

We don’t dabble in NFT/blockchain gaming stuff here because it’s not ‘our kind of thing’. But there’s certainly stuff bubbling up, especially with Axie Infinity. Axie links of the day: some real-life merchants prefer payments in Axie’s virtual currency; Dan Olson on the odd wage-slave-iness of Axie; how the Philippine government wants its cut of Axie earnings.

Look, serious reporting from Eurogamer about video games & the climate crisis. Read it, and consider signing up for the Playing 4 The Planet Alliance or otherwise help video games improve the world. As the UN’s Sam Barratt says: “The video gaming industry is the most agile industry in the world and knows how to capture imaginations better than anyone else in the world.” We can make a difference here. (See also: today’s Axios interview with Kristian Segerstrale.)

Microlinks, Pt.3: looks like the Switch OLED is even supply constrained in Japan, if you needed more proof that all consoles are having supply chain issues; Steam’s top releases of September 2021, headed by New World, are out for perusal; Azure PlayFab UGC brings “the same APIs and tools foundational to Minecraft’s User Generated Content platform”to commercial use, though it ain’t cheap, we reckon.

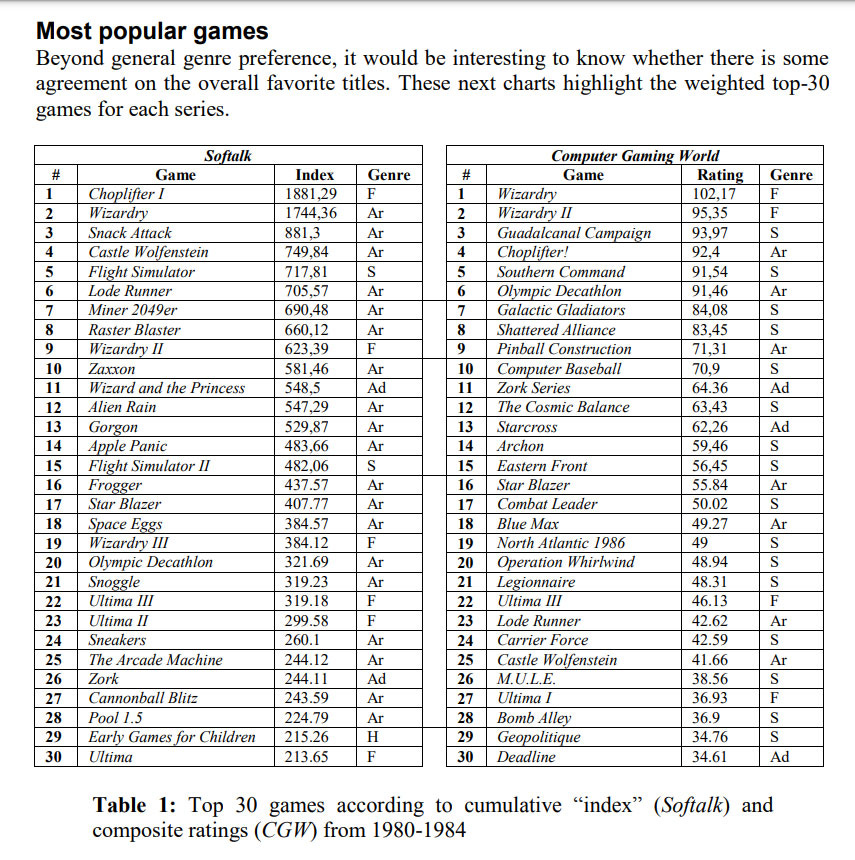

Finally, what were the most popular PC games for the years… 1980 to 1984? Felipe Pepe spotted an academic paper that calculated just that. And here’s the perhaps surprising results:

As he noted, sometimes we forget that the Wizardry franchise was a bigger deal than Ultima back in the day. (Though Wizardry is the only one of those franchises getting somewhat new Steam versions in the year 2021, ironically.)

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]