Pitching to game publishers: lessons from an in-progress deal

Publikováno: 16.2.2022

Some nice transparency from the Gremlins Inc. 2 devs.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

We’re back for your Wednesday newsletter, folks, and we hope you’re having a good one. Recommended listening for this newsletter: this LTJ Bukem drum & bass mix. Recommended drinking? Israel Adesanya presents Tekilla Kiwi Kill Cliff Ignite. (Just kidding, we Googled the most horrible-looking energy drink we could find.)

Our lead story this time out is another guest post from Sergei Klimov, head of studio at Charlie Oscar, following his piece about Spire Of Sorcery’s trials and tribulations. This time, he’s taking an honest look at the in-progress pitch process for their sequel to popular digital strategy board game Gremlins, Inc (5,100 positive Steam reviews!)

[Whoa, only a week left to get the 22% off GameDiscoverCo Plus deal, themed around the ‘2/2/22’ nexus. Perks include an exclusive weekly game trends analysis - next one’s on Friday, an info-filled Discord, a Steam data back-end & a hot game discovery eBook - thx for helping!]

How Gremlins, Inc. 2 approaches publisher pitches

So we've been talking to ±15 publishers/investors about Gremlins, Inc. II over the last couple of months. Here's our experience in a nutshell:

Setting the scene?

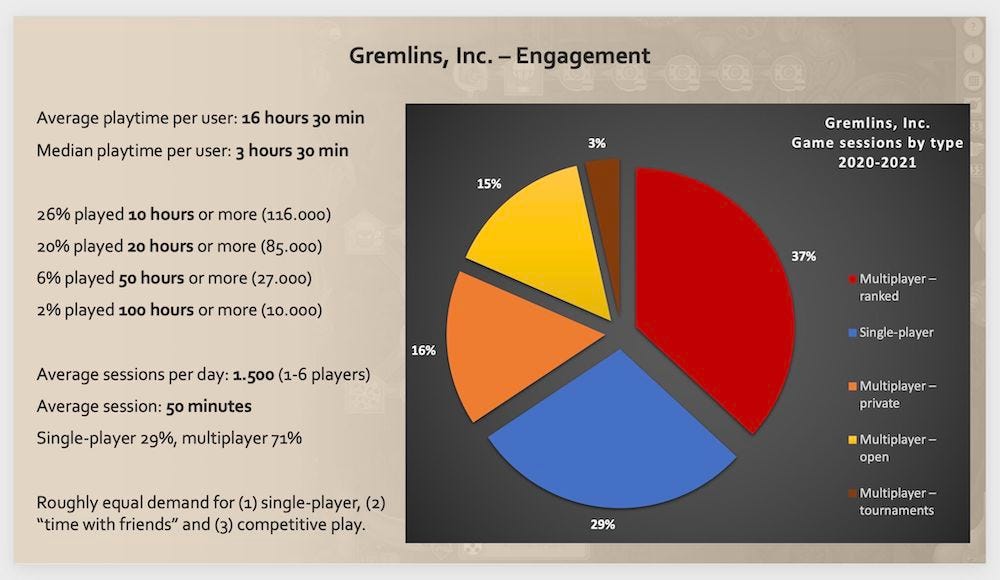

Concept: We're pitching a sequel to a game with an audience of 500k on Steam, that still retains high engagement after 6 years of live ops. This is different from, say, pitching an entirely new concept where much less data will be available. Our deck is thus very stat-heavy.

The concept of the sequel is clear. To test it, we explained it to the community in a Steam announcement in Gremlins Inc. itself, which got more likes than we’d ever had before (1,100+). This was a validation of all the key upgrades we plan for the sequel: peer to peer connection for custom multiplayer sessions, team sessions in ranked mode, cards that can be edited for mods & lots more.

Documents: We're sending around a 35-slide deck featuring stats around G1 (see above), the concept of G2, and a comparative table between G1 & G2 with a roadmap. Sometimes people ask for a "detailed GDD" (game design document). But for us, the GDD is a part of the production cycle.

The game’s development depends on the formats we prioritise, and the model (EA / direct to 1.0; Steam-only / multi-platform on PC / Switch / Xbox; mobile as companion / standalone; etc). If we do a GDD now, we don't need a publisher and expertise, we just need an investor. But if you're raising just the money, having a GDD may help as a proof of "ready to start tomorrow!" pole position.

Budget: We're raising €400k to reach Early Access, another €400k for the year of EA, and €200k for the first 6 months of live ops on the sequel. We don't play any ‘little games’ with inflating the budget and then coming back down, or include a bit of profit in there, or even bank on any meaningful revenue in Early Access (we hope! we aim! but we don't think we can *plan* on that). Just one publisher wanted to pay less than we ask - everyone else was perfectly fine with the numbers.

The part we didn't expect is having publishers ask us about what happens when we *double* the funding. Already 3 companies asked if we can deliver a "bigger everything" with €2M or €5M to spend. While we don't really think spending more pre-EA makes sense, and we're looking for a relationship where we can modify production along the way if it’ll help, it is an interesting point.

So if you folks pitch something for €1M, it makes sense to preempt similar questions with slides that cover "what if we have €2M or €3M to spend?"

What happened during the pitch process?

We improved our ‘ask’: Talking to different companies helped us crystallise our own goals, to the point of creating a "studio/term sheet" deck in addition to a "product deck".

Like the Early Access period helps by mentally processing real player feedback, pitching a game to publishers and investors helps to better understand what you, the studio, really want.

So our ask got clearer: 1. Expertise to help us deliver a better product (a producer!) 2. User acquisition help (ability to find and reach a relevant audience) 3. Budget (money, sometimes also solves for 1.) And crucially, what makes publishers stand apart from investors is the UA expertise/help.

We got deep into product & audience: One of the things that we discovered in our conversations with publishers is that smart publishers always look beyond your product to the audience that it will add to their portfolio. The basic math is that we're raising ±€1M for a product that will ride on the success of the previous game, generating ±€3M+. For investors, this maths is good enough. The sector is hot, the business model is clear, and the risk is moderate.

For publishers, though, there are two questions: does the product align with their existing portfolio? (i.e. how hard will the initial launch be?) and is there a way for the product to expand their existing audience? (i.e. what do we bring to the table, beyond the actual product?)

We found that on the face of it, we're pitching a product – but what's being evaluated is the audience. We have 500k users on Steam, and it pays off to provide a detailed breakdown of reach: 11% of our audience is in Japan, 8% in Russia, 30% in China, etc.

Best case scenario: your product's audience clicks with the publisher’s like two Lego bricks. (For example: the publisher's audience is in U.S./EU, while we deliver a strong Asian following, and everyone's better off.)

We discussed who owns the IP: In our conversations, we had proposals from "you keep the IP, we build a successful release together" to "we only work with studios that hand over their IP", with "we want to have the right to buy the IP from you written into the contract" in the middle.

It feels like decoupling IP from the developer may be driven by the need to add value to a publicly traded company (where shareholders may feel the company grows by owning more IP).

Generally, we felt that the focus on IP early in discussion is a red flag. Funnily enough, it may also give developer an idea that their IP is more valuable on its own than it really is ("it is desirable, thus valuable"). We think the IP is sometimes pursued not as much for its value, as as a way to exert more control in the relationship.

We talked equity - easier than signing a game right now? It may be something very specific to Q1 2022 [and the success of the first Gremlins Inc. game], but in our experience, raising investment for a stake in the studio seems to be much easier than landing a publishing deal.

One reason behind this is probably the source of money. Where companies are public or investor-backed, acquiring a part of the studio immediately translates into growth whereas funding a project is a bet that may or may not work out.

There is a lot of wild money out there! By wild, we mean funding that comes without any synergies, mostly from funds that are just entering the industry. We think of that as a "last resort" option, since then we will still walk alone – just better funded.

How did we evaluate publishers?

We looked at prior experience: We didn't reach out to publishers with whom we had bad prior experience. When we say "bad", it's mostly communication: someone requested 10 keys but didn't activate any, a company changed producers 3 times in a year, and so on.

It doesn't make these companies bad! It just means that specifically for us, trying to successfully hatch a new game with such a level of communication seems impossible. Very often these are fast-growing and/or large companies, pursuing a hit-driven policy in terms of content they release.

We took into account what fellow devs said: When we set out to find a partner, we got a lot of great references. For example, all developers that we know love both Chucklefish and Devolver (maybe they send great Christmas gifts?!), and will refer to them with pleasure. Whenever we got a recommendation like this from a studio we know, we always followed through.

We also got some negative references from dev teams who worked with a particular publisher and chose not to work with them again. We tried to clarify why specifically the developer wouldn't work again with them. In all cases it's been the "lack of": lack of support, lack of staff and lack of faith. Based on that, we did not reach out to those companies.

Why weren’t some deals coming together?

The window of opportunity was missed: Most of the deals that didn't happen after initial discussions didn't happen due to the partners we were interested in being busy with other titles in 2022-2023.

What we loved the most is the approach where a producer on the publisher's side "owns" each product, and is responsible for seeing it grow. However, you cannot clone good producers. Thus, any such team has a hard limit on the number of new projects they can carry at a time.

Our takeaway is that a studio like ours needs to be in touch with these publishers every 6 months, having a "catch up" call. No action points, just sharing plans. The same applies to the potential investors, by the way. You don't wake up on Monday and say "now is the good time to take an investment".

However, like many other dev teams we are simply too focused on the actual production to think of this, and too shy to call people with nothing specific to talk about. This, by the way, seems like the point where agencies may help a lot - by always keeping their ears to the ground on both sides of the industry.

Everyone’s real busy right now: We still have to meet a person in the industry who is not very busy. Where your project resonates, you get more attention, but the general environment is that most people's inboxes are on fire – with so much investment and growth in the industry.

If someone doesn't come back to you, it's not a "No", it's a "I have 5 projects competing for my time" situation. We resorted to weekly reminders, and consider the contact "gone" if nothing moves forward much after a month.

Conclusion: what lens are we looking at these deals from?

As of a few weeks back, we had 4 discussions that are progressing at different speeds. One involves a possible acquisition of the studio, and three are product-focused. We are also considering an application for EU funding as the "5th deal". This was out of 16 approaches we made.

What helps us orient ourselves is understanding the other party's ultimate interest, and whether it aligns with ours. What's our game to this possible partner, really?

If the company is publicly traded, what does the management want? Revenue, profit, sometimes internal strategic goals. Horizon? 2-3 years. If the partner is private, what do they want? Stronger portfolio, profit, sustainable cooperation. The horizon? From 2 to 6 years. Who makes the decision, and who will really get the credit for success or failure of this deal? And will they be still around in 2 years?

Essentially, the deal is about aligning interests at every level:

individuals on the dev team can aim for a great product and profit share.

the studio to aim for long-tail profit via 5-year deal where the release is just a mark on the timeline, and not the final milestone - after which motivation decreases.

the publisher to aim for success through ‘skin in the game’. If shelving your game bears no risk, or if a success is too minor to care about, you are not truly aligned.

As a summary of the whole adventure, we can say this: "It's a quest for finding a partner that adds leverage to your studio - with interests that closely align with your own". Everything else is really just technicalities. You deliver product and communication. They deliver reach and sales, and capital. And you work together as one team!

[Thanks to Sergei for providing this! This piece was adapted from a multi-part series on Charlie Oscar’s LinkedIn page. So feel free to check them out for a few other details we didn’t have space to include - plus new insights.]

Where’s your regional Steam wishlist count? Aha!

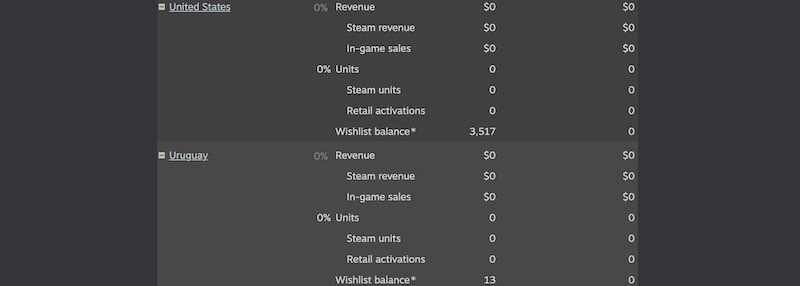

Since we chatted about this in the GameDiscoverCo Plus-exclusive Discord this week, and I realized it’s a super-useful stat which is extremely hidden (for unreleased Steam games), we’re going to run something on regional Steam wishlist count again. Plus a special bonus hack.

Basically: it’s very easy to see your total wishlist numbers for your Steam game in the back end (there’s a whole section called ‘Wishlists’!) But what’s the country breakdown for wishlisters? This may make a difference to you in terms of localization choices or marketing.

This data isn’t actually in the ‘Wishlists’ section, which is why a lot of people miss it - though the Steamworks documentation clearly calls out where it is. But to recap:

Go to the game’s app-specific page in the ‘Partner’ part of Steam’s dev back end - https://partner.steampowered.com/app/details/XXXXXX/ - where XXXXXX is your own app number. (You can’t see this stat for rival games, sorry.)

Select ‘Regional sales report’, which will show 0 sales for all the regions & countries if your game is unreleased. But don’t be dissuaded! Make sure you have ‘All history’ selected.

Then click the little ‘Plus’ button next to each country you want to see wishlist data for. At the very bottom of the country-based data on revenue and units is the region/country-specific wishlist balance.

Now, clicking every single plus button yourself isn’t much fun, eh? Well, Jupiter Moons: Mecha developer Artur Karpinski pointed out a neat way to manipulate the web page to see all the info at the same time:

Bring up your browser’s ‘developer console’ - on Chrome, it’s Option + ⌘ + J (on macOS), or Shift + CTRL + J (on Windows/Linux)

Enter the following code snippet and hit enter: for(var i = 0; i < 500; ++i) { ToggleDetails(i); }

That opens up all the details boxes, and from there, as he noted: “you can copy the data into Excel - it's made with the <table> tag so it [transfers] pretty nicely.” (Just close the dev console, highlight the data you want, and use the copy/paste functions in your OS.)

Anyhow, this obviously works for sales/wishlists on released games too. So if you’re not yet using a third-party tool like IndieBI to easily grab various forms of data, we think this is a handy tip. (Do with it as you will!)

The game discovery news round-up..

OK, finishing up for this week, let’s take a look at what’s been going on in the world of game platforms and discovery since Monday. And summed up in one phrase, it appears to be ‘quite a lot’. Let’s do it:

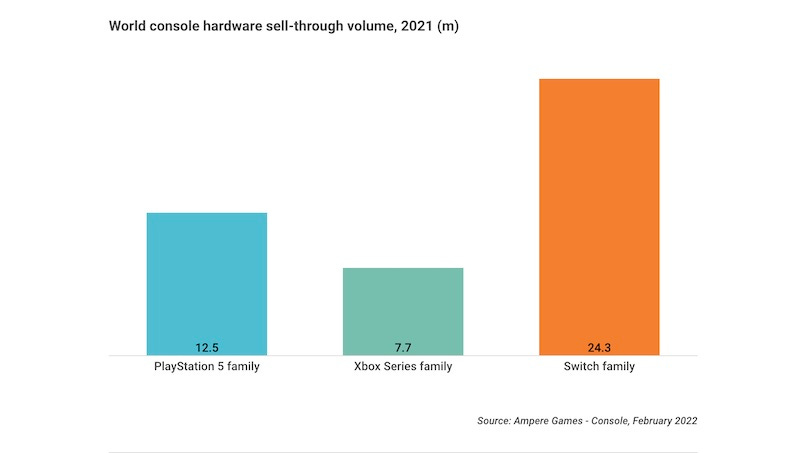

It’s not crystal clear how many ‘current gen’ game consoles were sold in 2021, but Ampere Analysis has done a good job of estimating (above), noting: “volume growth was significantly hampered by weak availability of Sony PlayStation 5, Microsoft Xbox Series X and Nintendo Switch OLED devices during the last two months of [2021].” Interestingly, “the cheaper, less powerful Xbox Series S has experienced much better availability”.

A little more Steam Deck tease for you? iFixIt has a full video and text teardown of Steam’s portable device, including: “The fact that both [thumbsticks] are independently replaceable without soldering is huge.” (Thumbstick ‘drift’ has been an issue on Switch.) In the ‘related disclaimer’ department, Valve said: “iFixit will be one of the authorized sellers of Steam Deck replacement parts – as well as replacement parts for the Valve Index VR products.” Super interesting approach.

Epic has picked up many smaller game & CG tool companies recently. And its new ‘tools for the metaverse’ blog post has a few interesting stats: 500 million Epic Games accounts (an already-known stat?), 40% more Unreal Engine downloads in 2021, 50% more Unreal Marketplace customers. (Unity market share across all games is still dominant, but Unreal’s a clear #2. Epic’s claiming “48% of announced next-gen games are being built on Unreal Engine”, hmm.)

This Friday (Feb. 18th), Itch.io is doing another Bandcamp-inspired ‘we take zero platform cut’ day: “From Midnight to Midnight (Pacific Time) developers will earn 100% of sales minus the usual taxes and fees. This means it’s a better time than ever to support your favorite developers, artists, and writers.” What a wonderful thing to do.

Microlinks: the 3DS and Wii U eShops are closing down in March 2023, so grab those digital games soon-ish; Kelly Wallick (Chairperson for IGF) and Seth Sivak (CEO of Proletariat) have an ‘interesting new ‘Big Questions In Video Games’ podcast; India has banned a bunch more Chinese-affiliated mobile apps/games, including Garena’s big hit Free Fire.

Some good analysis by Axios’ Stephen Totilo into the Horizon Forbidden West launch on PS5/4 and how it’s “a milestone in how different this hardware generation is than any before it.” Specifically: “The old rules: new consoles launch, and their manufacturers soon stop making major games for their predecessors. The new standard: Support for the older devices - even with marquee titles - long into the future.”

So, Reddit can be kinda important to promote your games. But did you know there’s some Reddit-related third party tools (free trial/paid) you can use? Two we saw recently are Postpone and Later For Reddit. Both allow ‘scheduling for the future’ across multiple subReddits, but also add various analytics.

What percentage of your own Steam library is Steam Deck compatible? The catchily named (third-party) Check My Deck tool uses your Steam ID & Valve’s compatibility lists to tell you. (Reminder: SteamDB also has an easy to see ‘Steam Deck Verified flag search’, if you just want to see which games in general.)

Microlinks, Pt.2: the Unity Awards nominations are up, including categories for both games & assets/tutorials; Supercell’s CEO has an interesting/honest update around team size lessons learned - also didn’t realize their mobile games have UGC nowadays; there’s been a 31% rise in VR-related insurance claims in the UK in 2021: “One child smashed two designer figurines – perched on the mantelpiece – when his game demanded a ‘swipe’ move.”

Finally, while we’re not wild about their core ‘social network’ product, it’s been fascinating to see the broad PR push on Meta Quest as a VR platform. This includes a very expensive, ‘hip ad agency’ Superbowl ad. Here’s the full version, if you didn’t spot:

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]