PlayStation VR2: what big launch games, and why?

Publikováno: 1.3.2023

Also: a look at Amazon's current publishing strategy & much more...

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to the latest newsletter, Internet - & thanks to many of you for the feedback about Monday’s ‘Steam key’ newsletter. (We’ll have a follow-up next week, exploring some of the nuances of how Steam keys are used and redeemed in 2023 - fun times!)

Before we get started: we love longform writing about video games, and so need to note that Boss Fight Books has a Kickstarter ending soon for books about Parappa, Animal Crossing, Minesweeper (!) & Day Of The Tentacle? Get backing, y’all…

[Don’t forget: our GameDiscoverCo Plus paid subscription includes our Friday ‘exclusive’ newsletter, exclusive Discord access, a login to our Steam ‘Hype’ & post-release game performance chart back-end, multiple eBooks & more. Support happily welcome…]

PlayStation VR2: which games hit big on launch?

So yes, PlayStation’s $549/€599 advanced PS VR2 headset launched last week, and early adopters have been very keen to get their hands on it. VR capability is a clear differentiator between PlayStation & Xbox, some high-end PS VR2 titles are truly impressive - and ‘next-gen’ console VR is a whole other market entry point.

However - and perhaps unfairly - I compared the PS VR2 to a platypus at DICE last week. What I was trying to say was: the wired hardware’s great, but it does seem like a fascinating but niche object from an ‘alternate universe’, mainstream appeal-wise.

Still, you’ve read some picks for top PS VR2 launch games. But perhaps you might want to know which of them are most bought & downloaded so far? PlayStation.com has charts about that spanning various countries, if youfilter them correctly.

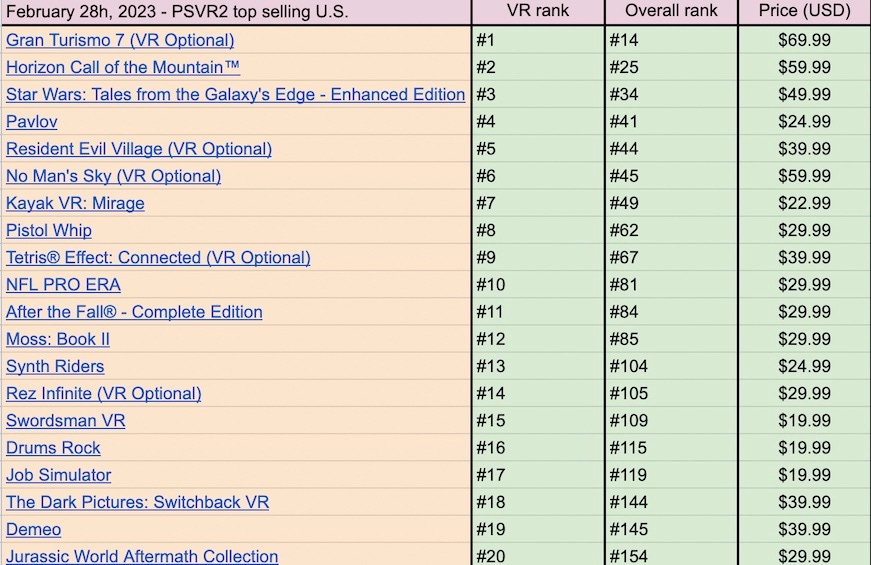

So we made some regional PS VR2 ‘launch week’ game charts(Google Drive doc, three tabs for the U.S., UK and Japan, charts listed for both top sales, plus top downloads, which includes demos & free upgrades.) Extracting the U.S. sales chart, we have:

Here are our major takeaways from the above - and various other - charts:

VR-exclusive top of the heap? Horizon Call Of The Mountain: of course, it’s also available packed-in with one of the two hardware SKUs, but Firesprite & Guerrilla’s PSVR2 exclusive first-party/person exploring & climbing game looks super-impressive in influencer playthroughs.

A few VR-enhanced games are seeing big uptick: the VR mode for the previously VR-bereftGran Turismo 7 is getting many raves. (Even if there are some issues around motion sickness for some.) Also check the impressive PSVR2 mode for Resident Evil Village, for example - and No Man’s Sky’s VR mode.

Some ‘hardcore games’ are doing pretty well: it makes sense given PlayStation’s demographic, but team-based multiplayer VR shooter Pavlov, already a big hit on PC VR with nearly 2 million players, is making a strong start on PS VR2. And rhythm shooter (and free PS VR upgrade) Pistol Whip is also charting.

But there’s still room for chill experiences: this is generally the case in VR! In particular, the gorgeous-lookingKayak VR: Mirage has got a lot of interest, and we also see the spectacularly synaesthetic Tetris Effect: Connected hanging out in the Top 10 VR titles, too.

The ‘top downloads’ chart also includes demos & upgrades: free demos are relatively rare on PlayStation, but American football sim NFL PRO ERA, drum simulator Drums Rock and Owlchemy’s latest Cosmonious High have ‘em, hence being in the Top 5 for overall VR downloads in the U.S. (As seen in the right-hand Google Drive chart.)

Otherwise, one possible player complaint? Most of these games previously appeared on other VR platforms, too. But heck, that’s the way of the world nowadays: long-term platform exclusives don’t make a lot of sense to anyone any more…

BTW, there doesn’t seem to be much regional buyer variation for these games, besides the NFL being big in the U.S. (duh!), and incredibly Japanese, VR-optional rhythm game Kizuna AI: Touch The Beat making the Top 10 in Japan on launch week.

Is this product line a distraction for Sony? Maybe. But it’s a bet on a longer-term future that the company doesn’t want to miss. And virtual reality game devs are happy to adopt another VR platform to have incremental sales wins on.

As for where VR is going? We do think AR (with VR overlay) and next-gen interface will eventually be how everyone goes online and plays games - even if many games get played on an AR-projected screen. But is that in 10 years or 50 years? No clue!

Amazon & games: a positive direction of travel?

Time for a short progress update from a big game/tech platform which is also publisher and creator of content in its own right. (Which is increasingly how it goes, nowadays - most platforms ‘get high on their own supply’.)

Firstly, we know Amazon does a lot of things in games. There’s Twitch, there’s Prime Gaming, there’s cloud service Luna, there’s also - of course - third-party physical hardware & game sales on Amazon itself. (And AWS for Games, and more…)

But its Amazon Games publishing arm has been - shall we say - ‘on a journey’ for a few years now. And VentureBeat’s Dean Takahashi interviewed Amazon Games’ head of marketing Sarah Anderson in-depth at DICE last week. Here’s what we took away:

Amazon’s dev/publishing effort didn’t quite gel before - as Dean says: “A decade ago, it formed Amazon Games. It made some big bets, hired a lot of game veterans as studio leaders and built a lot of teams... then it either didn’t launch the games, or they were released and became flops.”

One internal - and one external - MMO have been recent wins: the internal project, New World still has 20k CCUs on Steam most days, and Sarah notes: “Just this past Fall we did a big update… combined with a fresh start with the servers. We were able to get that back to the Steam Top 10.” And “Westernizing and localizing” Smilegate’s Lost Ark (close to 200k CCU!) has been a more major success.

For big IP, Amazon can really harness the rest of its media empire - Anderson notes: “when you look at IP like Tomb Raider… I think that if we can give our fans and community a way to engage with these properties through television and movies… it’s a service to the fans to let them engage with the franchise in a different way.” Plans afoot here, clearly…

Adapting big Asian PC online games to the West is becoming a signature move: Bandai Namco’s Blue Protocol is upcoming later this year, and the deal with NCSoft for Throne And Liberty is clearly a big one. With these deals, you’re taking advantage of other companies’ deep dev knowledge into MMOs - and sometimes a content headstart, if the game launches in Asia first!

Anyhow, it seems like this refocus - under newish Amazon Games uber-boss Christoph Hartmann, who is a 2K veteran - is the right one. Internal studios staffed from scratch - even by veterans - can be super-difficult to build scale and culture from.

And while the company is still working on that, with Amazon studios in Montreal and San Diego still to announce games, there’s that aforementioned deal with Crystal Dynamics for the next major Tomb Raider game, as well as with Glowmade and with Disruptive Games for unannounced, wholly Amazon-published new IP titles.

Actually, Amazon’s publishing strategy reminds me a little of Epic Games Publishing’s plans, in that both companies are focusing on PC and console online multiplayer* titles, and spreading bets across various sizes of project. (*OK, maybe Tomb Raider isn’t so multiplayer. Probably.)

And the main takeaway from the fallow years for Amazon Games? Why have an ‘not invented here’ bias to your business, when you can find external publishing and dev partners who bring a lot of skills/experience to the game? Then your internal studios aren’t taking all the publicity flak, and they can deliver (or not!) in their own time…

The game discovery news round-up..

Starting our link round-up, it’s great to see so many PC devs and publishers contributing to Humble’s Türkiye and Syria Earthquake Relief Bundle (above), which has 100% of the profits going to humanitarian crisis charities. Bravo! Here’s more:

Newly leaked by The Verge, a Meta internal presentation on its VR/AR plans revealed: “Meta has sold nearly 20 million Quest headsets to date.” This is also notable re: Quest engagement: “Sadly, the newer cohorts that are coming in, the people who bought it this last Christmas, they’re just not as into it [as] the ones who bought it early.”

Ampere’s look at 2022 console hardware numbers suggests “the 2022 global console gaming market declined by 7.8%* (constant currency -2.1%) to $56.2bn… The potential for better performance in 2022 was undermined by the lack of availability of PS5 and Xbox Series X… and some major games releases being delayed into 2023 and later.”

A spicy editorial? Yes, titled ‘I was an App Store games editor - that’s how I know Apple doesn’t care about games’: “It seemed to create a whole new games ecosystem by accident, and ever since has presided over it like a contemptuous landlord… today the App Store is a confusing mess, recently made even worse with the addition of ad slots in search, on the front page and even on the product pages themselves.”

The E3 2023 website is up and running. And while there’s no exhibitor list/floor plan, it does showcase how the show is being laid out, with South and Kentia hall (wooo! Kentia Hall!) used for B2C, and West Hall for B2B activities earlier in the June 13th-16th event. (It’s all a bit Gamescom-y in terms of staggered activities.)

If you’re not fed up with the Microsoft x Activision deal - there’s a report that Microsoft may offer the EU & the UK’s CMA a 10-year license to all Activision Blizzard games on Sony platforms, to try to put this deal to bed. (On the other hand, there’s now ‘MS will sell off Xbox if the deal doesn’t go through’ rumors too - ‘silly season’ is officially upon us.)

Did you know that, unlike Steam, Epic Games Store has a policy that excludes both “games with their own launchers” and “VR-only games”, as well as “games that are not localized in English”. (This may not be new, but was just brought to our attention - so FYI.)

The European Union’s Digital Services Act has brought us a new Xbox statistic: apparently around 4 million people access the Xbox console store from the EU every month. (This compares to 6 million going to the Xbox.com store pages, and 33 million accessing Microsoft’s ‘PC app store’.)

What is the future for ‘writing about the culture & biz of video games’ which isn’t, uhh, item collection guides or this newsletter? Luke Winkie takes a look: “The field is in the midst of a brutal, paradoxical contraction. The world’s power brokers are investing desperately in the games industry, but games media is another story entirely.”

Microlinks: for VR/AR headsets in the U.S., retail sales revenue is down 42% YoY for the six months ending January 2023; PC Game Pass is now available (for preview) in an additional 40 countries; checking out a flashy $1,300 Steam Deck competitor which works with SteamOS.

Finally, we love this solution for the Vampire Survivors dev not wanting to be on video, made for an upcoming doc from the ‘game dev documentary’ smarties Noclip:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]