Right subgenre, 'wrong' result: analyzing disappointing game ROI

Publikováno: 6.12.2023

Also: a look at the biggest streamed games of November & lots of news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Well, it’s the middle of the week, and it’s a particularly messy time for layoffs and studio closures in the PC/console game biz - search Google News if you don’t believe us. We cover platforms, but the platform supply/demand squeeze - alongside overinvestment from earlier times, in hindsight, is affecting studios.

We’re not sure there will be light at the end of a tunnel for a while. But we really feel for those affected. And all we can do is talk about and document the trends (which games are launching into the market strong, and why?) and hope it helps.

[PSA: yes, you can support GameDiscoverCo by subscribing to GDCo Plus now. You get full access to a super-detailed Steam data cache for unreleased & released games, weekly PC/console sales research, Discord access, six detailed game discovery eBooks - & lots more.]

Indoorlands: why did this game just do ‘alright’?

Newsletter subscriber Bennet Jeutter from Pixelsplit Games was kind enough to contact us a few weeks back, because he’d posted a one-year ‘Steam 1.0’ postmortem on Twitter/X regarding his team’s game Indoorlands.

The game, which launched in Early Access in July 2021, and went 1.0 in October 2022, is “an indoor park management simulator where you can create your rides and coasters from scratch and freely design your halls.” In our view, that’s a somewhat hot subgenre, with various older games (Planet Coaster, ~2.8m sold*, Parkitect, ~300k sold*, the Rollercoaster Tycoon games) doing well in the space. (*Our estimates, Steam only.)

(BTW, side note - devs, make sure your game descriptions on Steam have the right keywords - either in the description or ‘keywords’ section. Which researching this, we found out Park Beyond doesn’t use the word ‘rollercoaster’ anywhere on Steam! That’s gotta be an SEO fail.)

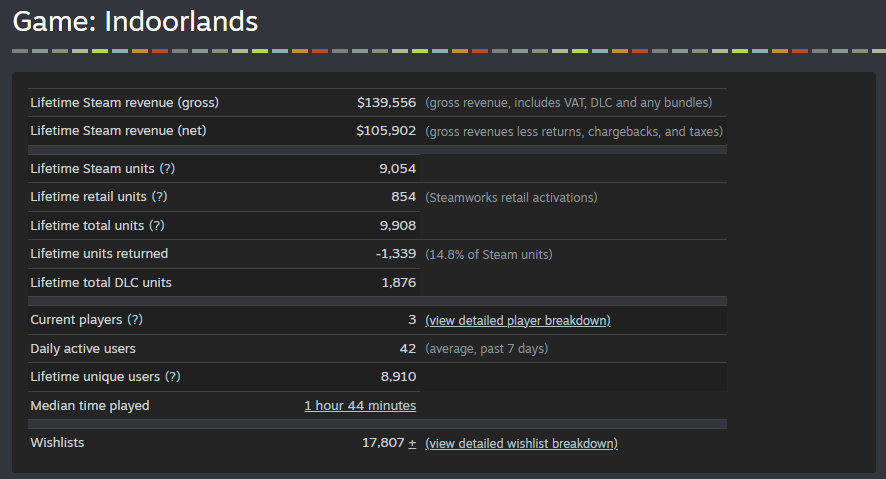

Anyhow, Indoorlands’ financial performance on Steam didn’t really work out - at least from an ROI/scaling point of view, compared to the amount of money put into it:

Bennet explains: “With ~200k€ production costs (excluding founder ‘self exploitation’) & ~100k€ net revenue to date, we're currently in a money deficit for the game. It is a bit sad, since it turned out quite well (82% Steam review rating). With a recent average of 1.5k€ net / month, just 66 more months till ROI.”

And this ‘net’ number listed on Steam’s back end is actually before the 30% Steam cut, boo, so it’s a little worse still. But the game itself - it’s pretty decent! And people ask us to stop concentrating on big Steam successes, and also cover ‘failures’. So here’s some takeaways from Bennet’s transparency into the game’s travails:

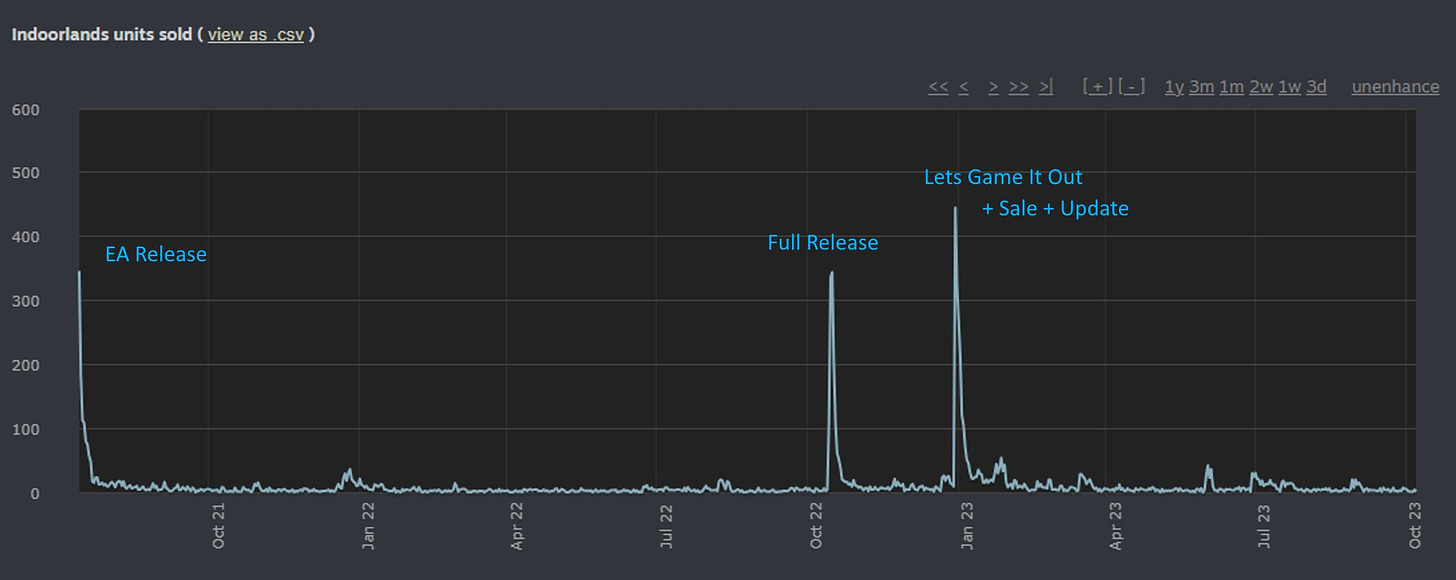

The game didn’t get much exposure pre-release: it “launched into Early Access with a modest 3k wishlists, achieving 1,000 sales in week one.” (That’s a really good wishlist to sales ratio, btw!) The team did send out Steam keys & used various third-party services, but to minimal results. From there, it’s going to be an uphill struggle.

Indoorlands was well-received throughout EA, and 1.0 was ‘OK’:“Full release saw wishlists jump from 8k to ~13k. First week sales were a modest 1.250 copies.” So that’s 1.2x of Early Access first week - makes sense, given the launch ratios we surveyed recently. Though: “There was a severe (Unity) bug that caused freezes and earned us a "mostly negative" rating in the beginning.”

Post-1.0, a major YouTuber pick-up led to a big sales spike:“Our first major [1.0] sale didn’t shake the earth. But an unexpected "Let's Game It Out" YouTube video on New Year's Eve did (for us) - 1.6k units sold in one week, surpassing our launch week!”

You can see the Steam units sold graph for Indoorlands below, including that impressive sales spike:

So why didn’t Indoorlands, which started in 2020 with 45k€ of funding from the German government, and was originally planned as a mobile game, partner with a publisher?

Bennet told me: “We tried to get a publisher, but the offers they made were all along the lines of ‘Oh, nice, you've been working on a game for 2 years, we'll do some marketing, no guarantees here. 50/50 is good, right?’.” Which was, uh, no go.

And I’m not sure a publisher would have made a giant difference to this game, frankly. So here’s our view on what went down, and why performance was what it was:

Maybe Indoorlands didn’t have the greatest ‘supplemental hook’? ‘A theme park, but… indoors’ is just not that exciting an idea. Whereas, a theme park starring… dinosaurs? (Everyone loves dinosaurs!) In the indie space, that’s Parkasaurus, and that’s done quite a bit better on Steam - 125-150k units, by our estimates.

The incumbents in this microgenre have added a lot of features: Planet Coaster has a lot of DLC, often reduced handily in bundles, and it’s regularly 70-80% off. Why would you buy this new title if an existing, higher-dev budget one that’s 80% off is available? (This is the issue bedeviling multiple genres in PC/console games.)

Look, getting 10,000 people to buy your new-IP game is kinda ‘good’: according to GameDiscoverCo Plus estimates, only ~60 of the 1,000 games debuting on Steam in Nov. 2023 have sold 10,000 units so far. (And that includes a number of sub <$10 games.) Even selling 10k over time at ~$15 - you’re in a top echelon.

So, despite the fact we would always advocate for people making rollercoaster/theme park games, we’ve identified a problem here. It’s the same problem that exists in most Steam genres, and is somewhat stifling the market for new titles from pro teams.

Simply: why would somebody buy your new $20 game - probably one with some bugs and ‘growing pains’ - when they can either a) buy a great, ‘older’ game in the same subgenre for 70-80% off b) already bought that game & have it in a Steam backlog?

We believe that’s the source of some - though obviously not all - of the recent market disruption. It doesn’t mean less $ is being spent on games. But it makes it way tougher to enter the market with new IP, unless you can get YouTubers playing your game regularly for major reach boost. Kudos to Bennet & co for getting somewhere, though!

Oh, and a bonus takeaway from Indoorlands: “Our Supporter DLC made ~12k$ net. It has music, artwork, some in-game deco bonuses and most importantly, it allows players to get their names into the game. It had a good ROI because the content was already there and the in-game features were easy to implement.” Yes - supporter DLC is great!

Fortnite’s a big ‘mover & shaker’ in Nov’s streaming

As we did last month, we’re teaming up with livestream analytics platform Stream Hatchet - which grabs data from lots of game streaming platforms: “Twitch, YouTube Live Gaming, Facebook Live, AfreecaTV, Kick, Steam, NaverTV, Trovo, Rooter, Nonolive, Openrec, Loco, Mildom, DLive, VK, KakaoTV, Mixer, Garena LIVE, Booyah.”

The Stream Hatchet folks did a blog post about the Top 20 most-streamed games of Nov. 2023, but also gave us a much bigger list of the Top 100 games(Google Drive doc), with month on month comparisons.

There’s plenty of interesting stuff in here - even games further down the charts. So let’s take a look at the notable trends:

The Top 10 sees big boosts for Fortnite, World Of Warcraft and Modern Warfare III: not really a big surprise, but Fortnite is up 3.3x to 150.9 million hours watched (thanks to the ‘classic map’ Fortnite OG season - this is just pre-Big Bang), World Of Warcraft up 2x to 84.7m hours (the WoW: Dragonflight expansion launch), and CoD: Modern Warfare III is up 3.7x to 49.4m hours (on its full release!)

Lethal Company saw a 35.8x (!) increase in popularity, month on month: we’ve talked about the phenomenon which is solo-dev co-op megahit Lethal Company. But it showed a giant streaming boost last month, from 547,000 hours and below the Top 100 (Oct.) to #19 and 19,581,000 hours (Nov.) We (GDCo x Gamalytic) estimate the game has sold 4.9 million copies now…

Other November debuts were led by Super Mario RPG: besides Modern Warfare III (#7), the other most-streamed debuts for November included the Super Mario RPG remake for Switch (#39, 6.1 million hours), the Yakuza-y Like a Dragon Gaiden: The Man Who Erased His Name (#58, 3.8 million hours), and co-op roguelite TTRPG For The King II (#76, 2.9 million hours).

Besides these, there were one or two other notables, particularly a Beta for “physics-based medieval combat simulator featuring historically accurate XV-century arms and armor” Half Sword getting 2.75 million hours viewed. (YouTubers also love this game, which is a goofy QWOP-like with visceral carnage & very silly player physics & anims.)

The game discovery news round-up…

And we’re finishing up the week* with these discovery news gems (*though Plus subscribers will also get our Friday newsletter analyzing specific new Steam and console game performance trends, of course):

Of course, the Grand Theft Auto VI reveal (above) dominates Footprints.gg’s list of top ‘trad media’ articles about games for the last week, with >10x the media coverage of the #10 title. (ICO’s Thomas Bidaux also mentioned to us that Ubisoft’s new Avatar game is all the way down at #12 - not great, like its reviews.)

Fascinating to discover Bethesda bringing back paid mods for Skyrim, as part of an expanded Creation Club program. (As Eurogamer explains: “Way back in 2015, Bethesda partnered with Valve to bring paid mods to Skyrim via Steam. However, it was incredibly unpopular with both players and mod makers, and the publisher removed the option.”) Could this also be a ‘dry run’ for other Bethesda games like Starfield?

Looking for a data-filled Steam game postmortem? This look at The Ouroboros King from its creator is a handy one: “What didn’t work for me in terms of getting wishlists [for the game] at scale: random Reddit posts, Twitter (#ScreenshotSaturday… random posting… What worked was emailing streamers, a single post on r/chess, and Steam Next Fest.” (It sold ~4.500 units in the 1st month at $10, btw.)

Supercell’s newish CMO had an interesting talk at RovioCon in Finland on ‘thinking big’ when it comes to video game IP, and getting smart with partnerships: “Clash Royale's recent Chess.com Chess Clash partnership… took a LOT of work on the marketing and game design front… [but] a DAU chart of Clash Royale players showed growth from around 13M active players to 14M+” during the promo.

Steam’s most-played games on Steam Deck in November 2023? Yep, Baldur’s Gate 3, Cyberpunk 2077, and Diablo IV are the high-profile Top 3, and not particularly surprising, given updates to the latter two. (Also notable further down? Laidback ‘island living’ farm sim Coral Island, which hit 1.0 in November.)

Microlinks: a few interesting micro-interviews with ‘up and coming’ Roblox creators; how Tile Busters scaled the F2P mobile ‘tile match’ genre impressively; here’s a new (paid) Steam event reminder bot for your dev Discord.

Twitch has announced it’s stopping its service in South Korea, since “our network fees in Korea are still 10 times more expensive than in most other countries.” Not surprising, since rules that let ISPs charge streaming companies for bandwidth have even been a longstanding legal issue for Netflix in the country, but ow.

Would you like to know when a game first set up its Steam page? There’s a few ways. But one, using SteamDB, is to go to ‘History’ and sort 'filter history to a single key', choosing website_release_date. If you scroll down, it will show you the first time the release date was set, generally on public page launch. (You can also look for the first day that the game accrued followers.)

As Fortnite continues to push Creative 2.0 modding, the dev team has rolled out radical new camera types for Fortnite islands: “With Early Access to devices for Fixed-point and Fixed-angle Cameras, alongside a Third-person Controls device, you now have the opportunity to design top-down gameplay, sidescrollers, and more.” Fascinated to see what goes down.

Esoteric microlinks: the New Yorker on how Jensen Huang’s Nvidia is powering the AI revolution; that time ‘when the makers of Pokémon Go and Sleep No More tried to reinvent theater’; this LA Review of Books longform book review of literature x video games says: "I am convinced that, were Isaac Newton alive today, he would be a video game speedrunner.” (?!)

Finally the latest reveal in the Video Game History Foundation’s Winter Fundraiser is 2+ hours of ‘new’ E3 2000 footage, including everything from the Conker’s Bad Fur Day bar (!) to Duke Nukem ‘irl’, and more. It’s all a bit.. cool but gross-weird? Avast:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]