SENTRY: analyzing a winning Next Fest demo!

Publikováno: 25.10.2023

Also: some advice on 'catching' players' attention & lots of discovery news.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

And we’re back, for a very fine second free GameDiscoverCo newsletter of the week! We’re looking at some game-specific Next Fest stats for our lead story. But first up, there’s a couple of ‘important’ Steam announcements that we’re putting up front...

Firstly, Valve is breaking the cycle of having to constantly adjust game pricing in countries with hyper-inflation (Argentina, Turkey, etc) by “[adding] two new pricing regions: LATAM-USD (which includes Argentina) and MENA-USD (which includes Turkey)”, which you’ll price in USD.Price changes needed by November 20th - a smart fix?

Second, pushback against the ‘SMS-only’ element of Valve’s dev account lockdowns has meant a rollout delay to November 8th, since Steam is “adding support to use the Steam Mobile App to also approve default builds being set live for released apps or inviting new [Steamworks] users”, as an alternative to text messages. Also good.

[DON’T FORGET: it’s our first GameDiscoverCo Plus discount since June! Until Nov. 2nd, you get 25% offour upgraded Plus PC game data suite, weekly PC/console sales research newsletter, an exclusive Discord, six game discovery eBooks & more… hurry, and hurray!]

Inside a winning Steam Next Fest demo showcase!

We’ve featured Steam festival-specific data from Gary Burchell of UK micro-indie Fireblade Software (Abandon Ship) before. So after we spotted his studio’s game SENTRY was one of the Top 30 games by unique players in this month’s Steam Next Fest, we were delighted to get in-depth data from him.

But first, let’s talk about ‘hook’ for this single-player FPS with a twist. We thought the attraction of its premise was well-explained by key YouTuber Splattercat’s intro to his enthusiastic ‘Lets Play’ of the game (above). Here’s what he said:

“It's kind of like Orcs Must Die! or Sanctum - this is a game where you have.. a big level and you've got to defend it from ‘tower defense’ waves… you're a cyborg killing machine that can also get in and help your towers and your defenses out…

I think this is actually a fairly hotly ‘in demand’ idea that does not get made very much (Tower Defense FPS). People think very fondly ofSanctum, and there haven't been a whole lot of other [subgenre competitors] to try to challenge that.”

That’s a great starting point for why people might be interested in SENTRY. But how interested were they? Let’s hear data from Gary about that:

The Next Fest appearance was good for ~20k extra Steam wishlists: “From the day before Next Fest to the final day, SENTRY gained: 1,137 Followers (a 20% increase) 19,147 net Wishlists (a 30% increase).” The game also climbed Steam’s Top Wishlists from #351 to #276. Gary’s 'best case' estimate, pre-Next Fest? 10k more wishlists.

SENTRY’s Next Fest demo got 41k downloads, 28k players: great data here on what a Top 30 demo can do: from Oct 5th (when the demo went live, pre-Next Fest) to Oct. 16th, “there were 40,960 downloads and 28,831 played the demo.” About 90% of the demo downloads took place during Next Fest itself (9th-16th).

Even ‘pre-gaming’, it’s difficult to get on Next Fest front page: ahead of Next Fest, SENTRY “planned several big marketing beats to improve our Wishlist velocity and therefore place higher on the 'Most Wishlisted' tab.” But while they gained 17 places on that tab compared to the Next Fest page ‘preview’ version, “about a third of these [places] were games dropping out of the festival”.

Indeed, that’s one of the challenges, with Next Fest getting higher profile. There’s more games with 100,000+ wishlist balance entering demos into it. So although SENTRY was close to the front page, Gary noted: “getting higher would have required either entering the festival with a much greater amount of Wishlists, or a much higher velocity. Considering what the games at the top of the chart achieved, this felt insurmountable.”

Still, SENTRY did pretty good, despite those bigger games coming in ‘over the top’. And one interesting influencer-related point is that Fireblade, having last launched a game (Abandon Ship) in 2018/2019 and perhaps used to a less-crowded market, felt like its streamer coverage “dribbled in continuously [but] the quantity was disappointing.”

But we looked at their numbers for their October 5th-embargoed reveal, and were impressed. Specifically: 512 YouTubers were contacted, and 32 covered SENTRY, and 930 Twitch streamers were contacted, with 36 covering the game.

Gary felt like this wasn’t great. But we think if you’re lifting embargoes around the Next Fest timeline, this kind of percentage coverage is pretty good! And obviously, it helps that two of the YouTubers were Splattercat and Wanderbots - two of the key influencers we referenced last year.

Gary’s conclusion? “I'm extremely happy with both the reception of the demo and the increase in wishlists, even if we didn't place higher than 30th in the 'Most Wishlisted' tab [in Next Fest].”

And for a microstudio like Fireblade, the economics can make sense. Maybe you wouldn’t want to make a multi-million dollar budgeted single player follow-up to Orcs Must Die.

And we’d note - can you really tell if 2 people, 5 people, 10 people or 20 people worked on SENTRY? (And does the public at large care, as long as the game is clean-looking and playable?) Cost vs. ROI is a key current conundrum in the PC/console game space - and SENTRY is staffed lean, so breakeven is way easier.

Thus, if SENTRY - which had 56,430 net wishlists at the start of Next Fest, and so about 75,000 at the end, can launch with 100k Steam wishlists and convert at a median level, it could sell 20k Steam units in Month 1, and 50-100k (or more!) units over time. Pretty sure that’ll work for them, financially.

Finishing up, here’s an opinion from Gary that we don’t disagree with: “Because of the competitive nature of Next Fest, along with the caliber of titles in the top 12 places, the event feels like an extension of Steam, in that the best-performing games reap the greatest rewards. This is evidenced by the top two-performing games (Enshrouded and Japanese Drift Master) getting 43% of the Follower increase from the top 12 games.” Big get bigger? Yesh.

The ‘catch’: how you can make players stop in their tracks?

It’s not often you get a detailed/smart article written about PC/console ‘game hook’ - something we’re singularly interested in here at GameDiscoverCo. So we were delighted to see veteran indie game dev/producer Paul Kilduff-Taylor’s longform article about it a few weeks back.

You should read the whole thing, but it made a bunch of great points that we wanted to bullet-point out for our readers, with Paul’s permission. Here’s what we’ve got:

Your product - to a great extent - is your marketing: Kilduff-Taylor notes: “I've seen many game devs blame ‘lack of marketing’ for a failed project: the good news here is that ‘marketing’ begins and ends with the product… To reach anyone at all, your game has to catch attention.”

The ‘catch’ (aka the hook) is all about standing out: “We're trying to make potential players stop in their tracks [when they first see your game] for a positive reason. They might already be heading towards a particular genre or style of game, but the ‘wow what's that??’ response still needs to be profound.”

Catchiness is often about a combination of familiarity and novelty (!): Paul cites Derek Thompson’s book Hit Makers, which says of music: “Audiences go wild for songs that have a recognisable beat or structure, but which also contain some specific novel element, such as a new type of vocal tone, an instrument they haven’t heard before, or an unusual tempo.”

Paul then goes into a lot of detail on elements of ‘catch’-iness, with a whole host of examples of art style (which we can’t possibly summarize easily!) But here are the other key elements we thought worth highlighting:

Genre-based thinking can be “overly reductive” for devs: Paul suggests that ‘deckbuilders are hot right now, so we should make a deckbuilder’ can be a bit basic: “This kind of rigidity can cause us to push way too far into familiarity while neglecting emotional impact, and also write off concepts which may have huge potential simply because they don't seem to fit in an obviously popular category.”

But there’s overarching gameplay elements that help attract player interest: he singles out: “Large scope of content, often involving procedural generation… Opportunities for system creation and iteration… Long playtimes / high retention… A high degree of player creativity and variant playstyles.” (Many ‘hot genre’ games also have these - so we shouldn’t discount genre completely!)

Games stand out if they show these key qualities near-instantly:“A game will catch attention if it demonstrates these qualities upfront, in as economical a manner as possible.” An example? “Baldur's Gate 3 presents itself clearly as both an immersive, character driven game and a highly complex multi-dimensional system which allows for an immense scope of player experimentation and growth.”

Concluding: we’re still surprised how much people separate the creation/nature of the game from how to popularize the game. (When, in fact, the two things are closely intertwined!) So thanks to Paul for going ‘deep’ on that very point…

The game discovery news round-up..

Well, after all of that, let’s finish things out by checking the multiverse of ‘possible turned into actual things that happened’ in discovery & platform news. Look here:

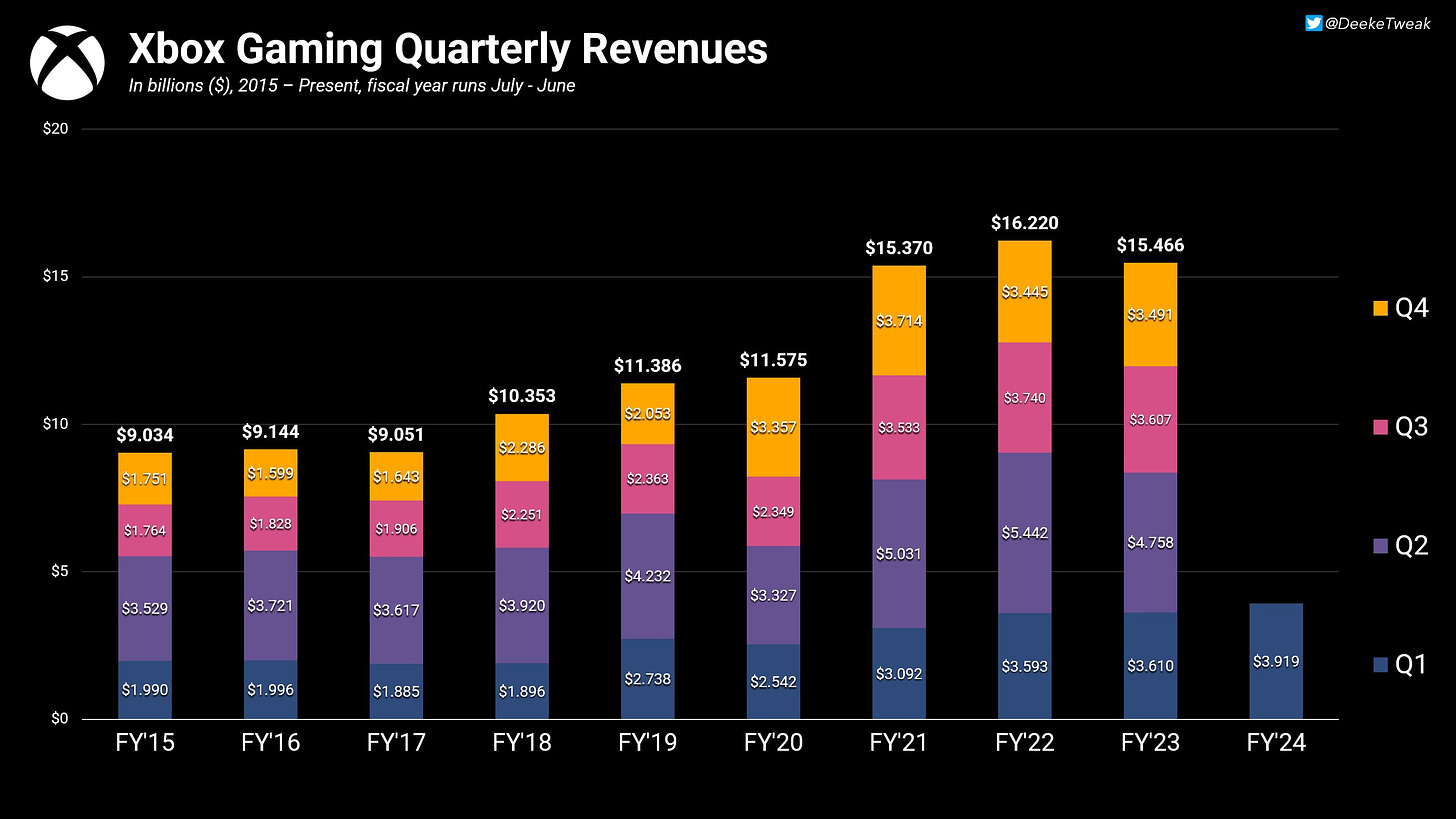

Microsoft’s financials saw game-related revenue up 9%, and above guidance, despite Xbox hardware revenue dipping 7% YoY. Of course, Starfield’s launch (it’s had 11 million players, and we estimate 2.1 million on Steam alone!) is a key driver here, but other stats look good - a “single day record of new Game Pass subscriptions at its launch”, and record hours played for subscriptions. (And with the other $68 billion of MS’ out-of-pocket game spending hitting soon, it’ll look nicer soon.)

Piper Sandler just finished its 46th (!) semi-annual survey of U.S. teens, and there’s two notable game-related stats in the mix: “Video games are 11% of male teen wallet share (vs. 12% Fall '23), and 33% expect to purchase a Next-Gen console within two years… Weekly usage of VR devices declined to ~10% from ~14% in spring '23. But 31% of teens now own a VR device, up from 29% in Spring '23.”

Subscription services raising prices, huh? Apple is the latest, with increases overall, but in particular, Apple Arcade going up from $5 to $7 USD per month. (Though we’re pretty sure 95%+ of people using it have it as part of the Apple One bundle, which bumped up from $17 to $20 per month for individuals in the U.S.)

Post-Epic, Sergei Galyonkin is cranking out content, and this overview of Battle Pass monetization tactics - partly informed by his work on Fortnite - is excellent: “Battle Pass… is a monetized progression track. But it doesn’t have to be an exclusively paid track, because the retention benefits should also apply to non-paying users.”

Xbox’s first-ever Partner Preview event just wrapped up, and here’s the full synopsis from Xbox. Notable? PC smash hit-to-be Manor Lords will be a Day 1 PC Game Pass release in April 2024. But the highest-profile games (Metal Gear Solid Δ: Snake Eater, Ark: Survival Ascended) are not Game Pass-bound… yet.

The ESA & friends put out a global ‘power of play’ report, and the PR summing it up says: “About 75% of global players believe video games provide mental stimulation and stress relief. Nearly two-thirds also find that video games provide them with a healthy outlet from everyday challenges (64%) and help them feel happier (63%).”

Netflix stuff: yes, the pricing went up for your ‘movies & games’ sub - at least the Basic and Premium tiers, while Netflix co-CEO Greg Peters played up the growth potential for games: “We’re talking about $140bn worth of [yearly] consumer spend on games outside of China [&] Russia… we want to really grow our engagement by many multiples of where it is today over the next handful of years.”

It’s official: Epic is adjusting Fortnite Creative payout to favor ‘maps where you spend V-Bucks before/after playing’? David Taylor points out that “Epic-owned maps have a higher % of platform engagement at the start of new seasons and events”, and then’s when players spend more money on cosmetics & Battle Passes. So (for now!) is this just a revenue clawback from third to first-party ‘islands’?

Microlinks: Discord is growing its app, game & bot dev monetization efforts; 53% of game devs say toxic player behavior has worsened in the past year; the ESA highlights ‘highly skilled hackers’, download sites and repackers as continued nexuses of video game piracy.

Finally, it’s not explicitly about games, but Wired’s piece on a TikTok influencer management company is both inspiring & stressful: “Artists who cut their teeth on digital platforms often idealize the careers of their childhood idols, who didn’t have to stress about the exhausting churn of TikTok trends.” These issues feel so… ‘now’?

Oh, and Ubisoft let animation producer Adi Shankar (Castlevania) go IP wild in ‘just released on Netflix’ series Captain Laserhawk: A Blood Dragon Story. Looks intriguing! And wow, look what they did (NSFW!) to adorable platformer ‘icon’ Rayman:

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]