Sony's multiplatform future - and its discovery effects?

Publikováno: 31.5.2022

How PlayStation's wider view might affect its own platform.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & company founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome back, knowledgenauts, to the lunar module that is GameDiscoverCo 5 craft. This week, we’ll be observing the PC & console game discovery stratus from far above, and making some specific observations on the weather for your very own games…

Oh, and our 33% off ‘$100 a year for Plus benefits’offer runs out this Friday. Reminder: you get exclusive Discord & data perks - we just added sales estimates to all Steam games in our back end - plus a whole extra newsletter every week! Sign up now…

Sony’s expansion plans: where PlayStation’s going

Some of you maybe spotted a Sony ‘Game & Network Services Segment’ presentation [.PDF, streaming video] by SIE’s president Jim Ryan last week. And it’s… kinda a big deal - because it very much shows PlayStation’s corporate strategy for the next few years.

We definitely recommend you watch the whole thing - or at least skim the slides - if you’d like to get a lot of dense data on where Sony sees its market going. But here’s the high points:

Sony is concentrating on ‘live service’ transformation of its own game catalog: a great deal of the presentation focused on how Sony can do better with ‘live service’, recurring revenue games. IDC’s data (left, above) suggests that almost all of the growth up to 2025 will be in DLC/IAP ‘add-on’ revenue on console, and Sony knows it’s ‘behind the 8-ball’ on these type of games.

Taking PlayStation games multi-platform is also a big focus: this mainly means PC, of course, where Sony revealed that they did $80 million USD in FY2021, thanks to games like Horizon: Zero Dawn, Days Gone & God Of War. (And Sony’s planning a massive boost to $300 million in FY 2022 on PC, not including Destiny 2, which it’s about to acquire with Bungie.)

The shift to F2P spending is big, even on console: in FY16 Sony says that digital ‘add-on’ revenue was only 5% of total spend in the PlayStation Store on PlayStation 4. But it in FY21, it’s over 25% - powered by games decidedly not owned by Sony like Fortnite, Genshin Impact, Call Of Duty Warzone, Apex Legends & Rocket League. No wonder Sony is moving that way swiftly.

Hardware supply issues are large and continuing: even Year 3 of PlayStation 5 is forecast to underperform PS4’s third year on sale, due to supply problems - but “Year 4 onwards, PS5 is expected to overtake again.” Especially with current China lockdowns, Sony can’t rely on hardware to bail out the company. (Though PlayStation Direct, scheduled for big growth in FY22 to $1.5 billion, allows the company to sell PS5s direct and cut out the middle man.)

What we thought was particularly notable in Sony’s presentation was how (relatively) little it’s concentrating on PlayStation Plus as a possible revenue source. It merited a single slide out of the forty-two in the presentation.

Why? Well, the company printed the below (IDC Q1 2022) estimates on console by revenue type:

Sure, we think that Sony is somewhat interested in beefing up its PlayStation Plus offering and competing on the ‘subscription’ side of things. Why wouldn’t they be?

But I think the company sees the $9 billion extra ‘digital add-on’ revenue up to CY25 as a) far higher-margin and b) far more attainable, given Sony’s IP, hardware ownership, and the quality of its internal game teams - plus the extra GaaS expertise of the incoming Bungie team.

Whether it’s that easy is another question. But the presentation definitely gave us the impression that ‘pivoting to GaaS/multi-platform with our new first-party games’ is the #1 discovery priority in Sony’s world. Whereas ‘growing Game Pass at all costs’ is definitely the #1 discovery priority in Xbox’s. Which is… interesting, right?

Why don’t we cover mobile discovery more?

In prepping this newsletter, we came across this Game Dev Reports write-up on new IDC and Data.ai estimates showing that, well, the mobile game market’s level of growth is spectacularly greater than PC/console over the past decade.

Even notwithstanding some weird market definition choices elsewhere (like splitting only Switch Lite into the ‘handheld’ category), it’s absolutely true that the mobile market is a beast. And yet we rarely discuss it in detail here. What gives?

Firstly, it’s because there’s a decent amount of existing analysis in F2P games space from experts - sites like GameRefinery do blogs on ongoing best practices, and Pocketgamer.biz (and more recently Mobilegamer.biz) have been doing regular news reporting on mobile games. They understand the space better than us.

Secondly, it’s because discovery is a very different beast on mobile. The vast majority of game discovery is paid (or cross-promoted), rather than organic. So it’s really about optimizing your game’s monetization so you can scale, using paid ads. It’s actually way more ‘scientific’ - and expensive, haha - than a lot of what we do in PC/console.

But I think another reason? Many of us are uncomfortable with in-game monetization which is so aggressive as to be exploitative, a subject that lurks beneath the surface of all non-’pay once’ games on any platform. And you need to be (fairly) ruthless to do well in this competitive market. But you can do this in fairer ways - for example:

This PocketGamer.biz piece from Edd Coates on how to “prevent ‘purposefully neglectful’ UI/UX dark patterns in F2P mobile games” talks about some of the bad behavior - and better alternatives. Apparently “Some games even impersonate people from the player’s friend list!” when they give out ‘free gifts’ - but you can easily do similar without faking social interactions.

This new Norwegian Consumer Council research on ‘loot boxes’ looks both at mobile (Raid: Shadow Legends) and PC/console (the FIFA franchise!) games, and makes concrete improvement suggestions, including “All in-game purchases should always be denominated in real-world currency”, though it goes further, suggesting players need “the option to use the game without algorithmically driven decision-making that aims to influence consumer behaviour.” (Seems.. trickier?)

Look - in today’s super-busy PC and console game market, having more recurring monetization or IAP/DLC seems important for success, if you’re making a continuously updated game. Sony thinks so, now! And mobile has many lessons for us, on that front. (Unfortunately, the mobile behemoths themselves are often non-transparent about how it’s done - for competitive and possible negative publicity reasons.)

But we’d like to talk about it more. So if you do post-launch monetization well on any platform and can explain, hit us up - we’d love to feature you. (And we have a guest column or two coming about how mobile discovery really works, which should help.)

The game discovery news round-up..

Finishing up for today’s newsletter, as we start the week a little later than normal? We are, and here’s the latest game discovery and platform news, from our particular vantage point:

Steam data sleuths have dug up evidence that Activision may be making a return to Valve’s PC game platform, specifically showing some indications that Call Of Duty groups on Steam are being newly set up by ActiBlizz employees. This shows that Battle.net may not be the be-all, end-all PC platform for the franchise, as it is for Vanguard, after all. (We’ll see shortly!)

Talking of ‘what do mobile gamers dig?’, the same Data.ai/IDC report from above, as analyzed by Axios, has notable sentiment analysis on playable ads, “which serve as short demos of other games in the Russian nesting doll that is mobile game advertising. Those get an “I can’t stand them” from about a quarter of mobile gamers, but more than half of players think they’re “OK” or even like them.” (Better than regular video ads!)

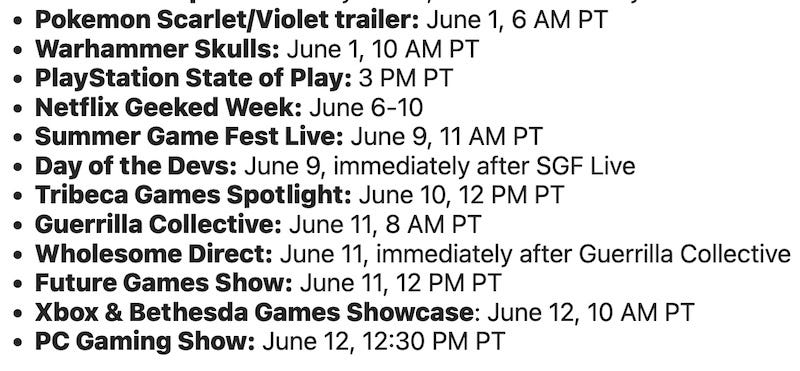

Spotted that GameSpot also has a ‘not-E3 press event’ primer (above), with additional comments on what to expect, for those wondering about the A (Day Of The Devs) to Z (Xbox & Bethesda Games Showcase) of the particularly busy ‘premiere’ period that spans June 9th to 12th.

Couple of PlayStation Plus follow-ups: Sony “has claimed a ‘technical error’ was to blame for charges made to PlayStation Plus users in Asia who had previously purchased discounted memberships.” (Hm, etc.. it’s fixed now anyhow!) And the respected Digital Foundry crew says: “Based on their debut showing on the Asian PSN, Sony's new classic games emulators for PlayStation Plus just aren't good enough.”

There’s a new Tim Sweeney interview over at the FT, with a number of aggressive anti-competitive points - as usual - from Epic’s CEO: “If you looked at the terms structure, Apple and Google have created terms that will give them a stranglehold over the metaverse, unless there are major changes in the practices they’re allowed to get away with.” (Though he finds Meta way less of an issue, currently.)

Talking of Meta, here’s a notable new development in the VR space: “Meta may be ramping up internal testing for its own first-party cloud gaming service which could let its latest standalone VR headset, Quest 2, play PC VR games without needing your own VR-ready computer.” It’s codenamed Avalanche, and it never occurred to me that Meta would provide this service - but it makes sense.

Xbox’s rumored ‘Keystone’ gaming stick for plugging into your TV - sans console - and cloud-gaming your Game Pass, etc? Windows Central has the scoop direct from Microsoft that: “We have made the decision to pivot away from the current iteration of the Keystone device. We will take our learnings and refocus our efforts on a new approach that will allow us to deliver Xbox Cloud Gaming to more players around the world in the future.” Not now, basically.

We should all be keeping an eye on TikTok, given its explosive success. So it’s interesting that it’s “launching a new subscription option for its TikTok Live service on Thursday, granting fans perks in exchange for a monthly fee to access their favorite creators’ content.” Will live game streaming become a bigger thing on TikTok also, we wonder…?

On the VR tip, this Protocol round-up of why Meta is looking ‘unbeatable’ in the VR space right now is well-done. PSVR2, Index and PICO aren’t shipping world-changing units, and Apple’s entry into the AR/VR space is increasingly late (and maybe expensive.) So for now, Meta’s winning through sheer focus and spend - and the Oculus headstart.

‘Other industries’ microlinks: for streaming film, here’s ‘Streaming media: All you can eat, until it eats you’ from an auteur/classic cinema perspective; for books, here’s ‘Is BookTok changing the way we talk about books?’ (BookTok being recommendation of books on TikTok, btw!)

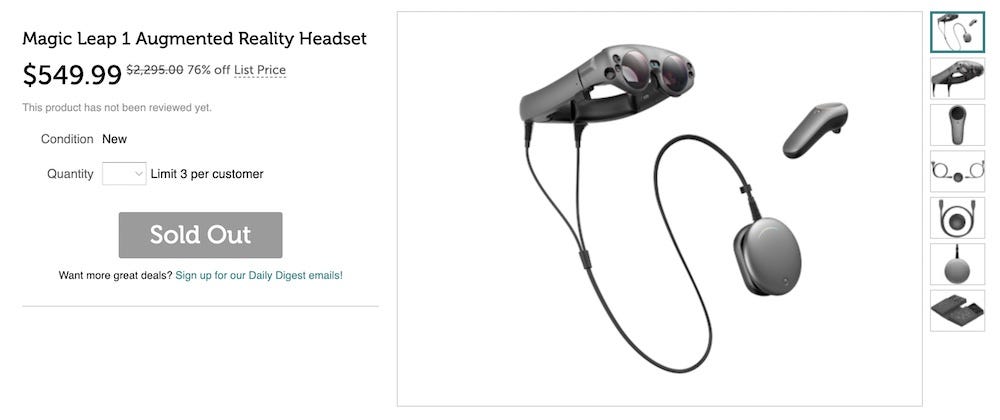

Finally, where does old AR/VR hardware go to die? In the case of the much-hyped but not quite delivered Magic Leap 1 headset, it was a listing on discount store Woot, where you could buy up to ‘3 per customer’ for $550, instead of $2,300:

I definitely didn’t need one of these. But it feels a little like an ‘alternate universe’ version of the future - it’s extra weird to see leftover units relegated to a bargain site.

[We’re GameDiscoverCo, an agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]