Steam: the state of 'long tail' revenue in 2021!

Publikováno: 22.9.2021

The first results from our 2021 Steam dev survey.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to our second free newsletter of the week! And in this one, we’re kicking off what is likely to be a three-part rundown of the results from our recent ‘state of Steam’ survey. It’s for those who enjoy numbers, graphs, and planning-related postulations.

And for those who don’t - skip past all the boxes and bar charts. We have plenty of ‘normal’ coverage underneath, with entertaining words, links and pictures and all that good stuff. Let’s hit it.

[Thanks to new members of our GameDiscoverCo Plus paid subscription - it includes an info-filled Discord, a data-exportable Steam Hype back-end for ranking/comparing unreleased games, our new ‘Game Discovery Toolkit’ eBook, & lots more - join them?]

What might your Steam ‘long tail’ revenue be?

As we mentioned above, GameDiscoverCo asked nicely for your anonymized Steam data. And we got it - more than 75 responses, all for games that launched in 2019, 2020, or 2021. We got data from games that grossed hundreds of dollars in their first week on Steam, and titles that grossed millions of dollars in that same time. (Thanks to everyone who submitted!)

We didn’t have one central purpose with this survey. Instead, we wanted to grab a few disparate pieces of data, and see what interesting trends we could identify. A reminder: we didn’t do ‘Steam reviews to sales ratio’ because it’s quite well settled by our work last year, and VGInsights’ recent expansion of that.

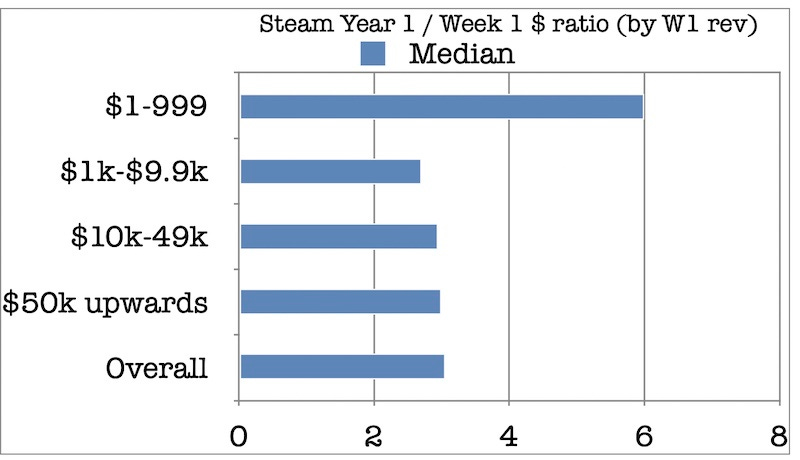

But we did want to look at how your first week Steam revenue compares to the first month, year, and beyond. We’ve done this once before - last November - and felt like we didn’t get enough recent games. And here’s the headline graph this time out, for ‘recent Steam games’:

[NOTE: the reason we use revenue, not units sold for all these ‘long tail’ calculations is that everyone discounts at different frequencies or percentages, and has different regional sales splits. So this equalizes everything to correspond to ‘real money’.]

We’re seeing that anyone who grossed at least $1,000 in Week 1 on Steam for releases during 2019 and 2020 getting a median of between 2.75x and 3x that amount of money, by the end of their first year on sale on Steam. In fact, the median of all categories is Year 1 revenue being 3.05x Week 1 revenue.

You’ll see one outlier up there. Because you might have sold a handful of copies if you just grossed a few hundred dollars, it’s possible to sell 100 or 200 more units in the rest of the year and get a very high revenue multiple. This explains the Year 1 median of 6x Week 1 - for games that sold $1-$999 in their first week on Steam.

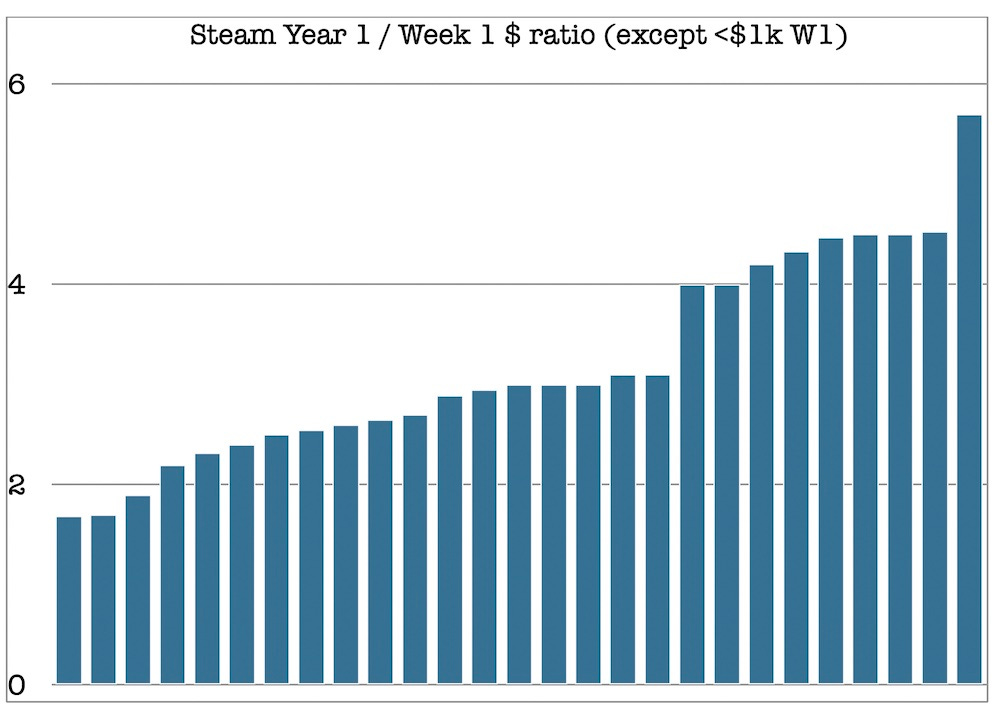

But we’re largely going to disregard these in our data-set. It’s not what most of you will see. And the combined ratio without Week 1 revenue of $1-$999 is pretty much exactly Year 1 = 3x Week 1. Here are the individual data points that make that up:

Interesting, huh? Most games - save a very few outliers - are ranging from Year 1 = 2x Week 1 revenue to about Year 1 = 4.5x Week 1 revenue. So that gives you a great idea of average range of outcomes. But what else separates these games? Well:

We looked solely at the titles that were >4x Year 1 revenue compared to Week 1, and they weren’t distributed only in a certain ‘first-week revenue’ set. They were all over the place, in fact - no clear pattern. (Though the above headline graph suggests sliightly better multiples with higher first week revenue.)

Over the whole data set, we really don’t see any indication that these Week 1/Year 1 multiples are majorly varying from release year to release year. It’s possible that when we saw some shifts before in finding a 4x median, it was survivorship bias from older successful games. But we see no big shifts from 2019 to 2020, and this is the state of ‘now’ on Steam.

Are the ratios different for Early Access games? Not really. Excluding the $1-$999 first week titles, the median for Early Access games (most of which hadn’t done a 1.0 launch during the year) was 3, and the median for regular releases was 2.85. The slightly depressed visibility for EA launches could account for that, in part - and more added features from an EA title, etc.

Finally, we did look quickly to see if a game’s default price could affect its Week 1/Year 1 ratios. And the answer is - maybe, a tiny bit. Games that cost $30 or more games had a median Year 1 multiplier of 3, $20-$29 games had a median of 2.95, $15-$19 games had a median of 2.825, and $10-$14 games had a median of 2.575. Not saying ‘charge more for your game because it’ll get a better multiplier’, though, haha.

(And finally, games costing between $1 and $9 had a Year 1 multiplier of 5. But these are mainly the hobbyist games grossing less than $1,000 in a week. And we talked about the distorting effect of these already.)

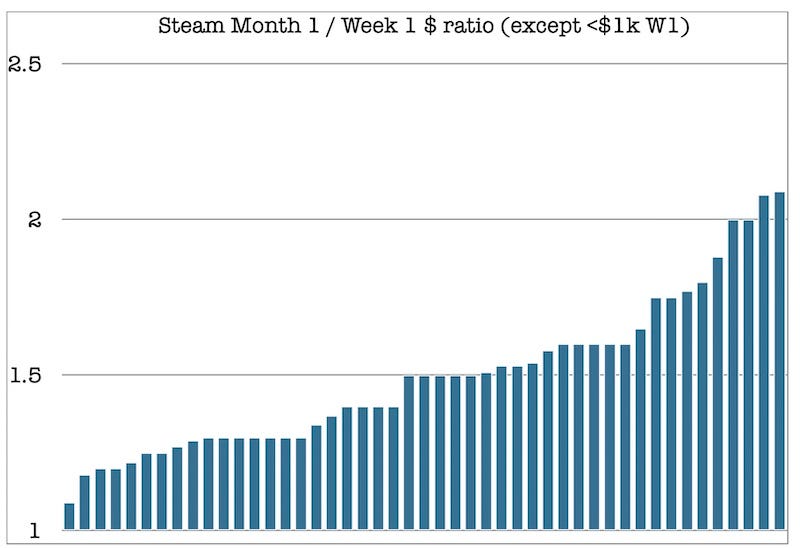

We also wanted to present some bonus data. Here’s the full set of data (except games that grossed <$1,000 in Week 1) for the multiple of Week 1 revenue that Month 1 is:

So if you’re explaining this entire section of the survey, and trying to give an idea of range of possible outcomes in addition to the median (vital!), we have:

Month 1 / Week 1 $: Median = 1.5x, range (excluding outliers) from 1.2x to 1.9x

Year 1 / Week 1 $: Median = 3x, range (excluding outliers) from 2x to 4.5x

Year 2 / Week 1 $: Median = 4.2x, range (excluding outliers) from 2.8x to 7.5x

Just summing this up in practical terms? Whew, we’re feeling good about putting Year 1 Steam revenues as 3x Week 1 in the Steam revenue estimate document we put out recently, given that was a bit lower than the data we had at the time.

And in general, we already knew that this area of Steam had a fairly tight set of possible outcomes. It’s things like ‘wishlists to sales ratios’ that are far more of an unpredictable wildcard. That’s what we’ll get into in the next Steam survey resulst newsletter - coming to all readers in the near future!

Apple vs. Epic - what happens next?

There’s a few notable follow-ups from the epic (ha ha) Apple vs. Epic platform-centric court battle. So we thought it was worth grouping them together. Apple CEO Tim Cook talked about the suit in an Apple all-hands internal meeting. (And then Cook sent out an email blasting the leaker, which was… also leaked. Nice work, The Verge.)

And it’s clear he is fairly happy with the result: “Epic came along and wanted basically to be handled in a special way. Our rules are that we treat everyone the same. They ask[ed] us repeatedly to treat them different, we said no, and they sued us on 10 different items. The court ruled nine of those in favor of Apple and one in favor of Epic. Most importantly, they ruled that Apple is not a monopoly, which we’ve always known. Apple is in a fiercely competitive market.”

Whatever Apple decides to do with its contracts on games that link off-store for IAP, Cook seems to think it’s not a big deal: “I think the ruling will be very good to try to put some of the discussions to rest on the App Store. In terms of the one we lost, there were one or two sentences scratched out of an agreement, that was the extent of it. I’m sort of looking forward to moving forward now.”

As for what independent experts think happens next, Eric Seufert at Mobile Dev Memo has a take on this: “Games is the category least likely to substantially benefit by re-routing revenues through alternative payments processors. Extreme spending behavior often involves large sequences of small, one-off purchases… Mobile games economies are predicted on low-friction purchase mechanics.”

It’s also unfortunate that these top mobile games incentivize such ‘extreme spending behavior’ from a small percentage of people to drive profit, by the way. (Is that good for the world, or the people spending in that way?) But I guess it’s reality.

And talking of games and the iOS App Store, Epic’s Tim Sweeney just announced: “Late last night, Apple informed Epic that Fortnite will be blacklisted from the Apple ecosystem until the exhaustion of all court appeals, which could be as long as a 5-year process.” So… that’s one thing that happened next!

The game discovery news round-up..

We’ll be back on Friday for all GameDiscoverCo Plus subscribers, with a deep-dive newsletter looking at specific games and game trends from Steam - and the rest of the game-buying universe. But for now, here’s a bunch of neat info and links you might have missed:

Continuing its tradition of announcing livestreams very late, Nintendo is broadcasting a Direct tomorrow - September 23rd - at 3pm PT “featuring roughly 40 minutes of information focused mainly on #NintendoSwitch games launching this winter.” Presumably it’ll be somewhat first-party centric. But it’ll be interesting to see what crops up.

The devs of co-op ARPG From Space surfaced in the GameDiscoverCo Plus Discord to mention that they made a free ‘instant’ multiplayer demo for Stadia, and they felt like it helped discovery in general. (Probably aided by first-party mentions on Stadia!) Haven’t seen many people doing this, so heads up.

Given our recent newsletter on console sales, interesting to see SkateBIRD’s Megan Fox tweeting: “The Switch copy of SkateBIRD is still outselling the Steam copy. I keep expecting it to drop off, because Switch doesn't really have the algorithmic storefront, but it hasn't yet.” The game also launched straight to Game Pass, but it does look like SkateBIRD’s whimsical stylings make it one of those titles that (currently) do better on Switch than Steam.

Microlinks: kids mega-platform Roblox is introducing age verification, finally; ‘we lend you money to fund your F2P game’ crew Pollen VC have a ‘discounted CPM’ calculator which shows why 90-day payment terms can really mess with your cashflow; if you want to see how Valorant Masters affected its streaming numbers vs. other big online games’ tournaments, Gamesight’s got your back.

My colleague Mike Rose from No More Robots has appeared on a GameDeveloper.com ‘editorial forum’, called ‘The Non-Sugarcoated Actual Cost of Making a Video Game’, which “ruthlessly breaks down the costs - both monetary and mental - that developers need to take into account when making a game.” Some interesting math(s) in here on what you need to break even.

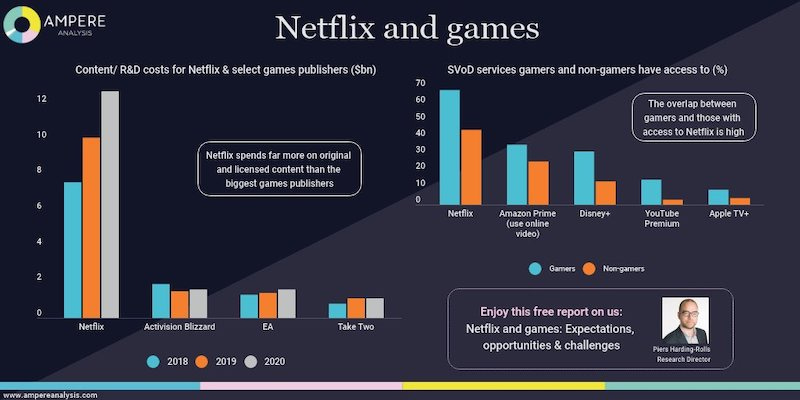

Have to admit that I’ve had ‘talk about Netflix and games more’ on my subject list for weeks. But between Matthew Ball’s gigantic article on ths subject and now Ampere’s Piers Harding-Rolls putting out a free (reg. required) report on it (above image), I’ll just point you to them instead! (Work… delegated.)

Tipsters sent me a couple ofPolish-language reports on Drago Entertainment’s recent hit Gas Station Simulator, which has specific Steam data: 105,000 units and 1,951 reviews (53.8 sales/review ratio) in first 5 days, 135,000 wishlists on launch, and other specific data you don’t see that often! Still some bubblicious stuff going on here with PlayWay seeding a billion public Polish companies, tho: “A company like PlayWay provides young teams with a solid game idea that they believe will sell and the funds for them to give it a try… Hence the entry into game development is becoming very easy compared to other countries.”

Microlinks, Pt. 2: Twitch finally cut a deal with the U.S. music publishers association to help stop pesky streamer DMCA penalties - but it’s complicated; Facebook is making noises about Apple’s IDFA changes leading to “greater than… expected” impacts on Facebook-driven ad campaigns for mobile games; did you know Snapchat has 30 million monthly game players on its app - and also an Among Us-ish game from Zynga?

An interesting note via a GameDiscoverCo newsletter reader: “While browsing through Steam's Points Shop, I've noticed a couple of pretty items from a game called Seen…. I noticed that some [reviewers] mentioned that they've also found the game through the Points Shop.” The game has over 5,000 Very Positive reviews at $1.99 USD base price, and I’ve also never heard of the Points Shop as a discovery starting point. But now you know a title it works for.

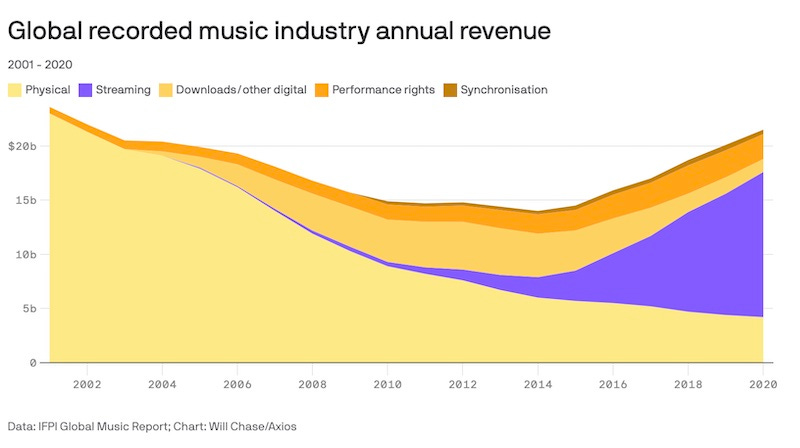

Finally, we were thinking about how the rise of game subscriptions is starting to affect the revenue split for your average paid PC or console game. In a few years, how will the split be between ‘base game $’, ‘DLC $’, ‘IAP $’, ‘being included in a game subscription $’, and ‘misc other $’, we wonder?

While we don’t have a way to chart that - yet - we liked this recent Axios Media Trends piece which did something similar for the music biz:

So your homework for this week is to go away and imagine a graph like the above one, but showing your video game revenues may change over the next 5 years, based on the buckets I mentioned. An interesting thought experiment, anyhow…

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? You can subscribe to GameDiscoverCo Plus to get access to exclusive newsletters, eBook and a Discord, plus interactive daily rankings of every unreleased Steam game, and more besides.]